Chart Of Accounts Grasp Information Administration: A Basis For Correct Monetary Reporting

Chart of Accounts Grasp Information Administration: A Basis for Correct Monetary Reporting

Associated Articles: Chart of Accounts Grasp Information Administration: A Basis for Correct Monetary Reporting

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Chart of Accounts Grasp Information Administration: A Basis for Correct Monetary Reporting. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Chart of Accounts Grasp Information Administration: A Basis for Correct Monetary Reporting

:max_bytes(150000):strip_icc()/chart-accounts.asp_final-438b76f8e6e444dd8f4cd8736b0baa6a.png)

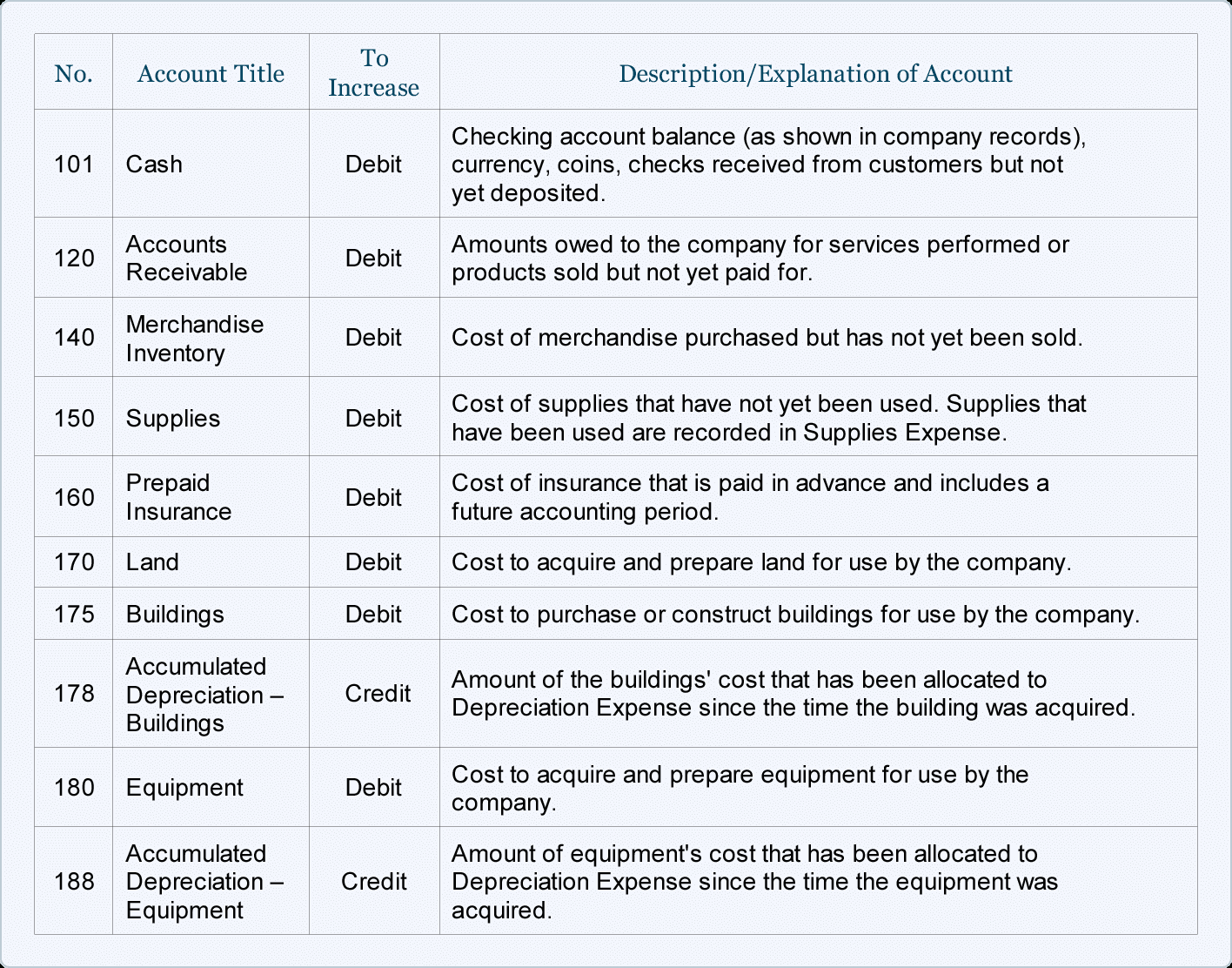

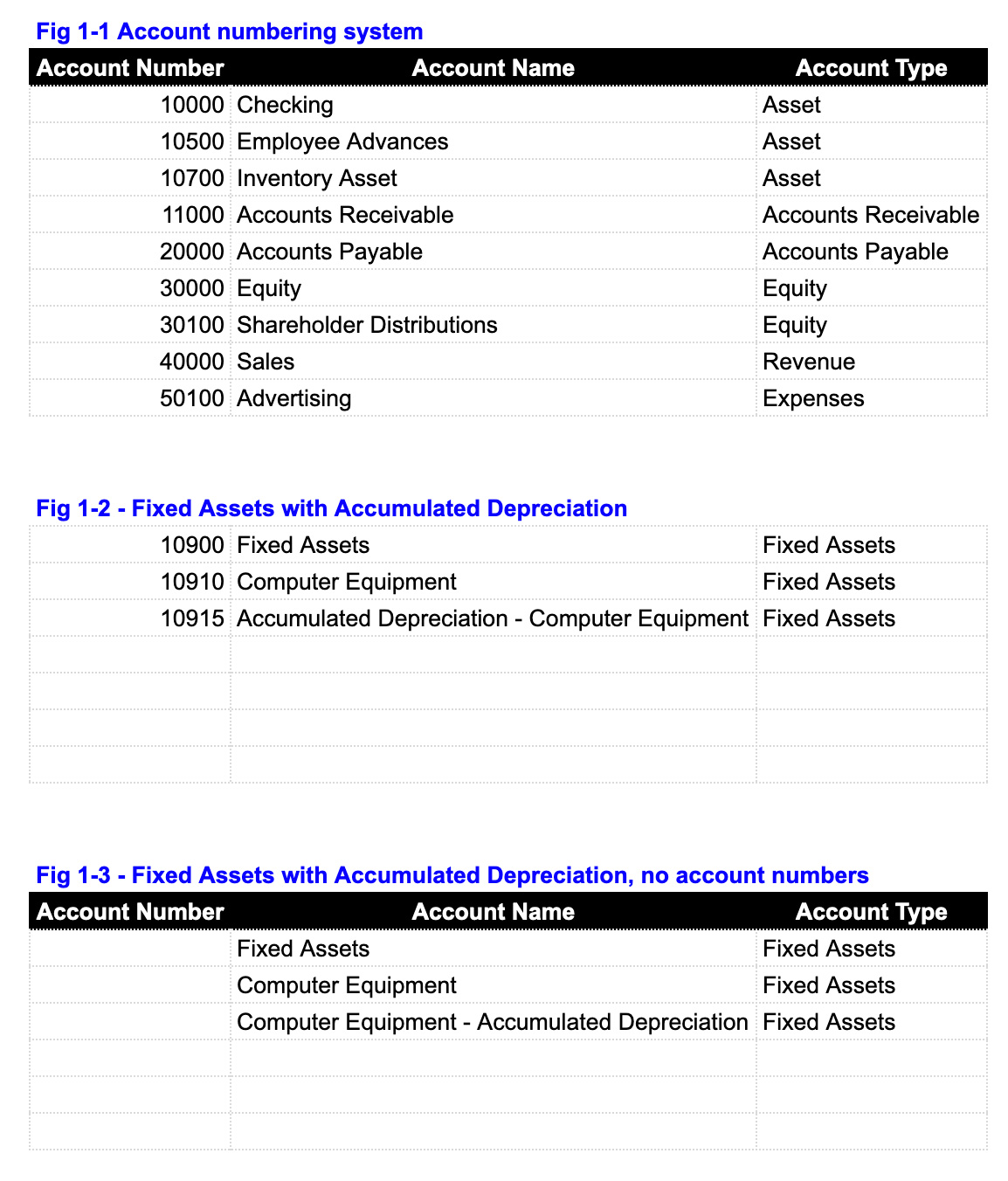

The chart of accounts (COA) is the spine of any group’s monetary system. It is a structured record of all of the accounts used to file monetary transactions, serving as an important aspect for correct monetary reporting, budgeting, and evaluation. Grasp information administration (MDM) of the COA, due to this fact, will not be merely a technical job; it is a strategic crucial for sustaining monetary integrity and operational effectivity. Efficient COA MDM ensures information accuracy, consistency, and completeness, finally resulting in improved decision-making and regulatory compliance.

This text explores the vital elements of COA grasp information administration, encompassing its significance, key challenges, finest practices, and technological options.

The Significance of COA Grasp Information Administration

A well-managed COA is greater than only a record of accounts. It is a fastidiously designed framework that displays the group’s construction, operational processes, and reporting necessities. Efficient COA MDM provides quite a few advantages, together with:

-

Improved Information Accuracy: Constant and correct information is the muse of dependable monetary reporting. MDM ensures that each one monetary transactions are recorded utilizing the right account codes, minimizing errors and inconsistencies. This reduces the chance of misstatements and improves the credibility of economic statements.

-

Enhanced Reporting and Evaluation: A well-structured COA permits for environment friendly and insightful monetary reporting. Information may be simply aggregated and analyzed throughout totally different dimensions, offering beneficial insights into the group’s monetary efficiency. This permits higher decision-making concerning useful resource allocation, funding methods, and operational effectivity.

-

Streamlined Processes: A standardized COA simplifies accounting processes, decreasing guide effort and the chance of human error. Automation turns into attainable, streamlining duties akin to journal entry processing, report technology, and reconciliation.

-

Higher Auditability: A well-managed COA simplifies the audit course of by offering a transparent and constant audit path. This reduces the effort and time required for audits, minimizing the chance of audit findings.

-

Regulatory Compliance: Many rules require particular accounting practices and reporting requirements. A well-defined and managed COA helps organizations adjust to these rules, minimizing the chance of penalties and authorized points. That is particularly essential for organizations working in a number of jurisdictions or industries with various regulatory landscapes.

-

Improved Collaboration: A centralized and well-maintained COA facilitates collaboration throughout totally different departments and enterprise models. This improves information consistency and reduces conflicts arising from totally different interpretations of account codes.

-

Scalability and Flexibility: As companies develop and evolve, their accounting wants change. A well-designed COA MDM system can adapt to those modifications, guaranteeing that the COA stays related and efficient. This flexibility is vital for organizations present process mergers, acquisitions, or important organizational restructuring.

Challenges in COA Grasp Information Administration

Regardless of its significance, managing the COA successfully presents a number of challenges:

-

Information Silos: Monetary information is usually scattered throughout totally different techniques and departments, resulting in inconsistencies and information duplication. Integrating information from varied sources right into a unified view is a big hurdle.

-

Lack of Standardization: Inconsistent naming conventions, account codes, and chart constructions throughout totally different departments or subsidiaries can result in confusion and errors. Establishing and implementing standardized procedures is essential.

-

Handbook Processes: Many organizations nonetheless depend on guide processes for COA upkeep, which is time-consuming, error-prone, and inefficient. Automating these processes is important for improved effectivity and accuracy.

-

Lack of Information Governance: And not using a clear governance framework, sustaining information high quality and consistency is tough. Establishing clear roles, tasks, and processes for COA administration is vital.

-

Integration with different Methods: The COA should seamlessly combine with different enterprise techniques, akin to ERP, CRM, and budgeting techniques. Lack of integration can result in information inconsistencies and inefficiencies.

-

Change Administration: Implementing modifications to the COA may be difficult, requiring cautious planning and communication to reduce disruption to enterprise operations. Efficient change administration processes are important.

-

Information Safety and Entry Management: Defending delicate monetary information is essential. Sturdy safety measures and entry controls are obligatory to forestall unauthorized entry and information breaches.

Finest Practices for COA Grasp Information Administration

Overcoming these challenges requires adopting finest practices in COA MDM:

-

Set up a Clear Information Governance Framework: Outline roles, tasks, and processes for managing the COA. Set up clear pointers for account creation, modification, and deletion.

-

Implement a Centralized Repository: Consolidate all COA info right into a single, centralized repository, offering a single supply of fact for all customers.

-

Standardize Account Codes and Naming Conventions: Develop a constant and standardized strategy to account naming and coding, guaranteeing readability and consistency throughout the group.

-

Automate COA Upkeep Processes: Automate duties akin to account creation, modification, and validation, decreasing guide effort and the chance of errors.

-

Implement Information High quality Guidelines and Validation: Set up guidelines and validation checks to make sure information accuracy and consistency. This contains checks for duplicate accounts, invalid account codes, and lacking info.

-

Usually Overview and Replace the COA: The COA must be repeatedly reviewed and up to date to mirror modifications within the group’s construction, operations, and reporting necessities.

-

Make the most of Know-how: Leverage MDM software program and instruments to automate processes, enhance information high quality, and improve collaboration.

-

Present Coaching and Training: Present coaching to customers on the correct use and upkeep of the COA.

Technological Options for COA Grasp Information Administration

A number of technological options can facilitate efficient COA MDM:

-

Grasp Information Administration (MDM) Software program: MDM software program gives a centralized repository for managing grasp information, together with the COA. These options supply options akin to information high quality guidelines, workflow automation, and information governance capabilities.

-

Enterprise Useful resource Planning (ERP) Methods: Most trendy ERP techniques embrace sturdy COA administration capabilities, integrating the COA with different monetary processes.

-

Cloud-Based mostly Options: Cloud-based options supply scalability, flexibility, and accessibility, making them perfect for managing the COA.

-

Information Integration Instruments: Information integration instruments might help consolidate COA information from varied sources right into a unified view.

-

Information Analytics and Enterprise Intelligence Instruments: These instruments can present insights into the COA information, serving to establish areas for enchancment and optimization.

Conclusion

Efficient COA grasp information administration is a vital element of any group’s monetary success. By implementing finest practices and leveraging applicable applied sciences, organizations can enhance information accuracy, streamline processes, improve reporting, and guarantee regulatory compliance. The funding in COA MDM isn’t just a price; it is a strategic funding that yields important returns by way of improved monetary integrity, operational effectivity, and knowledgeable decision-making. The journey in the direction of attaining sturdy COA MDM requires a holistic strategy, encompassing technological options, sturdy governance frameworks, and a dedication to steady enchancment. Solely then can organizations actually leverage the facility of their monetary information to drive progress and obtain their strategic aims.

Closure

Thus, we hope this text has supplied beneficial insights into Chart of Accounts Grasp Information Administration: A Basis for Correct Monetary Reporting. We thanks for taking the time to learn this text. See you in our subsequent article!