Chart Patterns Cheat Sheet HD: A Complete Information To Technical Evaluation

Chart Patterns Cheat Sheet HD: A Complete Information to Technical Evaluation

Associated Articles: Chart Patterns Cheat Sheet HD: A Complete Information to Technical Evaluation

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Chart Patterns Cheat Sheet HD: A Complete Information to Technical Evaluation. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Chart Patterns Cheat Sheet HD: A Complete Information to Technical Evaluation

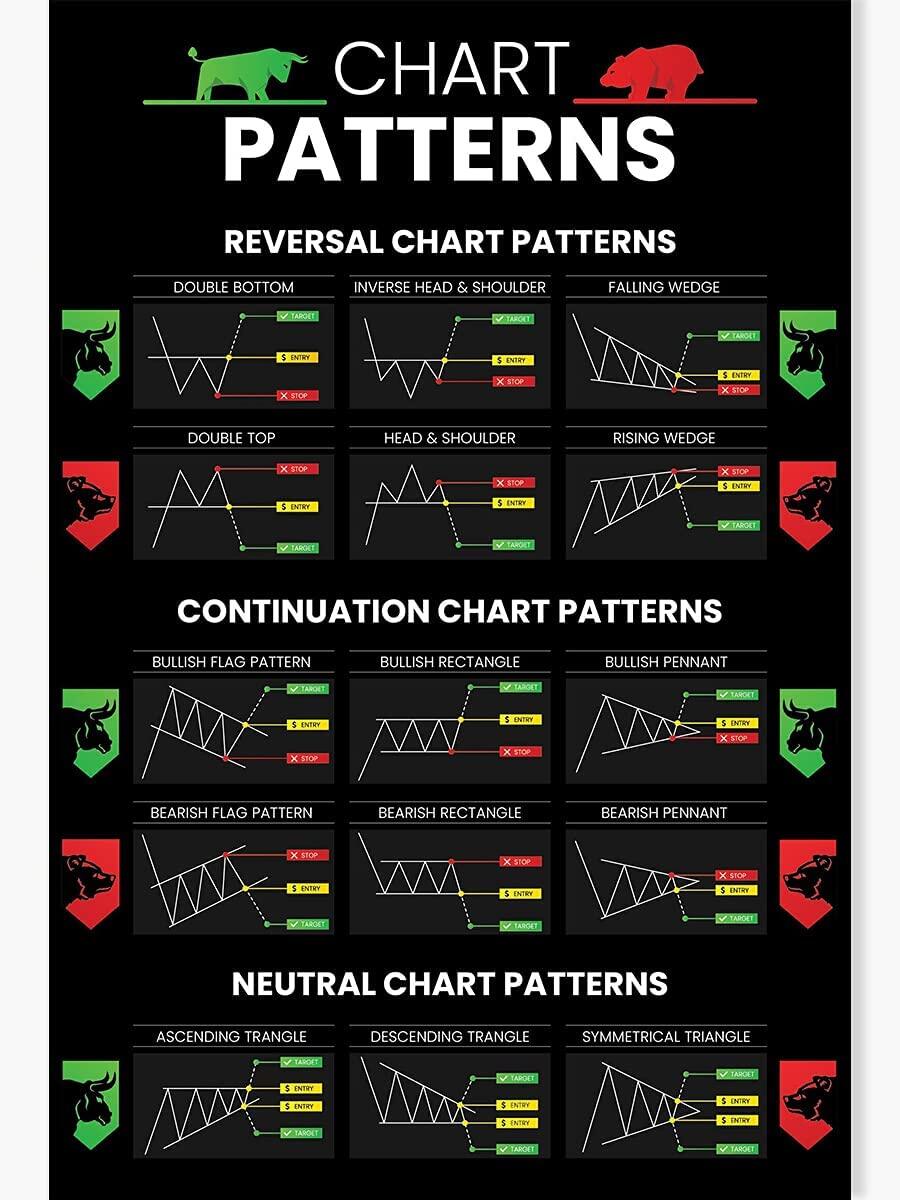

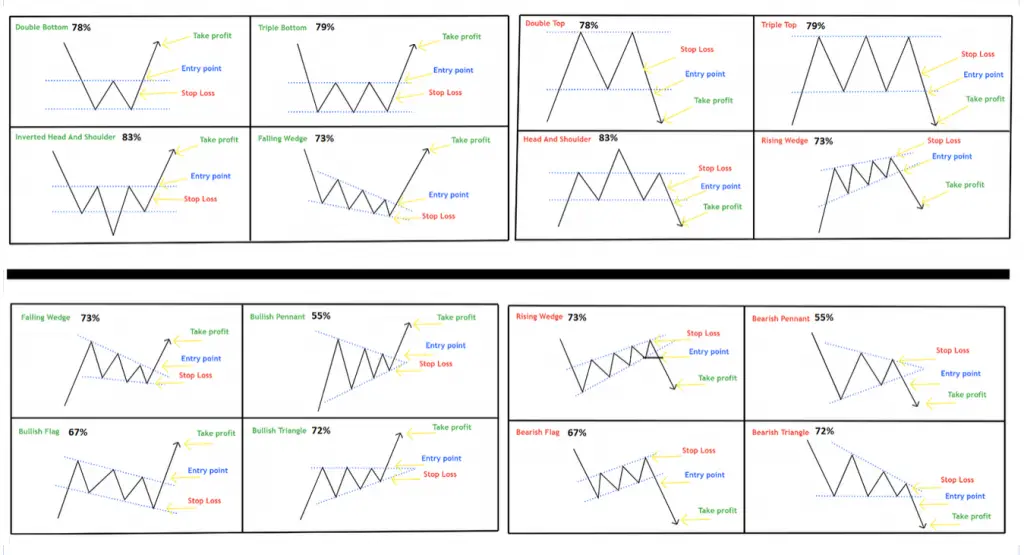

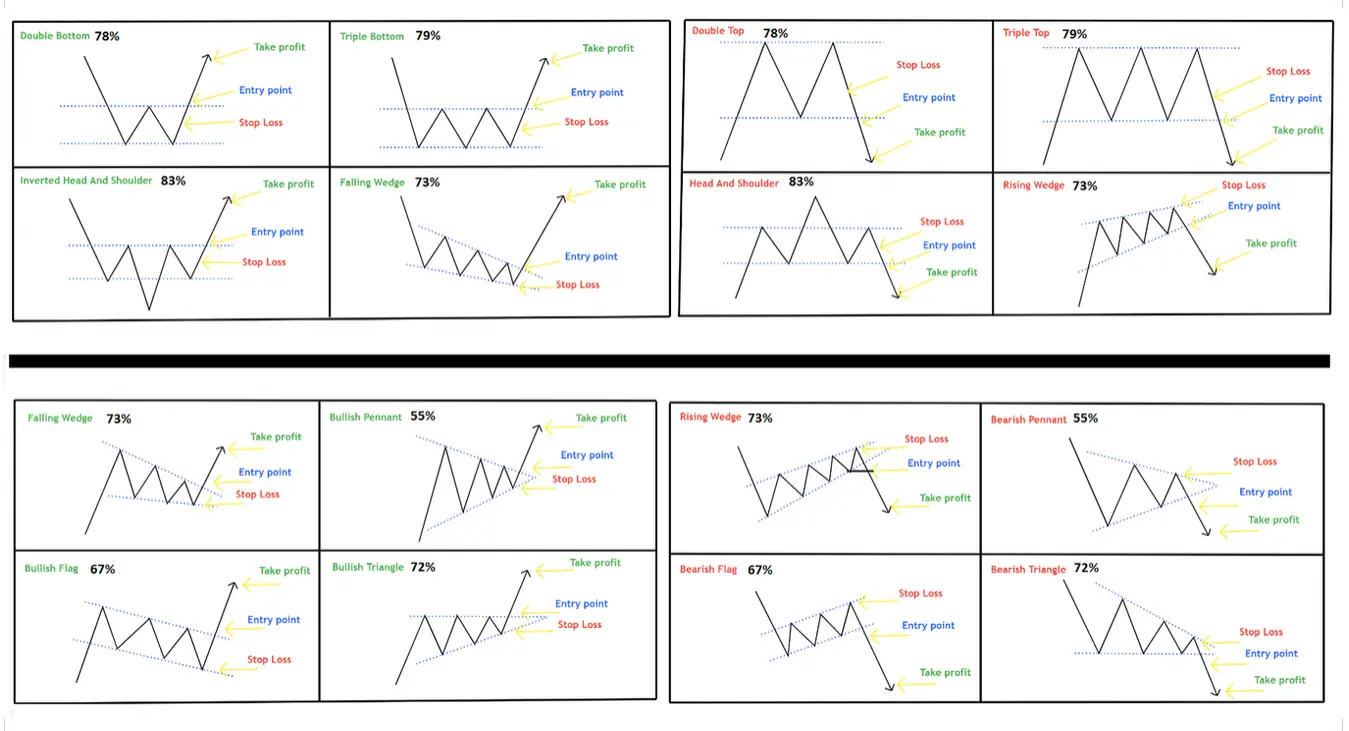

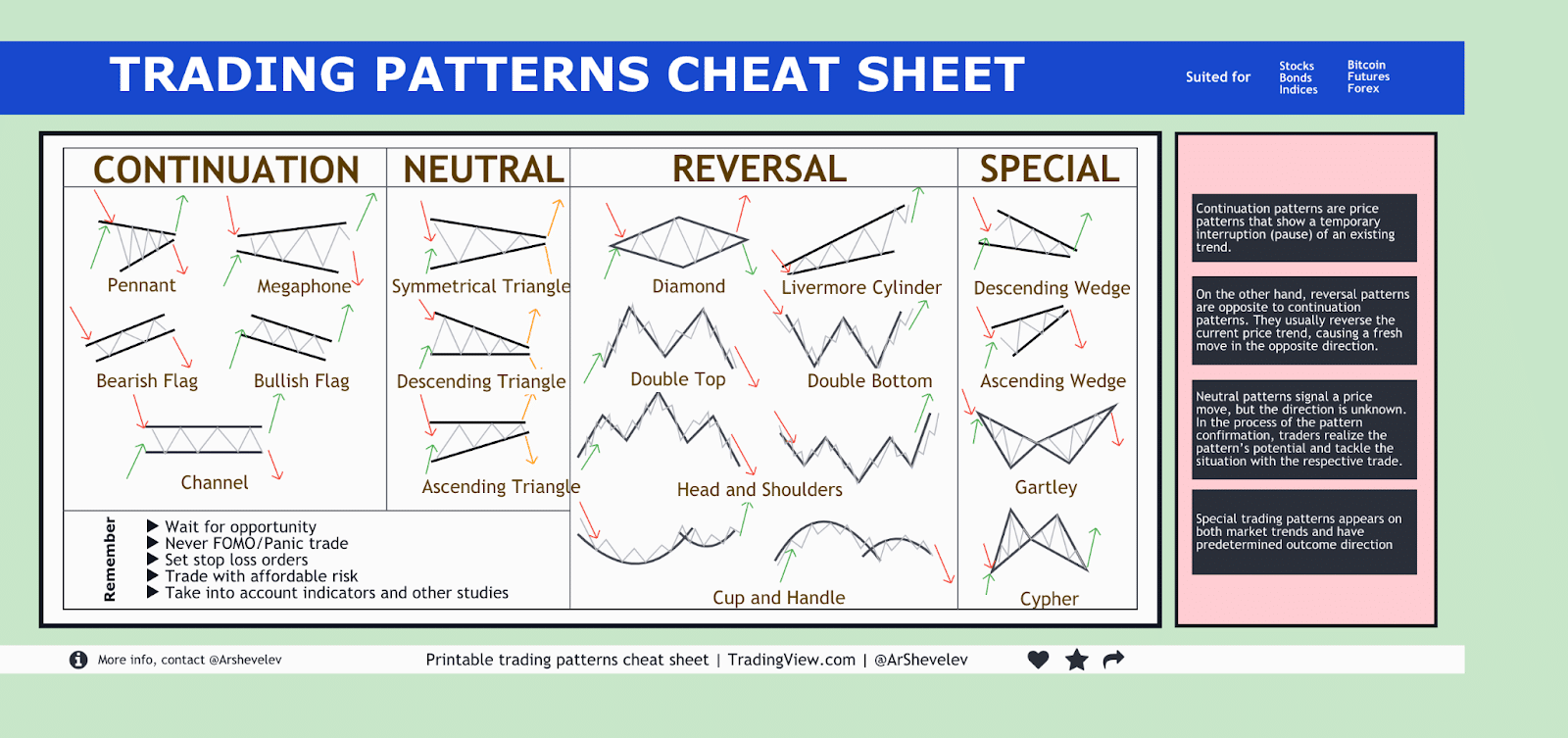

Technical evaluation, the examine of worth actions and quantity to foretell future worth tendencies, depends closely on recognizing recurring chart patterns. These patterns, usually visually identifiable on worth charts, supply merchants useful insights into potential market shifts. Whereas no sample ensures success, mastering their recognition and interpretation considerably enhances buying and selling methods. This complete information serves as a high-definition (HD) cheat sheet, detailing the commonest chart patterns, their traits, and buying and selling implications.

I. Introduction to Chart Patterns:

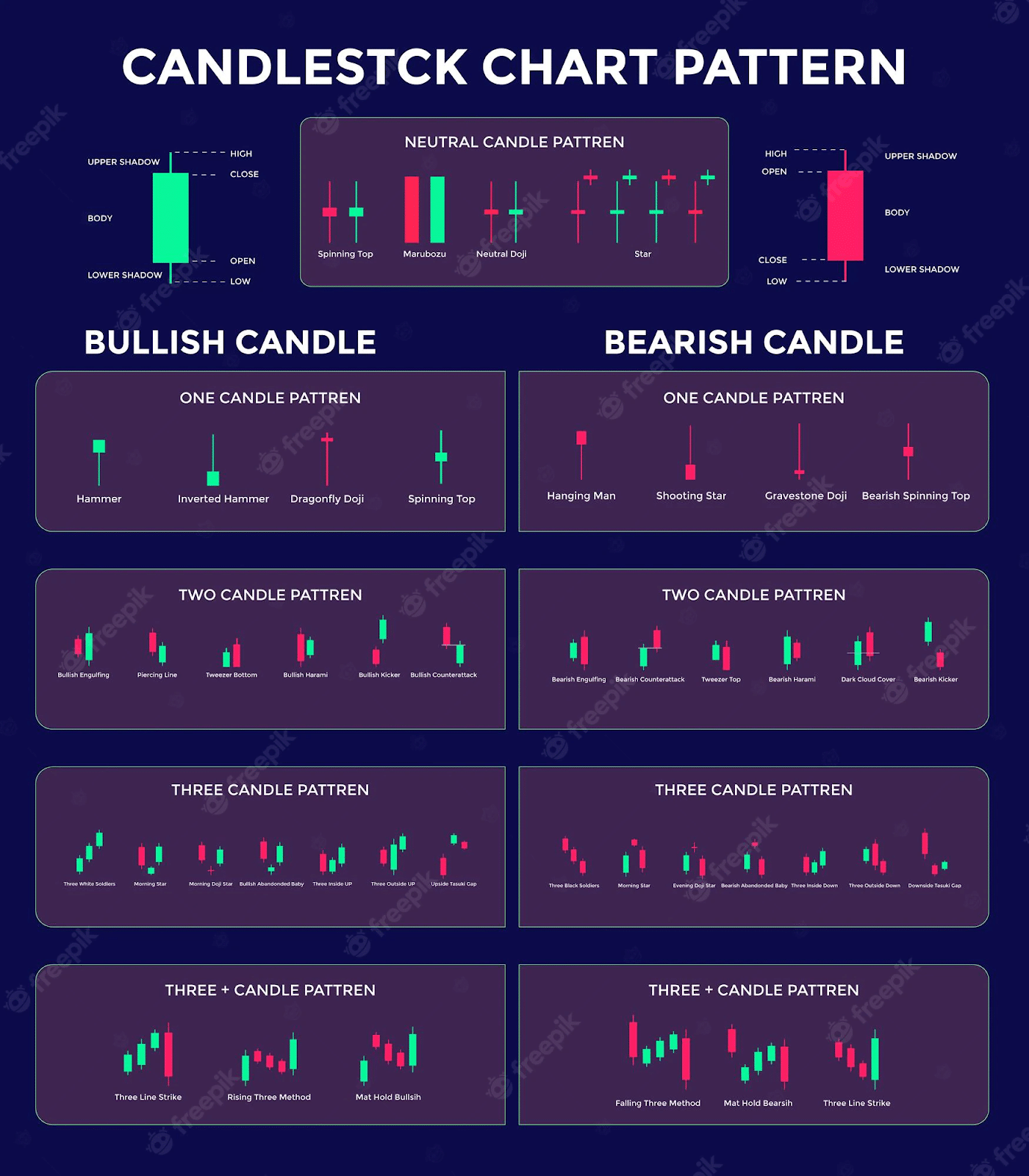

Chart patterns emerge from the interaction of provide and demand. Bullish patterns counsel an upward worth motion, whereas bearish patterns point out a downward pattern. Impartial patterns sign indecision or a interval of consolidation earlier than a possible breakout in both course. Understanding these patterns requires apply and a eager eye for element, however the rewards for correct identification could be substantial. This cheat sheet focuses on each candlestick and bar chart representations, as each are generally utilized in technical evaluation.

II. Bullish Chart Patterns:

These patterns counsel a possible upward worth motion. Profitable trades usually contain shopping for close to the sample’s completion and setting a stop-loss order beneath the sample’s help degree.

A. Head and Shoulders Backside:

- Traits: A 3-trough formation resembling a head and two shoulders. The "head" is the bottom trough, and the "shoulders" are related, however much less deep troughs on both aspect. The neckline connects the troughs of the shoulders.

- Affirmation: A breakout above the neckline, coupled with elevated quantity, confirms the sample.

- Buying and selling Technique: Purchase on the breakout above the neckline, with a stop-loss order positioned beneath the bottom level of the pinnacle.

- Goal Worth: The goal worth is usually calculated by measuring the space between the pinnacle and the neckline and including it to the breakout worth.

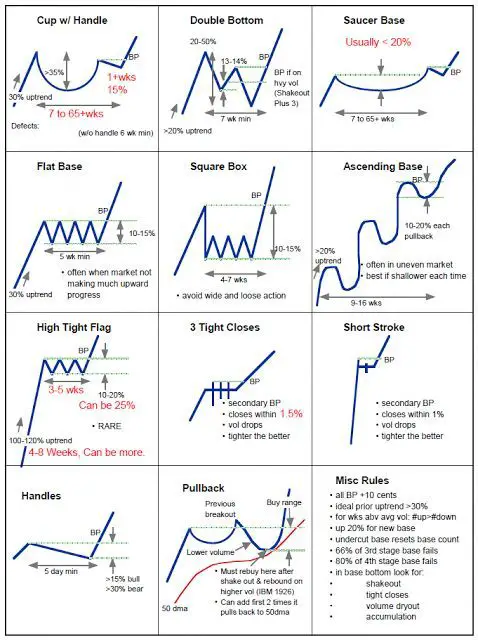

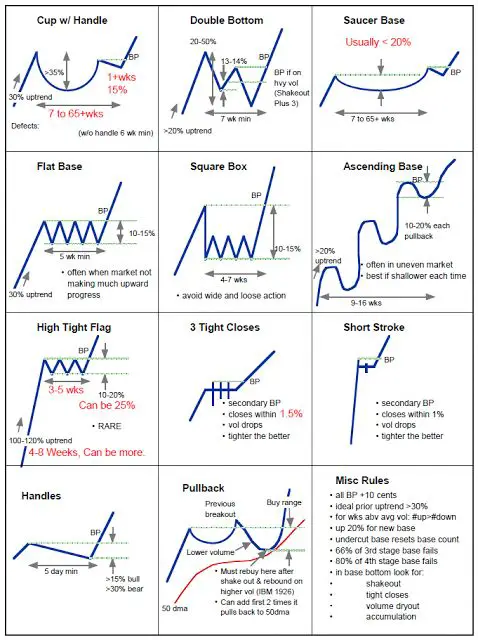

B. Double Backside:

- Traits: Two consecutive lows at roughly the identical worth degree, forming a "W" form. The neckline connects the 2 lows.

- Affirmation: A breakout above the neckline, with rising quantity, confirms the sample.

- Buying and selling Technique: Purchase on the breakout above the neckline, with a stop-loss order positioned beneath the decrease of the 2 lows.

- Goal Worth: Much like the Head and Shoulders Backside, the goal worth is commonly the space between the neckline and the bottom low, added to the breakout worth.

C. Inverse Head and Shoulders:

- Traits: A mirror picture of the Head and Shoulders sample, suggesting bullish reversal. This sample varieties a three-peak formation with the central peak ("head") being the very best. The neckline connects the peaks of the "shoulders."

- Affirmation: A breakout above the neckline with elevated quantity confirms the sample.

- Buying and selling Technique: Purchase on the breakout above the neckline, putting a stop-loss order beneath the bottom level of the sample.

- Goal Worth: Comparable calculation to Head and Shoulders Backside, utilizing the space between the pinnacle and neckline.

D. Cup and Deal with:

- Traits: A U-shaped "cup" adopted by a brief, downward "deal with."

- Affirmation: A breakout above the deal with’s resistance degree, with elevated quantity, confirms the sample.

- Buying and selling Technique: Purchase on the breakout above the deal with’s resistance, with a stop-loss order positioned beneath the underside of the cup.

- Goal Worth: The goal worth is commonly calculated by measuring the depth of the cup and including it to the breakout worth.

E. Ascending Triangle:

- Traits: A sample characterised by a collection of upper highs and a constant horizontal resistance line.

- Affirmation: A breakout above the resistance line with elevated quantity confirms the sample.

- Buying and selling Technique: Purchase on the breakout above the resistance line, with a stop-loss order positioned beneath the latest low.

- Goal Worth: The goal worth is commonly projected by measuring the peak of the triangle and including it to the breakout worth.

III. Bearish Chart Patterns:

These patterns counsel a possible downward worth motion. Profitable trades usually contain promoting quick close to the sample’s completion and setting a stop-loss order above the sample’s resistance degree.

A. Head and Shoulders Prime:

- Traits: The inverse of the Head and Shoulders Backside, forming a three-peak formation. The "head" is the very best peak. The neckline connects the peaks of the "shoulders."

- Affirmation: A breakdown beneath the neckline, coupled with elevated quantity, confirms the sample.

- Buying and selling Technique: Promote quick on the breakdown beneath the neckline, with a stop-loss order positioned above the very best level of the pinnacle.

- Goal Worth: The goal worth is usually calculated by measuring the space between the pinnacle and the neckline and subtracting it from the breakdown worth.

B. Double Prime:

- Traits: Two consecutive highs at roughly the identical worth degree, forming an "M" form. The neckline connects the 2 highs.

- Affirmation: A breakdown beneath the neckline, with rising quantity, confirms the sample.

- Buying and selling Technique: Promote quick on the breakdown beneath the neckline, with a stop-loss order positioned above the upper of the 2 highs.

- Goal Worth: Much like the Head and Shoulders Prime, the goal worth is commonly the space between the neckline and the very best excessive, subtracted from the breakdown worth.

C. Descending Triangle:

- Traits: A sample characterised by a collection of decrease lows and a constant horizontal help line.

- Affirmation: A breakdown beneath the help line with elevated quantity confirms the sample.

- Buying and selling Technique: Promote quick on the breakdown beneath the help line, with a stop-loss order positioned above the latest excessive.

- Goal Worth: The goal worth is commonly projected by measuring the peak of the triangle and subtracting it from the breakdown worth.

D. Falling Wedge:

- Traits: A wedge sample sloping downwards, characterised by converging trendlines.

- Affirmation: A breakdown beneath the decrease trendline confirms the bearish sample.

- Buying and selling Technique: Promote quick on the breakdown, with a stop-loss above the latest excessive.

- Goal Worth: The goal worth could be estimated by measuring the widest a part of the wedge and projecting it downwards from the breakout level.

IV. Impartial Chart Patterns:

These patterns point out a interval of consolidation or indecision, with potential for a breakout in both course. Merchants usually await a transparent breakout earlier than getting into a place.

A. Symmetrical Triangle:

- Traits: A triangle shaped by converging trendlines, with highs and lows converging in the direction of a central level.

- Affirmation: A breakout above the higher trendline or beneath the decrease trendline alerts a directional transfer.

- Buying and selling Technique: Look forward to a transparent breakout and elevated quantity earlier than getting into a protracted or quick place. Place a stop-loss order outdoors the triangle.

- Goal Worth: The goal worth is commonly projected by measuring the peak of the triangle and including it (for upside breakouts) or subtracting it (for draw back breakouts) from the breakout worth.

B. Rectangle:

- Traits: A sample characterised by horizontal help and resistance ranges.

- Affirmation: A breakout above the resistance or beneath the help degree confirms a directional transfer.

- Buying and selling Technique: Look forward to a transparent breakout and elevated quantity earlier than getting into a protracted or quick place. Place a stop-loss order outdoors the rectangle.

- Goal Worth: The goal worth is commonly projected by measuring the peak (or width) of the rectangle and including it (for upside breakouts) or subtracting it (for draw back breakouts) from the breakout worth.

V. Conclusion:

This HD cheat sheet gives a complete overview of frequent chart patterns utilized in technical evaluation. Do not forget that chart patterns should not foolproof predictors of market actions. They need to be used at the side of different technical indicators and basic evaluation for a extra sturdy buying and selling technique. Constant apply and a deep understanding of market dynamics are essential for efficiently figuring out and deciphering these patterns. At all times handle threat successfully by using applicable stop-loss orders and place sizing strategies. Additional analysis and expertise are important for mastering the artwork of chart sample recognition and attaining constant buying and selling success.

![Chart Patterns PDF Cheat Sheet [FREE Download]](https://howtotrade.com/wp-content/uploads/2023/02/chart-patterns-cheat-sheet-1024x724.png)

Closure

Thus, we hope this text has offered useful insights into Chart Patterns Cheat Sheet HD: A Complete Information to Technical Evaluation. We hope you discover this text informative and useful. See you in our subsequent article!