A Decade Of Development And Volatility: Analyzing The International GDP Chart (2013-2023)

A Decade of Development and Volatility: Analyzing the International GDP Chart (2013-2023)

Associated Articles: A Decade of Development and Volatility: Analyzing the International GDP Chart (2013-2023)

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to A Decade of Development and Volatility: Analyzing the International GDP Chart (2013-2023). Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

A Decade of Development and Volatility: Analyzing the International GDP Chart (2013-2023)

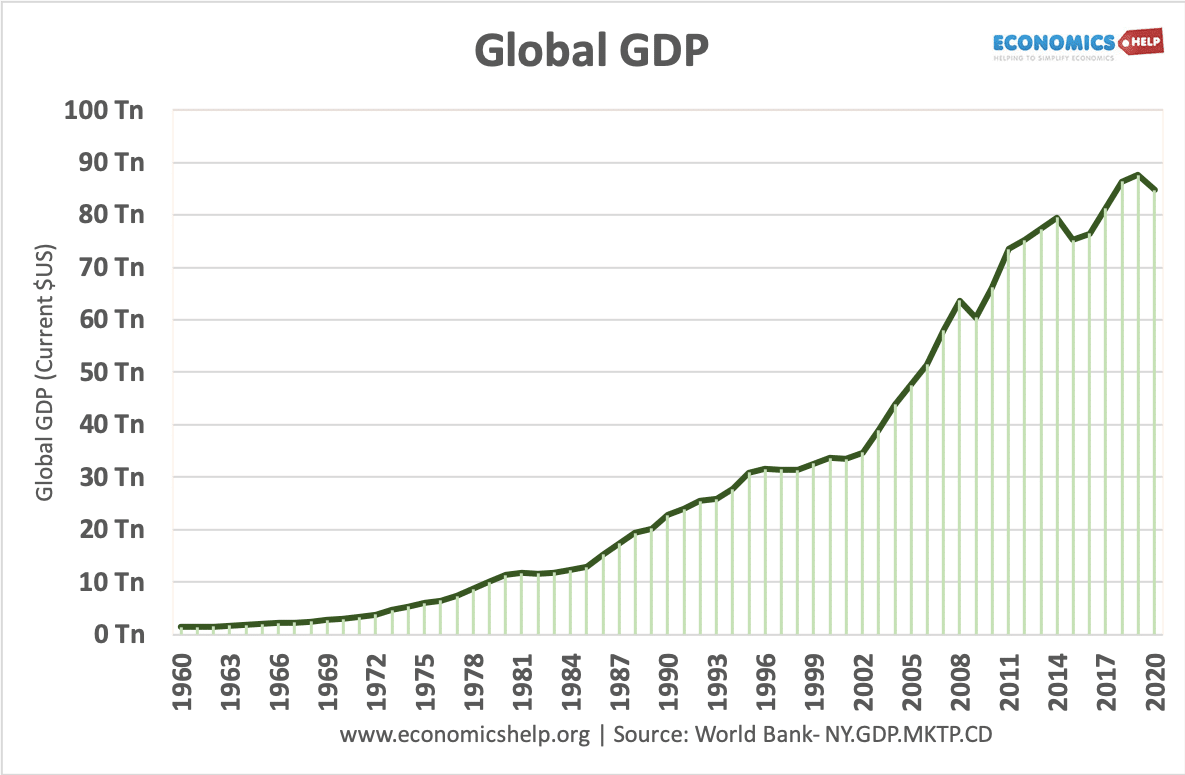

The worldwide Gross Home Product (GDP) chart for the previous decade (2013-2023) paints a fancy image of financial development, punctuated by intervals of enlargement and contraction, formed by each predictable cyclical fluctuations and unexpected international shocks. Analyzing this chart requires contemplating numerous components, from technological developments and geopolitical occasions to demographic shifts and coverage selections. This text will delve into the important thing traits noticed within the international GDP over this era, highlighting important occasions that influenced its trajectory and exploring the implications for the longer term.

The Pre-Pandemic Period (2013-2019): A Interval of Average Development and Uneven Distribution

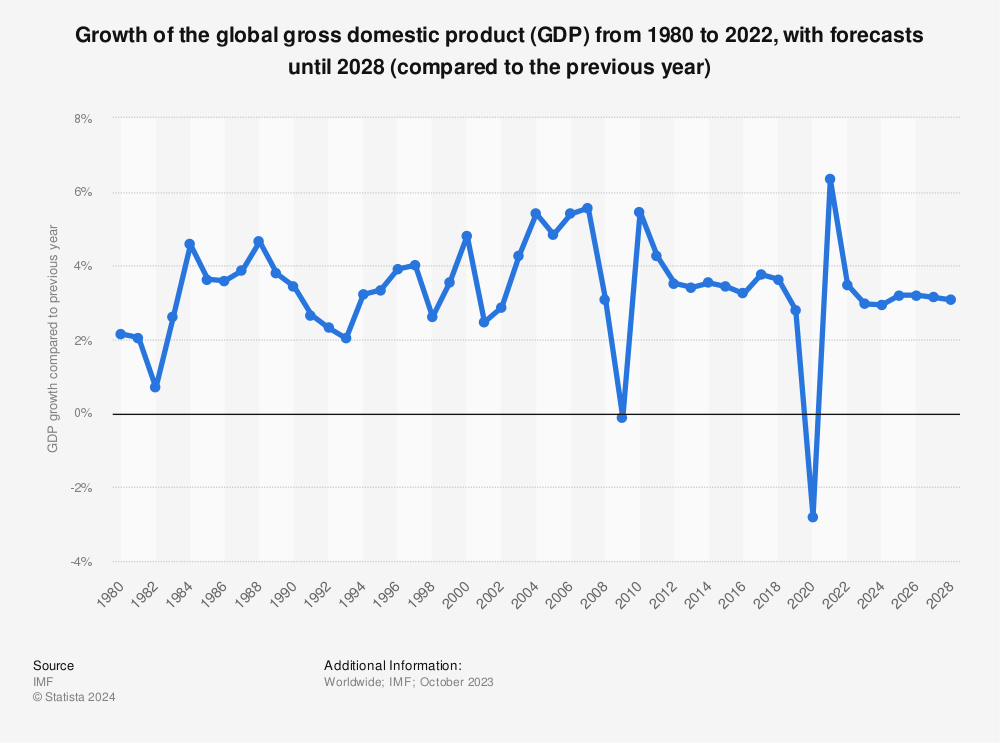

The interval between 2013 and 2019 witnessed a comparatively reasonable price of worldwide GDP development, averaging round 3-4% yearly. Nevertheless, this seemingly steady development masked important disparities throughout areas and nations. Rising markets, notably in Asia, skilled strong enlargement, fueled by speedy industrialization, urbanization, and rising client spending. China, particularly, performed a dominant position in driving international development throughout this era.

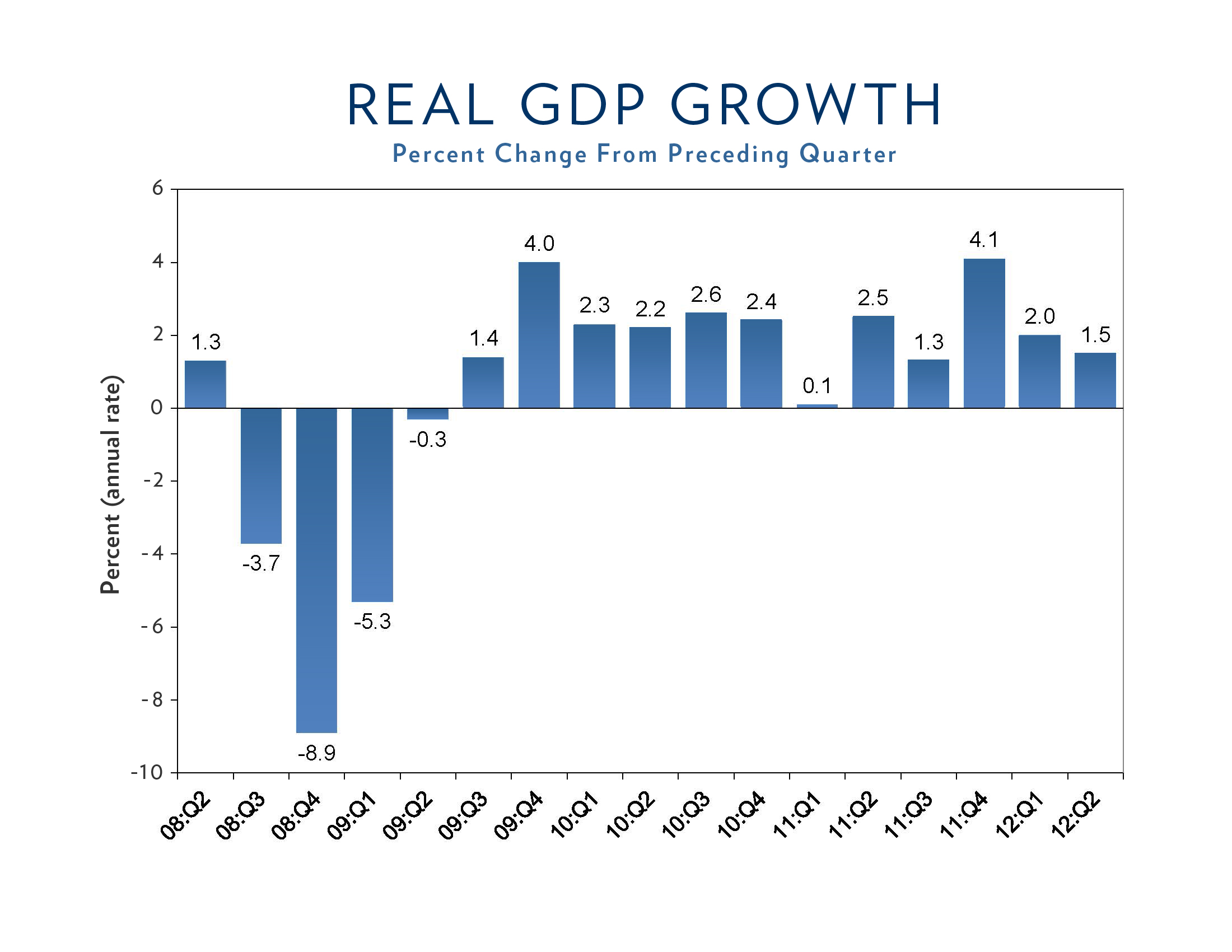

The restoration from the 2008 international monetary disaster was gradual and uneven, with many developed economies struggling to regain their pre-crisis momentum. Elements contributing to this uneven restoration included excessive ranges of public debt in a number of nations, persistent unemployment in some areas, and the lingering results of the monetary disaster on the worldwide banking system.

Technological developments, notably within the digital sector, performed a major position in driving productiveness positive factors and financial development throughout this era. The rise of e-commerce, cellular applied sciences, and massive information analytics reworked industries and created new alternatives for companies and customers alike.

Nevertheless, this era was not with out its challenges. Geopolitical instability, together with conflicts within the Center East and Ukraine, together with commerce tensions between main economies, created uncertainty and dampened funding. Moreover, rising earnings inequality inside and between nations remained a persistent concern, undermining social cohesion and probably limiting long-term development.

The COVID-19 Pandemic and its Financial Fallout (2020-2022): A Sharp Contraction and Uneven Restoration

The COVID-19 pandemic, which started in early 2020, delivered an unprecedented shock to the worldwide financial system. Lockdowns, journey restrictions, and disruptions to provide chains led to a pointy contraction in international GDP in 2020, marking the deepest recession for the reason that Nice Despair. The chart dramatically illustrates this sudden drop, a stark visible illustration of the pandemic’s financial influence.

The severity of the contraction different throughout sectors and nations. Industries closely reliant on in-person interplay, reminiscent of tourism, hospitality, and retail, skilled probably the most important declines. International locations with more practical public well being responses and stronger social security nets fared comparatively higher than those who struggled to include the virus and assist their populations.

The restoration that adopted was additionally uneven. Whereas some economies bounced again shortly, others skilled extended intervals of sluggish development. The uneven restoration was partly because of the differing paces of vaccination rollouts, the persistence of provide chain bottlenecks, and the emergence of recent virus variants. Inflation additionally surged in lots of nations, pushed by provide chain disruptions and elevated demand as economies reopened.

Authorities intervention performed an important position in mitigating the financial fallout from the pandemic. Huge fiscal stimulus packages had been carried out in lots of nations to assist companies and households, stopping a deeper and extra extended recession. Nevertheless, these stimulus measures additionally contributed to rising public debt ranges, elevating considerations about long-term fiscal sustainability.

Submit-Pandemic Challenges and Future Outlook (2023 and Past): Inflation, Geopolitical Tensions, and Power Transition

As of 2023, the worldwide financial system is navigating a fancy panorama of challenges. Excessive inflation stays a serious concern in lots of nations, forcing central banks to implement tighter financial insurance policies, which may gradual financial development. The conflict in Ukraine has additional exacerbated inflationary pressures, disrupting vitality markets and provide chains. Geopolitical tensions, together with rising commerce protectionism and the rising rivalry between the US and China, are additionally creating uncertainty and hindering international financial cooperation.

The transition to a extra sustainable and low-carbon financial system presents each challenges and alternatives. Whereas the shift away from fossil fuels is important to mitigate local weather change, it additionally requires important investments in renewable vitality applied sciences and infrastructure, probably disrupting present industries and requiring workforce retraining.

Demographic shifts, reminiscent of getting old populations in lots of developed nations, pose additional challenges to long-term financial development. Shrinking workforces and rising healthcare prices might put stress on public funds and restrict financial potential.

Analyzing the GDP chart for the previous decade reveals a sample of fluctuating development, punctuated by important shocks. Whereas the post-pandemic restoration has been underway, the trail ahead stays unsure. Efficiently navigating the challenges of inflation, geopolitical instability, vitality transition, and demographic change would require efficient policymaking, worldwide cooperation, and a dedication to sustainable and inclusive development. The longer term trajectory of the worldwide GDP will rely on how successfully these challenges are addressed. Additional evaluation, specializing in particular regional and sectoral traits, is important to realize a extra nuanced understanding of the complexities depicted throughout the international GDP chart. The info must be damaged down to know the efficiency of particular person nations and sectors to supply a extra granular image of the financial panorama. This may permit for higher forecasting and knowledgeable coverage selections to advertise sustainable and equitable international financial development within the years to come back. The last decade’s chart serves as an important reminder of the interconnectedness of the worldwide financial system and the significance of proactive and collaborative methods to navigate future challenges.

Closure

Thus, we hope this text has offered useful insights into A Decade of Development and Volatility: Analyzing the International GDP Chart (2013-2023). We thanks for taking the time to learn this text. See you in our subsequent article!