Chart Sample Reside: Mastering The Artwork Of Technical Evaluation In Actual-Time

Chart Sample Reside: Mastering the Artwork of Technical Evaluation in Actual-Time

Associated Articles: Chart Sample Reside: Mastering the Artwork of Technical Evaluation in Actual-Time

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Chart Sample Reside: Mastering the Artwork of Technical Evaluation in Actual-Time. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Chart Sample Reside: Mastering the Artwork of Technical Evaluation in Actual-Time

Chart patterns, the visible representations of worth motion and investor sentiment, are a cornerstone of technical evaluation. They provide merchants a robust device to anticipate potential worth actions, establish entry and exit factors, and handle threat. Whereas learning historic charts gives beneficial context, the true mastery of chart patterns lies in recognizing and reacting to them reside, as they unfold within the dynamic market. This text delves deep into the intricacies of chart sample recognition in real-time, exploring the challenges, methods, and important instruments wanted to succeed.

The Dynamic Nature of Reside Chart Sample Recognition:

In contrast to analyzing historic information, the place you might have the luxurious of hindsight and might meticulously measure formations, reside chart sample recognition calls for fast pondering, adaptability, and a eager eye for element. The market is consistently fluctuating, and patterns will be disrupted or evolve unexpectedly. A superbly shaped head and shoulders sample on a historic chart may seem incomplete or distorted in real-time, requiring a nuanced understanding to interpret its potential.

A number of key challenges distinguish reside evaluation:

- Incomplete Formations: Patterns not often type completely. Reside buying and selling typically entails coping with nascent formations that lack full definition. Merchants should have the ability to establish the potential of a sample even when solely a portion of it has emerged.

- Noise and Volatility: Market noise, random worth fluctuations unrelated to the underlying pattern, can obscure sample formation. Excessive volatility can distort patterns and make correct identification troublesome.

- Affirmation Bias: The human tendency to see what one desires to see can result in misinterpretations. Merchants should stay goal and keep away from confirming their pre-existing biases, as a substitute specializing in the target proof introduced by the value motion.

- Time Sensitivity: Alternatives introduced by chart patterns are sometimes fleeting. Delayed recognition can imply lacking out on worthwhile entries or being compelled into unfavorable positions.

- A number of Timeframes: Reside evaluation necessitates the power to interpret patterns throughout a number of timeframes concurrently. A sample forming on a short-term chart is perhaps confirmed or contradicted by the longer-term pattern.

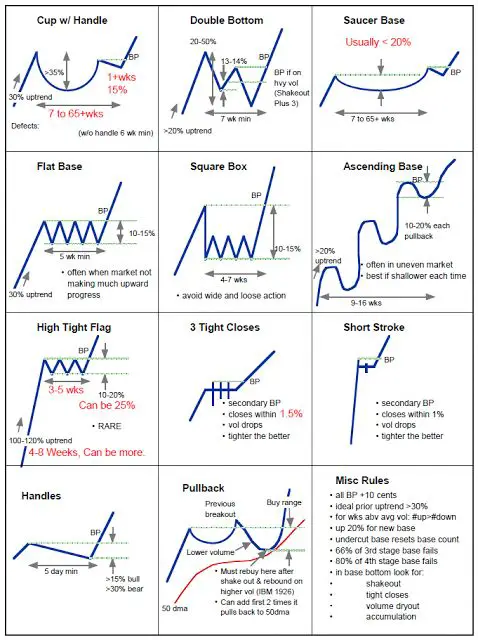

Key Chart Patterns for Reside Buying and selling:

Whereas quite a few chart patterns exist, some are significantly well-suited for reside buying and selling attributable to their relative ease of identification and constant reliability:

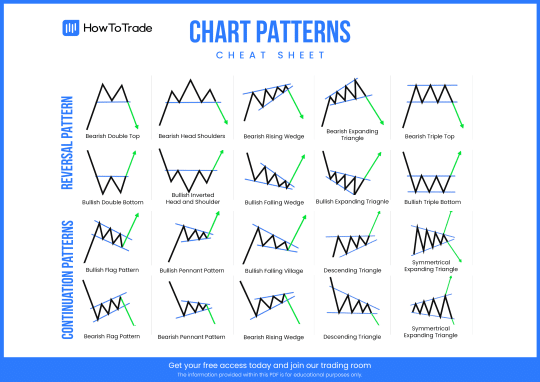

- Triangles: These patterns, characterised by converging trendlines, characterize intervals of consolidation earlier than a breakout. Figuring out the breakout path is essential. Ascending triangles counsel bullish breakouts, whereas descending triangles point out bearish breakouts. Reside merchants want to look at for quantity surges accompanying the breakout to substantiate its validity.

- Head and Shoulders: This basic reversal sample signifies a shift in momentum. Figuring out the top, shoulders, and neckline is essential. A break under the neckline confirms the bearish sign. Reside merchants want to watch worth motion across the neckline for affirmation and potential entry factors.

- Double Tops/Bottoms: These patterns characterize a brief reversal in a longtime pattern. Two distinct worth peaks (double prime) or troughs (double backside) adopted by a break under/above the help/resistance degree sign a possible pattern reversal. Reside merchants want to look at for sturdy quantity accompanying the breakout.

- Flags and Pennants: These continuation patterns point out a brief pause in a prevailing pattern. They’re characterised by a short consolidation interval inside a channel, adopted by a resumption of the pattern. Reside merchants have to establish the path of the underlying pattern and search for breakouts from the flag or pennant to substantiate the continuation.

- Channel Breakouts: Costs typically transfer inside outlined channels, representing established developments. Breakouts from these channels can signify important pattern modifications. Reside merchants want to watch quantity and make sure the breakout with different indicators earlier than getting into a place.

Methods for Efficient Reside Chart Sample Recognition:

- A number of Timeframe Evaluation: Mix short-term charts (e.g., 5-minute, 15-minute) with longer-term charts (e.g., hourly, every day) to get a complete view of the market. This helps affirm potential patterns and filter out noise.

- Quantity Affirmation: All the time contemplate quantity. Robust quantity accompanying a breakout confirms the power of the transfer, whereas weak quantity suggests a possible false breakout.

- Indicator Integration: Mix chart sample evaluation with different technical indicators, akin to shifting averages, RSI, MACD, to reinforce accuracy and filter out false indicators.

- Danger Administration: All the time use stop-loss orders to restrict potential losses. That is essential in reside buying and selling, the place speedy worth actions can rapidly wipe out income.

- Apply and Endurance: Mastering reside chart sample recognition takes time and observe. Begin with simulated buying and selling to develop your abilities earlier than risking actual capital.

- Disciplined Method: Follow your buying and selling plan. Keep away from emotional buying and selling selections primarily based on intestine feeling or concern. Comply with your predetermined entry and exit guidelines.

- Information and Financial Knowledge: Maintain abreast of market-moving information and financial information. Important occasions can disrupt chart patterns and invalidate indicators.

- Make the most of Buying and selling Platforms: Select a buying and selling platform with superior charting instruments and real-time information feeds. Options like drawing instruments, customizable indicators, and a number of timeframe views are essential.

Instruments and Applied sciences for Reside Chart Sample Recognition:

Fashionable buying and selling platforms provide a plethora of instruments to facilitate reside chart sample recognition:

- Superior Charting Software program: Platforms like TradingView, MetaTrader 4/5, and Bloomberg present superior charting options, together with customizable indicators, drawing instruments, and a number of timeframe evaluation.

- Actual-time Knowledge Feeds: Entry to high-quality, real-time information is essential for correct evaluation. Delayed information can result in missed alternatives and poor buying and selling selections.

- Automated Sample Recognition Instruments: Some platforms provide automated sample recognition instruments, which can assist establish potential patterns, though human oversight stays essential.

- Alert Programs: Arrange alerts to inform you of potential breakouts or sample completions, making certain you do not miss essential buying and selling alternatives.

Conclusion:

Reside chart sample recognition is a difficult however rewarding ability for merchants. It calls for a mix of technical experience, analytical abilities, self-discipline, and the power to adapt to the ever-changing market dynamics. By mastering the methods and using the fitting instruments, merchants can considerably improve their buying and selling efficiency and capitalize on the alternatives introduced by these dynamic market formations. Nevertheless, keep in mind that no system is foolproof, and constant observe, threat administration, and steady studying are important for long-term success in reside buying and selling. The journey to mastering reside chart sample recognition is ongoing, demanding dedication, endurance, and a willingness to study from each successes and failures.

:max_bytes(150000):strip_icc()/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-05-a19b59070c434400988fca7fa83898dd.jpg)

Closure

Thus, we hope this text has offered beneficial insights into Chart Sample Reside: Mastering the Artwork of Technical Evaluation in Actual-Time. We respect your consideration to our article. See you in our subsequent article!