Chart Patterns: Your Information To Navigating The World Of Technical Evaluation Web sites

Chart Patterns: Your Information to Navigating the World of Technical Evaluation Web sites

Associated Articles: Chart Patterns: Your Information to Navigating the World of Technical Evaluation Web sites

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Chart Patterns: Your Information to Navigating the World of Technical Evaluation Web sites. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Chart Patterns: Your Information to Navigating the World of Technical Evaluation Web sites

The world of finance is advanced, full of fluctuating markets and unpredictable tendencies. For merchants and buyers, understanding these fluctuations is paramount to success. Technical evaluation, the research of previous market information to foretell future worth actions, gives a priceless toolkit. Central to technical evaluation are chart patterns – recurring formations on worth charts that counsel potential future worth motion. Quite a few web sites devoted to chart patterns have emerged, providing a spread of instruments and sources to assist navigate this advanced panorama. This text will delve into the world of chart patterns web sites, exploring their options, advantages, limitations, and the way to decide on the fitting one in your wants.

Understanding Chart Patterns and Their Significance:

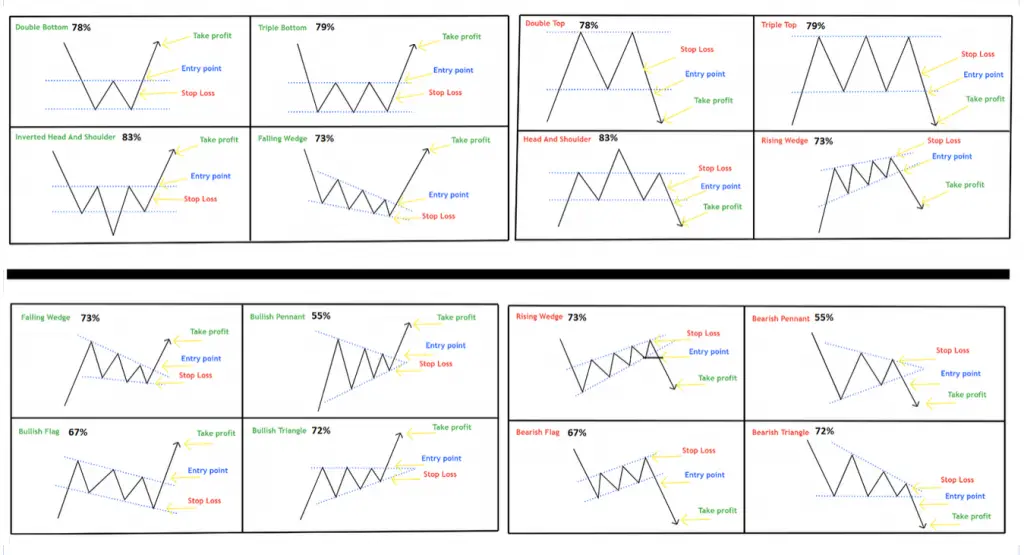

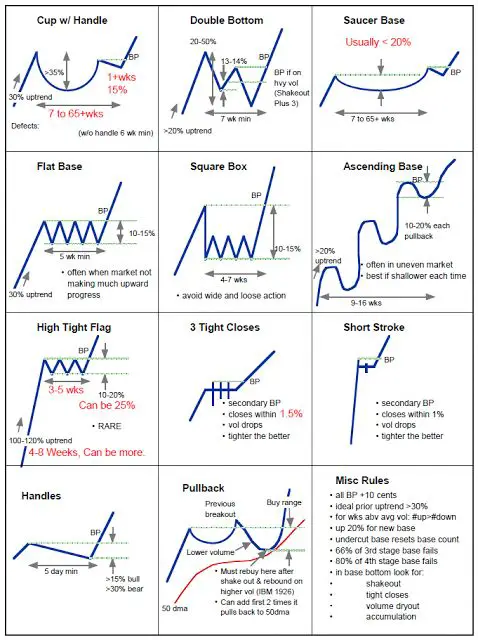

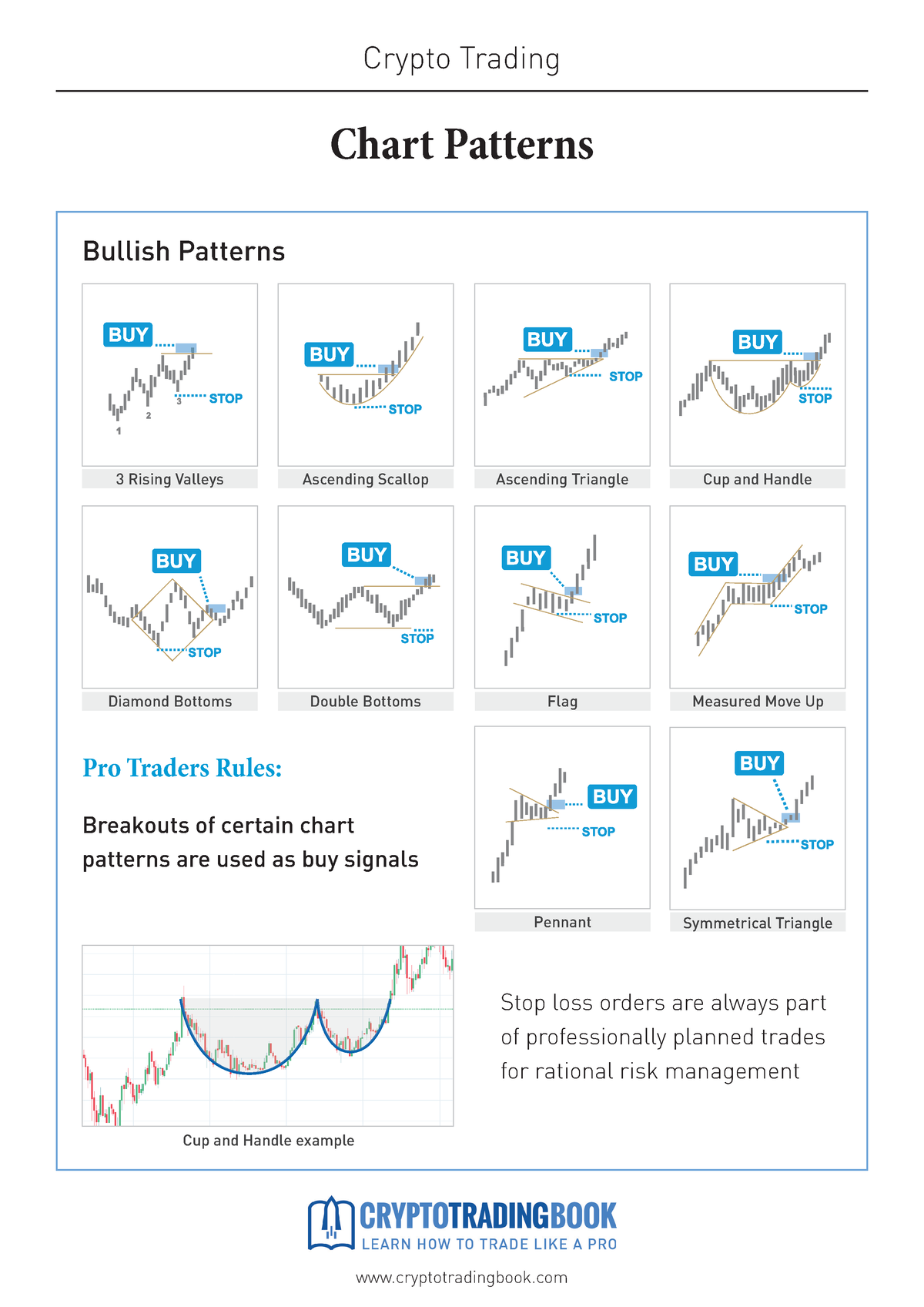

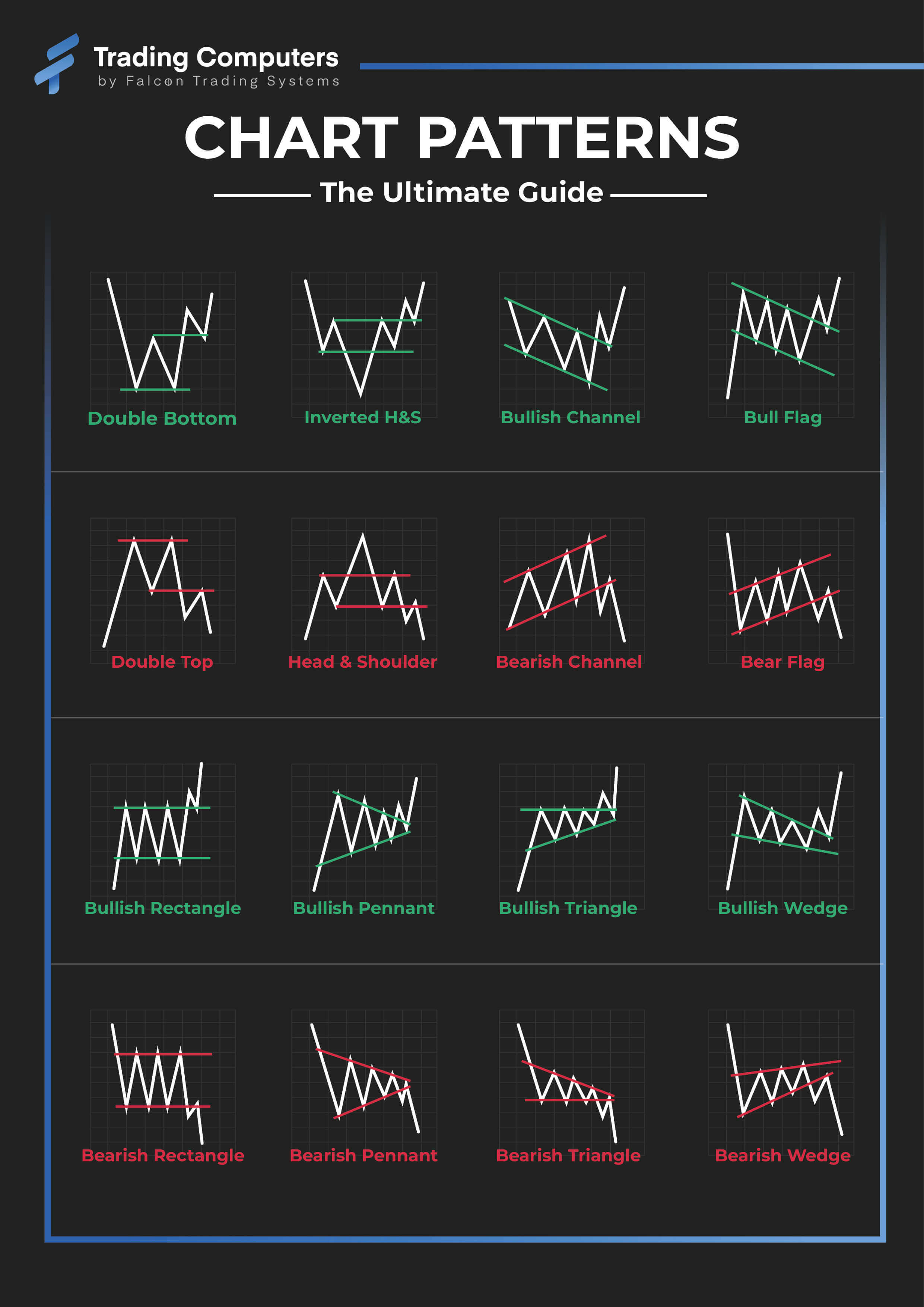

Chart patterns are visually identifiable formations on worth charts (sometimes candlestick or bar charts) that symbolize shifts in market sentiment and potential future worth actions. They aren’t foolproof predictors, however reasonably probabilistic indicators that, when mixed with different technical indicators and elementary evaluation, can improve buying and selling choices. Widespread chart patterns embrace:

- Head and Shoulders: This reversal sample suggests a possible pattern change, with a peak (the pinnacle) flanked by two smaller peaks (the shoulders).

- Double Tops/Bottoms: These patterns point out potential pattern reversals, with two comparable worth peaks (double prime) or troughs (double backside).

- Triangles: These patterns symbolize durations of consolidation, with costs contained inside converging pattern traces. Triangles might be symmetrical, ascending, or descending, every with completely different implications.

- Flags and Pennants: These patterns counsel a continuation of the present pattern, with a brief pause in worth motion.

- Wedges: Much like triangles, wedges counsel consolidation, however the converging pattern traces have a special slope, indicating both bullish or bearish continuation.

- Cup and Deal with: This bullish continuation sample resembles a cup with a small deal with, suggesting a possible upward breakout.

These are just some examples, and lots of different chart patterns exist, every with its personal nuances and interpretation. Understanding these patterns requires data of candlestick patterns, help and resistance ranges, and quantity evaluation.

The Position of Chart Patterns Web sites:

Chart patterns web sites play a vital position in simplifying and enhancing the method of technical evaluation. They provide quite a lot of options designed to assist merchants establish, analyze, and interpret chart patterns:

- Charting Instruments: Most web sites present superior charting instruments with customizable indicators, timeframes, and drawing instruments to establish potential patterns. These instruments usually permit customers to overlay numerous technical indicators alongside chart patterns for a extra complete evaluation.

- Sample Recognition: Some superior platforms make the most of AI and machine studying to mechanically establish potential chart patterns, saving merchants priceless effort and time. Nevertheless, it is essential to do not forget that automated sample recognition must be used as a supplementary software, not a sole decision-making issue.

- Academic Sources: Many web sites supply academic sources, together with tutorials, articles, and webinars, to assist customers study chart patterns and technical evaluation. That is notably useful for freshmen who’re new to the sector.

- Backtesting Capabilities: Some platforms permit customers to backtest their buying and selling methods utilizing historic information, simulating the efficiency of their buying and selling plans based mostly on recognized chart patterns. This helps refine methods and assess their effectiveness earlier than deploying them with actual capital.

- Neighborhood Options: Sure web sites foster a way of group by permitting customers to share their insights, focus on buying and selling methods, and study from one another’s experiences. This is usually a priceless useful resource for each skilled and novice merchants.

- Actual-time Knowledge Feeds: Entry to real-time market information is essential for efficient technical evaluation. Many web sites supply real-time information feeds, guaranteeing merchants have essentially the most up-to-date info obtainable.

- Screening Instruments: Some superior platforms supply screening instruments that permit customers to filter by an enormous variety of belongings based mostly on particular chart sample standards, serving to establish potential buying and selling alternatives.

Selecting the Proper Chart Patterns Web site:

Selecting the best chart patterns web site is determined by a number of components, together with your expertise degree, buying and selling fashion, and price range:

- Ease of Use: For freshmen, a user-friendly interface with intuitive navigation is essential. The web site must be straightforward to study and use, even with out in depth technical data.

- Options and Performance: Take into account the options supplied by the web site, together with charting instruments, sample recognition capabilities, academic sources, and group options. Select a web site that gives the options you must help your buying and selling fashion.

- Knowledge High quality and Reliability: Guarantee the web site supplies correct and dependable market information. Verify the supply of the info and its historic accuracy.

- Price and Pricing: Chart patterns web sites vary in worth from free to premium subscriptions. Take into account your price range and select a web site that gives good worth in your cash. Free variations usually have limitations, resembling restricted information entry or fewer options.

- Buyer Help: Search for a web site with responsive and useful buyer help. That is notably essential when you encounter any technical points or have questions concerning the platform’s options.

- Safety and Privateness: Guarantee the web site prioritizes the safety and privateness of your information. Search for web sites that use encryption and different safety measures to guard your info.

Limitations of Chart Patterns Web sites:

Whereas chart patterns web sites supply priceless instruments for technical evaluation, it is important to acknowledge their limitations:

- Subjectivity: Figuring out chart patterns might be subjective, with completely different merchants doubtlessly deciphering the identical chart in a different way. This may result in discrepancies in buying and selling choices.

- False Indicators: Chart patterns will not be foolproof predictors, they usually can typically generate false indicators, resulting in inaccurate predictions and potential losses.

- Overreliance: Overreliance on chart patterns with out contemplating different components, resembling elementary evaluation and market sentiment, might be detrimental to buying and selling success.

- Lagging Indicator: Chart patterns are based mostly on previous worth motion, that means they’re lagging indicators. By the point a sample is recognized, the value might have already moved considerably.

Conclusion:

Chart patterns web sites supply a strong set of instruments for merchants and buyers in search of to boost their technical evaluation abilities. By understanding the several types of chart patterns, leveraging the options supplied by these web sites, and acknowledging their limitations, merchants can considerably enhance their decision-making course of. Nevertheless, it is essential to do not forget that chart patterns are only one piece of the puzzle. Profitable buying and selling requires a holistic strategy that mixes technical evaluation with elementary evaluation, danger administration, and a disciplined buying and selling plan. Selecting the best web site, based mostly in your particular person wants and expertise degree, is an important step in the direction of harnessing the facility of chart patterns in your buying and selling journey. Bear in mind to at all times conduct thorough analysis, follow accountable danger administration, and by no means make investments greater than you possibly can afford to lose.

Closure

Thus, we hope this text has supplied priceless insights into Chart Patterns: Your Information to Navigating the World of Technical Evaluation Web sites. We thanks for taking the time to learn this text. See you in our subsequent article!