Chart Sample Recognition Software program In MT4: A Deep Dive Into Automated Technical Evaluation

Chart Sample Recognition Software program in MT4: A Deep Dive into Automated Technical Evaluation

Associated Articles: Chart Sample Recognition Software program in MT4: A Deep Dive into Automated Technical Evaluation

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Chart Sample Recognition Software program in MT4: A Deep Dive into Automated Technical Evaluation. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Chart Sample Recognition Software program in MT4: A Deep Dive into Automated Technical Evaluation

The MetaTrader 4 (MT4) platform, a veteran within the foreign exchange and CFD buying and selling world, has developed considerably since its inception. One space of outstanding improvement is the combination of automated buying and selling instruments and indicators, together with software program designed for chart sample recognition. This text delves into the capabilities, limitations, and sensible purposes of chart sample recognition software program throughout the MT4 surroundings, inspecting its potential advantages and inherent dangers.

Understanding Chart Patterns and Their Significance

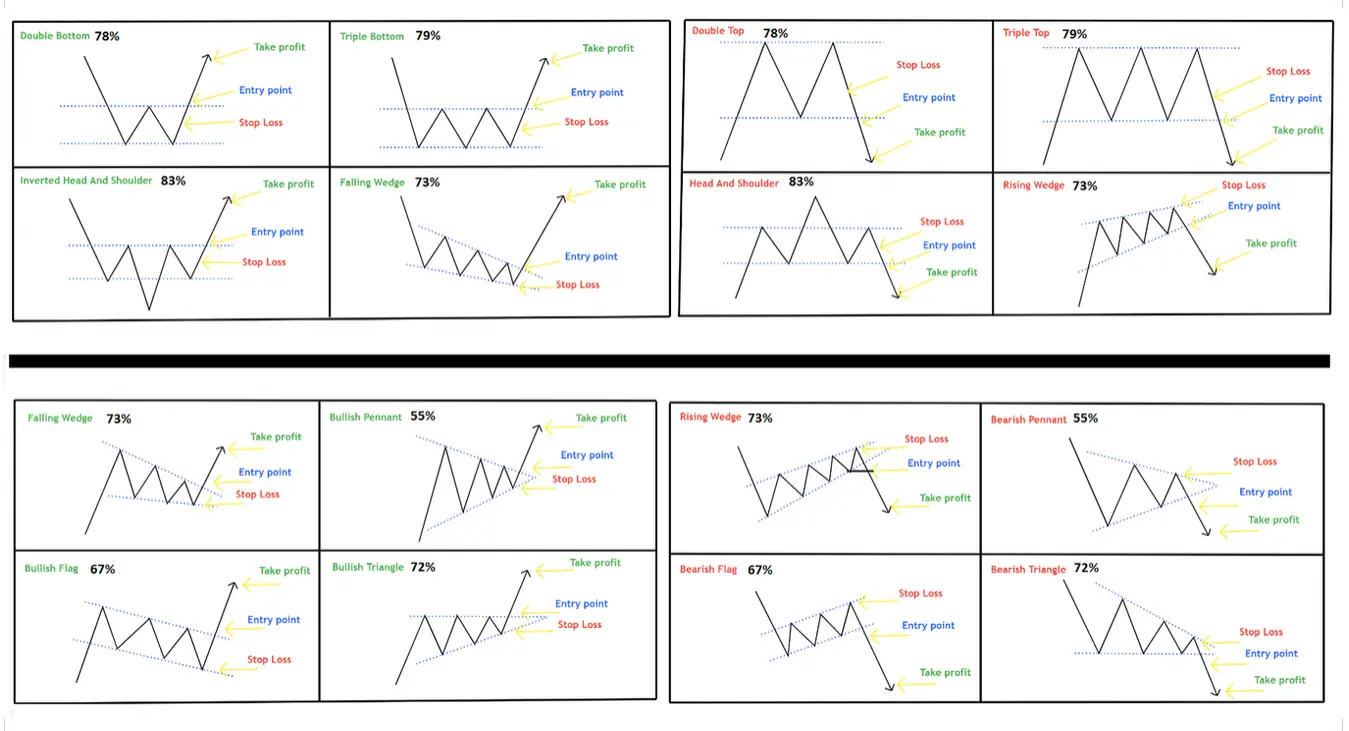

Earlier than exploring the software program itself, it is essential to understand the basic idea of chart patterns in technical evaluation. These patterns, fashioned by worth motion over time, are believed to supply clues about future worth actions. They symbolize visually identifiable formations that mirror the interaction of provide and demand, typically indicating potential reversals or continuations of present tendencies. Widespread patterns embody:

- Head and Shoulders: A bearish reversal sample suggesting a peak within the worth.

- Inverse Head and Shoulders: A bullish reversal sample signaling a possible worth improve.

- Double Tops/Bottoms: Reversal patterns indicating a possible change in development path.

- Triangles (Symmetrical, Ascending, Descending): Continuation patterns suggesting a interval of consolidation earlier than a breakout.

- Flags and Pennants: Continuation patterns indicating a short lived pause in a development.

- Wedges (Ascending, Descending): Patterns that may sign both continuation or reversal, relying on the kind.

- Rectangles: Consolidation patterns with horizontal help and resistance ranges.

Manually figuring out these patterns requires vital expertise, eager commentary, and a deep understanding of market dynamics. That is the place chart sample recognition software program steps in, providing automated identification and probably bettering buying and selling effectivity.

How Chart Sample Recognition Software program Works in MT4

MT4’s extensibility permits builders to create customized indicators and Skilled Advisors (EAs) that may analyze worth charts and determine predefined patterns. These software program options sometimes work by:

- Information Enter: The software program receives historic worth knowledge from the MT4 platform.

-

Sample Matching Algorithms: Subtle algorithms evaluate the enter knowledge in opposition to predefined sample templates. These algorithms might use numerous methods, together with:

- Geometric Sample Matching: This method compares the form and angles of the worth chart to the best form of a selected sample. This technique is comparatively easy however may be delicate to noise within the worth knowledge.

- Statistical Sample Recognition: This method makes use of statistical strategies to determine patterns based mostly on worth actions and volatility. That is typically extra strong to noisy knowledge however may require extra computational energy.

- Machine Studying (ML): Superior software program might make the most of machine studying algorithms, comparable to neural networks, to be taught and determine patterns from huge quantities of historic knowledge. ML-based options can probably adapt to evolving market circumstances and determine extra advanced patterns.

- Sample Affirmation: As soon as a possible sample is recognized, the software program might apply extra standards to verify its validity. This might contain checks on quantity, worth volatility, or different technical indicators.

- Sign Era: Upon affirmation, the software program generates a buying and selling sign, which may be displayed visually on the chart or relayed to an automatic buying and selling system. This sign may recommend a possible entry level, stop-loss stage, or take-profit stage.

Advantages of Utilizing Chart Sample Recognition Software program in MT4

Using chart sample recognition software program in MT4 gives a number of potential benefits:

- Elevated Effectivity: Automating the sample identification course of considerably reduces the effort and time required for guide evaluation. Merchants can analyze a number of charts and timeframes concurrently.

- Objectivity: Software program eliminates emotional biases that may cloud judgment throughout guide evaluation. The software program constantly applies the identical standards to all charts, guaranteeing constant sign technology.

- Early Identification: Software program can typically detect patterns sooner than a human dealer, offering a possible benefit in market timing.

- Backtesting Capabilities: Many software program options enable backtesting on historic knowledge, enabling merchants to judge the efficiency of the sample recognition algorithms and optimize their parameters.

- A number of Timeframe Evaluation: Some software program can analyze patterns throughout a number of timeframes, offering a extra holistic view of the market.

Limitations and Dangers of Chart Sample Recognition Software program

Regardless of its potential advantages, chart sample recognition software program will not be a foolproof buying and selling system. A number of limitations and dangers have to be thought-about:

- False Indicators: Software program can generate false indicators attributable to noise within the worth knowledge, inaccurate sample recognition, or sudden market occasions. Over-reliance on software program indicators can result in vital losses.

- Overfitting: In machine learning-based options, overfitting can happen when the algorithm turns into too specialised to the historic knowledge and fails to generalize to new market circumstances.

- Subjectivity in Sample Definition: The definition of a sample may be subjective, and totally different software program may use barely totally different standards, resulting in variations in sign technology.

- Lack of Contextual Understanding: Software program lacks the contextual understanding that skilled merchants possess, comparable to geopolitical occasions, financial information, or basic evaluation.

- Market Volatility: Excessive market volatility can disrupt the accuracy of sample recognition algorithms.

Selecting and Implementing Chart Sample Recognition Software program in MT4

Deciding on acceptable software program requires cautious consideration of a number of components:

- Accuracy: Look at the software program’s backtesting outcomes and impartial opinions to evaluate its accuracy in figuring out patterns and producing worthwhile indicators.

- Options: Think about options such because the variety of supported patterns, a number of timeframe evaluation, customizable parameters, and integration with different MT4 instruments.

- Value: Software program choices vary from free indicators to costly, superior options. Select an answer that aligns together with your finances and buying and selling type.

- Ease of Use: Make sure the software program is user-friendly and integrates seamlessly together with your MT4 platform.

Conclusion:

Chart sample recognition software program gives a strong instrument for enhancing technical evaluation throughout the MT4 surroundings. It may enhance effectivity, objectivity, and probably early identification of buying and selling alternatives. Nevertheless, it is essential to keep in mind that this software program will not be a magic bullet. It ought to be used as a supplementary instrument, alongside different types of technical and basic evaluation, and with an intensive understanding of its limitations and dangers. Merchants ought to at all times make use of danger administration methods, together with stop-loss orders, to guard their capital and keep away from vital losses. Finally, profitable buying and selling depends on a mix of technical expertise, market data, danger administration, and a disciplined method, with chart sample recognition software program serving as a priceless, however not definitive, element of the general buying and selling technique.

Closure

Thus, we hope this text has offered priceless insights into Chart Sample Recognition Software program in MT4: A Deep Dive into Automated Technical Evaluation. We admire your consideration to our article. See you in our subsequent article!