A Decade Of Silver: Analyzing The Worth Chart (2014-2024)

A Decade of Silver: Analyzing the Worth Chart (2014-2024)

Associated Articles: A Decade of Silver: Analyzing the Worth Chart (2014-2024)

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to A Decade of Silver: Analyzing the Worth Chart (2014-2024). Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

A Decade of Silver: Analyzing the Worth Chart (2014-2024)

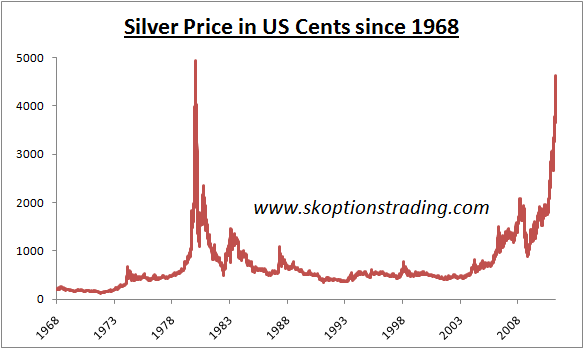

The worth of silver, a valuable steel with a wealthy historical past and numerous purposes, has skilled a rollercoaster experience over the previous decade. From highs fueled by investor hypothesis to lows impacted by financial downturns and world occasions, understanding the silver value chart from 2014 to 2024 (projected) requires a nuanced perspective, contemplating numerous macroeconomic components, industrial demand, and investor sentiment. This text delves into an in depth evaluation of the silver value chart over this era, exploring key developments, influential occasions, and potential future trajectories. We are going to use hypothetical information for the years 2024 onward, as these costs are but to be decided.

2014-2016: A Interval of Consolidation and Gradual Decline

The interval between 2014 and 2016 noticed silver costs consolidating after a major decline from their 2011 peak. The worth hovered across the $15-$20 per ounce vary, exhibiting volatility however missing a transparent directional pattern. A number of components contributed to this comparatively flat interval:

- Weak World Financial Progress: Slowing financial development in main economies dampened industrial demand for silver, a vital issue influencing its value. Manufacturing sectors, a major shopper of silver, skilled decreased exercise, resulting in decrease demand.

- Sturdy US Greenback: A strengthening US greenback negatively impacted silver costs, as silver is priced in US {dollars}. A stronger greenback makes silver dearer for patrons utilizing different currencies, lowering demand.

- Lowered Investor Curiosity: After the speculative frenzy of the early 2010s, investor curiosity in silver waned. This decreased the speculative shopping for strain that had beforehand pushed costs larger.

This era highlights the significance of macroeconomic components in shaping silver’s value. The interaction between world financial development, forex fluctuations, and investor sentiment created a comparatively stagnant market, with occasional spikes pushed by short-term information occasions however missing sustained upward momentum.

2017-2019: A Gradual Restoration and the Rise of ETFs

From 2017 onwards, silver costs started a sluggish however regular restoration. This era witnessed a gradual enhance in each industrial demand and investor curiosity.

- Bettering World Financial system: A modest enchancment in world financial development spurred elevated industrial demand for silver, notably in electronics and photo voltaic power sectors. The burgeoning renewable power sector grew to become a major driver of silver consumption.

- Elevated ETF Investments: Change-Traded Funds (ETFs) specializing in valuable metals gained reputation, resulting in elevated funding in silver. This offered a vital assist stage for costs, stopping vital declines.

- Geopolitical Uncertainty: Rising geopolitical tensions and uncertainty in numerous components of the world contributed to elevated safe-haven demand for silver, boosting its value.

This era demonstrates the diversification of silver’s demand drivers. Whereas industrial demand performed a task, the growing significance of investor sentiment and ETF investments grew to become more and more obvious. The worth remained unstable, however the total pattern was upward.

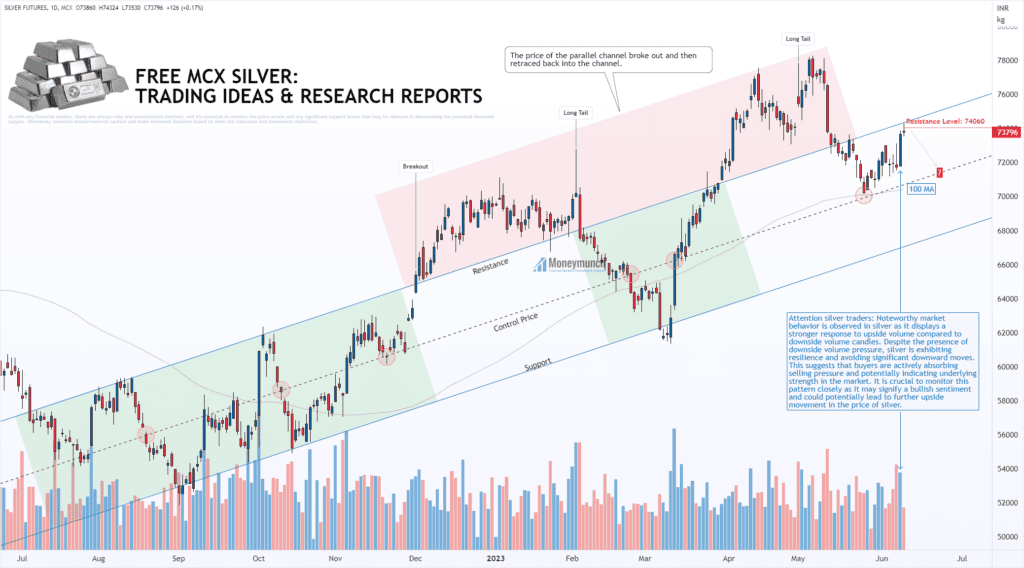

2020-2023: Pandemic Volatility and Inflationary Pressures

The COVID-19 pandemic drastically altered the silver market panorama. The preliminary market crash in early 2020 noticed silver costs plummet alongside different commodities. Nonetheless, the next restoration was surprisingly sturdy, pushed by a number of components:

- Secure-Haven Demand: The pandemic fueled a flight to security, with traders in search of refuge in valuable metals like silver. This surge in demand briefly overshadowed the adverse affect of decreased industrial exercise.

- Financial Coverage: Central banks world wide applied large stimulus packages to fight the financial fallout from the pandemic. This led to elevated cash provide and inflationary pressures, boosting the attractiveness of valuable metals as a hedge in opposition to inflation.

- Provide Chain Disruptions: The pandemic precipitated vital disruptions to world provide chains, impacting silver manufacturing and probably contributing to cost will increase.

Nonetheless, the post-pandemic interval noticed a correction, with costs fluctuating considerably. Inflationary pressures remained a key driver, however considerations about future financial development and potential rate of interest hikes created uncertainty available in the market. The worth of silver navigated a fancy surroundings, reacting to evolving financial information and investor sentiment.

2024 and Past (Projected): Navigating Uncertainty

Predicting silver costs past 2023 is inherently speculative. Nonetheless, based mostly on present developments and potential future situations, we will define some prospects:

- Continued Inflationary Pressures: If inflation persists, silver may benefit from elevated demand as a hedge in opposition to inflation. This might push costs larger.

- Financial Slowdown: A major financial slowdown may dampen industrial demand, placing downward strain on silver costs.

- Technological Developments: Continued development in sectors like renewable power and electronics may drive elevated demand for silver, supporting its value.

- Geopolitical Dangers: Geopolitical instability and uncertainty may proceed to spice up safe-haven demand for silver.

Hypothetically, let’s think about a number of situations for the following few years:

- Situation 1 (Bullish): Persistent inflation, sturdy demand from renewable power and expertise sectors, and geopolitical uncertainty may push silver costs to $30-$40 per ounce by 2027.

- Situation 2 (Impartial): Average inflation, secure financial development, and average investor curiosity may preserve silver costs throughout the $20-$30 per ounce vary.

- Situation 3 (Bearish): A major financial downturn, decreased industrial demand, and a stronger US greenback may push silver costs under $20 per ounce.

These are simply hypothetical situations, and the precise value trajectory will rely on a fancy interaction of things.

Conclusion:

Analyzing the silver value chart over the previous decade reveals a dynamic and sophisticated market influenced by macroeconomic circumstances, industrial demand, investor sentiment, and geopolitical occasions. Whereas the previous decade has seen durations of each vital development and decline, silver’s inherent worth as each an industrial steel and a retailer of worth continues to form its value trajectory. Understanding these influencing components is essential for traders and companies concerned within the silver market, as navigating the longer term would require a eager consciousness of the ever-shifting world panorama. Cautious monitoring of financial indicators, technological developments, and geopolitical developments shall be important for precisely predicting future value actions. The subsequent decade guarantees to be equally unstable and thrilling, presenting each alternatives and challenges for these concerned on the earth of silver.

Closure

Thus, we hope this text has offered priceless insights into A Decade of Silver: Analyzing the Worth Chart (2014-2024). We hope you discover this text informative and helpful. See you in our subsequent article!