Chart Flag Patterns: A Complete Information For Merchants

Chart Flag Patterns: A Complete Information for Merchants

Associated Articles: Chart Flag Patterns: A Complete Information for Merchants

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Chart Flag Patterns: A Complete Information for Merchants. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Chart Flag Patterns: A Complete Information for Merchants

Chart patterns are invaluable instruments for technical analysts, offering visible representations of market sentiment and potential future value actions. Amongst these patterns, flag patterns stand out for his or her comparatively excessive chance of success and clear identification standards. Understanding flag patterns can considerably improve a dealer’s capability to foretell value course and handle threat. This text supplies a complete information to chart flag patterns, overlaying their varieties, identification, buying and selling methods, and threat administration concerns.

What are Chart Flag Patterns?

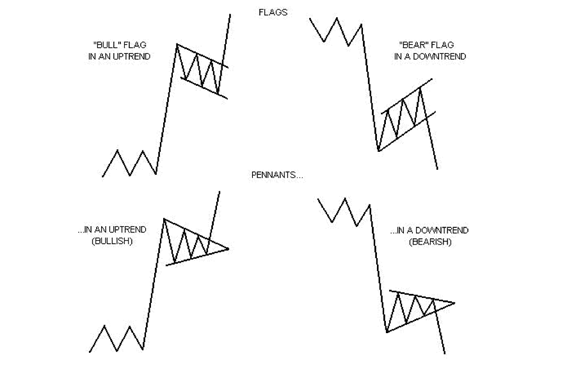

Flag patterns are continuation patterns, which means they point out a continuation of the present pattern slightly than a reversal. They’re characterised by a pointy value transfer (the "pole"), adopted by a interval of consolidation inside an outlined channel (the "flag"). The consolidation section represents a brief pause within the dominant pattern earlier than a resumption of the preliminary directional motion. Consider it like a flag waving on a pole – the pole represents the sturdy preliminary pattern, and the flag represents a quick pause earlier than the pattern continues.

Kinds of Flag Patterns:

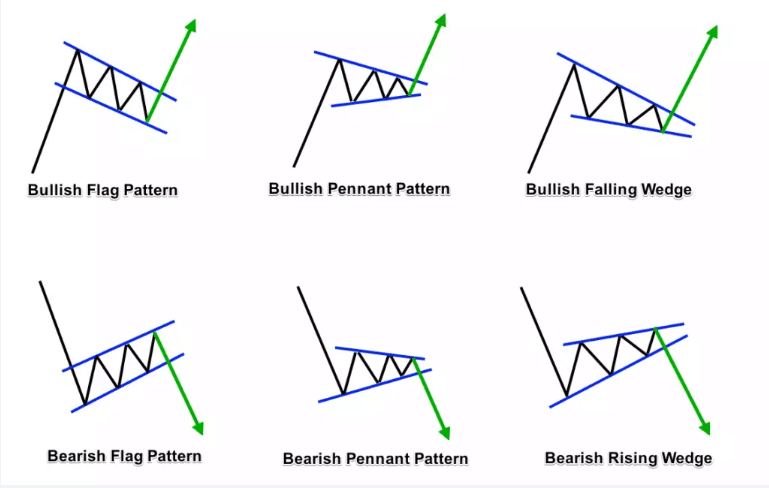

There are two major varieties of flag patterns:

-

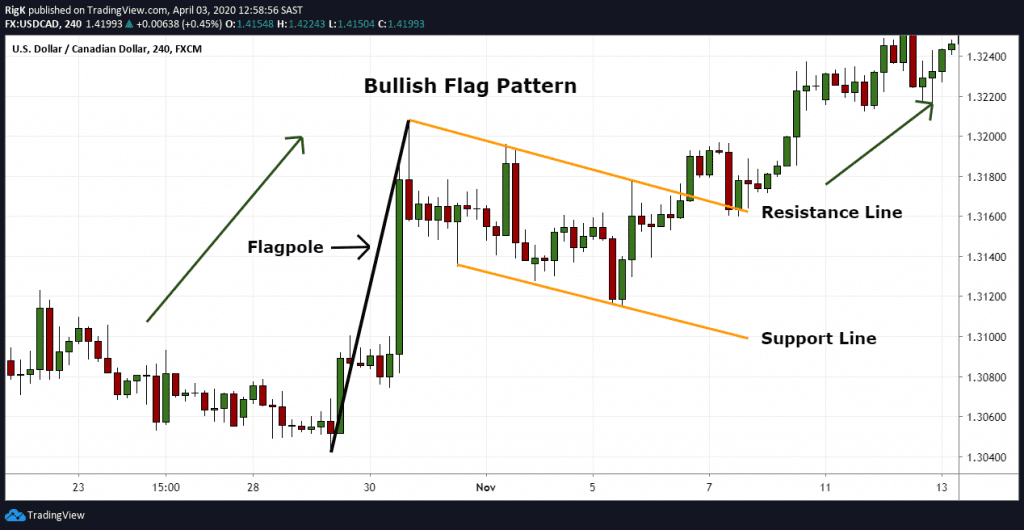

Bullish Flag: This sample signifies a continuation of an uptrend. The flag is characterised by a barely downward-sloping channel, indicating a interval of consolidation or minor profit-taking inside the total uptrend. The worth motion inside the flag is usually characterised by comparatively low volatility and smaller value swings in comparison with the previous pole.

-

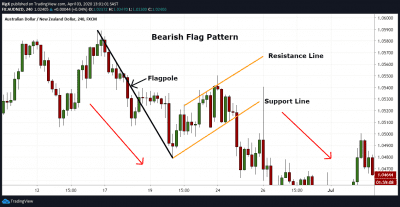

Bearish Flag: This sample indicators a continuation of a downtrend. The flag is characterised by a barely upward-sloping channel, representing a brief pause or short-lived bounce inside the prevailing downtrend. Just like the bullish flag, the value motion inside the bearish flag displays decrease volatility than the previous pole.

Figuring out Flag Patterns:

Figuring out a flag sample requires cautious commentary of the value chart and understanding the important thing traits:

-

The Pole: The pole is the preliminary sturdy and decisive value motion that precedes the flag. It must be a transparent and well-defined pattern, both upward (for bullish flags) or downward (for bearish flags). The size of the pole is essential; an extended pole typically suggests a extra highly effective and dependable breakout.

-

The Flag: The flag is the consolidation section that follows the pole. It is characterised by a parallel channel with converging trendlines. The channel must be comparatively tight, indicating low volatility. The flag sometimes lasts for a couple of days to a couple weeks, relying on the timeframe being analyzed. The slope of the channel distinguishes between bullish and bearish flags.

-

Quantity: Quantity typically performs a big function in confirming the sample. Usually, quantity is excessive through the pole, reflecting the sturdy momentum, and comparatively low through the flag, reflecting the consolidation section. A surge in quantity accompanying the breakout from the flag additional confirms the sample’s validity.

-

Breakout: The breakout from the flag is the essential sign for merchants. A decisive break above the higher trendline of a bullish flag or under the decrease trendline of a bearish flag confirms the continuation of the underlying pattern. The breakout ought to ideally be accompanied by elevated quantity.

Buying and selling Methods for Flag Patterns:

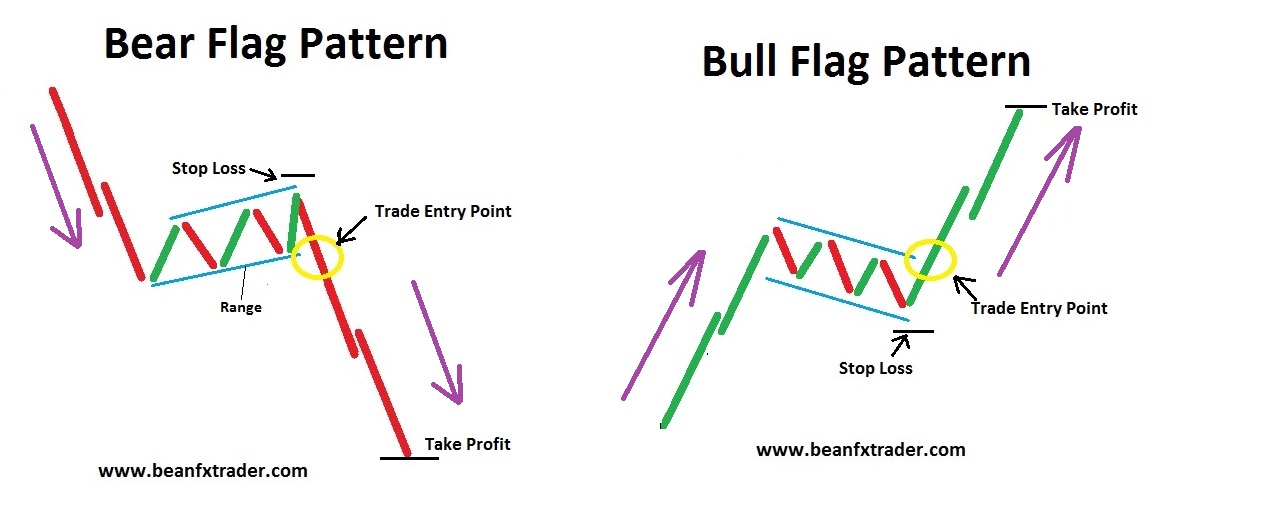

The buying and selling technique for flag patterns entails figuring out the sample, inserting a commerce upon the breakout, and setting applicable stop-loss and take-profit ranges.

-

Entry: The entry level is usually positioned simply after the value breaks out of the flag’s channel. For bullish flags, this implies inserting an extended place barely above the higher trendline. For bearish flags, this implies inserting a brief place barely under the decrease trendline. Utilizing a trailing cease loss might be helpful to lock in income as the value strikes in your favor.

-

Cease-Loss: The stop-loss order must be positioned under the decrease trendline for lengthy positions (bullish flags) and above the higher trendline for brief positions (bearish flags). This limits potential losses if the breakout fails. The stop-loss stage must be positioned strategically to attenuate false breakouts and handle threat successfully.

-

Take-Revenue: The take-profit stage might be decided in a number of methods. One widespread technique is to undertaking the goal value based mostly on the pole’s top. For instance, in a bullish flag, the take-profit goal could possibly be set at a distance equal to the pole’s top from the breakout level. Alternatively, merchants can use different technical indicators or assist/resistance ranges to find out their take-profit targets.

Danger Administration Concerns:

Buying and selling flag patterns, like several buying and selling technique, carries inherent dangers. Efficient threat administration is essential to mitigate potential losses.

-

False Breakouts: It is vital to concentrate on the potential of false breakouts. A value may briefly break by way of the flag’s channel earlier than reversing. Merchants ought to use affirmation indicators, similar to elevated quantity or sturdy candlestick patterns, to filter out false breakouts.

-

Place Sizing: Correct place sizing is essential to handle threat. Merchants ought to solely threat a small proportion of their buying and selling capital on any single commerce. This helps to stop important losses even when a commerce goes in opposition to their expectations.

-

Timeframe Choice: The timeframe chosen for figuring out flag patterns impacts the buying and selling technique. Longer-term patterns typically provide bigger potential income however require extra persistence. Shorter-term patterns permit for extra frequent trades however may result in larger transaction prices and elevated threat of whipsaws.

Combining Flag Patterns with Different Indicators:

Whereas flag patterns present precious insights, combining them with different technical indicators can improve their accuracy and effectiveness. Indicators similar to:

-

Transferring Averages: Transferring averages can affirm the pattern and supply extra entry and exit indicators.

-

Relative Energy Index (RSI): The RSI can assist determine overbought or oversold circumstances, which might help in confirming breakouts or figuring out potential reversals.

-

MACD: The Transferring Common Convergence Divergence (MACD) can assist affirm the pattern and determine potential momentum shifts.

can be utilized together with flag patterns to enhance buying and selling choices.

Conclusion:

Chart flag patterns are precious instruments for technical merchants searching for to capitalize on persevering with tendencies. By understanding their traits, figuring out them precisely, and using sound threat administration strategies, merchants can considerably enhance their buying and selling efficiency. Nonetheless, it is essential to do not forget that no buying and selling technique ensures success, and thorough analysis, self-discipline, and threat administration are important for profitable buying and selling. Constant apply and steady studying are key to mastering the artwork of figuring out and buying and selling flag patterns successfully. All the time bear in mind to backtest your methods and adapt them based mostly on market circumstances and your private threat tolerance.

Closure

Thus, we hope this text has offered precious insights into Chart Flag Patterns: A Complete Information for Merchants. We thanks for taking the time to learn this text. See you in our subsequent article!