Bitcoin Value Chart 2025: A Retrospective Evaluation

Bitcoin Value Chart 2025: A Retrospective Evaluation

Associated Articles: Bitcoin Value Chart 2025: A Retrospective Evaluation

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Bitcoin Value Chart 2025: A Retrospective Evaluation. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Bitcoin Value Chart 2025: A Retrospective Evaluation

Predicting the longer term worth of Bitcoin (BTC) is a notoriously tough activity. The cryptocurrency market is risky, influenced by a posh interaction of technological developments, regulatory modifications, macroeconomic components, and market sentiment. Whereas nobody can definitively say the place Bitcoin’s worth might be in 2025, a retrospective evaluation of predictions and market developments permits us to investigate potential eventualities and achieve a greater understanding of the components that might form its trajectory.

This text will discover numerous views on Bitcoin’s potential worth in 2025, analyzing previous predictions, analyzing market cycles, contemplating technological developments, and assessing the impression of macroeconomic and regulatory environments. We are going to keep away from making definitive worth predictions, as a substitute specializing in a nuanced understanding of the forces at play.

Previous Predictions and Their Accuracy:

Wanting again at previous Bitcoin worth predictions gives a invaluable, albeit humbling, lesson. Many analysts and consultants have tried to forecast Bitcoin’s worth, with various levels of success (or lack thereof). Some predicted exponential development, whereas others foresaw a collapse. The truth, as all the time, has been much more complicated. The accuracy of previous predictions highlights the inherent uncertainty in forecasting such a risky asset. Analyzing the explanations for these inaccuracies – whether or not it was an underestimation of regulatory hurdles, unexpected technological developments, or a misjudgment of market sentiment – helps refine our understanding of the components influencing Bitcoin’s worth.

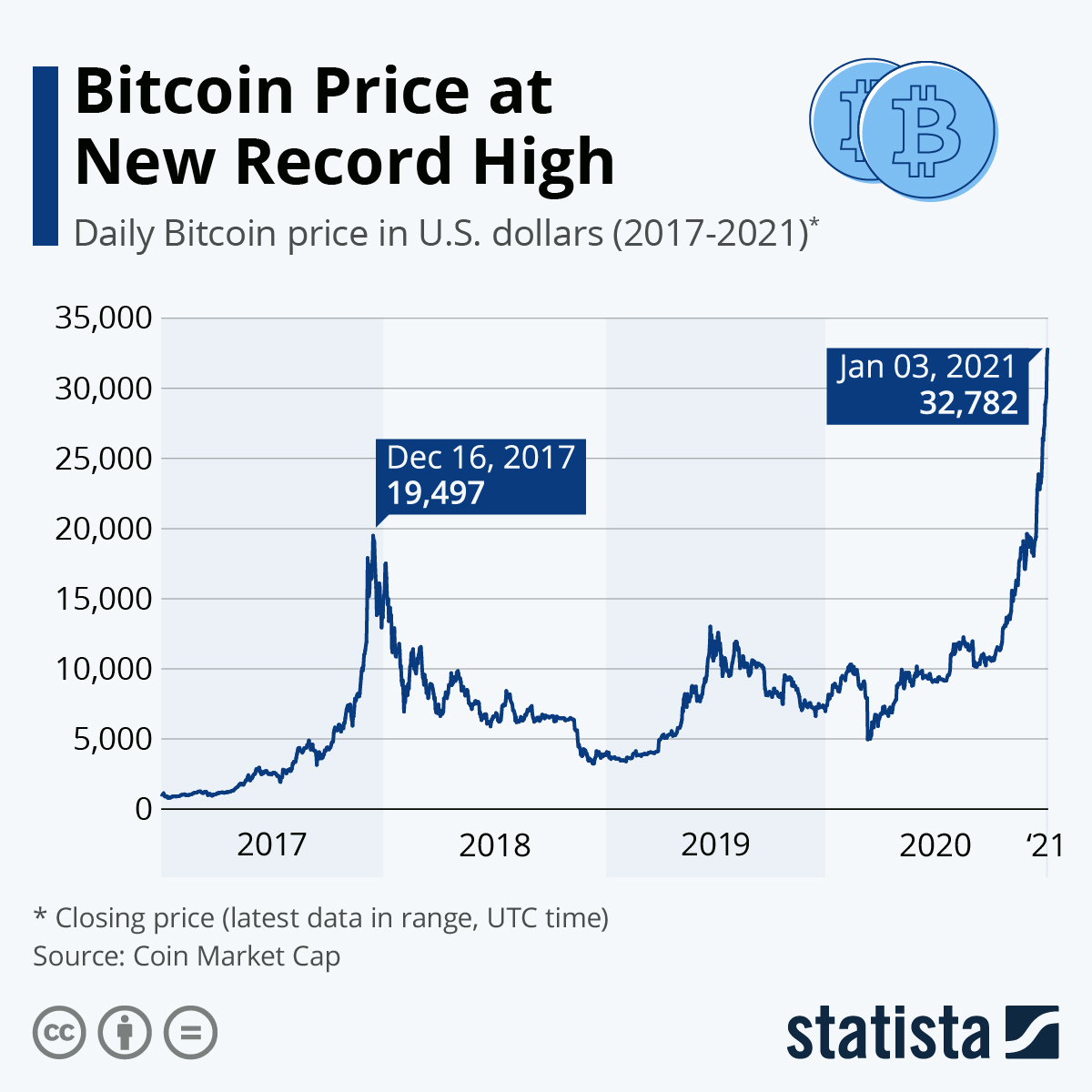

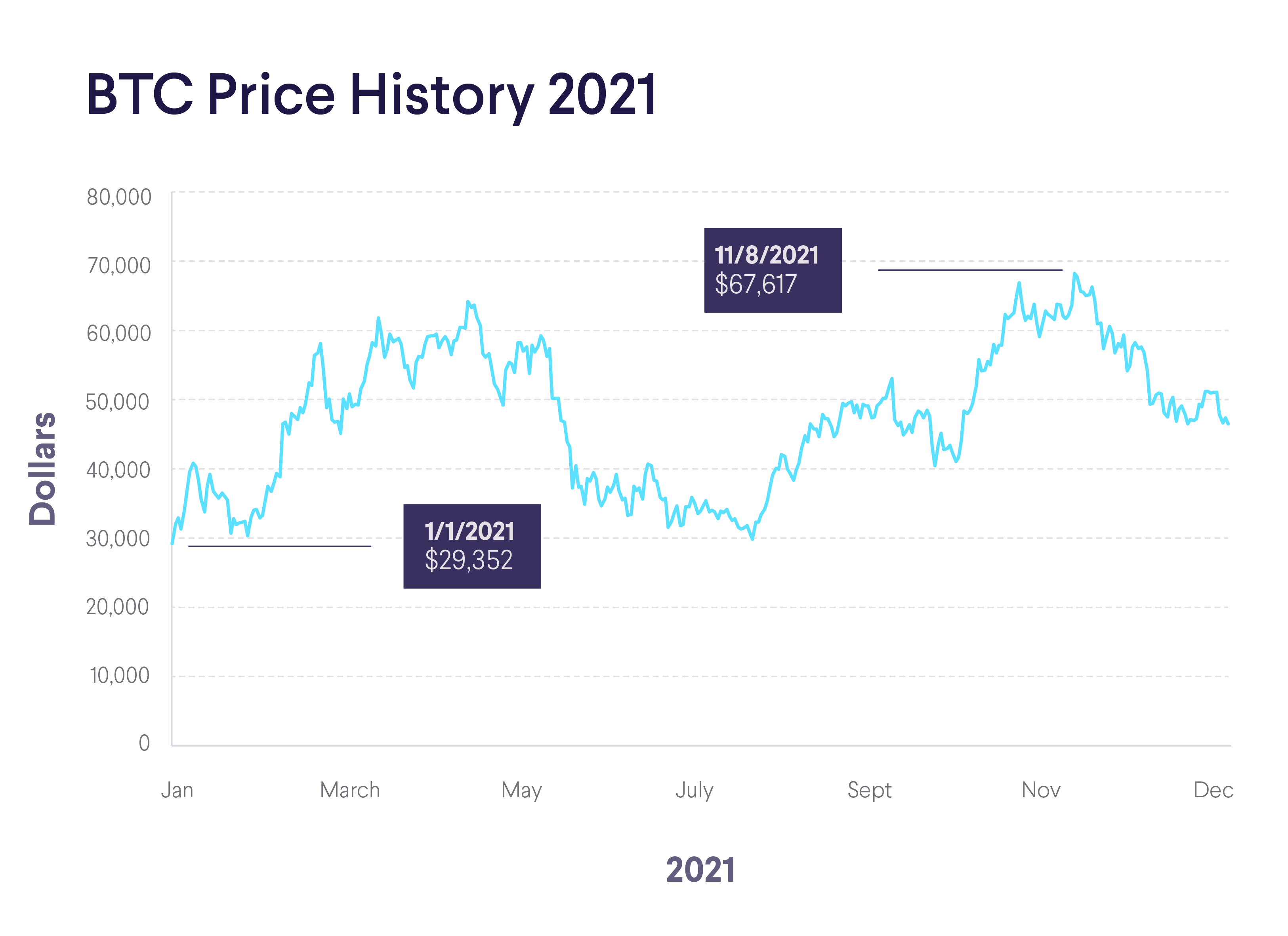

For instance, predictions made in 2017, in the course of the top of the final main bull market, had been wildly optimistic for a lot of. These predictions typically didn’t account for the next "crypto winter" that adopted, characterised by a big worth drop and extended bear market. Equally, predictions made in the course of the bear market typically underestimated the resilience of Bitcoin and its potential to recuperate. These situations underscore the significance of contemplating a spread of potential outcomes relatively than counting on single-point predictions.

Market Cycles and Historic Tendencies:

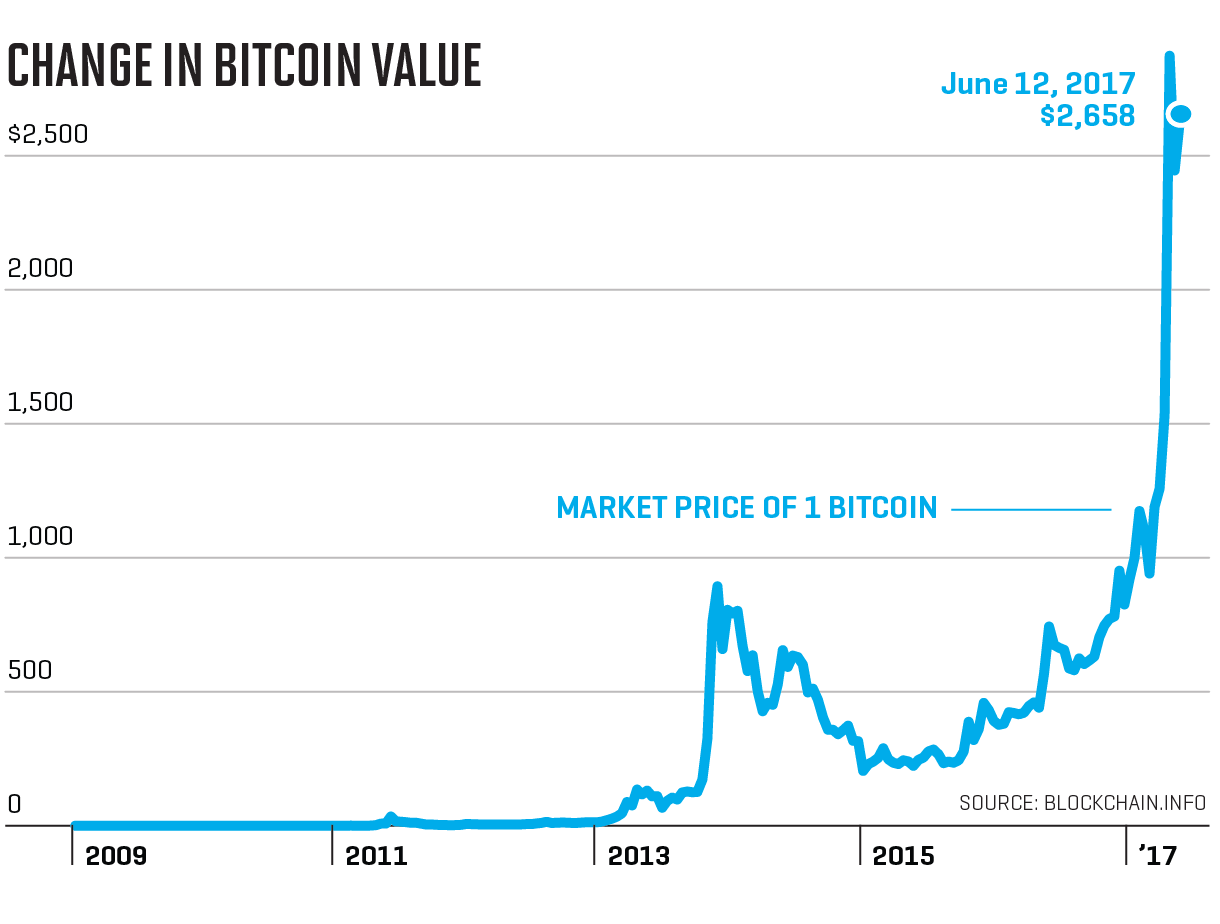

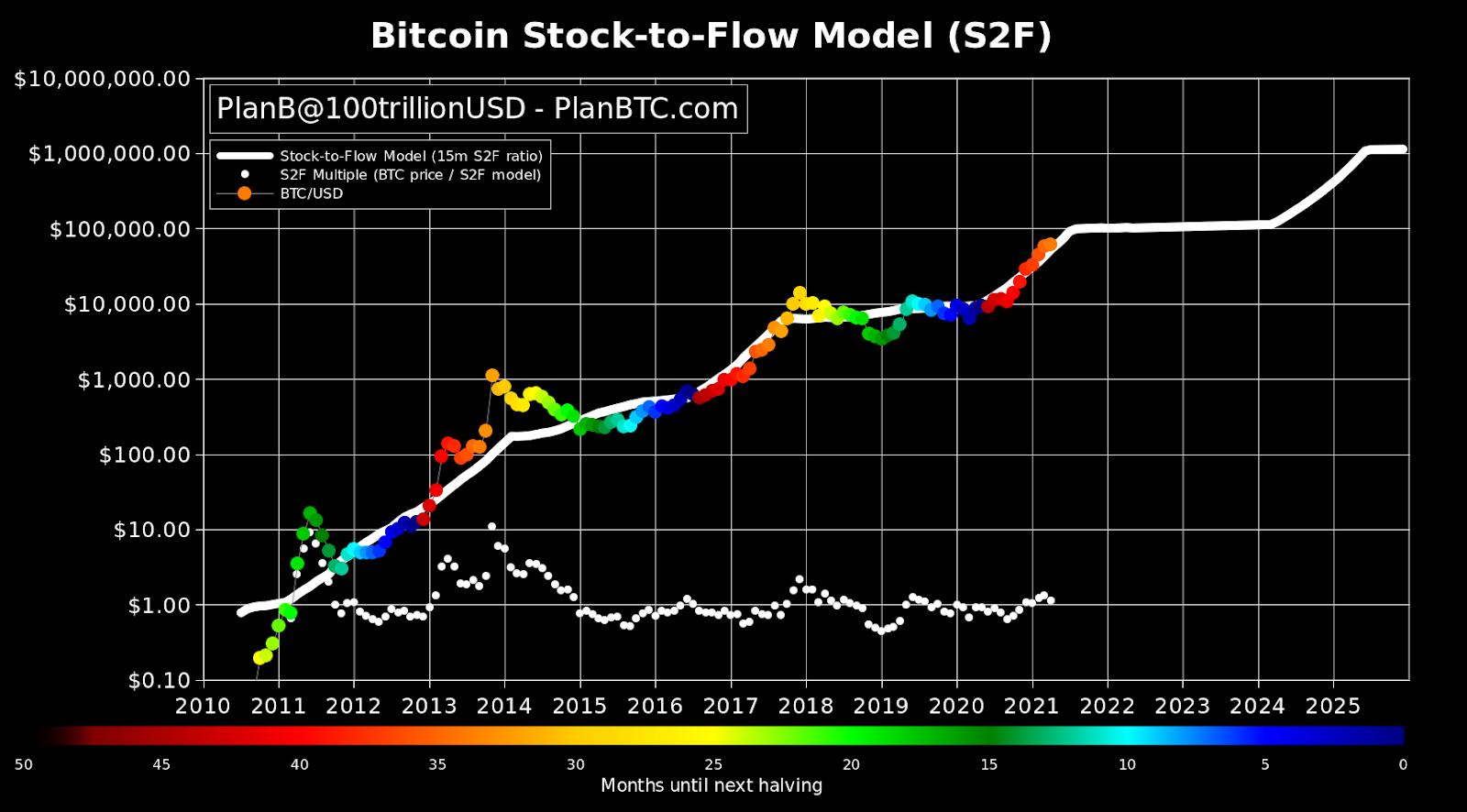

Bitcoin’s worth historical past reveals cyclical patterns, characterised by durations of explosive development (bull markets) adopted by durations of decline (bear markets). Understanding these cycles is essential for any try to investigate potential worth actions in 2025. Analyzing the period and magnitude of previous cycles, together with the underlying components that triggered them, can supply insights into potential future patterns.

The halving occasions, which happen roughly each 4 years and cut back the speed of Bitcoin mining rewards, have traditionally been related to bullish worth actions. The halving reduces the provision of latest Bitcoins getting into the market, doubtlessly resulting in elevated shortage and worth appreciation. Nonetheless, the impression of halving occasions is just not assured, and different market components can override their affect.

Technological Developments and Adoption:

The event and adoption of Bitcoin and associated applied sciences play a big position in shaping its worth. Enhancements in scalability, safety, and value might drive elevated adoption and, consequently, worth appreciation. Conversely, setbacks or safety breaches might negatively impression investor confidence and result in worth declines.

The Lightning Community, for instance, is a layer-2 scaling resolution designed to enhance Bitcoin’s transaction velocity and cut back charges. Wider adoption of the Lightning Community might make Bitcoin extra sensible for on a regular basis transactions, doubtlessly boosting demand and worth. Equally, developments in privacy-enhancing applied sciences might appeal to new customers involved about transaction transparency.

Conversely, technological challenges, reminiscent of persistent scalability points or the emergence of competing cryptocurrencies with superior expertise, might hinder Bitcoin’s development and negatively impression its worth.

Macroeconomic Elements and Regulatory Panorama:

International macroeconomic circumstances considerably impression Bitcoin’s worth. Elements reminiscent of inflation, rates of interest, and general financial development can affect investor urge for food for riskier belongings like Bitcoin. In periods of excessive inflation or financial uncertainty, Bitcoin could also be seen as a hedge in opposition to inflation, driving demand and worth appreciation. Conversely, durations of financial stability or rising rates of interest might lead traders to maneuver in direction of extra conventional belongings, doubtlessly lowering demand for Bitcoin.

Regulatory developments additionally play a vital position. Clear and favorable regulatory frameworks can foster investor confidence and drive adoption, whereas restrictive or unclear laws can stifle development and negatively impression the worth. The regulatory panorama varies considerably throughout totally different jurisdictions, and the evolving international regulatory atmosphere will proceed to be a key issue influencing Bitcoin’s worth.

Potential Eventualities for 2025:

Contemplating the components mentioned above, a number of potential eventualities for Bitcoin’s worth in 2025 might be envisioned:

-

Bullish State of affairs: Widespread adoption, technological developments, favorable regulatory developments, and a constructive macroeconomic atmosphere might result in important worth appreciation. On this state of affairs, Bitcoin’s worth might doubtlessly attain considerably increased ranges than its earlier all-time highs.

-

Bearish State of affairs: Destructive macroeconomic circumstances, unfavorable regulatory actions, technological setbacks, or a lack of investor confidence might result in a protracted bear market and decrease costs. This state of affairs might see Bitcoin’s worth stay beneath its present ranges and even expertise additional important declines.

-

Impartial State of affairs: A comparatively steady market with average development, characterised by a steadiness between constructive and destructive components. This state of affairs would possible see Bitcoin’s worth fluctuate inside a sure vary, with out experiencing dramatic worth swings in both course.

Conclusion:

Predicting the Bitcoin worth in 2025 stays a speculative train. Whereas analyzing historic information, market cycles, technological developments, macroeconomic components, and regulatory landscapes offers invaluable insights, it doesn’t assure correct predictions. As an alternative of specializing in a selected worth goal, it’s extra prudent to contemplate a spread of potential outcomes and perceive the components that might drive Bitcoin’s worth in both course. The way forward for Bitcoin stays unsure, however its evolution will undoubtedly proceed to be formed by the interaction of those complicated and interconnected forces. Steady monitoring of those components is essential for navigating the dynamic cryptocurrency market. In the end, the worth of Bitcoin in 2025 might be decided by the collective actions and beliefs of thousands and thousands of contributors in a world, decentralized market.

Closure

Thus, we hope this text has offered invaluable insights into Bitcoin Value Chart 2025: A Retrospective Evaluation. We admire your consideration to our article. See you in our subsequent article!