Chart Patterns For Swing Buying and selling: Mastering The Visible Language Of The Market

Chart Patterns for Swing Buying and selling: Mastering the Visible Language of the Market

Associated Articles: Chart Patterns for Swing Buying and selling: Mastering the Visible Language of the Market

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Chart Patterns for Swing Buying and selling: Mastering the Visible Language of the Market. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Chart Patterns for Swing Buying and selling: Mastering the Visible Language of the Market

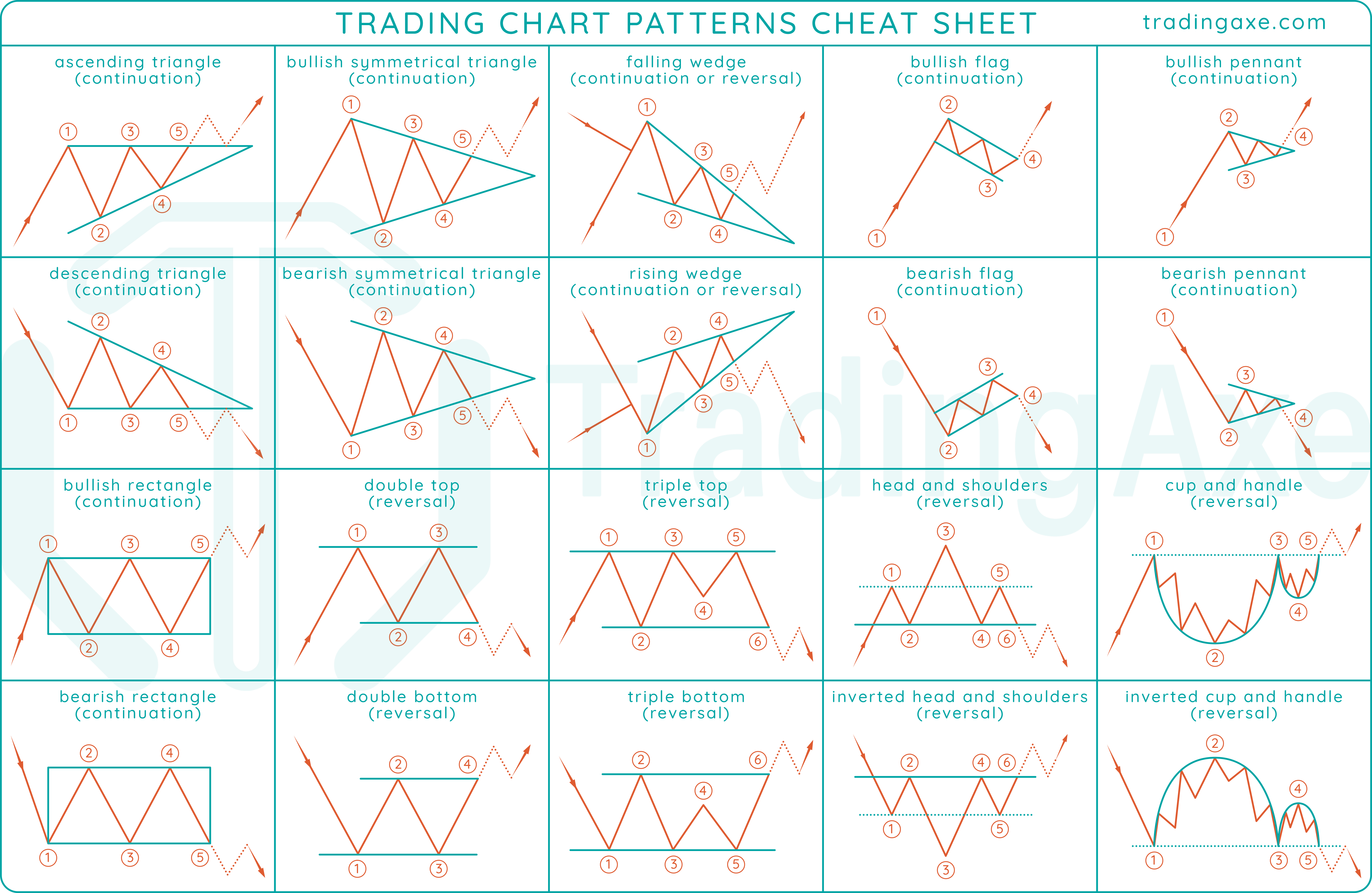

Swing buying and selling, a method targeted on capturing short-to-medium-term worth actions, depends closely on technical evaluation. Understanding and figuring out chart patterns is an important talent for profitable swing merchants. These patterns, shaped by worth motion and quantity, provide visible clues about potential future worth course and momentum, permitting merchants to anticipate entry and exit factors with better confidence. Whereas no sample ensures success, mastering their recognition considerably enhances a dealer’s odds. This text delves into among the most prevalent and dependable chart patterns utilized in swing buying and selling.

Understanding the Context: Worth Motion and Quantity

Earlier than diving into particular patterns, it is essential to grasp that chart patterns will not be remoted entities. Their significance is amplified when thought of throughout the broader market context, together with general development, sector efficiency, and financial indicators. Quantity performs a vital position in validating a sample’s potential. Excessive quantity throughout sample formation confirms sturdy participation and will increase the probability of a breakout. Conversely, low quantity suggests weak conviction and a better probability of a false breakout.

Reversal Patterns: Figuring out Turning Factors

Reversal patterns sign a possible shift within the prevailing development. These are extremely wanted by swing merchants aiming to capitalize on development modifications.

-

Head and Shoulders (H&S): This traditional reversal sample consists of three peaks, with the center peak (the "head") being the best. The 2 outer peaks (the "shoulders") are roughly equal in top. A neckline connects the lows of the 2 troughs. A break under the neckline confirms the sample and alerts a possible bearish reversal. The value goal is often calculated by measuring the gap between the top and the neckline and projecting it downwards from the neckline. The quantity must be comparatively excessive in the course of the formation of the top and will lower throughout the precise shoulder, adopted by a surge upon the neckline break.

-

Inverse Head and Shoulders (IH&S): The mirror picture of the H&S sample, this means a possible bullish reversal. It options three troughs, with the center trough being the bottom. A neckline connects the highs of the 2 peaks. A break above the neckline confirms the sample and suggests a possible upward transfer. The value goal is calculated by measuring the gap between the top (lowest trough) and the neckline and projecting it upwards from the neckline. Related quantity concerns because the H&S sample apply.

-

Double Prime/Backside: A double high varieties when the value reaches the same excessive twice, adopted by a decline. A double backside, conversely, exhibits two comparable lows adopted by an increase. The neckline is shaped by connecting the lows (for double high) or highs (for double backside) between the 2 peaks/troughs. A break under the neckline (double high) or above the neckline (double backside) confirms the sample and alerts a possible reversal. The value goal is calculated equally to the H&S sample. Quantity performs a key position; excessive quantity on the peaks/troughs and elevated quantity in the course of the breakout confirms the sample’s validity.

-

Triple Prime/Backside: Much like double tops/bottoms, however with three cases of comparable highs/lows. These patterns are usually thought of stronger alerts as a result of elevated affirmation. The evaluation and worth goal calculation stay comparable.

Continuation Patterns: Confirming the Pattern

Continuation patterns recommend a brief pause within the prevailing development earlier than the value resumes its authentic course. Swing merchants make the most of these patterns to determine optimum entry factors throughout the ongoing development.

-

Triangles: Triangles are characterised by converging trendlines, forming a triangular form. There are three predominant sorts: symmetrical, ascending, and descending. Symmetrical triangles recommend a continuation with no clear directional bias, whereas ascending triangles are bullish and descending triangles are bearish. A breakout from the triangle’s boundaries confirms the sample and signifies the continuation of the development. The value goal is usually projected based mostly on the peak of the triangle. Quantity usually decreases in the course of the formation of the triangle and will increase sharply upon the breakout.

-

Flags and Pennants: These patterns resemble flags or pennants connected to a flagpole (the previous development). Flags are characterised by parallel trendlines, whereas pennants have converging trendlines. Each patterns recommend a brief pause within the development, adopted by a resumption within the authentic course. A break above the higher trendline (for an uptrend) or under the decrease trendline (for a downtrend) confirms the sample. The value goal is usually projected based mostly on the flagpole’s top. Quantity is normally low in the course of the formation of the flag/pennant and will increase upon the breakout.

-

Rectangles: Rectangles are characterised by two horizontal trendlines, indicating a interval of consolidation. Breakouts above the higher trendline sign a continuation of the uptrend, whereas breakouts under the decrease trendline sign a continuation of the downtrend. Quantity is often low in the course of the consolidation section and will increase upon the breakout.

Superior Concerns and Danger Administration

Whereas chart patterns present priceless insights, it is essential to do not forget that they aren’t foolproof. False breakouts can happen, resulting in losses. Subsequently, efficient danger administration is paramount. Using stop-loss orders is essential to restrict potential losses. The position of stop-loss orders must be fastidiously thought of, typically slightly below the neckline in reversal patterns or under/above the trendline in continuation patterns.

Moreover, combining chart patterns with different technical indicators, equivalent to transferring averages, RSI, and MACD, can improve the accuracy of predictions. Analyzing quantity alongside worth motion can be important for confirming the validity of the patterns. Lastly, all the time take into account the broader market context and basic elements earlier than making buying and selling choices.

Conclusion:

Chart patterns provide a robust device for swing merchants to determine potential entry and exit factors. Understanding their formation, traits, and implications, mixed with efficient danger administration and a holistic method to technical evaluation, can considerably enhance buying and selling efficiency. Nevertheless, constant studying, apply, and adaptation are essential for mastering the artwork of figuring out and decoding these visible cues within the dynamic world of swing buying and selling. Do not forget that backtesting and paper buying and selling are invaluable instruments for refining your expertise and constructing confidence earlier than risking actual capital. The journey to mastering chart patterns is ongoing, demanding dedication and a dedication to steady enchancment.

Closure

Thus, we hope this text has supplied priceless insights into Chart Patterns for Swing Buying and selling: Mastering the Visible Language of the Market. We thanks for taking the time to learn this text. See you in our subsequent article!