Deciphering The Inverse Head And Shoulders: A Complete Information For Merchants

Deciphering the Inverse Head and Shoulders: A Complete Information for Merchants

Associated Articles: Deciphering the Inverse Head and Shoulders: A Complete Information for Merchants

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Deciphering the Inverse Head and Shoulders: A Complete Information for Merchants. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Deciphering the Inverse Head and Shoulders: A Complete Information for Merchants

The inverse head and shoulders (IHS) sample is a strong bullish reversal chart sample acknowledged by technical analysts worldwide. Its look typically alerts a possible shift from a downtrend to an uptrend, providing merchants a high-probability setup for lengthy positions. Understanding its formation, affirmation, and potential pitfalls is essential for profitable buying and selling. This text gives a complete information to the IHS sample, protecting its identification, interpretation, and sensible utility.

Understanding the Formation of the Inverse Head and Shoulders Sample

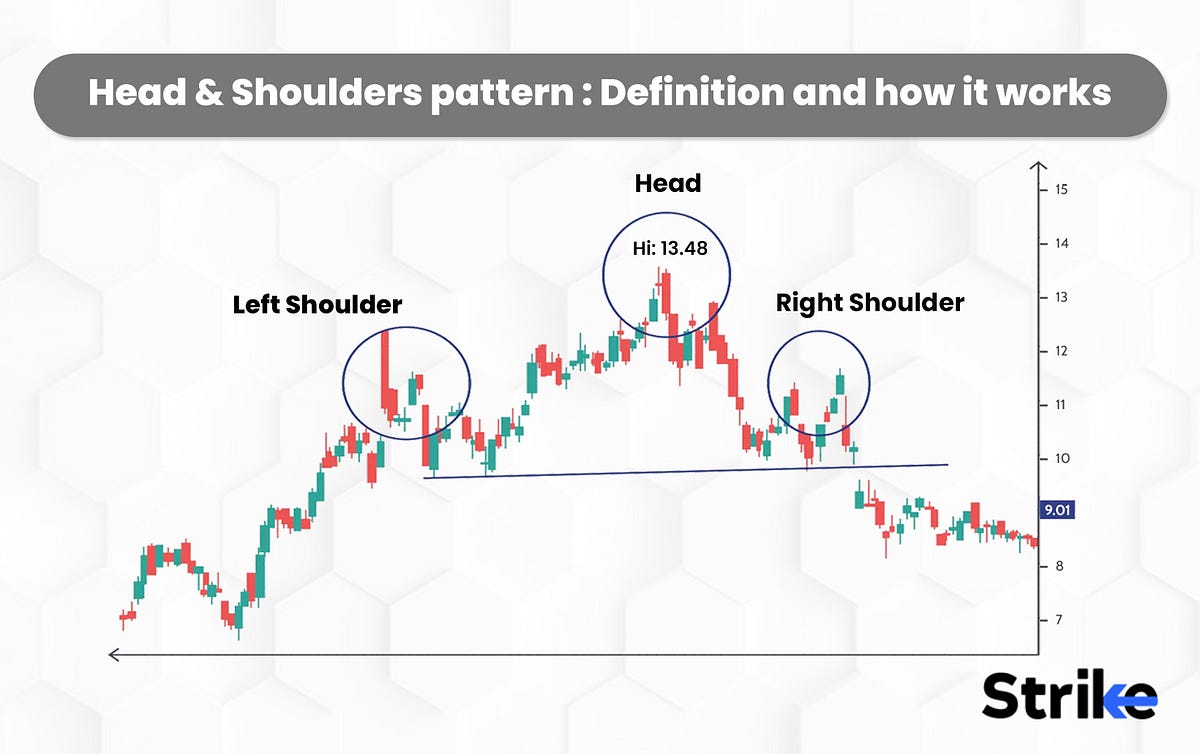

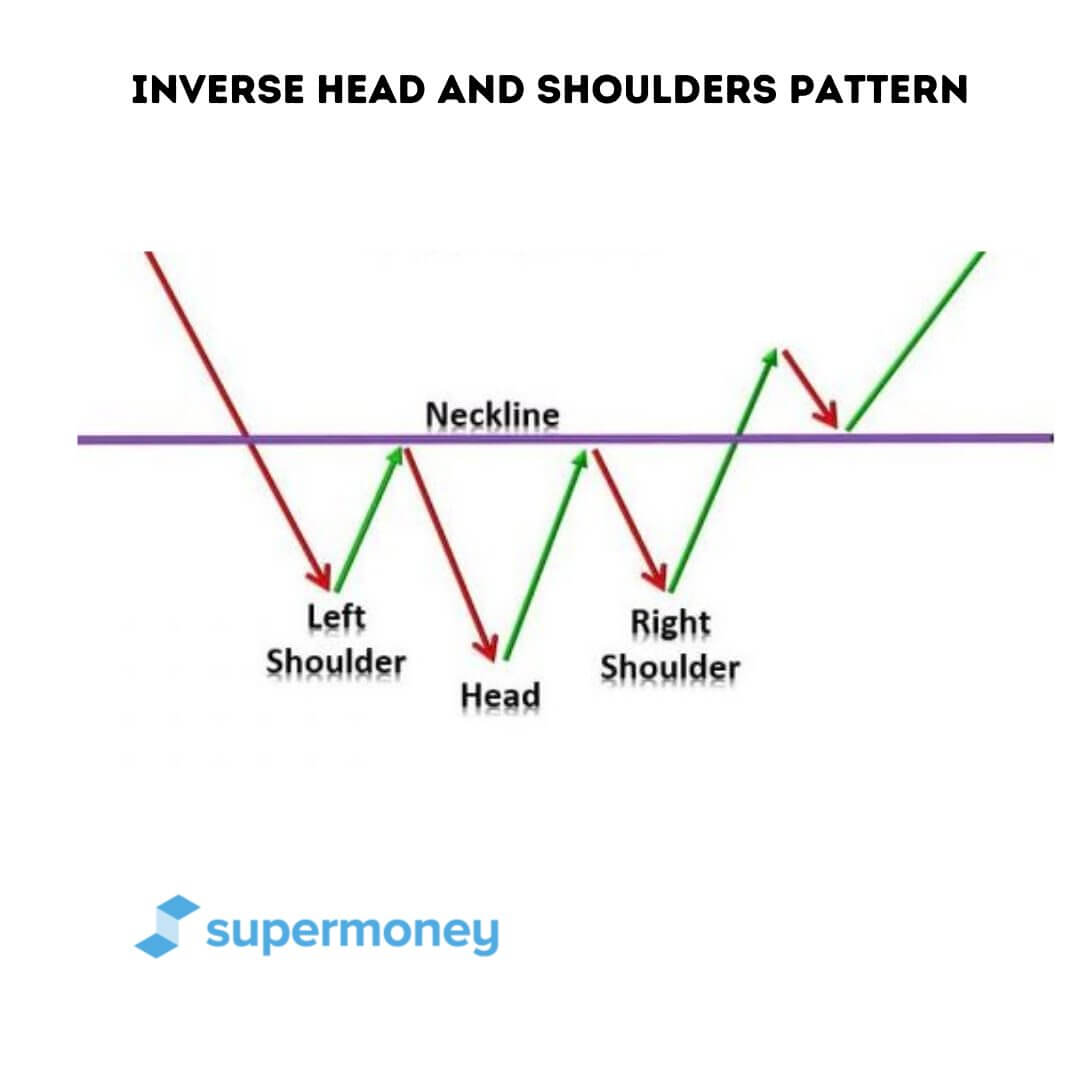

The IHS sample, mirroring its bearish counterpart (the pinnacle and shoulders sample), is characterised by a three-trough formation resembling an inverted "head and shoulders." Let’s break down its key parts:

-

Left Shoulder: The sample begins with a downward pattern culminating in a trough (a low level). This trough represents the left shoulder. The left shoulder is shaped by a value decline adopted by a rally that fails to surpass earlier highs.

-

Head: Following the left shoulder, the value continues its decline, making a decrease trough than the left shoulder. This decrease trough types the "head" of the sample, representing a major low level within the downtrend. That is sometimes the bottom level of all the sample.

-

Proper Shoulder: After the pinnacle, the value rallies once more, creating the next trough than the pinnacle however decrease than the left shoulder. This trough types the suitable shoulder. The precise shoulder ideally ought to be roughly the identical top because the left shoulder.

-

Neckline: Connecting the troughs of the left and proper shoulders types a assist line often called the "neckline." This neckline acts as an important resistance degree through the sample’s formation and a key assist degree as soon as the sample breaks out.

-

Breakout: The bullish sign is generated when the value decisively breaks above the neckline. This breakout confirms the potential reversal of the downtrend and alerts a potential uptrend.

Figuring out a Legitimate Inverse Head and Shoulders Sample

Whereas the visible illustration is essential, a number of elements contribute to validating an IHS sample:

-

Quantity Affirmation: Ideally, the pinnacle ought to have larger quantity than the left and proper shoulders. This means stronger promoting strain through the formation of the pinnacle, adopted by reducing quantity through the formation of the suitable shoulder, suggesting weakening promoting strain. Elevated quantity through the breakout above the neckline additional confirms the bullish sign.

-

Neckline Readability: A well-defined and clearly identifiable neckline is important. A sloping neckline can alter the sample’s interpretation and potential goal value.

-

Shoulder Symmetry: Whereas good symmetry is not necessary, the left and proper shoulders ought to have comparatively comparable depth. Important discrepancies can weaken the sample’s reliability.

-

Timeframe Issues: The IHS sample can seem on varied timeframes, from short-term intraday charts to long-term weekly or month-to-month charts. The timeframe influences the sample’s significance and potential revenue targets. An extended timeframe sample usually suggests a extra vital value motion.

-

Market Context: Contemplate the broader market context. Is the general market bullish or bearish? A robust bullish market setting would improve the sample’s reliability, whereas a bearish setting may negate its bullish implications.

Measuring Potential Worth Targets

As soon as the IHS sample breaks out above the neckline, merchants typically use the next strategies to challenge potential value targets:

-

Peak Measurement: The most typical technique entails measuring the space between the pinnacle’s low and the neckline. This distance is then projected upwards from the breakout level. This projection represents the potential value goal.

-

Fibonacci Retracement: Fibonacci retracement ranges may be utilized to all the sample, figuring out potential assist and resistance ranges. These ranges might help refine the value goal or determine potential areas of profit-taking.

Affirmation and Threat Administration

Whereas the breakout above the neckline is a bullish sign, it is essential to attend for affirmation earlier than coming into a protracted place:

-

Shut Above the Neckline: A closing value above the neckline confirms the breakout and reduces the chance of a false sign.

-

Elevated Buying and selling Quantity: Elevated quantity throughout and after the breakout reinforces the bullish sign and signifies robust shopping for strain.

-

Technical Indicators: Combining the IHS sample with different technical indicators, corresponding to shifting averages or RSI, can improve affirmation and danger administration.

Potential Pitfalls and False Alerts

It is vital to acknowledge that not all IHS patterns result in profitable trades. False alerts can happen, and merchants ought to concentrate on the next:

-

Head and Shoulders Lure: A misleading sample the place the value breaks above the neckline however fails to maintain the upward momentum, leading to a reversal again beneath the neckline.

-

Lack of Quantity Affirmation: A breakout with out ample quantity affirmation weakens the bullish sign and will increase the chance of a false breakout.

-

Ambiguous Neckline: A poorly outlined or ambiguous neckline could make the sample’s interpretation troublesome and unreliable.

-

Market Sentiment: Hostile market situations can override the bullish sign of the IHS sample.

Sensible Utility and Buying and selling Methods

The IHS sample provides varied buying and selling methods:

-

Lengthy Entry: Enter a protracted place after a confirmed breakout above the neckline. Place a stop-loss order beneath the neckline to restrict potential losses.

-

Trailing Cease-Loss: As the value strikes upward, modify the stop-loss order to guard earnings.

-

Revenue Goal: Use the peak measurement or Fibonacci retracement to find out a revenue goal.

-

Threat-Reward Ratio: All the time think about the risk-reward ratio earlier than coming into a commerce. A good risk-reward ratio is important for profitable buying and selling.

Conclusion:

The inverse head and shoulders sample is a useful software for technical analysts, offering a high-probability setup for lengthy positions. Nevertheless, its profitable utility requires a radical understanding of its formation, affirmation, and potential pitfalls. Combining the IHS sample with different technical indicators and sound danger administration methods considerably will increase the probabilities of worthwhile trades. Bear in mind, diligent analysis, endurance, and disciplined buying and selling are key to harnessing the ability of this highly effective chart sample. Whereas this sample provides robust potential, it is essential to keep in mind that no buying and selling technique ensures success, and cautious danger administration is paramount. All the time conduct thorough analysis and think about consulting with a monetary advisor earlier than making any funding selections.

![Inverse Head And Shoulders Pattern [2023 Update] - Daily Price Action](https://dailypriceaction.com/wp-content/uploads/2015/03/Inverse-head-and-shoulders-pattern.jpg)

![Regular way or Inverse Head & Shoulders [Which one Wins] - YouTube](https://i.ytimg.com/vi/Ts8XPfqd9UM/maxresdefault.jpg)

Closure

Thus, we hope this text has supplied useful insights into Deciphering the Inverse Head and Shoulders: A Complete Information for Merchants. We thanks for taking the time to learn this text. See you in our subsequent article!