Chart Patterns In Day Buying and selling: A Complete Information

Chart Patterns in Day Buying and selling: A Complete Information

Associated Articles: Chart Patterns in Day Buying and selling: A Complete Information

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to Chart Patterns in Day Buying and selling: A Complete Information. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Chart Patterns in Day Buying and selling: A Complete Information

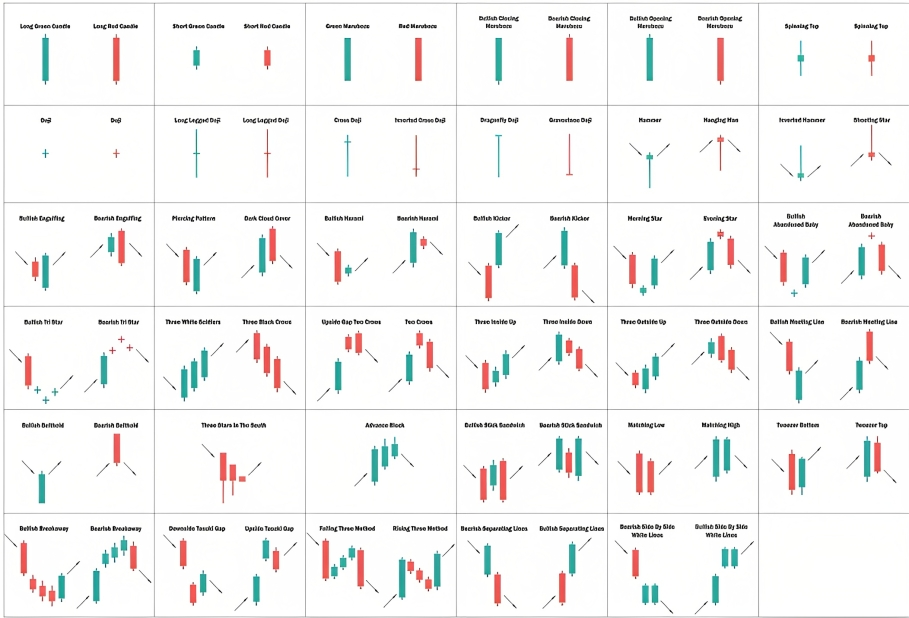

Day buying and selling, the artwork of shopping for and promoting securities throughout the identical buying and selling day, hinges on velocity, precision, and a deep understanding of market dynamics. Whereas basic evaluation performs a task, technical evaluation, significantly the identification and interpretation of chart patterns, types the spine of many profitable day buying and selling methods. Chart patterns provide visible representations of market sentiment and potential worth actions, permitting merchants to anticipate future worth motion and capitalize on fleeting alternatives. This text delves into the world of chart patterns in day buying and selling, exploring their significance, varied sorts, and sensible functions.

The Significance of Chart Patterns in Day Buying and selling

Chart patterns are fashioned by the value motion of an asset over time, reflecting the collective habits of consumers and sellers. These patterns, typically recurring and predictable, present precious insights into potential assist and resistance ranges, worth momentum, and potential reversal or continuation factors. Within the fast-paced world of day buying and selling, the place even small worth fluctuations can yield important earnings or losses, recognizing these patterns turns into essential.

The benefit of utilizing chart patterns in day buying and selling lies of their skill to:

- Determine potential entry and exit factors: Patterns typically sign potential breakout factors, providing merchants clear entry indicators with outlined stop-loss ranges. Equally, they’ll point out potential reversals, offering exit indicators to lock in earnings or decrease losses.

- Gauge market sentiment: The form and formation of a chart sample typically reveal the prevailing sentiment amongst market contributors. A bullish sample suggests optimism and potential upward worth motion, whereas a bearish sample signifies pessimism and potential downward motion.

- Verify worth developments: Patterns can affirm or contradict present developments, serving to merchants make knowledgeable selections about whether or not to journey the development or anticipate a reversal.

- Cut back reliance on indicators: Whereas technical indicators might be helpful, chart patterns present a visible illustration of worth motion, lowering reliance on doubtlessly lagging or conflicting indicators.

Sorts of Chart Patterns Utilized in Day Buying and selling

Quite a few chart patterns exist, every with its personal traits and implications. Listed below are a number of the mostly used patterns in day buying and selling:

1. Continuation Patterns: These patterns recommend a short lived pause in an present development earlier than the value resumes its unique path.

- Flags and Pennants: These patterns resemble flags or pennants hooked up to a flagpole (the previous development). Flags are characterised by parallel trendlines, whereas pennants have converging trendlines. A breakout from both sample confirms the continuation of the previous development.

- Triangles (Symmetrical, Ascending, Descending): Triangles are characterised by converging trendlines. Symmetrical triangles recommend a continuation with unsure path, whereas ascending triangles recommend a bullish continuation and descending triangles recommend a bearish continuation. Breakouts happen when the value breaks above (bullish) or under (bearish) the converging trendlines.

- Rectangles (or Consolidation Patterns): These patterns are characterised by horizontal assist and resistance ranges. The value consolidates inside an outlined vary earlier than breaking out within the path of the previous development.

2. Reversal Patterns: These patterns recommend a possible change within the path of the prevailing development.

- Head and Shoulders (and Inverse Head and Shoulders): This traditional sample consists of three peaks (or troughs), with the center peak (or trough) being the very best (or lowest). A neckline connects the troughs (or peaks) on both aspect of the central peak (or trough). A break under the neckline in a head and shoulders sample confirms a bearish reversal, whereas a break above the neckline in an inverse head and shoulders sample confirms a bullish reversal.

- Double Tops and Bottoms: These patterns include two comparable peaks (or troughs) adopted by a decline (or rise). A break under the assist degree of a double high confirms a bearish reversal, whereas a break above the resistance degree of a double backside confirms a bullish reversal.

- Rounding Tops and Bottoms: These patterns are characterised by a gradual curve, resembling a rounded "U" form. Rounding tops point out a bearish reversal, whereas rounding bottoms point out a bullish reversal.

3. Different Notable Patterns:

- Wedges (Ascending and Descending): Wedges are much like triangles however have converging trendlines that slope both upward (ascending wedge, often bearish) or downward (descending wedge, often bullish). Breakouts typically happen within the path reverse to the wedge slope.

- Gaps: Gaps are worth discontinuities the place the value opens considerably increased or decrease than the day gone by’s shut. They’ll sign important information or occasions and might be adopted by continuation or reversal patterns.

Sensible Purposes in Day Buying and selling

Figuring out and deciphering chart patterns successfully requires follow and expertise. Here is how day merchants can leverage chart patterns:

- Mix with different indicators: Chart patterns should not be utilized in isolation. Combining them with technical indicators like shifting averages, RSI, or MACD can improve accuracy and supply affirmation indicators.

- Outline stop-loss and take-profit ranges: Earlier than getting into a commerce primarily based on a chart sample, it is essential to outline clear stop-loss and take-profit ranges to handle danger and defend earnings. Cease-loss orders needs to be positioned under assist ranges (for lengthy positions) or above resistance ranges (for brief positions). Take-profit ranges needs to be set primarily based on the sample’s projected goal.

- Contemplate quantity: Excessive quantity accompanying a breakout confirms the power of the transfer and will increase the probability of a profitable commerce. Low quantity breakouts could also be false indicators.

- Make the most of completely different timeframes: Analyzing chart patterns on a number of timeframes (e.g., 5-minute, 15-minute, 1-hour) can present a extra complete view of the market and make sure the validity of the sample.

- Handle danger: Day buying and selling is inherently dangerous. By no means danger extra capital than you may afford to lose. Correct place sizing and danger administration are essential for long-term success.

Limitations and Concerns

Whereas chart patterns are precious instruments, they don’t seem to be foolproof. A number of limitations have to be thought of:

- Subjectivity: Figuring out and deciphering chart patterns might be subjective. Completely different merchants might interpret the identical sample in another way, resulting in conflicting buying and selling selections.

- False breakouts: Typically, the value might escape of a sample solely to revert again, resulting in losses. Utilizing quantity affirmation and different indicators will help mitigate this danger.

- Market noise: Market noise can obscure the formation of clear chart patterns, making identification troublesome.

- Not a standalone technique: Chart patterns needs to be used as a part of a complete buying and selling technique, incorporating danger administration, cash administration, and different technical and basic evaluation strategies.

Conclusion

Chart patterns provide a robust visible instrument for day merchants to anticipate potential worth actions and capitalize on market alternatives. By understanding the varied kinds of chart patterns, their implications, and their limitations, day merchants can considerably improve their buying and selling accuracy and profitability. Nevertheless, it is essential to keep in mind that constant success in day buying and selling requires a mix of data, talent, self-discipline, and efficient danger administration. Steady studying, follow, and adaptation are key to mastering the artwork of utilizing chart patterns on this dynamic and difficult market atmosphere. Moreover, backtesting methods and simulated buying and selling will help refine sample recognition and danger administration expertise earlier than committing actual capital. The journey to turning into a profitable day dealer entails a steady technique of studying and refinement, and mastering chart patterns is a vital step alongside the best way.

Closure

Thus, we hope this text has offered precious insights into Chart Patterns in Day Buying and selling: A Complete Information. We hope you discover this text informative and useful. See you in our subsequent article!