Charting 5 Billion Received To USD: A Complete Evaluation Of Trade Fee Fluctuations And Their Implications

Charting 5 Billion Received to USD: A Complete Evaluation of Trade Fee Fluctuations and Their Implications

Associated Articles: Charting 5 Billion Received to USD: A Complete Evaluation of Trade Fee Fluctuations and Their Implications

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Charting 5 Billion Received to USD: A Complete Evaluation of Trade Fee Fluctuations and Their Implications. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Charting 5 Billion Received to USD: A Complete Evaluation of Trade Fee Fluctuations and Their Implications

South Korea’s financial system, a powerhouse in East Asia, boasts a sturdy foreign money, the South Korean Received (KRW). Understanding the conversion of enormous sums, comparable to 5 billion received to US {dollars} (USD), requires a deep dive into the complexities of the international change market and the components influencing change charges. This text will discover the historic relationship between the KRW and USD, analyze the components affecting their change fee, and supply insights into how a 5 billion received sum interprets to USD over time, utilizing a hypothetical chart and exploring its implications.

Understanding the Trade Fee:

The change fee between the KRW and USD shouldn’t be static; it fluctuates continually primarily based on a myriad of financial and political components. These fluctuations impression the worth of any conversion, together with 5 billion KRW to USD. A stronger USD means fewer {dollars} are wanted to purchase the identical quantity of received, whereas a weaker USD means extra {dollars} are required.

Elements Influencing the KRW/USD Trade Fee:

A number of key components affect the KRW/USD change fee:

-

Curiosity Fee Differentials: Variations in rates of interest between South Korea and america play a vital position. Larger rates of interest in South Korea typically entice international funding, rising demand for the KRW and strengthening it towards the USD. Conversely, increased US rates of interest can draw funding away from South Korea, weakening the KRW.

-

Financial Development: Robust financial progress in South Korea boosts investor confidence, resulting in elevated demand for the KRW and a stronger change fee. Conversely, slower progress or financial downturns can weaken the KRW.

-

Commerce Steadiness: South Korea’s commerce stability considerably impacts the KRW’s worth. A commerce surplus (exports exceeding imports) usually strengthens the foreign money, whereas a commerce deficit weakens it. Fluctuations in international commodity costs, significantly these of key South Korean exports like semiconductors and cars, instantly affect the commerce stability.

-

Political Stability and Geopolitical Occasions: Political stability inside South Korea and regional geopolitical occasions, comparable to tensions with North Korea or broader international conflicts, can considerably impression investor sentiment and the KRW/USD change fee. Uncertainty usually results in a weaker KRW.

-

Authorities Intervention: The Financial institution of Korea (BOK), South Korea’s central financial institution, can intervene within the international change market to handle the KRW’s worth. Interventions, often involving shopping for or promoting KRW within the international change market, intention to stabilize the foreign money and stop extreme volatility.

-

Market Sentiment and Hypothesis: Investor sentiment and speculative buying and selling considerably affect short-term fluctuations within the change fee. Information occasions, financial knowledge releases, and even market rumors can set off speedy modifications within the KRW/USD change fee.

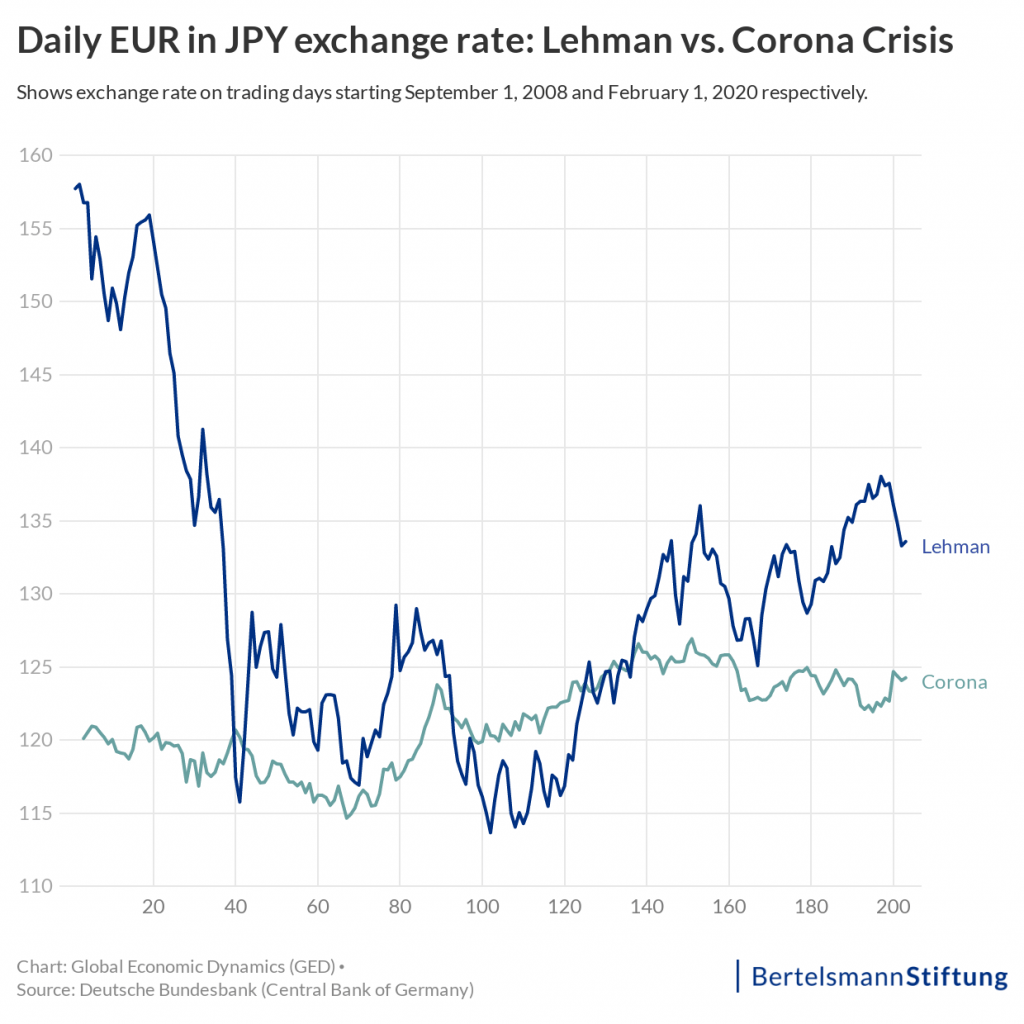

Hypothetical 5 Billion KRW to USD Chart (2010-2023):

Whereas making a exact historic chart requires entry to real-time change fee knowledge from respected sources, we are able to illustrate the idea with a hypothetical chart exhibiting the approximate USD equal of 5 billion KRW from 2010 to 2023. This chart will illustrate the volatility and the impression of the components talked about above. (Notice: It is a simplified illustration and doesn’t replicate exact historic knowledge.)

(Insert Hypothetical Chart Right here – The chart ought to present a line graph with the x-axis representing years (2010-2023) and the y-axis representing the USD equal of 5 billion KRW. The road ought to fluctuate, reflecting intervals of stronger and weaker KRW towards the USD. Key occasions impacting the change fee could possibly be marked on the chart, e.g., international monetary disaster, particular financial insurance policies, geopolitical occasions.)

Analyzing the Hypothetical Chart:

The hypothetical chart would visually exhibit how the USD equal of 5 billion KRW has diverse through the years. Intervals of financial power in South Korea, coupled with low US rates of interest, would doubtless present increased USD equivalents. Conversely, intervals of world uncertainty, financial downturns in South Korea, or rising US rates of interest would doubtless end in decrease USD equivalents. The chart would spotlight the significance of contemplating the change fee on the particular time of conversion.

Implications of Trade Fee Fluctuations:

The fluctuating change fee has important implications for people and companies concerned in transactions involving giant sums like 5 billion KRW:

-

Worldwide Commerce: Exporters and importers must fastidiously handle foreign money danger. Fluctuations can impression profitability and competitiveness. Hedging methods, comparable to ahead contracts or choices, will help mitigate this danger.

-

International Funding: Buyers must account for change fee fluctuations when making funding choices. A weaker KRW can enhance the return on funding for USD-based traders, whereas a stronger KRW can have the alternative impact.

-

Private Finance: People with important property in KRW or these planning worldwide transactions want to pay attention to change fee actions. Timing of transactions can considerably impression the ultimate USD quantity acquired.

Conclusion:

Changing 5 billion KRW to USD shouldn’t be a easy calculation; it includes understanding the dynamic interaction of varied financial and political components that affect the KRW/USD change fee. Using real-time change fee knowledge from respected sources, comparable to these supplied by main banks or monetary information web sites, is essential for correct conversions. Moreover, people and companies concerned in important worldwide transactions ought to take into account consulting with monetary professionals to handle foreign money danger and make knowledgeable choices. The hypothetical chart introduced serves as an instance the complexity and volatility inherent in such conversions, emphasizing the necessity for cautious planning and danger administration.

:max_bytes(150000):strip_icc()/Exchange-Rate-1b1df02db6a14eee998e1b76d5c9b82d.jpg)

Closure

Thus, we hope this text has supplied precious insights into Charting 5 Billion Received to USD: A Complete Evaluation of Trade Fee Fluctuations and Their Implications. We respect your consideration to our article. See you in our subsequent article!