A Century Of Ups And Downs: Charting 100 Years Of The Dow Jones Industrial Common

A Century of Ups and Downs: Charting 100 Years of the Dow Jones Industrial Common

Associated Articles: A Century of Ups and Downs: Charting 100 Years of the Dow Jones Industrial Common

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to A Century of Ups and Downs: Charting 100 Years of the Dow Jones Industrial Common. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

A Century of Ups and Downs: Charting 100 Years of the Dow Jones Industrial Common

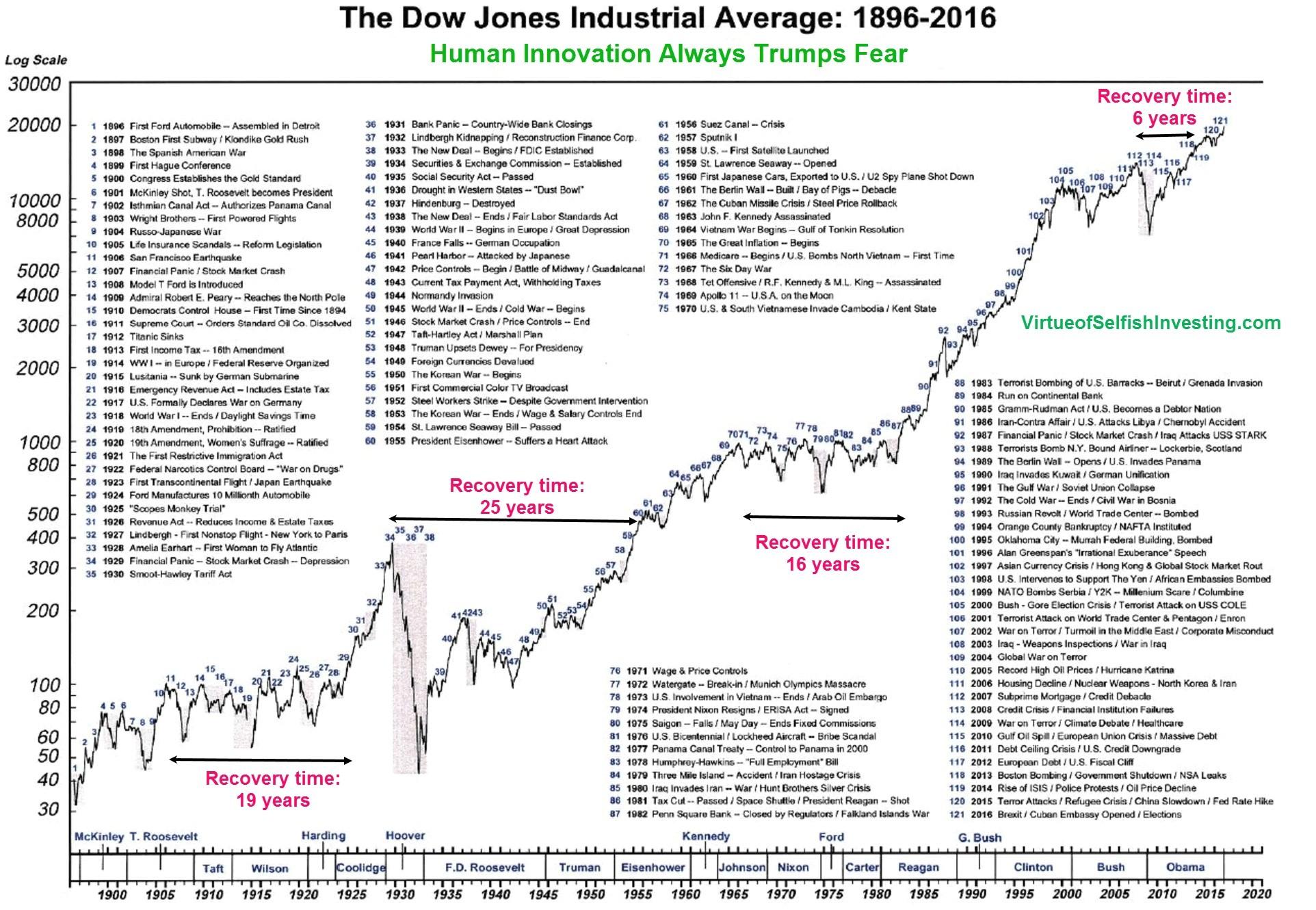

The Dow Jones Industrial Common (DJIA), a benchmark of American financial well being and a barometer of investor sentiment, boasts a historical past spanning over a century. Its trajectory, mirrored in its iconic chart, is a charming narrative of booms and busts, technological revolutions, geopolitical upheavals, and the enduring resilience of the American capitalist system. Analyzing the Dow’s 100-year historical past – specializing in key intervals and vital occasions – reveals invaluable classes about market dynamics, financial cycles, and the long-term energy of investing. Whereas we can not cowl a full 100 years intimately inside this text, we will discover pivotal many years and vital turning factors to grasp the broader narrative.

The Roaring Twenties and the Nice Melancholy (Nineteen Twenties-Thirties):

The Nineteen Twenties witnessed the Dow’s preliminary ascent, fueled by post-World Struggle I optimism and burgeoning industrial progress. The last decade noticed a interval of unprecedented prosperity, culminating in a peak in 1929, simply earlier than the notorious Black Tuesday crash. This crash, marking the start of the Nice Melancholy, despatched the Dow plummeting by over 89% from its peak, a devastating blow that worn out fortunes and left thousands and thousands unemployed. This era highlights the inherent volatility of the market and the potential for catastrophic declines, even in periods of seemingly sustained progress. The chart from this period reveals a pointy, virtually vertical climb adopted by an equally dramatic, virtually vertical fall – a stark visible illustration of the increase and bust cycle.

The Thirties have been characterised by extended financial hardship and authorities intervention. President Franklin D. Roosevelt’s New Deal insurance policies, whereas controversial, helped stabilize the financial system and lay the groundwork for future progress. The Dow’s restoration throughout this decade was gradual and gradual, reflecting the arduous path to financial restoration. The chart illustrates an extended, gradual climb out of the melancholy’s depths, a testomony to the effort and time required to beat such a big financial disaster.

Put up-Struggle Growth and the Seventies Stagflation (Forties-Seventies):

Following World Struggle II, the US skilled a interval of sustained financial growth, generally known as the post-war increase. The Dow’s chart displays this progress, exhibiting a constant upward pattern fueled by elevated client spending, technological developments, and the rise of the center class. The Nineteen Fifties and Nineteen Sixties have been characterised by relative stability and powerful financial efficiency.

Nonetheless, the Seventies introduced a brand new problem: stagflation – a mixture of excessive inflation and gradual financial progress. The oil disaster of 1973 exacerbated this case, resulting in vital market volatility. The Dow’s chart throughout this era exhibits a interval of sideways motion, punctuated by intervals of each beneficial properties and losses, reflecting the financial uncertainty of the period. This decade demonstrated the market’s vulnerability to exterior shocks and the complexities of managing an financial system going through simultaneous inflation and unemployment.

The Nineteen Eighties and the Rise of Know-how (Nineteen Eighties-Nineties):

The Nineteen Eighties ushered in an period of deregulation and technological innovation. The rise of non-public computer systems, the growth of the monetary providers trade, and the Reagan administration’s financial insurance policies contributed to a big bull market. The Dow’s chart throughout this era exhibits a robust upward pattern, punctuated by periodic corrections however finally reflecting the optimistic financial local weather.

The Nineties witnessed the dot-com increase, a interval of unprecedented progress pushed by the web and associated applied sciences. The Dow skilled a spectacular rise, fueled by investor enthusiasm and the promise of recent applied sciences. Nonetheless, this era additionally culminated within the dot-com bubble burst in 2000, leading to a big market correction. The chart from this period showcases a fast, virtually parabolic rise adopted by a pointy decline, illustrating the hazards of speculative bubbles and the significance of prudent funding methods.

The twenty first Century: From 9/11 to the Nice Recession and Past (2000s-Current):

The twenty first century has been marked by a collection of serious occasions which have impacted the Dow. The September eleventh terrorist assaults, the dot-com bubble burst, the housing market crash of 2008, and the next Nice Recession all left their mark on the Dow’s chart. The Nice Recession, particularly, resulted in a dramatic decline, mirroring the severity of the Nice Melancholy, albeit with a quicker restoration. The chart vividly shows the sharp drop and subsequent, although slower, restoration, highlighting the interconnectedness of the worldwide financial system and the impression of systemic monetary crises.

The years following the Nice Recession have seen a interval of restoration and progress, though not with out its challenges. The rise of globalization, technological developments (notably within the areas of cellular computing and the web of issues), and evolving geopolitical landscapes have all influenced the Dow’s trajectory. The chart of current years exhibits a mixture of ups and downs, reflecting the continued volatility and uncertainty inherent out there. The impression of the COVID-19 pandemic in 2020 additionally created vital volatility, exhibiting a pointy preliminary drop adopted by a remarkably swift restoration fueled by unprecedented authorities stimulus.

Classes from the Chart:

A 100-year chart of the Dow Jones Industrial Common presents invaluable insights:

- Lengthy-term progress potential: Regardless of intervals of serious decline, the Dow has proven a long-term upward pattern, reflecting the general progress of the American financial system.

- Market volatility: The chart vividly demonstrates the inherent volatility of the market, highlighting the significance of diversification and long-term funding methods.

- Influence of exterior occasions: Geopolitical occasions, technological developments, and financial insurance policies all considerably affect the Dow’s efficiency.

- The cyclical nature of the financial system: The chart reveals the cyclical nature of financial booms and busts, emphasizing the significance of understanding financial cycles and managing threat.

In conclusion, the 100-year historical past of the Dow Jones Industrial Common, as visualized in its chart, is a compelling narrative of financial progress, punctuated by intervals of each extraordinary progress and devastating setbacks. Understanding this historical past is essential for traders, policymakers, and anybody searching for to understand the complexities of the American financial system and the worldwide monetary system. The chart serves not simply as a document of previous efficiency, however as a strong instrument for understanding the forces that form our financial future. Whereas predicting the longer term is unattainable, learning the previous offers invaluable context and perspective for navigating the ever-evolving panorama of the monetary markets.

Closure

Thus, we hope this text has supplied useful insights into A Century of Ups and Downs: Charting 100 Years of the Dow Jones Industrial Common. We hope you discover this text informative and helpful. See you in our subsequent article!