Chart Of Accounts: The Spine Of Monetary Reporting

Chart of Accounts: The Spine of Monetary Reporting

Associated Articles: Chart of Accounts: The Spine of Monetary Reporting

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to Chart of Accounts: The Spine of Monetary Reporting. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Chart of Accounts: The Spine of Monetary Reporting

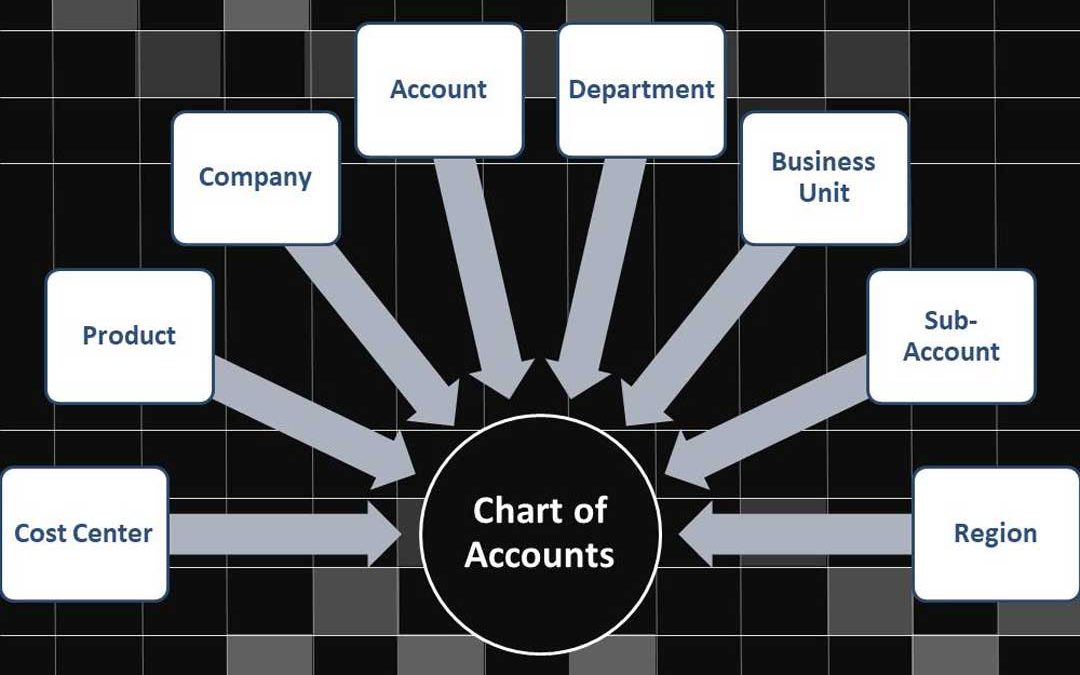

A chart of accounts (COA) is the cornerstone of any group’s monetary reporting system. It is a structured, organized record of all of the accounts utilized by a enterprise to file its monetary transactions. Consider it as an in depth roadmap of the corporate’s monetary actions, offering a standardized framework for monitoring belongings, liabilities, fairness, revenues, and bills. With no well-defined chart of accounts, monetary information can be chaotic, inconsistent, and finally ineffective for making knowledgeable enterprise choices. This text will delve deep into the construction, operate, and significance of a chart of accounts, exploring its varied parts and greatest practices for implementation and upkeep.

Understanding the Construction of a Chart of Accounts:

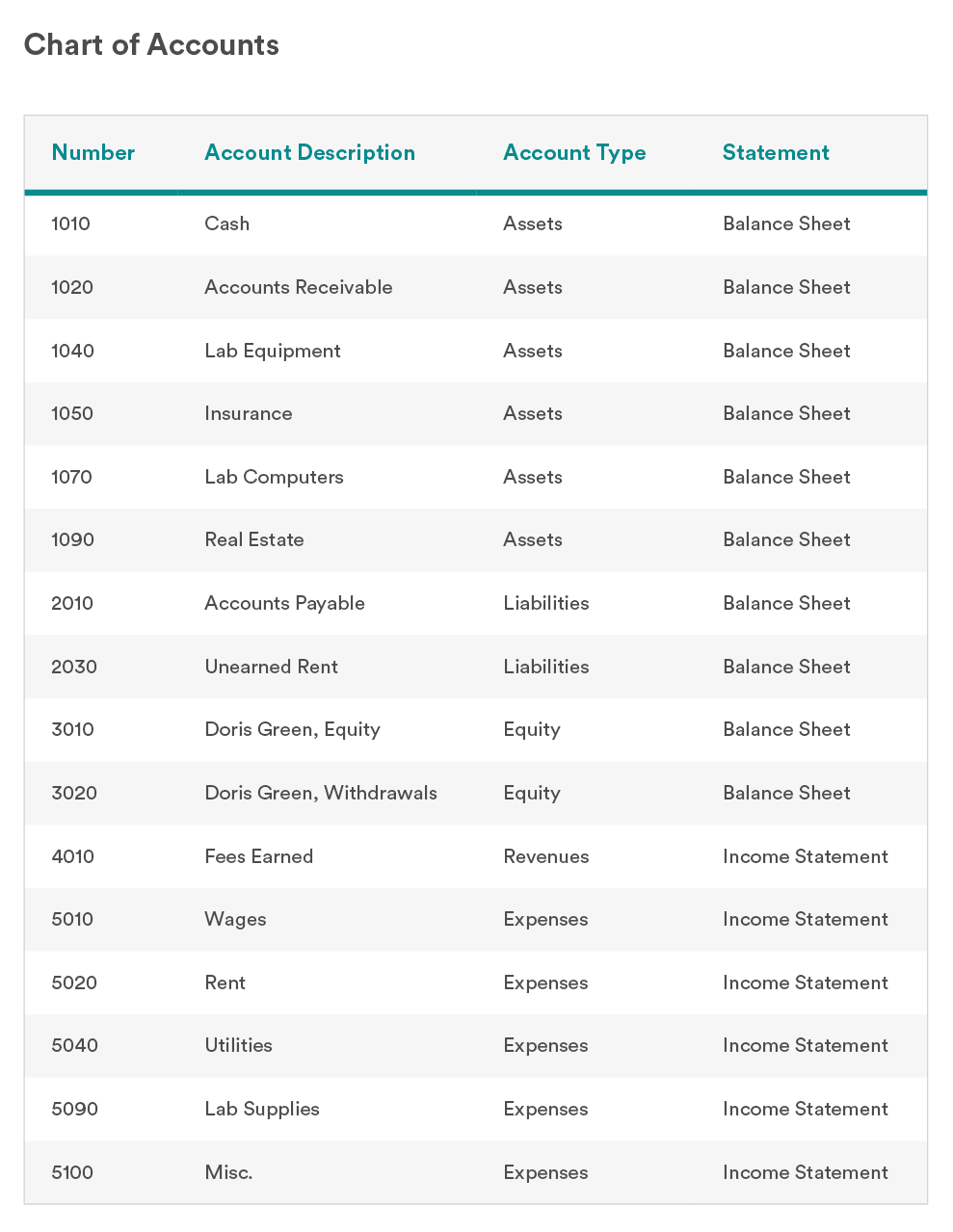

A COA is often hierarchical, which means accounts are categorized and sub-categorized to offer a transparent and logical construction. This hierarchy permits for detailed evaluation and reporting. A standard construction makes use of a numbering system to signify the hierarchy, with bigger numbers indicating higher specificity. For instance:

-

Stage 1: Main Account Classes: This stage represents the broadest classifications of economic accounts, adhering to typically accepted accounting rules (GAAP) or Worldwide Monetary Reporting Requirements (IFRS). These sometimes embody:

- Belongings: Sources owned by the corporate, equivalent to money, accounts receivable, stock, and property, plant, and gear (PP&E).

- Liabilities: Obligations owed by the corporate to others, together with accounts payable, loans payable, and deferred income.

- Fairness: The proprietor’s stake within the firm, representing the residual curiosity after deducting liabilities from belongings. For companies, this consists of retained earnings and contributed capital.

- Revenues: Inflows of belongings or settlements of liabilities ensuing from the unusual actions of the enterprise.

- Bills: Outflows of belongings or incurrences of liabilities ensuing from the unusual actions of the enterprise.

-

Stage 2: Sub-accounts: These accounts additional break down the foremost classes into extra particular accounts. For instance, below "Belongings," you may need sub-accounts for "Money in Financial institution," "Petty Money," and "Accounts Receivable." Below "Bills," you may need "Salaries Expense," "Hire Expense," and "Utilities Expense."

-

Stage 3 & Past: Detailed Accounts: This stage offers even higher specificity. As an illustration, "Accounts Receivable" is likely to be additional damaged down into "Accounts Receivable – Home" and "Accounts Receivable – Worldwide." This stage of element is essential for efficient monetary evaluation.

The numbering system used within the COA usually displays this hierarchy. A standard strategy makes use of a system of digits, the place every digit represents a stage within the hierarchy. For instance:

- 1000 – Belongings

- 1100 – Present Belongings

- 1110 – Money

- 1111 – Money in Financial institution

- 1112 – Petty Money

This method permits for simple identification and monitoring of particular person accounts and their relationship to the broader monetary construction.

The Significance of a Effectively-Outlined Chart of Accounts:

A well-designed chart of accounts is essential for a number of causes:

-

Correct Monetary Reporting: A constant and structured COA ensures that each one monetary transactions are recorded precisely and persistently, resulting in dependable monetary statements. That is important for inner decision-making and exterior reporting to traders, collectors, and regulatory our bodies.

-

Improved Monetary Evaluation: An in depth COA permits for in-depth evaluation of economic efficiency. By breaking down bills and revenues into particular classes, managers can determine areas of power and weak spot, optimize useful resource allocation, and enhance profitability.

-

Enhanced Budgeting and Forecasting: A well-structured COA facilitates the creation of correct budgets and forecasts. Through the use of historic information from the COA, companies can predict future monetary efficiency and make knowledgeable choices about useful resource allocation and funding.

-

Streamlined Auditing: A well-defined COA simplifies the auditing course of. Auditors can simply hint transactions and confirm the accuracy of economic information, decreasing the time and price related to audits.

-

Improved Inside Controls: A well-designed COA can contribute to a powerful inner management system. By clearly defining account duties and entry controls, companies can forestall fraud and make sure the accuracy of their monetary information.

-

Facilitates Information Evaluation and Reporting: Trendy accounting software program depends on the COA to generate stories and analyze information. A correctly structured COA permits the creation of personalized stories that present helpful insights into the enterprise’s monetary efficiency.

Greatest Practices for Implementing and Sustaining a Chart of Accounts:

-

Trade Requirements: Think about industry-specific greatest practices and customary account classifications. This ensures consistency and comparability with different companies in the identical sector.

-

Future Scalability: Design the COA with future development in thoughts. Permit for the addition of latest accounts because the enterprise expands and its operations change into extra advanced.

-

Common Evaluate and Updates: The COA must be reviewed and up to date periodically to make sure it stays related and correct. That is notably necessary when the enterprise undergoes vital modifications, equivalent to mergers, acquisitions, or modifications in accounting requirements.

-

Documentation: Preserve thorough documentation of the COA, together with account descriptions, numbering system, and any modifications remodeled time. This ensures consistency and facilitates understanding for all customers.

-

Coaching: Present enough coaching to all personnel concerned in utilizing the COA. This ensures that everybody understands the system and makes use of it persistently.

-

Software program Integration: Select accounting software program that seamlessly integrates with the COA. It will streamline information entry and reporting processes.

Conclusion:

The chart of accounts isn’t just an inventory of accounts; it is a crucial element of an organization’s monetary infrastructure. A well-designed and maintained COA is important for correct monetary reporting, efficient monetary evaluation, and sound enterprise decision-making. By following greatest practices and recurrently reviewing and updating the COA, companies can make sure the integrity of their monetary data and acquire helpful insights into their monetary efficiency. Investing time and sources in creating a sturdy and adaptable COA is a strategic funding that pays dividends in the long term, contributing to the general well being and success of the group.

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

Closure

Thus, we hope this text has offered helpful insights into Chart of Accounts: The Spine of Monetary Reporting. We thanks for taking the time to learn this text. See you in our subsequent article!