Ascending Triangles: A Complete Information To This Highly effective Chart Sample

Ascending Triangles: A Complete Information to This Highly effective Chart Sample

Associated Articles: Ascending Triangles: A Complete Information to This Highly effective Chart Sample

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Ascending Triangles: A Complete Information to This Highly effective Chart Sample. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Ascending Triangles: A Complete Information to This Highly effective Chart Sample

The world of technical evaluation is wealthy with chart patterns, every providing insights into potential worth actions. Amongst these, the ascending triangle stands out as a bullish continuation sample, signaling a possible upward breakout after a interval of consolidation. Understanding its formation, traits, and implications is essential for any dealer aiming to leverage its predictive energy. This complete information delves into the nuances of ascending triangles, offering an in depth clarification for each novice and skilled merchants.

Understanding the Formation of an Ascending Triangle

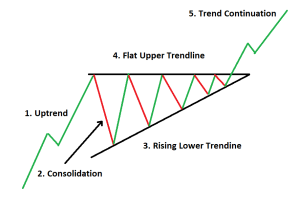

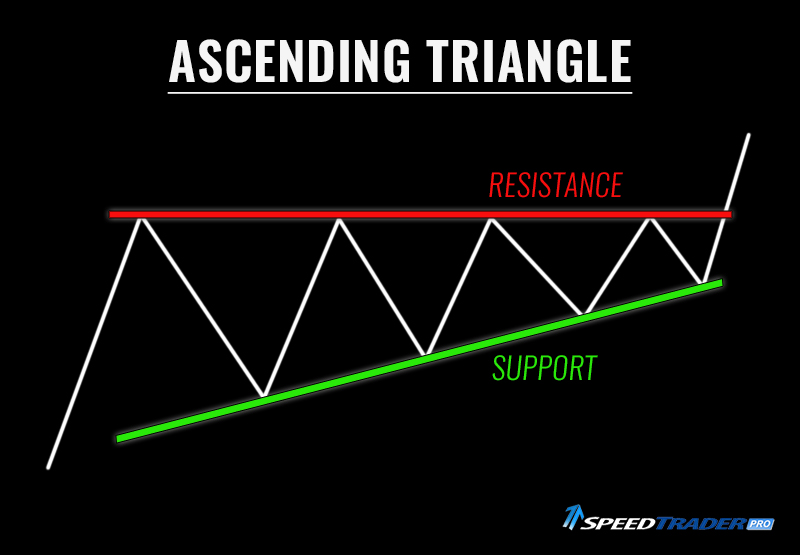

An ascending triangle is characterised by two converging trendlines: a horizontal resistance line and an upward-sloping assist line. The horizontal resistance line represents a worth stage the place promoting strain constantly prevents the value from breaking by means of. This resistance stage is essential, because it highlights a zone of great hesitation or rejection amongst patrons. Conversely, the upward-sloping assist line displays growing shopping for strain, with every subsequent low increased than the earlier one. This upward development in assist suggests rising bullish sentiment and accumulating shopping for energy.

The convergence of those two traces creates a triangular form, therefore the identify "ascending triangle." The sample’s period can fluctuate considerably, starting from a number of weeks to a number of months, relying on the underlying asset’s volatility and market situations. The longer the sample develops, the extra important the anticipated breakout tends to be.

Key Traits of an Ascending Triangle

A number of key traits assist differentiate an ascending triangle from different chart patterns:

-

Horizontal Resistance: A clearly outlined horizontal resistance line is the defining characteristic. This line connects a sequence of swing highs, representing factors the place the value repeatedly fails to surpass a selected stage. It is essential to establish this resistance precisely, because it varieties the idea of the sample’s predictive energy.

-

Upward-Sloping Help: The ascending assist line connects a sequence of upper lows. This line signifies rising shopping for strain, with patrons constantly stepping in to assist the value at progressively increased ranges. The slope of this line can fluctuate, however a delicate upward incline is typical.

-

Convergence: The core of the sample lies within the convergence of the horizontal resistance and the upward-sloping assist. Because the sample develops, the hole between these two traces narrows, creating a way of mounting strain for a breakout. This narrowing hole typically results in elevated volatility as the value approaches the apex of the triangle.

-

Quantity: Whereas not a defining attribute, quantity typically performs a major position in confirming the sample’s validity. Usually, quantity tends to lower because the sample develops, reflecting the consolidation part. Nonetheless, a surge in quantity accompanying the breakout typically alerts a powerful affirmation of the upward transfer.

-

Time Body: Ascending triangles can seem on numerous timeframes, from short-term intraday charts to long-term weekly or month-to-month charts. The timeframe influences the interpretation of the sample’s implications and the potential magnitude of the breakout.

Figuring out False Breakouts

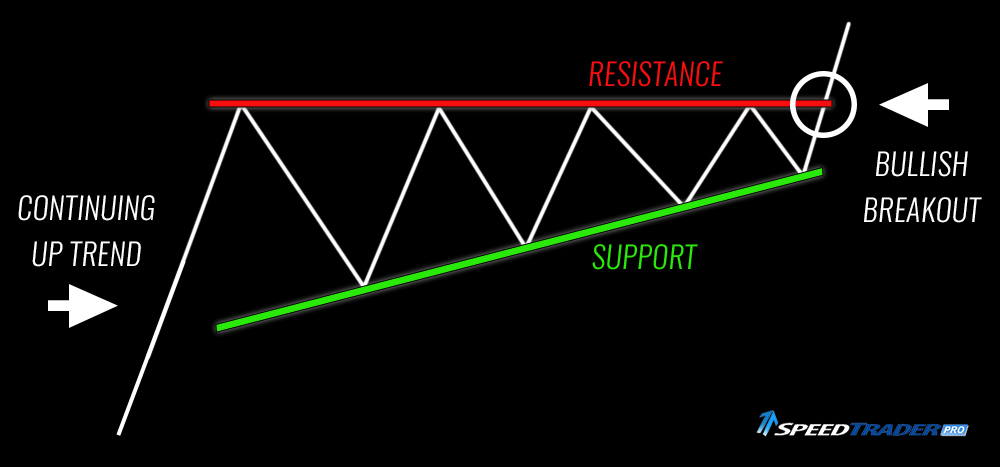

One potential pitfall when buying and selling ascending triangles is the prevalence of false breakouts. A false breakout happens when the value briefly breaks beneath the upward-sloping assist line, making a misleading bearish sign. Nonetheless, patrons typically shortly step in to reverse this transfer, pushing the value again above the assist line. These false breakouts might be irritating for merchants, resulting in untimely exits or incorrect entries.

A number of elements will help establish potential false breakouts:

-

Quantity: An absence of great quantity accompanying a break beneath the assist line typically suggests a false breakout. A real breakout normally includes a surge in buying and selling quantity.

-

Worth Motion: The value motion following a possible false breakout can present additional clues. A fast reversal and a return above the assist line, coupled with elevated shopping for strain, point out a false sign.

-

Technical Indicators: Utilizing technical indicators equivalent to RSI (Relative Power Index) or MACD (Transferring Common Convergence Divergence) will help affirm or refute a breakout. Divergences between worth and these indicators can sign a possible false breakout.

Buying and selling Methods for Ascending Triangles

The ascending triangle sample suggests a bullish outlook, with the value anticipated to interrupt above the horizontal resistance line. Profitable buying and selling methods contain figuring out the appropriate entry and exit factors, managing threat successfully, and contemplating numerous market situations.

-

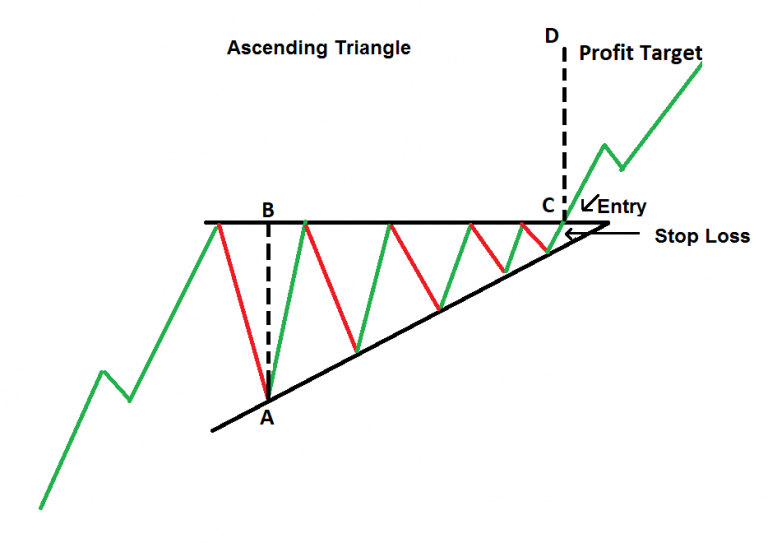

Entry Level: A typical technique is to enter an extended place as soon as the value decisively breaks above the horizontal resistance line, accompanied by elevated quantity. A stop-loss order ought to be positioned beneath the lately damaged assist line to restrict potential losses in case the breakout proves false.

-

Goal Worth: The goal worth is usually calculated by measuring the peak of the triangle’s vertical dimension and projecting it upwards from the breakout level. This projection offers a possible worth goal for the following upward motion.

-

Threat Administration: Correct threat administration is essential, particularly contemplating the potential for false breakouts. Utilizing stop-loss orders and place sizing strategies will help handle potential losses and defend capital.

-

Affirmation: Whereas a breakout above the resistance line is a key sign, affirmation from different technical indicators or worth motion patterns can strengthen the buying and selling sign and improve confidence.

Limitations and Issues

Whereas ascending triangles are a robust sample, it is essential to acknowledge their limitations:

-

False Breakouts: As mentioned earlier, false breakouts can result in losses if not correctly managed.

-

Affirmation: Reliance solely on the sample with out contemplating different elements, equivalent to total market sentiment and basic evaluation, can result in inaccurate predictions.

-

Time Sensitivity: The sample’s effectiveness can diminish if the breakout doesn’t happen inside an affordable timeframe. Extended consolidation can invalidate the sample.

-

Context Issues: The sample’s interpretation ought to all the time think about the broader market context. A bullish sample in a bearish market could not yield the anticipated outcomes.

Conclusion

The ascending triangle sample is a worthwhile device in a dealer’s arsenal, offering insights into potential worth actions. By understanding its formation, traits, and potential pitfalls, merchants can leverage this sample to reinforce their buying and selling methods. Nonetheless, it is essential to do not forget that no chart sample ensures success. Combining technical evaluation with sound threat administration and a holistic understanding of market dynamics is important for making knowledgeable buying and selling choices. All the time keep in mind to conduct thorough analysis and think about your threat tolerance earlier than implementing any buying and selling technique based mostly on chart patterns. The ascending triangle, when appropriately recognized and interpreted inside a broader market context, can considerably improve the chance of profitable trades, however it ought to by no means be considered as a standalone predictor of future worth actions.

:max_bytes(150000):strip_icc()/dotdash_Final_Ascending_Triangle_Definition_and_Tactics_Nov_2020-01-3ad09a5a80c847b6bfe5f50bb1726d57.jpg)

Closure

Thus, we hope this text has supplied worthwhile insights into Ascending Triangles: A Complete Information to This Highly effective Chart Sample. We thanks for taking the time to learn this text. See you in our subsequent article!