A Decade Of Gold: Analyzing The Canadian Gold Worth Chart (2014-2024)

A Decade of Gold: Analyzing the Canadian Gold Worth Chart (2014-2024)

Associated Articles: A Decade of Gold: Analyzing the Canadian Gold Worth Chart (2014-2024)

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to A Decade of Gold: Analyzing the Canadian Gold Worth Chart (2014-2024). Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

A Decade of Gold: Analyzing the Canadian Gold Worth Chart (2014-2024)

:max_bytes(150000):strip_icc()/GOLD_2023-05-17_09-51-04-aea62500f1a249748eb923dbc1b6993b.png)

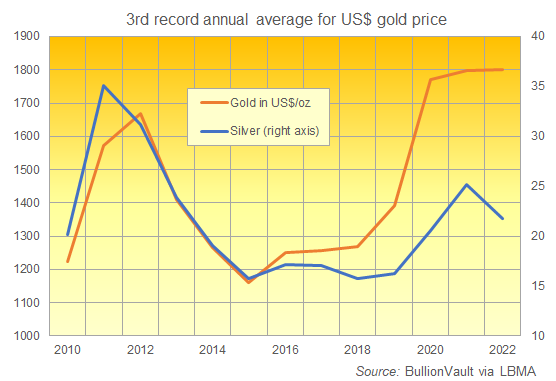

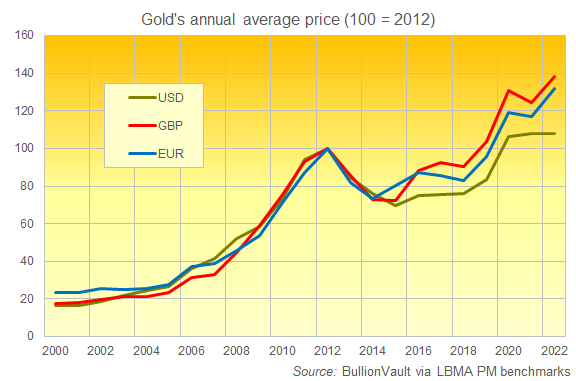

The value of gold, a conventional protected haven asset, has skilled vital fluctuations over the previous decade in Canada, mirroring international traits whereas additionally reflecting distinctive home financial components. Analyzing the Canadian gold worth chart from 2014 to 2024 (projected information for 2024 can be primarily based on present market traits and professional predictions) reveals a fancy interaction of geopolitical occasions, financial insurance policies, and investor sentiment. This text delves into the important thing drivers influencing gold’s efficiency in Canada throughout this era, highlighting main traits and providing insights into potential future actions.

2014-2016: A Interval of Decline and Consolidation

The interval between 2014 and 2016 witnessed a normal downward pattern in gold costs globally, and Canada was no exception. The preliminary decline stemmed from the tapering of quantitative easing (QE) by the US Federal Reserve, signaling a strengthening US greenback. A stronger greenback sometimes places downward strain on gold costs, as gold is priced in US {dollars}. Moreover, a comparatively strong international economic system throughout this era lowered the demand for safe-haven belongings like gold. Buyers shifted their focus in the direction of higher-yielding investments, additional contributing to the gold worth decline. Inside Canada, the sturdy Canadian greenback additionally performed a job, making gold comparatively costlier for home patrons.

Nevertheless, the decline wasn’t linear. Geopolitical uncertainties, such because the Greek debt disaster and the continued battle in Ukraine, periodically sparked temporary rallies in gold costs. These rallies, although momentary, highlighted the inherent volatility of the gold market and its sensitivity to international occasions. By the tip of 2016, gold costs had consolidated round a decrease vary, setting the stage for the next surge.

2017-2020: The Rise of Uncertainty and Gold’s Resurgence

The interval from 2017 to 2020 marked a major turnaround for gold. A number of components contributed to this upward pattern:

-

Elevated Geopolitical Threat: Rising commerce tensions between the US and China, Brexit uncertainty, and escalating geopolitical conflicts in varied components of the world fueled investor anxiousness. Gold, as a safe-haven asset, benefited from this heightened uncertainty. Canadian buyers, notably, sought refuge in gold amid international instability.

-

Low Curiosity Charges and Quantitative Easing: Central banks globally, together with the Financial institution of Canada, maintained low rates of interest and carried out additional rounds of QE to stimulate financial development. This atmosphere of low cost cash eroded the returns on conventional investments, making gold a comparatively extra enticing possibility.

-

Weakening US Greenback: Whereas the US greenback skilled durations of power, general, it weakened in opposition to many currencies, together with the Canadian greenback. This made gold comparatively cheaper for Canadian buyers, boosting demand.

-

Inflationary Pressures: Whereas inflation remained comparatively subdued in Canada throughout a lot of this era, issues about rising inflation globally started to emerge. Gold, traditionally seen as a hedge in opposition to inflation, noticed elevated demand as buyers sought to guard their buying energy.

The COVID-19 pandemic in 2020 acted as a major catalyst, sending gold costs to file highs. The pandemic triggered unprecedented financial uncertainty, market volatility, and a flight to security, propelling gold costs to their peak.

2021-2023: Consolidation and the Affect of Rising Curiosity Charges

The interval from 2021 to 2023 noticed a level of consolidation in gold costs. The preliminary surge in worth following the onset of the pandemic started to average as economies began to recuperate. A key issue influencing this consolidation was the shift in financial coverage by central banks globally. The US Federal Reserve, and subsequently different central banks together with the Financial institution of Canada, started elevating rates of interest to fight rising inflation. Increased rates of interest enhance the chance price of holding non-yielding belongings like gold, resulting in lowered demand.

Nevertheless, persistent inflation and ongoing geopolitical tensions continued to offer help for gold costs, stopping a major collapse. The struggle in Ukraine in 2022 additional exacerbated international uncertainty, offering a lift to gold costs. The Canadian gold market mirrored these international traits, though the affect of rising rates of interest was felt domestically.

2024 (Projected): Navigating Uncertainties

Predicting gold costs for 2024 requires contemplating a number of components:

-

Inflationary Outlook: The trajectory of inflation can be essential. If inflation stays stubbornly excessive, gold might proceed to function an inflation hedge, supporting its worth. Conversely, if inflation eases considerably, gold’s attraction would possibly diminish.

-

Curiosity Price Coverage: The stance of central banks on rates of interest can be a key determinant. If rates of interest stay excessive or proceed to rise, it might exert downward strain on gold costs. Nevertheless, if central banks pause or reverse their fee hikes because of financial slowdown, gold might regain a few of its misplaced attraction.

-

Geopolitical Panorama: Continued geopolitical instability and uncertainty might increase gold’s safe-haven standing, driving demand. Conversely, a interval of relative international peace and stability might result in decrease gold costs.

-

US Greenback Power: The power of the US greenback will proceed to play a major position. A stronger greenback will doubtless put downward strain on gold costs, whereas a weaker greenback might increase demand.

-

Provide and Demand Dynamics: The interaction of world gold provide and demand will affect costs. Any vital disruption to gold mining operations or a surge in investor demand might push costs larger.

Primarily based on present market forecasts, a average enhance or consolidation in gold costs is anticipated for 2024 in Canada. Nevertheless, the numerous uncertainties surrounding international financial development, inflation, and geopolitical stability make exact predictions difficult.

Conclusion:

The Canadian gold worth chart over the previous decade displays a dynamic interaction of world and home financial components. Whereas durations of decline had been noticed, notably within the early years, the general pattern has been considered one of vital worth appreciation, pushed primarily by geopolitical uncertainty, low rates of interest, and inflationary pressures. The long run trajectory of gold costs stays unsure, contingent on the evolution of those components. Buyers ought to fastidiously think about these complexities and diversify their portfolios accordingly. Steady monitoring of macroeconomic indicators, geopolitical developments, and central financial institution insurance policies is essential for knowledgeable funding selections within the Canadian gold market.

Closure

Thus, we hope this text has supplied useful insights into A Decade of Gold: Analyzing the Canadian Gold Worth Chart (2014-2024). We thanks for taking the time to learn this text. See you in our subsequent article!