Apple’s Share Worth Chart In 2000: A Yr Of Transition And Uncertainty

Apple’s Share Worth Chart in 2000: A Yr of Transition and Uncertainty

Associated Articles: Apple’s Share Worth Chart in 2000: A Yr of Transition and Uncertainty

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Apple’s Share Worth Chart in 2000: A Yr of Transition and Uncertainty. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Apple’s Share Worth Chart in 2000: A Yr of Transition and Uncertainty

The 12 months 2000 marked a pivotal second in Apple’s historical past, a 12 months of serious transition and appreciable uncertainty mirrored vividly in its share value chart. Whereas the dot-com bubble was inflating to unprecedented heights, Apple, then an organization struggling to search out its footing after years of near-collapse, navigated a turbulent market panorama. Analyzing the Apple share value chart of 2000 reveals a narrative of fluctuating fortunes, reflecting the corporate’s inside struggles and the broader macroeconomic setting. This text delves into the components that formed Apple’s inventory efficiency all through that 12 months, providing an in depth evaluation of the chart’s actions and their underlying causes.

The Pre-2000 Context: A Firm on the Brink

To know the 2000 chart, it is essential to look at the previous years. Apple, within the late Nineteen Nineties, was removed from the tech big it’s at present. The corporate had confronted near-bankruptcy within the mid-90s, struggling to compete with the rising dominance of Home windows-based PCs. Whereas the iMac’s launch in 1998 marked a big turnaround, injecting much-needed vitality and innovation into the model, the corporate was nonetheless fragile and closely reliant on the success of some key merchandise. Its inventory value, whereas displaying indicators of restoration, remained unstable and prone to market shifts.

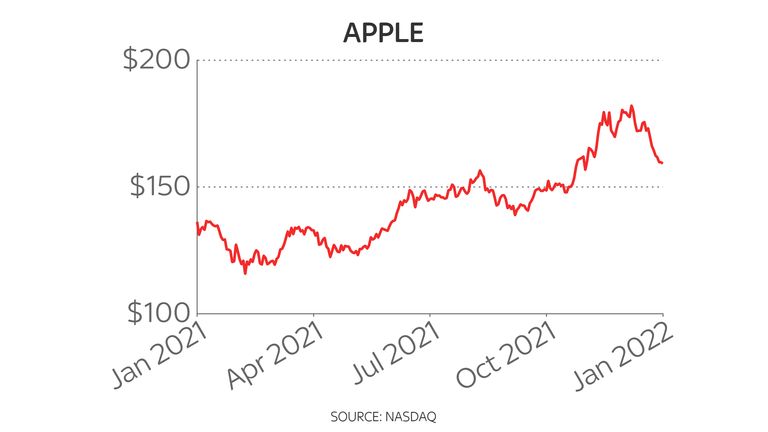

The 2000 Chart: A Rollercoaster Trip

The Apple share value chart for 2000 reveals a dramatic rollercoaster trip. The 12 months did not start with a bang. The inventory value began comparatively low, reflecting the lingering uncertainty surrounding Apple’s long-term viability. Whereas the iMac had been a hit, its influence on the underside line was nonetheless creating. The preliminary months of the 12 months noticed a interval of relative stability, with the value fluctuating inside a slender vary. This era of consolidation is likely to be attributed to buyers cautiously assessing Apple’s progress and the general market sentiment.

Nevertheless, the relative calm did not final. Because the 12 months progressed, the chart started to exhibit larger volatility. A number of components contributed to this elevated fluctuation:

-

The Dot-Com Bubble: The 12 months 2000 was on the peak of the dot-com bubble, a interval of unprecedented development in internet-related firms. Whereas this exuberance boosted many tech shares, it additionally created an setting vulnerable to speculative bubbles and speedy corrections. Apple, as a tech firm, was inevitably influenced by this broader market development. Intervals of serious positive aspects had been interspersed with sharp drops as investor sentiment swung wildly.

-

Product Launches and Efficiency: Apple’s product releases and their market reception considerably impacted the share value. Profitable product launches usually led to constructive market reactions and share value will increase. Conversely, any perceived shortcomings or delays might set off sell-offs. The efficiency of current merchandise additionally performed a task. Continued success of the iMac and any constructive gross sales figures for different merchandise offered a cushion in opposition to market downturns.

-

Monetary Efficiency: Apple’s quarterly earnings experiences performed an important function in shaping the share value. Sturdy earnings usually boosted investor confidence, main to cost will increase. Conversely, disappointing outcomes might set off vital sell-offs, amplifying the volatility already current out there. Analysts’ forecasts and their subsequent revisions additionally performed a big function in driving investor sentiment and share value actions.

-

Aggressive Panorama: The aggressive panorama remained intensely difficult. Microsoft continued its dominance within the PC market, whereas different tech firms had been vying for market share. Any perceived aggressive benefit or drawback for Apple straight impacted investor confidence and share value. Information of recent merchandise from rivals, particularly within the burgeoning cellular market, might set off detrimental reactions.

-

Basic Market Sentiment: The general market sentiment, influenced by macroeconomic components like rates of interest and financial development, additionally performed a task. Intervals of constructive financial sentiment typically led to broader market positive aspects, benefiting Apple’s inventory value. Conversely, detrimental financial information or uncertainty might set off sell-offs throughout the board, impacting Apple’s share value no matter its particular efficiency.

Analyzing Particular Chart Patterns:

An in depth evaluation of the 2000 Apple share value chart would reveal particular patterns reflecting the interaction of those components. For example, we would observe:

-

Intervals of sharp upward actions: These may very well be attributed to profitable product launches, robust earnings experiences, or constructive market sentiment.

-

Intervals of serious decline: These might mirror disappointing earnings, detrimental information about rivals, or broader market corrections pushed by the bursting dot-com bubble.

-

Consolidation intervals: These intervals of relative stability, characterised by smaller value fluctuations, counsel a interval of market indecision or cautious optimism as buyers watch for additional data.

The Significance of 2000 in Apple’s Trajectory:

The 2000 share value chart isn’t just a report of every day fluctuations; it is a visible illustration of Apple’s battle for survival and its gradual transition in the direction of turning into the tech big we all know at present. Whereas the 12 months itself did not present a dramatic upward development, it laid the groundwork for future development. The corporate was studying to navigate a difficult market, refining its product technique, and constructing a basis for future innovation. The volatility of the chart displays the inherent dangers and rewards related to investing in a younger, quickly evolving firm.

Conclusion:

The Apple share value chart for 2000 gives an enchanting case examine within the interaction of company efficiency, market sentiment, and macroeconomic components. Whereas the 12 months was characterised by vital volatility, it additionally laid the inspiration for Apple’s subsequent outstanding development. Analyzing this chart permits us to understand the challenges confronted by the corporate throughout this essential interval and perceive the components that in the end contributed to its transformation into one of many world’s Most worthy firms. The teachings discovered from this era spotlight the significance of long-term imaginative and prescient, strategic product improvement, and the power to adapt to a quickly altering technological panorama. The 2000 chart serves as a reminder that even essentially the most profitable firms face intervals of uncertainty and that sustained success requires resilience, innovation, and a eager understanding of the market forces at play. It’s a testomony to the corporate’s means to not solely survive however thrive within the face of adversity.

Closure

Thus, we hope this text has offered invaluable insights into Apple’s Share Worth Chart in 2000: A Yr of Transition and Uncertainty. We hope you discover this text informative and useful. See you in our subsequent article!