Deciphering HDFC On TradingView: A Complete Information For Chart Evaluation

Deciphering HDFC on TradingView: A Complete Information for Chart Evaluation

Associated Articles: Deciphering HDFC on TradingView: A Complete Information for Chart Evaluation

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Deciphering HDFC on TradingView: A Complete Information for Chart Evaluation. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Deciphering HDFC on TradingView: A Complete Information for Chart Evaluation

HDFC Financial institution, a behemoth within the Indian banking sector, is a ceaselessly traded inventory, attracting each seasoned buyers and novice merchants. Understanding its worth motion and predicting future actions requires a strong analytical strategy. TradingView, a preferred charting platform, supplies a strong toolkit for this evaluation. This text delves deep into using TradingView’s options to successfully analyze HDFC’s chart, protecting numerous technical indicators, chart patterns, and threat administration methods.

I. Setting the Stage: Navigating the HDFC Chart on TradingView

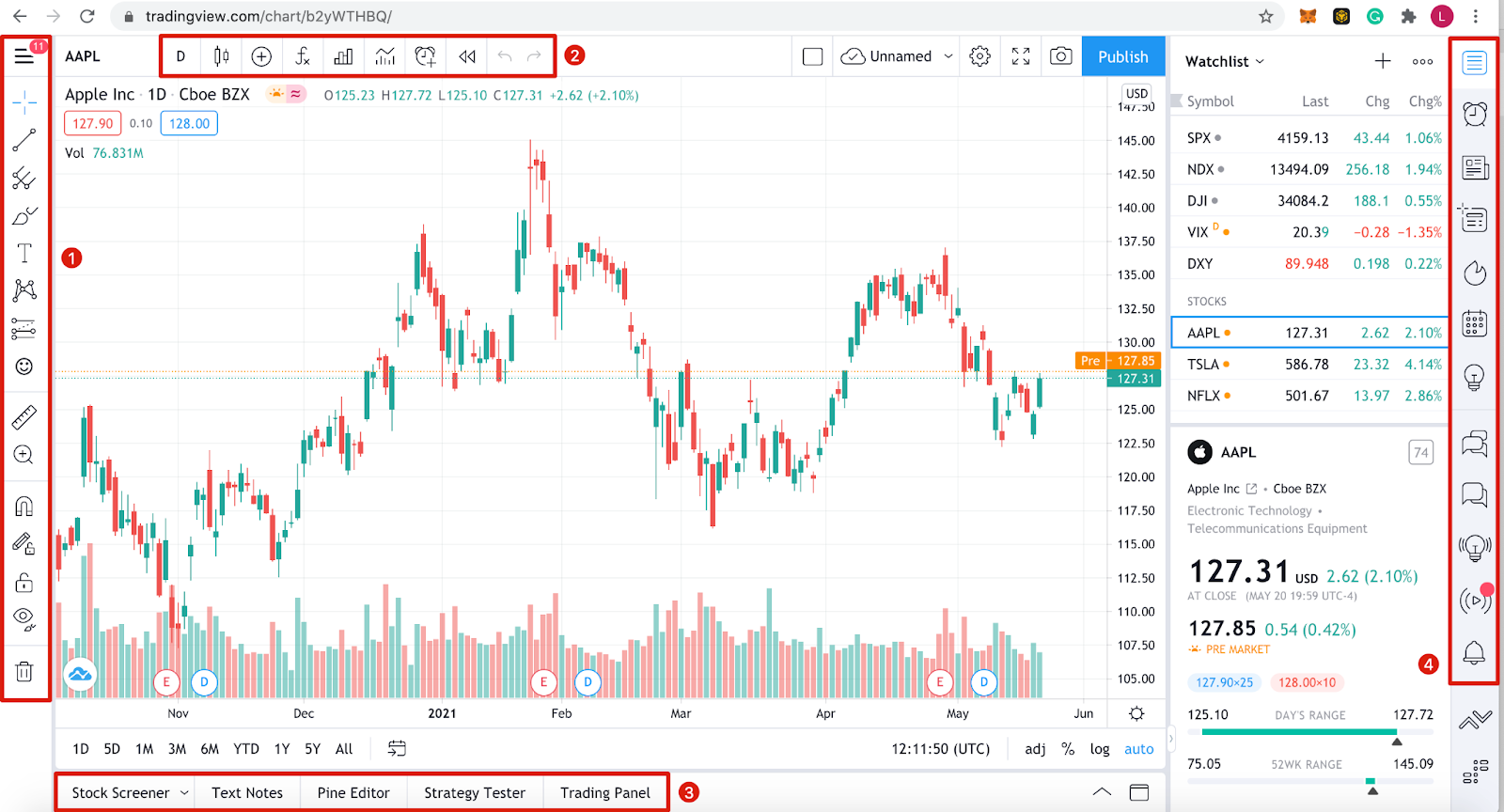

Earlier than diving into intricate analyses, it is essential to grasp the fundamentals of navigating the HDFC chart on TradingView. After trying to find "HDFC" (or its particular ticker image on the NSE or BSE), you will be offered with a default candlestick chart. This shows the opening, excessive, low, and shutting costs for a selected timeframe (e.g., every day, hourly, 5-minute).

TradingView gives customization choices to tailor the chart to your analytical preferences. You possibly can:

-

Change the timeframe: Analyze HDFC’s worth motion throughout numerous timeframes – from intraday (1-minute, 5-minute) to long-term (weekly, month-to-month) – to determine developments and patterns throughout completely different scales. Understanding the interaction between these timeframes is essential. A bullish development on the month-to-month chart may nonetheless expertise short-term corrections on the every day chart.

-

Choose chart varieties: Experiment with completely different chart varieties like candlestick, bar, line, Heikin Ashi, and Renko to visualise worth knowledge in numerous methods. Every sort has its strengths and weaknesses; Heikin Ashi, for instance, smooths out worth fluctuations, making developments simpler to determine, whereas Renko charts give attention to worth motion relatively than time.

-

Add indicators: TradingView boasts an enormous library of technical indicators. We’ll discover a number of key indicators beneath, however the platform lets you experiment with numerous mixtures to search out what works finest on your buying and selling type.

-

Draw instruments: Make the most of drawing instruments like Fibonacci retracements, development strains, help/resistance ranges, and channels to visually determine potential worth targets, reversal factors, and development continuation areas. These instruments are subjective, however when used along side different indicators, they will present precious insights.

II. Key Technical Indicators for Analyzing HDFC on TradingView

No single indicator supplies a foolproof prediction. A complete evaluation requires combining a number of indicators and contemplating broader market context. Listed here are some important indicators for HDFC evaluation on TradingView:

-

Shifting Averages (MA): Shifting averages clean out worth fluctuations and determine developments. Fashionable selections embody the straightforward transferring common (SMA) and the exponential transferring common (EMA). A crossover of a short-term MA (e.g., 20-day EMA) above a long-term MA (e.g., 50-day EMA) is usually thought of a bullish sign, whereas the other suggests bearishness. Nevertheless, relying solely on MA crossovers can result in whipsaws.

-

Relative Energy Index (RSI): RSI measures the magnitude of latest worth adjustments to guage overbought and oversold circumstances. Readings above 70 usually point out an overbought market (potential for a worth correction), whereas readings beneath 30 counsel an oversold market (potential for a worth rebound). RSI divergences (worth making new highs/lows whereas RSI fails to take action) may be highly effective alerts of development reversals.

-

MACD (Shifting Common Convergence Divergence): MACD is a trend-following momentum indicator that identifies adjustments within the power, course, momentum, and length of a development. It includes three strains: the MACD line, the sign line, and the histogram. Crossovers between the MACD and sign strains, together with histogram divergence, can sign potential development adjustments.

-

Bollinger Bands: Bollinger Bands plot normal deviations round a transferring common. They may also help determine potential worth reversals when the value touches the higher or decrease bands. Breakouts past the bands can sign robust momentum in both course.

-

Quantity: Analyzing quantity alongside worth motion is essential. Excessive quantity confirms worth actions, whereas low quantity suggests weak developments and potential reversals. Quantity spikes throughout important worth adjustments present precious affirmation alerts.

III. Chart Patterns and Their Significance in HDFC Evaluation

Figuring out chart patterns may also help predict future worth actions. TradingView lets you simply draw and determine numerous patterns:

-

Head and Shoulders: A bearish reversal sample characterised by three peaks, with the center peak (the pinnacle) being the best. A breakout beneath the neckline confirms the sample and alerts a possible downward development.

-

Inverse Head and Shoulders: A bullish reversal sample, the mirror picture of the pinnacle and shoulders sample. A breakout above the neckline suggests a possible upward development.

-

Triangles: Triangles are continuation patterns that point out a interval of consolidation earlier than a possible breakout within the course of the prevailing development. Symmetrical, ascending, and descending triangles are widespread variations.

-

Flags and Pennants: These are continuation patterns characterised by a short interval of consolidation inside a bigger development. Breakouts from these patterns usually proceed the prevailing development.

-

Double Tops and Double Bottoms: These are reversal patterns indicating a possible change in development course. A breakout above a double backside or beneath a double high confirms the sample and suggests a development reversal.

IV. Danger Administration and Buying and selling Methods

Profitable buying and selling on HDFC, or any asset, requires a strong threat administration technique. TradingView facilitates this by:

-

Cease-loss orders: Setting stop-loss orders helps restrict potential losses if the commerce goes towards your prediction. Place stop-loss orders at a degree that minimizes your threat whereas permitting for some worth fluctuation.

-

Take-profit orders: Take-profit orders lock in income when the value reaches a predetermined goal. These orders allow you to capitalize on profitable trades and keep away from giving again income resulting from market volatility.

-

Place sizing: Decide the suitable place measurement based mostly in your threat tolerance and account steadiness. By no means threat greater than a small proportion of your capital on a single commerce.

-

Backtesting: TradingView lets you backtest your methods utilizing historic knowledge. This helps you consider the effectiveness of your strategy and refine your buying and selling plan.

V. Combining Technical Evaluation with Elementary Evaluation

Whereas technical evaluation utilizing TradingView supplies insights into worth motion, a holistic strategy requires integrating basic evaluation. Think about components like:

-

HDFC’s monetary efficiency: Analyze HDFC’s monetary statements (revenue assertion, steadiness sheet, money move assertion) to evaluate its monetary well being and development prospects.

-

Business developments: Perceive the general developments within the Indian banking sector and the way HDFC is positioned inside the trade.

-

Financial components: Think about the impression of macroeconomic components like rates of interest, inflation, and financial development on HDFC’s efficiency.

-

Regulatory adjustments: Keep knowledgeable about any regulatory adjustments that would have an effect on HDFC’s operations.

VI. Conclusion:

TradingView gives a strong platform for analyzing HDFC’s worth motion. By mastering the platform’s options, combining numerous technical indicators, figuring out chart patterns, and integrating basic evaluation, merchants can develop a strong strategy to buying and selling HDFC. Do not forget that buying and selling includes threat, and no analytical method ensures revenue. Constant studying, disciplined threat administration, and an intensive understanding of the market are essential for fulfillment. All the time apply accountable buying and selling and take into account looking for recommendation from a certified monetary advisor earlier than making any funding selections.

Closure

Thus, we hope this text has supplied precious insights into Deciphering HDFC on TradingView: A Complete Information for Chart Evaluation. We hope you discover this text informative and useful. See you in our subsequent article!