Charting The Course: A Deep Dive Into The USD/JPY Change Charge Historical past

Charting the Course: A Deep Dive into the USD/JPY Change Charge Historical past

Associated Articles: Charting the Course: A Deep Dive into the USD/JPY Change Charge Historical past

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Charting the Course: A Deep Dive into the USD/JPY Change Charge Historical past. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Charting the Course: A Deep Dive into the USD/JPY Change Charge Historical past

The USD/JPY alternate price, representing the worth of the US greenback towards the Japanese yen, is an important indicator of world financial well being and a big driver for worldwide commerce and funding. Its historical past is a fancy tapestry woven from international occasions, financial insurance policies, and shifting market sentiment. Understanding this historical past, visualized by means of charts and analyzed by means of financial lenses, is important for anybody concerned in worldwide finance or fascinated about macroeconomic traits.

This text will discover the historic trajectory of the USD/JPY alternate price, specializing in key durations of volatility and stability, and analyzing the underlying financial components that formed its actions. We’ll make the most of numerous charts for instance these traits and supply context for future predictions. Whereas exact forecasting is unattainable, understanding previous patterns can present priceless insights into potential future eventualities.

Early 2000s: A Comparatively Steady Interval (2000-2007)

The early 2000s noticed a comparatively steady USD/JPY alternate price, fluctuating inside a broad vary. A chart illustrating this era would present a typically sideways pattern, with occasional spikes pushed by short-term information occasions. The interval was characterised by:

- Low Curiosity Charges in Japan: Japan maintained extraordinarily low rates of interest all through a lot of this era, a coverage aimed toward stimulating financial development after the "misplaced decade" of the Nineteen Nineties. These low charges typically put downward strain on the yen, making the greenback comparatively stronger.

- US Financial Progress: The US economic system skilled durations of average development throughout this time, attracting overseas funding and supporting the worth of the greenback.

- World Financial Stability: The worldwide economic system was comparatively steady, with few main crises considerably impacting the USD/JPY alternate price. Nevertheless, occasions just like the dot-com bubble burst in 2000 and the 9/11 assaults prompted momentary fluctuations.

A chart would reveal a comparatively flat trendline, with minor oscillations round a central level. The vary of fluctuation could be considerably smaller in comparison with the durations of excessive volatility that adopted.

The World Monetary Disaster and its Aftermath (2007-2012)

The worldwide monetary disaster of 2008 dramatically impacted the USD/JPY alternate price. A chart depicting this era would present a pointy and dramatic shift. Key components embrace:

- Flight to Security: Because the disaster unfolded, buyers sought safe-haven belongings, driving important demand for the yen. This led to a dramatic appreciation of the yen towards the greenback, pushing the USD/JPY alternate price to report lows. The chart would present a steep downward pattern.

- Quantitative Easing within the US: The US Federal Reserve carried out quantitative easing (QE) applications to inject liquidity into the monetary system. Whereas supposed to stimulate the economic system, this coverage additionally weakened the greenback, additional contributing to the yen’s appreciation.

- Japanese Intervention: The Japanese authorities intervened within the overseas alternate market on a number of events to curb the yen’s rise, trying to guard its export-oriented industries. These interventions could be seen on the chart as sudden, albeit momentary, reversals within the downward pattern.

The post-crisis interval noticed a gradual restoration of the greenback, however the USD/JPY alternate price remained considerably decrease than its pre-crisis ranges for a number of years.

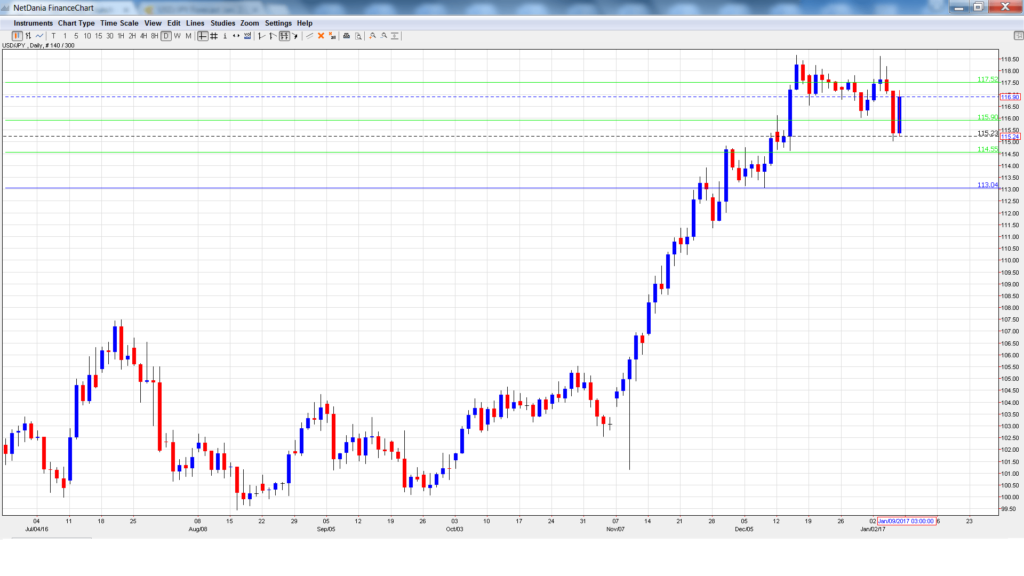

Abenomics and Yen Weak point (2013-2016)

The interval following the disaster noticed the implementation of "Abenomics," a set of financial insurance policies launched by Prime Minister Shinzo Abe. This era could be characterised by a big weakening of the yen on a chart. Key components embrace:

- Aggressive Financial Easing: The Financial institution of Japan (BOJ) carried out aggressive financial easing insurance policies, together with quantitative and qualitative easing (QQE), aiming to stimulate inflation and financial development. These insurance policies considerably weakened the yen.

- Elevated Authorities Spending: Abenomics additionally concerned elevated authorities spending and structural reforms. These measures, whereas aiming to spice up the economic system, not directly contributed to the yen’s depreciation.

- World Financial Restoration: The worldwide economic system was slowly recovering from the monetary disaster, which additionally contributed to a relative strengthening of the greenback.

A chart would present a transparent upward pattern within the USD/JPY alternate price, reflecting the numerous weakening of the yen.

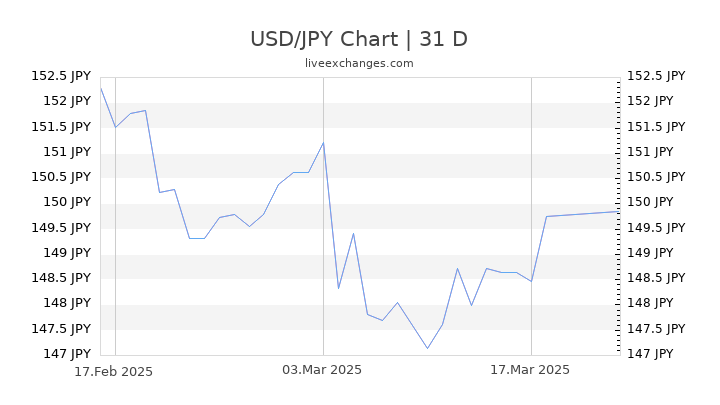

Current Developments and Volatility (2017-Current)

The newest interval has been marked by elevated volatility and uncertainty. A chart would present a extra erratic sample, influenced by a mess of things:

- US-China Commerce Warfare: The commerce battle between the US and China created important uncertainty in international markets, impacting each the greenback and the yen.

- COVID-19 Pandemic: The pandemic prompted unprecedented financial disruption, resulting in important fluctuations within the USD/JPY alternate price. The chart would present dramatic swings reflecting the preliminary market panic and subsequent restoration makes an attempt.

- Curiosity Charge Differentials: Variations in rate of interest insurance policies between the US and Japan proceed to play a big position in influencing the alternate price. Durations of upper US rates of interest typically strengthen the greenback.

- Geopolitical Occasions: Geopolitical occasions, resembling tensions in Jap Europe and elsewhere, contribute to uncertainty and volatility within the alternate price.

This era highlights the interconnectedness of world occasions and their influence on foreign money markets. The chart would probably exhibit a scarcity of a transparent long-term pattern, with important short-term fluctuations.

Conclusion:

The USD/JPY alternate price historical past is a compelling narrative of world financial occasions, financial insurance policies, and market sentiment. Analyzing historic charts, mixed with an understanding of the underlying financial components, offers priceless insights into the dynamics of this significant foreign money pair. Whereas predicting future actions with certainty is unattainable, learning previous traits may also help buyers and analysts higher navigate the complexities of the worldwide foreign money markets. Additional analysis might contain analyzing particular occasions in larger element, incorporating technical evaluation alongside basic evaluation, and exploring the influence of various financial fashions on alternate price predictions. The USD/JPY alternate price stays a key barometer of world financial well being, and its continued monitoring is essential for understanding the ever-evolving panorama of worldwide finance. Future charts will undoubtedly proceed to inform a narrative of world financial shifts and their influence on this important foreign money pair.

Closure

Thus, we hope this text has offered priceless insights into Charting the Course: A Deep Dive into the USD/JPY Change Charge Historical past. We hope you discover this text informative and useful. See you in our subsequent article!