Deciphering The Nifty 50: A Dealer’s Information To Charting On TradingView

Deciphering the Nifty 50: A Dealer’s Information to Charting on TradingView

Associated Articles: Deciphering the Nifty 50: A Dealer’s Information to Charting on TradingView

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Deciphering the Nifty 50: A Dealer’s Information to Charting on TradingView. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Deciphering the Nifty 50: A Dealer’s Information to Charting on TradingView

The Nifty 50 index, a benchmark for India’s high 50 corporations, is a dynamic and sometimes unstable market. For merchants, understanding its worth actions is essential for fulfillment. TradingView, a preferred charting platform, offers a complete suite of instruments to investigate the Nifty 50 and develop efficient buying and selling methods. This text explores the best way to successfully make the most of TradingView to chart and analyze the Nifty 50, overlaying numerous technical indicators, chart patterns, and threat administration methods.

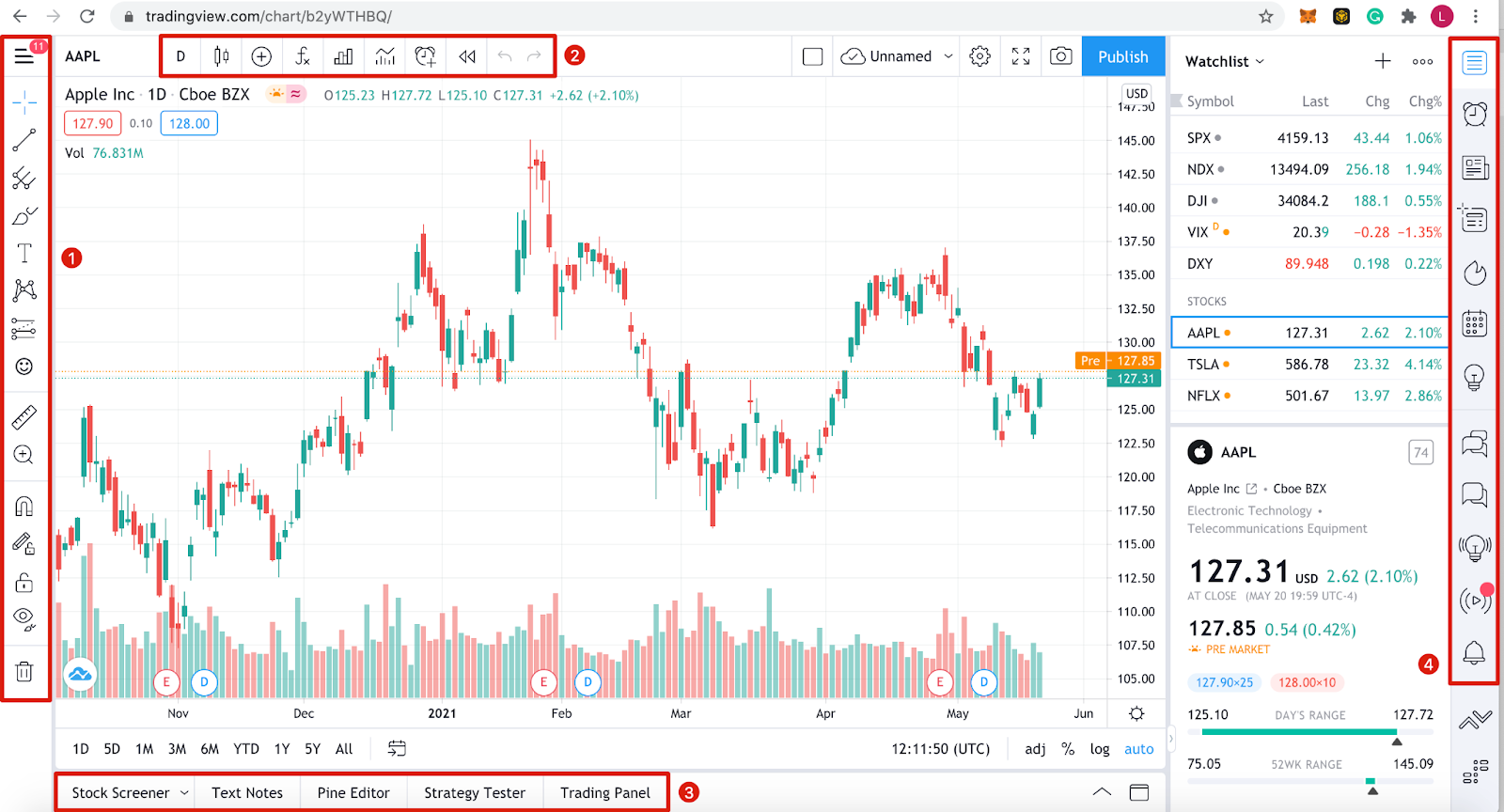

I. Accessing and Establishing the Nifty 50 Chart on TradingView:

Step one is accessing the Nifty 50 chart on TradingView. Merely seek for "NIFTY 50" or its ticker image (normally ^NSEI) within the search bar. TradingView provides numerous knowledge suppliers, so make sure you’re utilizing a dependable supply with real-time or delayed knowledge, relying in your subscription.

As soon as the chart masses, customise it to your preferences. This contains:

- Chart Sort: Select between candlestick, bar, line, Heikin Ashi, and Renko charts. Candlestick charts are extensively most popular for his or her visible illustration of worth motion.

- Timeframe: Choose the suitable timeframe, starting from intraday (1-minute, 5-minute, 15-minute, and many others.) to each day, weekly, and month-to-month charts. The selection is dependent upon your buying and selling fashion; scalpers use shorter timeframes, whereas swing merchants favor longer ones.

- Indicators: Add technical indicators to realize insights into worth tendencies, momentum, and volatility. TradingView provides an unlimited library of indicators, permitting for personalized evaluation.

II. Important Technical Indicators for Nifty 50 Evaluation:

A number of technical indicators are significantly helpful when analyzing the Nifty 50 on TradingView:

- Shifting Averages (MA): Shifting averages clean out worth fluctuations, revealing underlying tendencies. Standard decisions embody the 20-day, 50-day, and 200-day MAs. Crossovers between totally different MAs can sign potential purchase or promote alerts. As an example, a bullish crossover happens when a shorter-term MA crosses above a longer-term MA.

- Relative Energy Index (RSI): The RSI measures the magnitude of current worth modifications to judge overbought and oversold circumstances. Readings above 70 usually point out overbought circumstances (potential promote sign), whereas readings under 30 counsel oversold circumstances (potential purchase sign). Nevertheless, RSI divergences (worth transferring in a single path whereas RSI strikes within the reverse) may also be vital alerts.

- MACD (Shifting Common Convergence Divergence): MACD is a trend-following momentum indicator that identifies modifications within the power, path, momentum, and period of a development. Crossovers of the MACD line and sign line, together with histogram evaluation, can present purchase/promote alerts.

- Bollinger Bands: Bollinger Bands plot commonplace deviations round a transferring common, displaying worth volatility. Worth bounces off the higher and decrease bands can sign potential reversals. Band width growth signifies elevated volatility, whereas contraction suggests decreased volatility.

- Quantity: Analyzing quantity alongside worth motion is essential. Excessive quantity confirms worth actions, whereas low quantity suggests weak tendencies. Quantity spikes can point out vital shopping for or promoting stress.

III. Chart Patterns and Their Significance:

Recognizing chart patterns can considerably enhance buying and selling selections. TradingView permits for simple identification of varied patterns:

- Head and Shoulders: A bearish reversal sample indicating a possible worth decline.

- Inverse Head and Shoulders: A bullish reversal sample suggesting a possible worth improve.

- Triangles (Ascending, Descending, Symmetrical): Triangles point out intervals of consolidation earlier than a possible breakout.

- Flags and Pennants: These are continuation patterns suggesting the continuation of the present development.

- Double Tops and Double Bottoms: These patterns counsel potential reversals.

IV. Using TradingView’s Drawing Instruments for Enhanced Evaluation:

TradingView provides a wide selection of drawing instruments to boost chart evaluation:

- Pattern Traces: Drawing development strains helps determine the dominant development and potential help and resistance ranges.

- Fibonacci Retracements: These instruments determine potential help and resistance ranges based mostly on Fibonacci ratios.

- Help and Resistance Ranges: Figuring out key help and resistance ranges helps predict potential worth reversals.

- Channels: Drawing channels helps visualize worth actions inside an outlined vary.

V. Threat Administration Methods throughout the TradingView Context:

Efficient threat administration is paramount in buying and selling the Nifty 50. TradingView facilitates threat administration via:

- Cease-Loss Orders: Setting stop-loss orders limits potential losses by routinely exiting a place when the value reaches a predetermined stage.

- Take-Revenue Orders: Setting take-profit orders locks in earnings by routinely exiting a place when the value reaches a predetermined stage.

- Place Sizing: Figuring out the suitable place measurement based mostly in your threat tolerance and account steadiness is essential. TradingView does not instantly handle place sizing, however the charting instruments assist decide entry and exit factors which inform place sizing calculations.

VI. Elementary Evaluation Integration:

Whereas TradingView focuses on technical evaluation, integrating basic evaluation enhances your total buying and selling technique. Think about elements like:

- Financial indicators: GDP progress, inflation charges, rates of interest, and different financial knowledge can considerably influence the Nifty 50.

- Firm-specific information: Important information occasions associated to particular person corporations throughout the Nifty 50 can have an effect on the index’s worth.

- Authorities insurance policies: Authorities insurance policies and laws can even influence the market.

You’ll be able to combine basic evaluation by consulting exterior sources and incorporating this info into your TradingView evaluation.

VII. Backtesting and Technique Optimization:

TradingView permits for backtesting methods (although restricted in scope in comparison with devoted backtesting platforms). This entails testing your buying and selling technique on historic knowledge to judge its efficiency. Whereas not an ideal predictor of future efficiency, backtesting may help refine your technique and enhance its effectiveness.

VIII. Group and Schooling:

TradingView’s robust group facet provides a useful studying alternative. You’ll be able to discover different customers’ charts, methods, and concepts, increasing your information and gaining totally different views.

Conclusion:

TradingView offers a robust platform for analyzing the Nifty 50 index. By successfully using its charting instruments, technical indicators, and drawing instruments, mixed with sound threat administration practices and basic evaluation, merchants can develop strong methods for navigating this dynamic market. Do not forget that no single indicator or technique ensures success, and steady studying and adaptation are essential for long-term profitability. At all times follow accountable buying and selling and think about searching for skilled monetary recommendation earlier than making any funding selections.

Closure

Thus, we hope this text has supplied useful insights into Deciphering the Nifty 50: A Dealer’s Information to Charting on TradingView. We thanks for taking the time to learn this text. See you in our subsequent article!