Chart Of Accounts: The Spine Of Monetary Reporting

Chart of Accounts: The Spine of Monetary Reporting

Associated Articles: Chart of Accounts: The Spine of Monetary Reporting

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Chart of Accounts: The Spine of Monetary Reporting. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Chart of Accounts: The Spine of Monetary Reporting

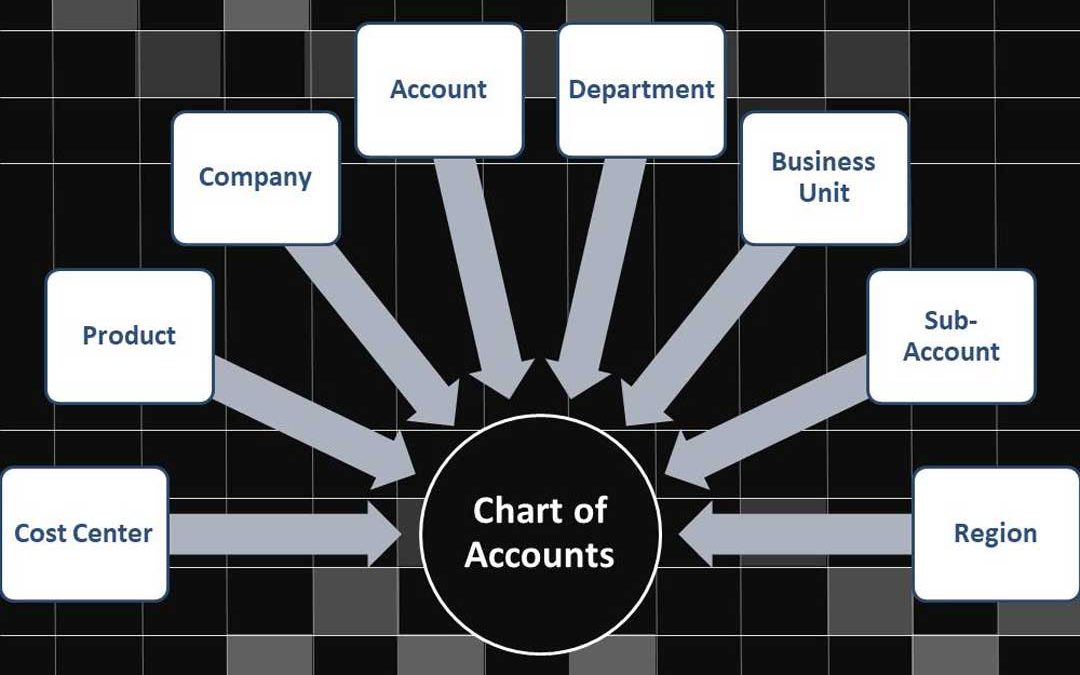

The chart of accounts (COA) is the bedrock of any group’s monetary reporting system. It is a structured, organized checklist of all of the accounts a enterprise makes use of to report its monetary transactions. Consider it as an in depth index to an organization’s monetary life, meticulously categorizing each penny earned and spent. A well-designed chart of accounts is essential for correct monetary reporting, environment friendly accounting processes, and knowledgeable decision-making. This text will delve into the intricacies of chart of accounts, exploring its definition, construction, design issues, and its very important function in varied accounting capabilities.

Defining the Chart of Accounts:

A chart of accounts is a complete itemizing of all of the accounts utilized by a enterprise to categorise and summarize its monetary transactions. These accounts are organized systematically, sometimes following a numbering system that displays the account’s nature and hierarchical place inside the total accounting construction. Every account has a novel identifier (account quantity) and a descriptive title that clearly signifies its objective. The accounts are designed to trace property, liabilities, fairness, revenues, and bills, offering a whole image of the monetary place and efficiency of the enterprise.

The aim of a COA extends past merely recording transactions. It serves as an important software for:

- Monetary Reporting: The COA facilitates the preparation of economic statements just like the steadiness sheet, revenue assertion, and money stream assertion. By categorizing transactions into particular accounts, it ensures that monetary experiences precisely replicate the corporate’s monetary well being.

- Inside Management: A well-designed COA contributes to sturdy inner controls by offering a framework for separating duties, authorizing transactions, and monitoring monetary exercise. This reduces the danger of errors and fraud.

- Budgeting and Forecasting: The COA supplies a construction for budgeting and forecasting. By monitoring bills and revenues in particular accounts, companies can create extra correct budgets and forecasts.

- Evaluation and Choice-Making: The categorized knowledge inside the COA permits for detailed monetary evaluation. Administration can observe key efficiency indicators (KPIs), determine developments, and make knowledgeable enterprise choices primarily based on this available data.

- Auditing: The COA is crucial throughout audits. It supplies auditors with a transparent framework for analyzing the corporate’s monetary data and guaranteeing the accuracy and reliability of economic reporting.

Construction and Group of a Chart of Accounts:

The construction of a COA can range relying on the scale and complexity of the enterprise, in addition to industry-specific necessities. Nonetheless, most COAs observe a standardized framework primarily based on the basic accounting equation: Belongings = Liabilities + Fairness. This framework ensures that the accounts are logically grouped and interconnected.

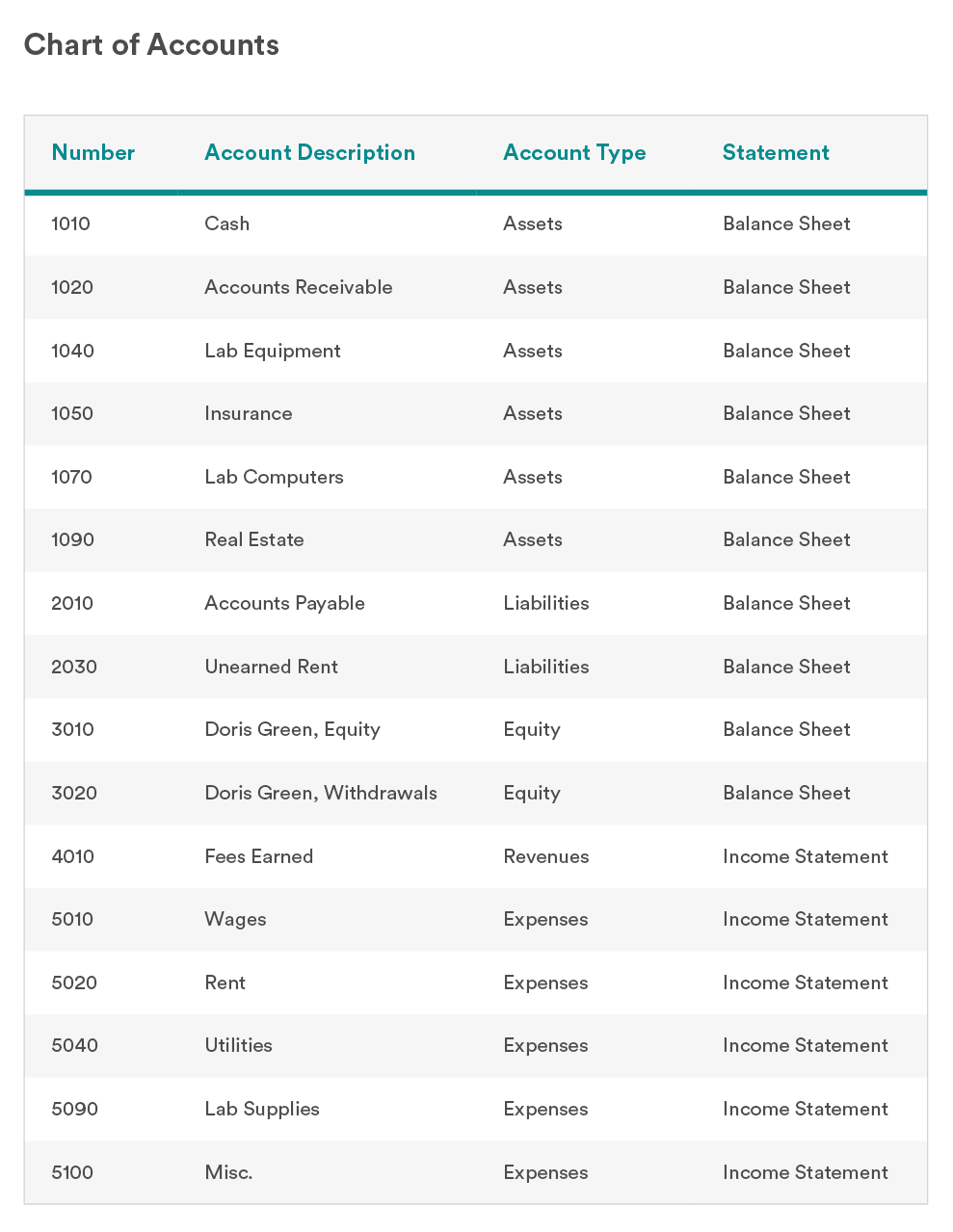

A typical COA construction consists of the next main account classes:

- Belongings: These characterize what an organization owns, together with present property (money, accounts receivable, stock) and non-current property (property, plant, and gear, intangible property). These accounts are sometimes numbered sequentially, beginning with low numbers.

- Liabilities: These characterize what an organization owes to others, together with present liabilities (accounts payable, salaries payable) and non-current liabilities (long-term debt). These accounts sometimes observe the asset accounts in numbering.

- Fairness: This represents the house owners’ stake within the firm, together with contributed capital and retained earnings. Fairness accounts often observe liabilities within the numbering scheme.

- Revenues: These characterize the revenue generated from the corporate’s core operations. Income accounts are sometimes numbered individually from property, liabilities, and fairness, utilizing a distinct vary of numbers.

- Bills: These characterize the prices incurred in producing revenues. Expense accounts are additionally numbered individually and are sometimes categorized by operate (e.g., value of products offered, promoting bills, administrative bills).

Inside every main class, accounts are additional sub-categorized to supply higher element. For instance, the "accounts receivable" account could be additional damaged down into accounts receivable by buyer, permitting for extra granular evaluation of excellent invoices. This hierarchical construction, typically utilizing a numbering system with a number of digits (e.g., 1000 for property, 2000 for liabilities, and so forth.), permits for environment friendly group and retrieval of economic data.

Design Concerns for an Efficient Chart of Accounts:

Creating an efficient COA requires cautious planning and consideration of assorted elements. Some key issues embrace:

- Enterprise Dimension and Complexity: A small enterprise may require a less complicated COA with fewer accounts, whereas a big company may want a extra advanced COA with quite a few sub-accounts to seize detailed monetary data.

- Business-Particular Necessities: Sure industries have particular accounting necessities that must be mirrored within the COA. For instance, a producing firm may want accounts for work-in-progress and completed items stock, whereas a service-based enterprise won’t.

- Future Progress: The COA must be designed to accommodate future progress and enlargement. It must be versatile sufficient to deal with new merchandise, providers, or enterprise segments with out requiring vital restructuring.

- Scalability: The COA must be simply scalable to deal with growing volumes of transactions because the enterprise grows.

- Consistency: Sustaining consistency within the COA is essential for correct monetary reporting. All transactions must be recorded utilizing the identical account numbers and descriptions.

- Consumer-Friendliness: The COA must be simple to grasp and use by all members of the accounting group. Clear account titles and a logical numbering system are important.

- Compliance: The COA should adjust to related accounting requirements and laws, similar to Usually Accepted Accounting Rules (GAAP) or Worldwide Monetary Reporting Requirements (IFRS).

Software program and Chart of Accounts:

Fashionable accounting software program packages play an important function in managing and using the chart of accounts. These techniques automate many points of accounting, together with:

- Automated Transaction Posting: Software program robotically posts transactions to the suitable accounts primarily based on the COA.

- Actual-time Reporting: Software program supplies real-time entry to monetary knowledge, permitting for fast and environment friendly reporting.

- Knowledge Evaluation and Visualization: Software program affords instruments for analyzing monetary knowledge and creating visualizations, similar to charts and graphs.

- Integration with Different Methods: Software program can combine with different enterprise techniques, similar to CRM and ERP techniques, to supply a holistic view of the enterprise.

Sustaining and Updating the Chart of Accounts:

The chart of accounts will not be a static doc. It requires common overview and updates to make sure it stays related and correct. Adjustments could be crucial as a consequence of:

- Enterprise Progress and Growth: New accounts may must be added to replicate new merchandise, providers, or enterprise segments.

- Adjustments in Accounting Requirements: Updates to accounting requirements may require modifications to the COA.

- Improved Effectivity: The COA could be reorganized to enhance effectivity and accuracy of economic reporting.

- Technological Developments: New software program or techniques may require changes to the COA.

Common overview and updates make sure the COA stays a worthwhile software for correct monetary reporting and knowledgeable decision-making.

Conclusion:

The chart of accounts is a basic part of any group’s monetary administration system. Its design, construction, and upkeep are crucial for correct monetary reporting, efficient inner controls, and knowledgeable enterprise choices. By rigorously contemplating the elements mentioned on this article, companies can create a chart of accounts that helps their particular wants and contributes to their total monetary success. A well-designed and maintained COA is not only a listing of accounts; it is the spine of a strong and dependable monetary reporting system, enabling companies to navigate the complexities of their monetary panorama with readability and confidence.

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

Closure

Thus, we hope this text has supplied worthwhile insights into Chart of Accounts: The Spine of Monetary Reporting. We hope you discover this text informative and useful. See you in our subsequent article!