Chart Patterns Screeners: Unlocking Market Alternatives With Automated Technical Evaluation

Chart Patterns Screeners: Unlocking Market Alternatives with Automated Technical Evaluation

Associated Articles: Chart Patterns Screeners: Unlocking Market Alternatives with Automated Technical Evaluation

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to Chart Patterns Screeners: Unlocking Market Alternatives with Automated Technical Evaluation. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Chart Patterns Screeners: Unlocking Market Alternatives with Automated Technical Evaluation

The inventory market, a fancy tapestry woven from numerous financial threads, can appear impenetrable to the informal observer. Nevertheless, for these prepared to delve deeper, patterns emerge – recurring formations in worth charts that usually foreshadow future worth actions. Figuring out these patterns manually is time-consuming and liable to subjective biases. That is the place chart patterns screeners come into play, providing a robust software for automated technical evaluation and probably unlocking vital market alternatives.

This text delves into the world of chart patterns screeners, exploring their performance, advantages, limitations, and tips on how to successfully make the most of them as a part of a complete buying and selling technique.

Understanding Chart Patterns:

Technical evaluation depends closely on the identification and interpretation of chart patterns. These patterns, fashioned by worth actions over time, characterize the collective habits of market contributors. Recognizing these formations can present precious insights into potential assist and resistance ranges, future worth route, and the energy of a pattern. Some frequent chart patterns embody:

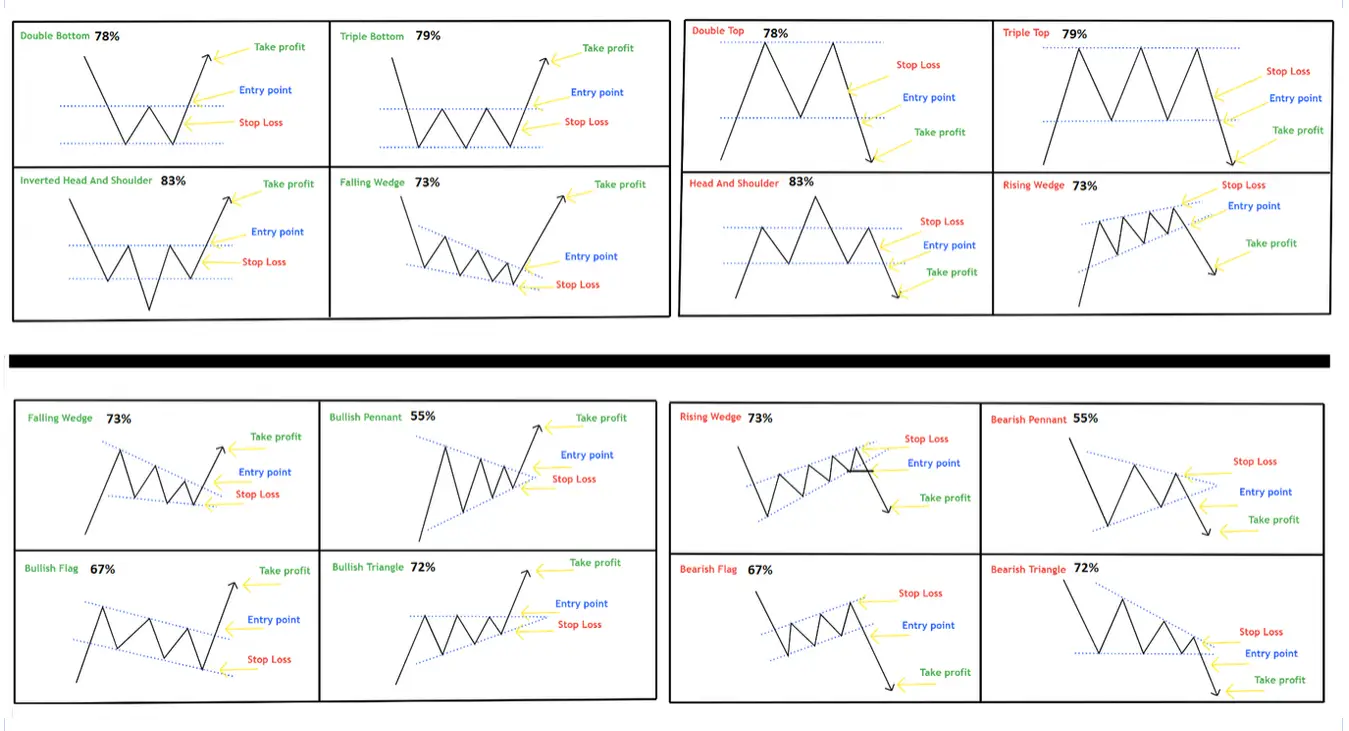

- Head and Shoulders: A bearish reversal sample characterised by three peaks, with the center peak (the pinnacle) being the very best.

- Inverse Head and Shoulders: A bullish reversal sample, the mirror picture of the pinnacle and shoulders sample.

- Double Tops/Bottoms: These patterns counsel a possible reversal within the pattern after two comparable worth peaks (double high) or troughs (double backside).

- Triangles (Symmetrical, Ascending, Descending): These patterns characterize intervals of consolidation, with the kind of triangle hinting on the potential breakout route.

- Flags and Pennants: These patterns characterize non permanent pauses in a powerful pattern, usually adopted by a continuation of the pattern.

- Cup and Deal with: A bullish continuation sample resembling a cup with a deal with.

- Wedge (Ascending, Descending): Just like triangles, wedges point out consolidation, however their sloping traces counsel a possible breakout route.

Manually figuring out these patterns throughout quite a few shares or property requires vital time and experience. A single misinterpretation can result in expensive buying and selling selections. That is the place chart patterns screeners present a big benefit.

The Energy of Chart Patterns Screeners:

Chart patterns screeners are software program instruments designed to routinely scan huge quantities of market knowledge and establish shares or property exhibiting particular chart patterns. They remove the handbook effort concerned in chart evaluation, permitting merchants to concentrate on different elements of their technique, resembling threat administration and commerce execution. Key options of a strong chart sample screener embody:

- Sample Recognition: The core performance is the flexibility to routinely establish predefined chart patterns throughout a specific set of property. The sophistication of the sample recognition algorithms varies throughout totally different screeners. Some use easy geometric comparisons, whereas others make use of extra superior machine studying methods for larger accuracy.

- Customizable Parameters: Efficient screeners enable customers to customise the parameters for sample recognition. This consists of adjusting the timeframe (e.g., day by day, weekly, month-to-month), the minimal worth motion required, and the tolerance ranges for sample imperfections. This flexibility permits merchants to fine-tune their searches to match their particular buying and selling fashion and threat tolerance.

- A number of Asset Courses: Many screeners assist a number of asset lessons, together with shares, ETFs, futures, and foreign exchange, permitting merchants to scan a broad vary of markets for potential alternatives.

- Backtesting Capabilities: Refined screeners supply backtesting functionalities, permitting customers to simulate the efficiency of a buying and selling technique primarily based on recognized chart patterns over historic knowledge. That is essential for evaluating the effectiveness of the screener and refining the parameters used.

- Integration with Buying and selling Platforms: One of the best screeners seamlessly combine with fashionable buying and selling platforms, enabling merchants to instantly execute trades primarily based on the recognized patterns.

- Alerting Methods: Many screeners supply real-time alerts, notifying merchants when new patterns matching their predefined standards emerge. That is significantly helpful for day merchants or swing merchants who have to react rapidly to market actions.

Advantages of Utilizing Chart Patterns Screeners:

- Elevated Effectivity: Screeners drastically cut back the time spent on handbook chart evaluation, permitting merchants to display a bigger variety of property in a shorter timeframe.

- Objectivity and Consistency: Automated sample recognition eliminates subjective biases that may affect handbook evaluation, resulting in extra constant buying and selling selections.

- Early Identification of Alternatives: By repeatedly scanning the market, screeners can establish rising patterns earlier than they grow to be widely known, offering a possible edge available in the market.

- Enhanced Danger Administration: Backtesting capabilities enable merchants to evaluate the historic efficiency of a method primarily based on recognized chart patterns, serving to to handle threat extra successfully.

- Diversification: The flexibility to display a number of asset lessons permits merchants to diversify their portfolios and cut back general threat.

Limitations of Chart Patterns Screeners:

- False Alerts: No screener is ideal. They will generate false alerts, figuring out patterns that don’t result in worthwhile trades. It is essential to make use of screeners as one element of a broader buying and selling technique, not as the only real foundation for buying and selling selections.

- Overfitting: Overly customizing the parameters of a screener can result in overfitting, the place the screener performs properly on historic knowledge however poorly on reside market knowledge.

- Dependence on Historic Information: Chart patterns are primarily based on previous worth actions, and previous efficiency is just not essentially indicative of future outcomes.

- Price: Excessive-quality chart patterns screeners will be costly, significantly these with superior options and integration capabilities.

Efficient Utilization of Chart Patterns Screeners:

To maximise the advantages of chart patterns screeners, take into account the next:

- Mix with Elementary Evaluation: Do not rely solely on technical evaluation. Combine chart sample screening with elementary evaluation to achieve a extra holistic view of the market.

- Develop a Strong Buying and selling Plan: Set up clear entry and exit guidelines, threat administration methods, and place sizing tips earlier than utilizing a screener.

- Backtest Totally: Rigorously backtest any buying and selling technique primarily based on recognized patterns to judge its historic efficiency and refine its parameters.

- Use A number of Indicators: Do not rely solely on chart patterns. Mix them with different technical indicators (e.g., transferring averages, RSI, MACD) to verify alerts and cut back false positives.

- Handle Expectations: Do not forget that no screener ensures earnings. Be ready for losses and handle your threat successfully.

Conclusion:

Chart patterns screeners supply a robust software for merchants looking for to boost their technical evaluation capabilities. By automating the identification of chart patterns, they considerably enhance effectivity, objectivity, and the potential for figuring out market alternatives. Nevertheless, it is essential to grasp their limitations and use them as a part of a well-defined, diversified buying and selling technique that comes with elementary evaluation, threat administration, and thorough backtesting. The important thing to profitable utilization lies in combining the facility of automation with sound buying and selling ideas and a sensible understanding of market dynamics. Deal with the screener as a precious assistant, not a magic bullet, and your probabilities of success shall be considerably improved.

:max_bytes(150000):strip_icc()/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-05-a19b59070c434400988fca7fa83898dd.jpg)

Closure

Thus, we hope this text has supplied precious insights into Chart Patterns Screeners: Unlocking Market Alternatives with Automated Technical Evaluation. We hope you discover this text informative and useful. See you in our subsequent article!