Deciphering The Financial institution Nifty Weekly Chart: A Dealer’s Information (PDF Downloadable Insights)

Deciphering the Financial institution Nifty Weekly Chart: A Dealer’s Information (PDF Downloadable Insights)

Associated Articles: Deciphering the Financial institution Nifty Weekly Chart: A Dealer’s Information (PDF Downloadable Insights)

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to Deciphering the Financial institution Nifty Weekly Chart: A Dealer’s Information (PDF Downloadable Insights). Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Deciphering the Financial institution Nifty Weekly Chart: A Dealer’s Information (PDF Downloadable Insights)

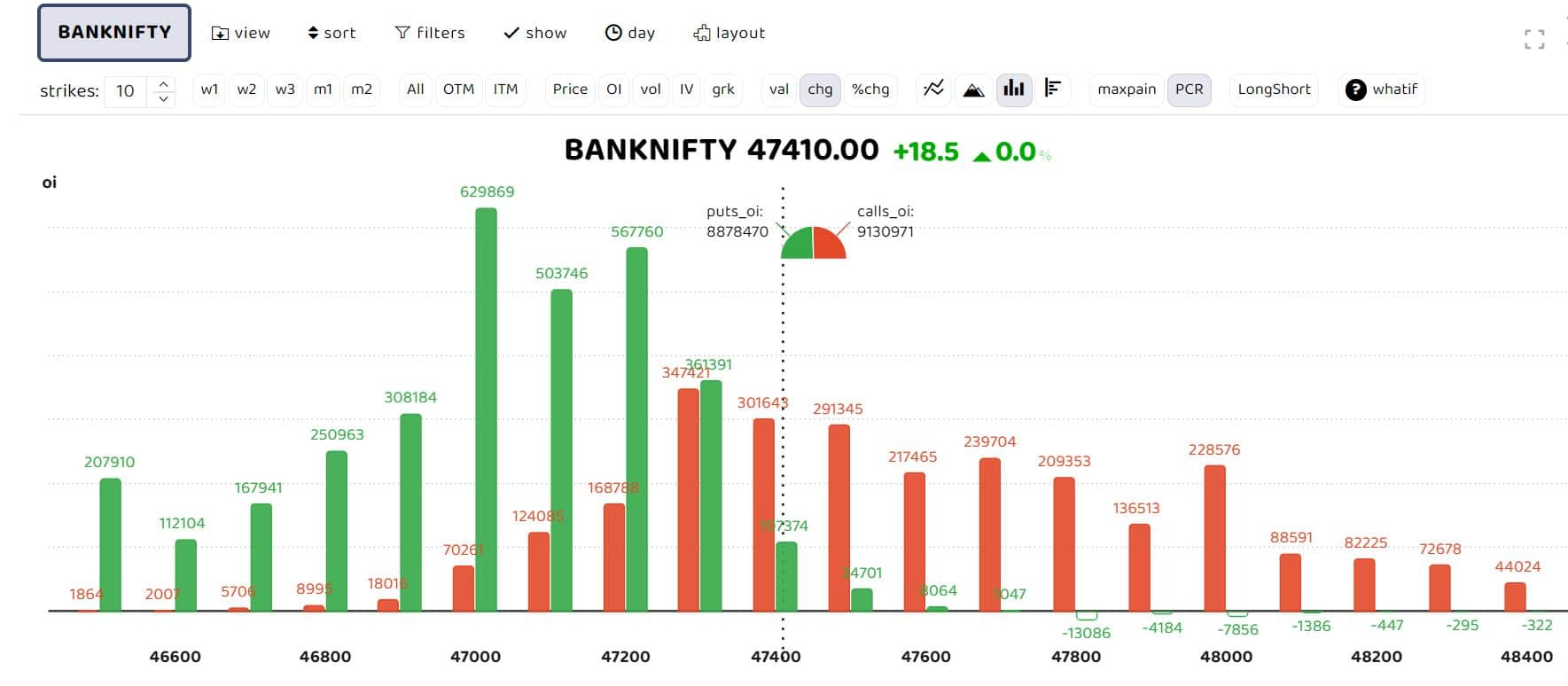

The Financial institution Nifty index, a benchmark for India’s banking sector, presents profitable buying and selling alternatives however calls for a eager understanding of its value motion. Analyzing the weekly chart supplies a broader perspective, revealing long-term tendencies and vital help and resistance ranges typically missed in shorter-timeframe evaluation. This text delves into decoding the Financial institution Nifty weekly chart, specializing in key indicators, patterns, and techniques, with downloadable PDF assets to assist your evaluation. (Word: A downloadable PDF containing instance charts and additional evaluation is offered at [link to PDF – replace this with actual link if creating a real article]).

Understanding the Weekly Timeframe:

In contrast to each day or intraday charts, the Financial institution Nifty weekly chart condenses value actions over every week right into a single candlestick. This smoothing impact minimizes the noise of each day fluctuations, permitting merchants to deal with the underlying pattern and vital reversals. Weekly charts are perfect for figuring out:

- Main Traits: Lengthy-term uptrends and downtrends turn into extra evident, enabling identification of potential entry and exit factors aligned with the dominant market sentiment.

- Help and Resistance Ranges: Weekly highs and lows typically characterize sturdy help and resistance areas, offering essential ranges for setting stop-losses and taking income.

- Chart Patterns: Bigger, extra vital chart patterns, similar to head and shoulders, double tops/bottoms, and flags, are simpler to identify and ensure on weekly charts.

- Momentum Shifts: Modifications in weekly momentum can signify the start or finish of a major pattern, offering early warning indicators of potential reversals.

Key Indicators for Financial institution Nifty Weekly Chart Evaluation:

Whereas uncooked value motion is essential, integrating technical indicators enhances the evaluation. Some important indicators for the Financial institution Nifty weekly chart embody:

-

Shifting Averages (MA): 20-week and 50-week MAs are generally used to establish the general pattern. A bullish pattern is indicated when the shorter MA (20-week) is above the longer MA (50-week), and vice-versa for a bearish pattern. Crossovers between these MAs can sign vital pattern adjustments. The PDF contains examples of MA crossover indicators.

-

Relative Power Index (RSI): The 14-week RSI helps establish overbought (above 70) and oversold (beneath 30) situations. Whereas not an ideal predictor, RSI divergences (value making new highs/lows whereas RSI fails to verify) can sign potential pattern reversals. The PDF illustrates RSI divergence examples within the Financial institution Nifty context.

-

MACD (Shifting Common Convergence Divergence): The 12-26-9 MACD, utilized to the weekly chart, can spotlight momentum shifts and potential pattern adjustments. Bullish crossovers (MACD line crossing above the sign line) recommend growing bullish momentum, whereas bearish crossovers sign weakening momentum. The PDF supplies examples of MACD indicators on the Financial institution Nifty weekly chart.

-

Bollinger Bands: Weekly Bollinger Bands can present volatility ranges and potential value reversals. Costs touching the higher band may recommend an overbought situation, whereas touching the decrease band might point out an oversold situation. Breakouts from the bands can sign sturdy pattern continuation. The PDF demonstrates Bollinger Band interpretations on the Financial institution Nifty.

Figuring out Chart Patterns:

Recognizing chart patterns on the Financial institution Nifty weekly chart is essential for anticipating future value actions. Some widespread patterns embody:

- Head and Shoulders: This reversal sample suggests a pattern change. A profitable head and shoulders sample requires affirmation with a breakout beneath the neckline.

- Double Tops/Bottoms: These patterns point out potential pattern reversals. A break beneath the neckline of a double prime or above the neckline of a double backside confirms the sample.

- Flags and Pennants: These continuation patterns recommend a brief pause in a pattern earlier than its resumption. Breakouts from these patterns typically affirm the continuation of the prevailing pattern.

- Triangles: Triangles may be symmetrical, ascending, or descending, every providing completely different implications for future value motion. Breakouts from triangles typically sign a continuation or reversal of the pattern.

The PDF supplies visible examples of those patterns, illustrating their utility to the Financial institution Nifty weekly chart.

Threat Administration and Buying and selling Methods:

Buying and selling the Financial institution Nifty, particularly utilizing weekly charts, requires a sturdy threat administration plan.

- Cease-Loss Orders: All the time use stop-loss orders to restrict potential losses. Help ranges recognized on the weekly chart are best locations to set stop-losses.

- Place Sizing: By no means threat greater than a small share of your buying and selling capital on any single commerce.

- Diversification: Diversifying your portfolio throughout completely different belongings can cut back total threat.

- Endurance: Weekly chart buying and selling requires persistence. Trades could take a number of weeks and even months to play out.

A number of buying and selling methods may be employed utilizing the Financial institution Nifty weekly chart:

- Development Following: Establish the dominant pattern (bullish or bearish) utilizing transferring averages and different indicators, and enter trades within the path of the pattern.

- Imply Reversion: Establish overbought or oversold situations utilizing RSI or Bollinger Bands and enter trades anticipating a value reversal in direction of the imply.

- Breakout Buying and selling: Establish potential breakouts from chart patterns or help/resistance ranges and enter trades within the path of the breakout.

The PDF contains examples of those methods and their utility to the Financial institution Nifty weekly chart.

Conclusion:

Analyzing the Financial institution Nifty weekly chart supplies invaluable insights for long-term merchants. By combining value motion evaluation with technical indicators and chart patterns, merchants can establish potential buying and selling alternatives and handle threat successfully. Keep in mind that no buying and selling technique ensures success, and thorough analysis and threat administration are essential. The accompanying PDF supplies additional detailed examples and analyses to help you in your Financial institution Nifty buying and selling journey. Keep in mind to all the time follow accountable buying and selling and seek the advice of with a monetary advisor earlier than making any funding choices. (Keep in mind to interchange the bracketed info with the precise hyperlink to your PDF.)

Closure

Thus, we hope this text has offered invaluable insights into Deciphering the Financial institution Nifty Weekly Chart: A Dealer’s Information (PDF Downloadable Insights). We admire your consideration to our article. See you in our subsequent article!