Chart Patterns: Decoding Market Psychology For Worthwhile Buying and selling

Chart Patterns: Decoding Market Psychology for Worthwhile Buying and selling

Associated Articles: Chart Patterns: Decoding Market Psychology for Worthwhile Buying and selling

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Chart Patterns: Decoding Market Psychology for Worthwhile Buying and selling. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Chart Patterns: Decoding Market Psychology for Worthwhile Buying and selling

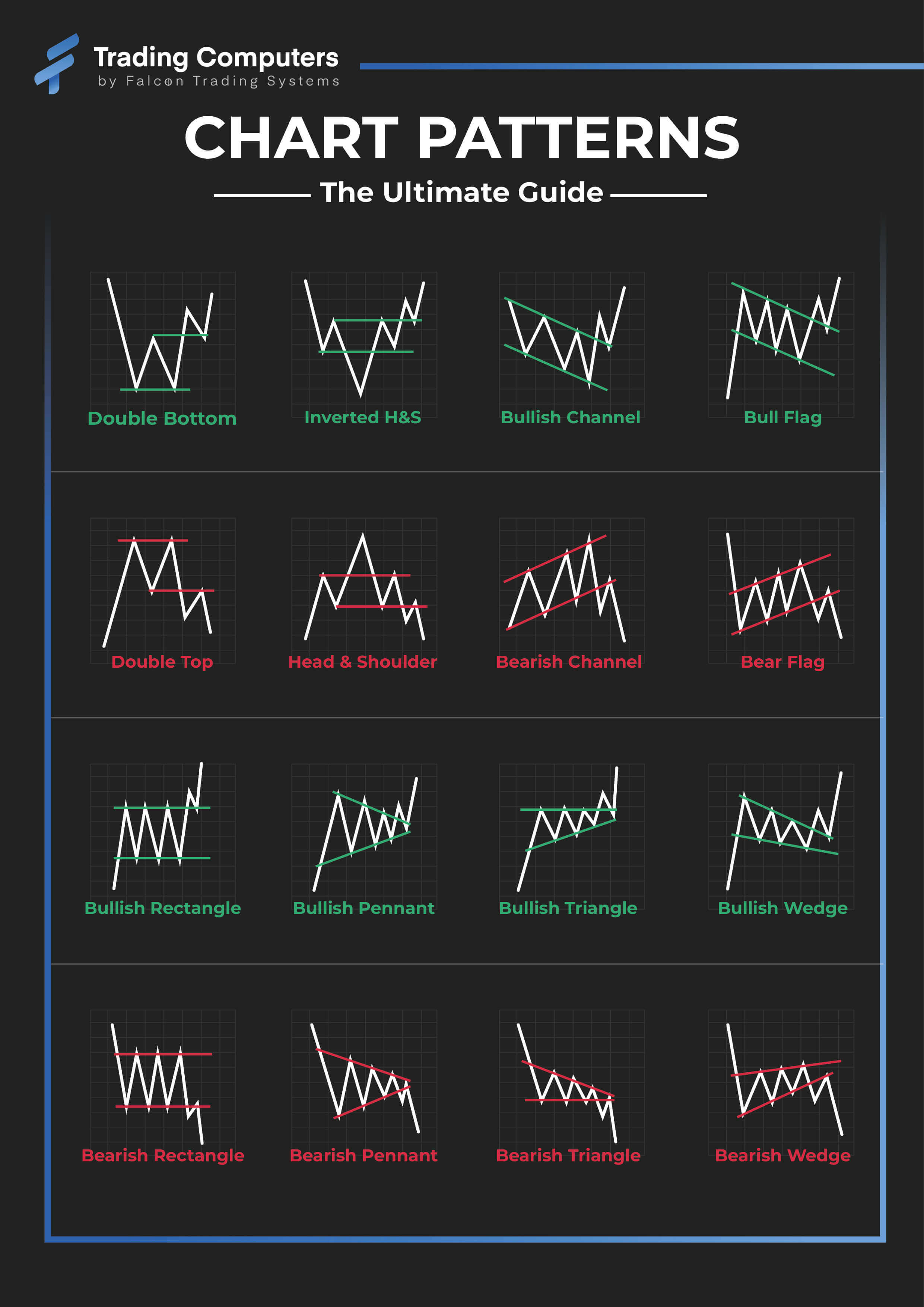

Chart patterns, visible representations of value motion over time, are invaluable instruments for technical analysts. They provide insights into market sentiment, potential value actions, and risk-reward eventualities, enabling merchants to make extra knowledgeable selections. Whereas not foolproof predictors of the longer term, understanding and accurately figuring out chart patterns considerably improves buying and selling accuracy and threat administration. This text delves deep into the world of chart patterns, exploring their formation, interpretation, and sensible software in buying and selling methods.

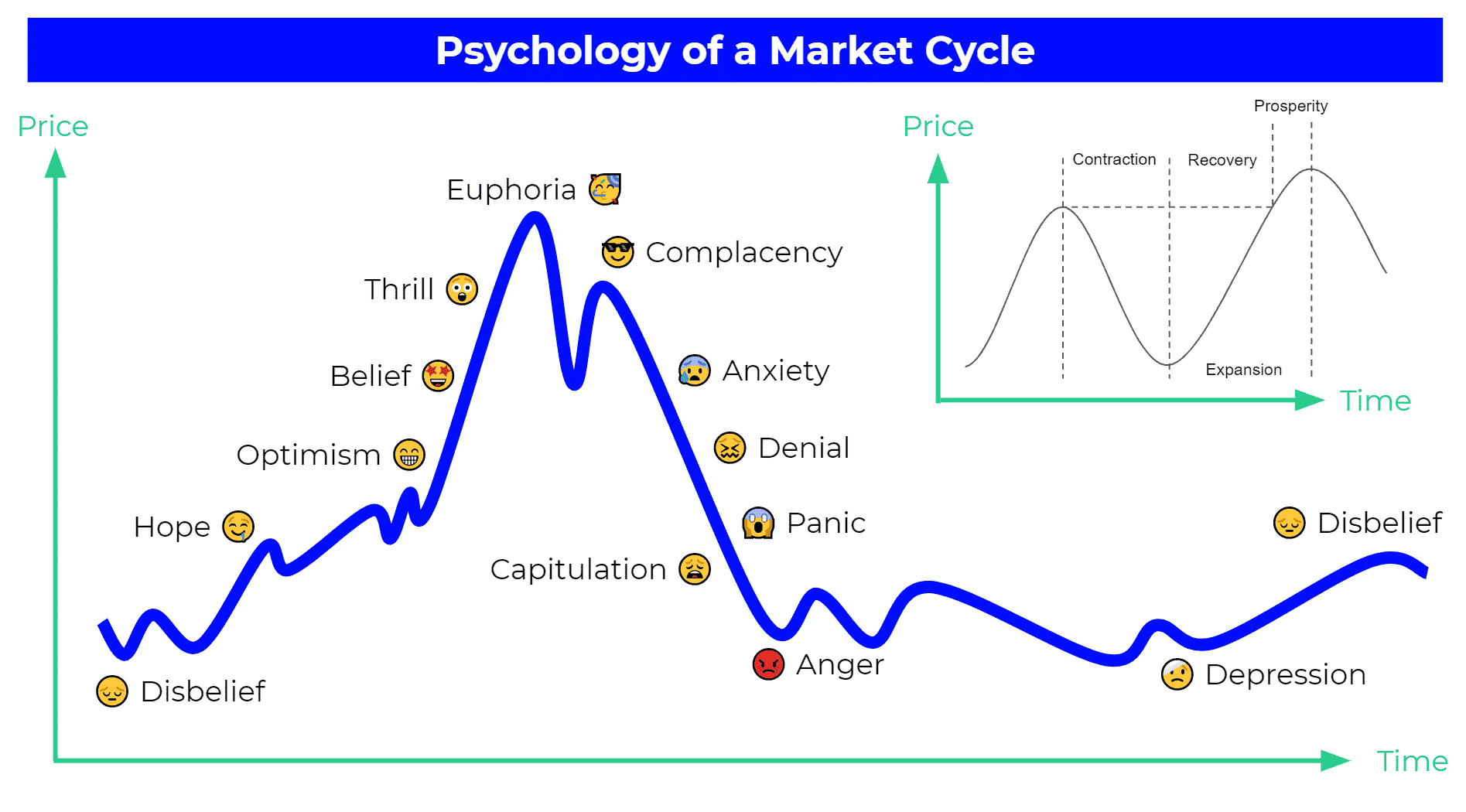

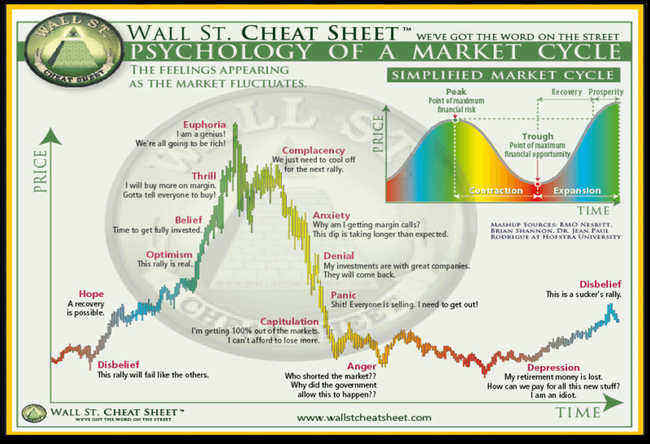

Understanding the Basis: Value Motion and Market Psychology

Earlier than diving into particular patterns, it is essential to grasp the underlying precept: value motion displays market psychology. Each value motion, each candlestick, each fluctuation, is a consequence of the collective selections of consumers and sellers. Chart patterns emerge from the interaction of those forces, creating recognizable shapes that usually precede important value modifications. Bullish patterns counsel a prevailing bullish sentiment, indicating a possible value improve, whereas bearish patterns sign bearish dominance and a possible value decline. The power of the sample, as indicated by elements like quantity and the readability of the formation, performs a big position in predicting the potential magnitude and reliability of the anticipated value motion.

Categorizing Chart Patterns: Continuations and Reversals

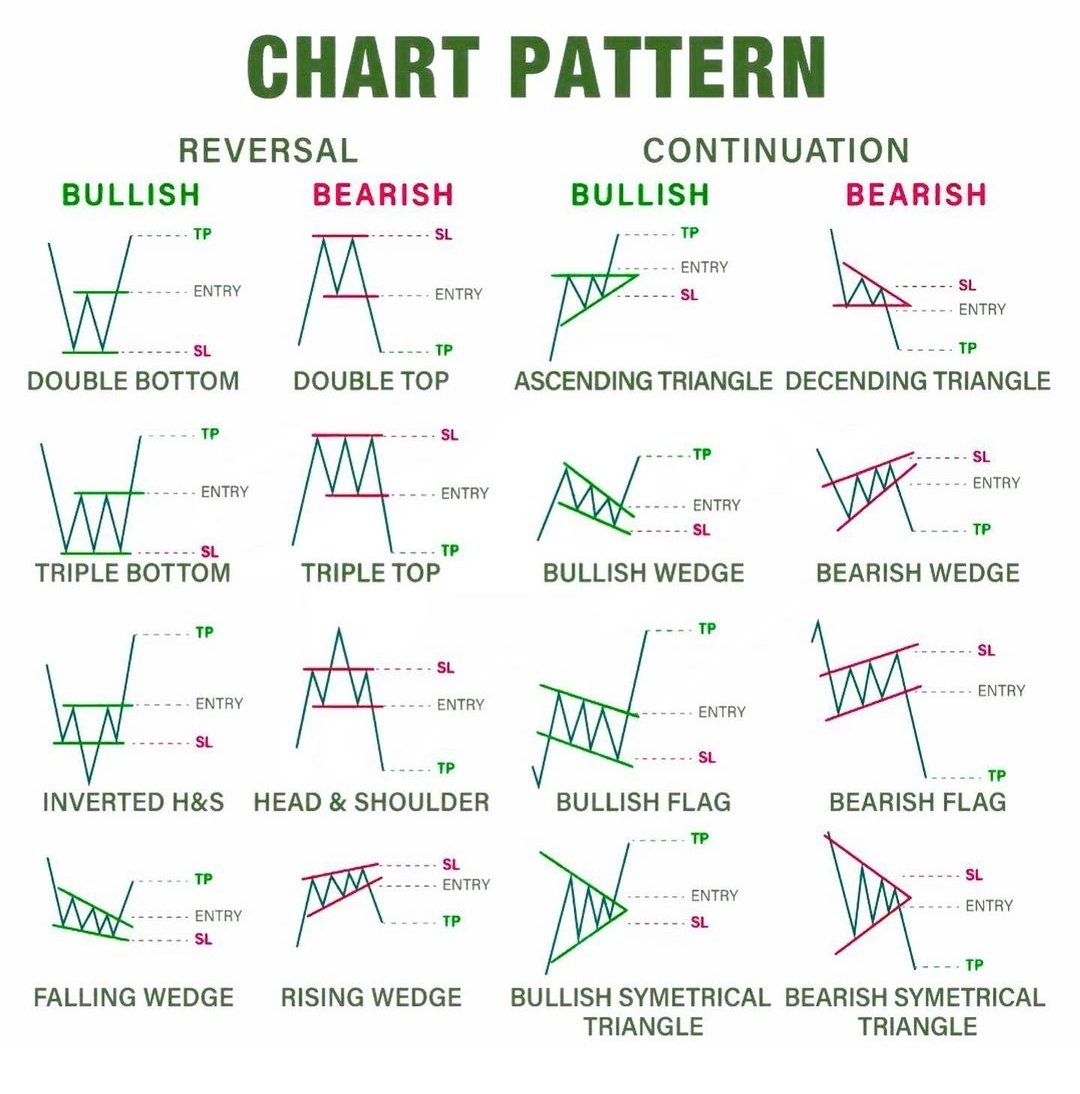

Chart patterns are broadly categorized into two teams: continuation and reversal patterns.

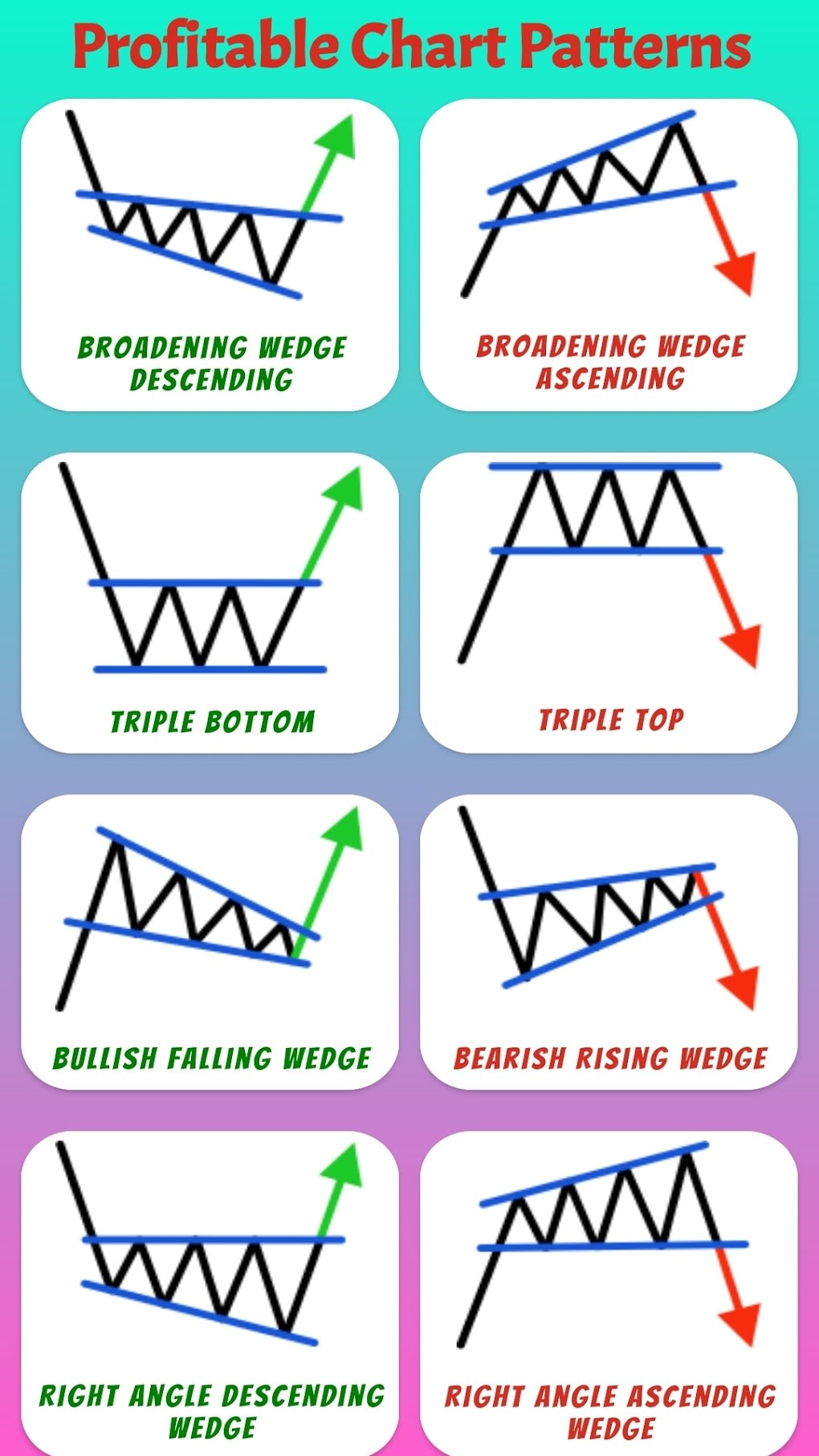

1. Continuation Patterns: These patterns counsel that the prevailing development will proceed after a short lived pause or consolidation. They characterize a interval of indecision or relaxation earlier than the development resumes its momentum. Widespread continuation patterns embrace:

-

Triangles: Triangles are characterised by converging trendlines, forming a triangular form. There are three important sorts: symmetrical, ascending, and descending. Symmetrical triangles point out indecision, with neither consumers nor sellers gaining a transparent benefit. Ascending triangles counsel bullish stress, with larger highs and flat lows. Descending triangles suggest bearish stress, with decrease lows and flat highs. Breakouts from triangles are sometimes used as entry factors, with the breakout course indicating the continuation of the development.

-

Rectangles: Rectangles are characterised by horizontal help and resistance ranges, creating an oblong or box-like form. They characterize a interval of consolidation, with value fluctuating inside an outlined vary. Breakouts from rectangles, both above the resistance or under the help, are sometimes thought-about robust alerts for the continuation of the prevailing development. The breakout course dictates the anticipated value motion.

-

Flags and Pennants: These patterns resemble flags or pennants hooked up to a flagpole (the previous development). Flags are characterised by parallel trendlines, forming an oblong or barely sloped form. Pennants are related however have converging trendlines, forming a triangular form. Each patterns characterize a short lived pause in a powerful development, with the breakout from the sample usually persevering with within the course of the previous development.

2. Reversal Patterns: These patterns counsel a possible change within the prevailing development. They point out a shift in market sentiment, from bullish to bearish or vice versa. Figuring out reversal patterns requires cautious remark and affirmation, as false alerts are doable. Widespread reversal patterns embrace:

-

Head and Shoulders: This can be a traditional reversal sample characterised by three peaks, with the center peak (the pinnacle) being considerably larger than the opposite two (the shoulders). A neckline connects the troughs between the peaks. A break under the neckline confirms the sample and alerts a possible bearish reversal.

-

Inverse Head and Shoulders: That is the mirror picture of the pinnacle and shoulders sample, indicating a possible bullish reversal. It options three troughs, with the center trough (the pinnacle) being considerably decrease than the opposite two (the shoulders). A break above the neckline confirms the sample.

-

Double Tops and Double Bottoms: These patterns are shaped by two consecutive peaks (double high) or troughs (double backside) at roughly the identical value stage. A break under the neckline of a double high or above the neckline of a double backside alerts a possible reversal.

-

Triple Tops and Triple Bottoms: Just like double tops and bottoms, however with three peaks or troughs. These patterns typically present stronger affirmation of a reversal.

Utilizing Chart Patterns in a Buying and selling Technique:

Figuring out chart patterns is just step one. Profitable buying and selling requires incorporating these patterns right into a complete technique that features:

-

Affirmation: Relying solely on chart patterns is dangerous. Affirmation from different technical indicators, comparable to transferring averages, RSI, MACD, or quantity evaluation, strengthens the sign and reduces the danger of false breakouts.

-

Threat Administration: All the time use stop-loss orders to restrict potential losses. The location of stop-loss orders ought to be fastidiously thought-about based mostly on the particular sample and the general market context.

-

Entry and Exit Methods: Outline clear entry and exit factors based mostly on the sample’s traits and affirmation alerts. Think about using trailing stop-loss orders to guard income as the value strikes in your favor.

-

Place Sizing: Decide the suitable place measurement based mostly in your threat tolerance and the potential reward-to-risk ratio of the commerce.

-

Market Context: Take into account the broader market context, together with financial indicators, information occasions, and total market sentiment. Chart patterns are most dependable in trending markets.

Limitations of Chart Patterns:

Whereas chart patterns might be useful buying and selling instruments, it is essential to acknowledge their limitations:

-

Subjectivity: Figuring out chart patterns might be subjective, with totally different merchants decoding the identical value motion in a different way.

-

False Alerts: Chart patterns can produce false alerts, resulting in losses if not confirmed by different indicators or market context.

-

Timeframe Dependence: The effectiveness of chart patterns can range relying on the timeframe used. Patterns recognized on a each day chart might not be as dependable on an hourly chart, and vice versa.

-

Market Manipulation: Giant market contributors can manipulate value motion, creating false patterns or disguising true market sentiment.

Conclusion:

Chart patterns supply a strong visible illustration of market psychology and potential value actions. By understanding the formation, interpretation, and limitations of assorted chart patterns, merchants can considerably enhance their buying and selling accuracy and threat administration. Nonetheless, it is essential to mix chart sample evaluation with different technical indicators, sound threat administration practices, and an intensive understanding of the market context to maximise profitability and decrease losses. Constant follow, steady studying, and disciplined adherence to a well-defined buying and selling plan are important for fulfillment in utilizing chart patterns for worthwhile buying and selling. Bear in mind, no buying and selling technique is foolproof, and steady adaptation and refinement are key to long-term success within the dynamic world of monetary markets.

![10 Most Profitable Chart Patterns Analysis [PDF]](https://forexpops.com/wp-content/uploads/2023/01/Most-Profitable-Chart-Patterns-768x327.jpg)

Closure

Thus, we hope this text has offered useful insights into Chart Patterns: Decoding Market Psychology for Worthwhile Buying and selling. We respect your consideration to our article. See you in our subsequent article!