Deciphering The Nifty Future Chart: A Complete Information For Merchants

Deciphering the Nifty Future Chart: A Complete Information for Merchants

Associated Articles: Deciphering the Nifty Future Chart: A Complete Information for Merchants

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Deciphering the Nifty Future Chart: A Complete Information for Merchants. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Deciphering the Nifty Future Chart: A Complete Information for Merchants

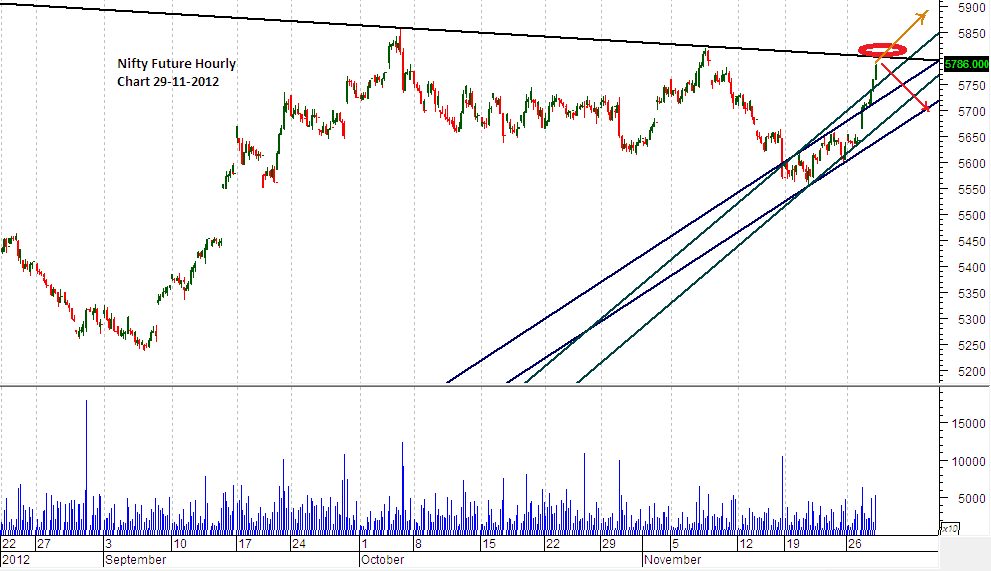

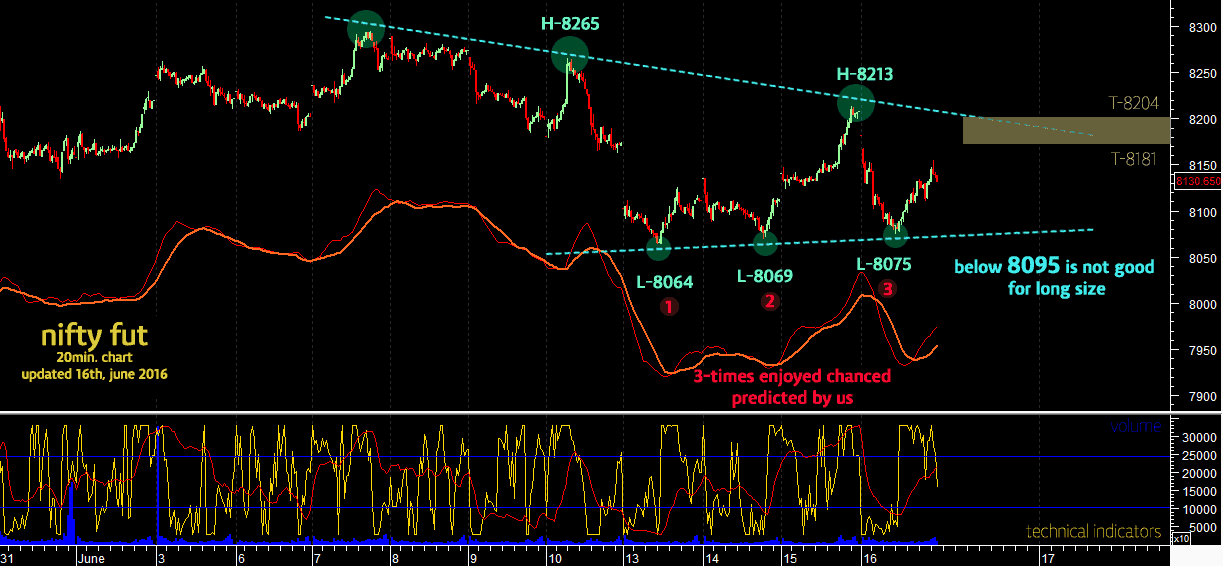

The Nifty 50 index futures contract, generally known as Nifty Futures, is a well-liked spinoff instrument traded on the Nationwide Inventory Alternate of India (NSE). It permits merchants to take a position on the long run value actions of the Nifty 50 index with out proudly owning the underlying belongings. Understanding the Nifty future chart is essential for profitable buying and selling, requiring a grasp of varied technical indicators, value motion, and market sentiment. This text delves deep into deciphering the Nifty future chart, exploring completely different analytical strategies and offering insights for each novice and skilled merchants.

Understanding the Fundamentals of the Nifty Future Chart:

A Nifty future chart shows the worth actions of the Nifty 50 index futures contract over a particular interval. The chart sometimes reveals the next info:

- Value: The present and historic costs of the Nifty future contract. That is often represented by candlestick charts, line charts, or bar charts.

- Time: The timeframe chosen by the dealer, starting from intraday (1-minute, 5-minute, 15-minute, and so on.) to day by day, weekly, or month-to-month charts.

- Quantity: The variety of contracts traded throughout every interval. Excessive quantity usually signifies sturdy conviction within the value motion.

- Open Curiosity (OI): The entire variety of excellent contracts that have not been settled. Modifications in OI can present insights into market sentiment and potential value reversals.

Technical Evaluation of the Nifty Future Chart:

Technical evaluation focuses on historic value and quantity information to foretell future value actions. A number of instruments and strategies are used to interpret the Nifty future chart:

-

Candlestick Patterns: These patterns, fashioned by the opening, closing, excessive, and low costs of a interval, reveal potential value reversals or continuations. Examples embrace bullish engulfing patterns, bearish engulfing patterns, hammer, hanging man, and capturing star. Recognizing these patterns can present invaluable buying and selling alerts.

-

Shifting Averages: These are calculated by averaging the worth over a particular interval (e.g., 20-day shifting common, 50-day shifting common, 200-day shifting common). Shifting averages assist clean out value fluctuations and determine tendencies. Crossovers between completely different shifting averages (e.g., a 50-day MA crossing above a 200-day MA) can sign potential purchase or promote alerts.

-

Relative Power Index (RSI): This momentum indicator measures the velocity and alter of value actions. RSI values above 70 are usually thought-about overbought, whereas values beneath 30 are thought-about oversold. These ranges can point out potential value reversals.

-

MACD (Shifting Common Convergence Divergence): This trend-following momentum indicator identifies adjustments within the energy, course, momentum, and length of a pattern. MACD crossovers (the MACD line crossing the sign line) can sign purchase or promote alternatives.

-

Bollinger Bands: These bands plot normal deviations above and beneath a shifting common. They assist determine volatility and potential value reversals when costs contact the higher or decrease bands.

-

Help and Resistance Ranges: These are value ranges the place the worth has traditionally struggled to interrupt by means of. Help ranges signify potential shopping for alternatives, whereas resistance ranges signify potential promoting alternatives. Breakouts above resistance or beneath help can sign sturdy directional strikes.

-

Fibonacci Retracements: Based mostly on the Fibonacci sequence, these retracements determine potential help and resistance ranges throughout value corrections.

Basic Evaluation and its Affect on the Nifty Future Chart:

Whereas technical evaluation focuses on chart patterns, basic evaluation considers macroeconomic elements and company-specific information that may impression the Nifty 50 index. Components like:

-

International Financial Circumstances: International financial progress, rate of interest adjustments, inflation, and geopolitical occasions can considerably affect the Nifty future chart.

-

Home Financial Knowledge: Indian GDP progress, inflation charges, financial coverage choices, and authorities insurance policies all play an important function.

-

Company Earnings: Sturdy company earnings studies usually enhance the Nifty 50 index, whereas weak earnings can result in value declines.

-

Sectoral Developments: Efficiency of particular sectors inside the Nifty 50 can affect the general index motion.

Understanding these basic elements supplies context for deciphering the technical evaluation of the Nifty future chart. A powerful upward pattern within the chart may be additional supported by constructive financial information or sturdy company earnings.

Threat Administration in Nifty Future Buying and selling:

Buying and selling Nifty futures entails vital threat. Efficient threat administration methods are essential for profitable buying and selling:

-

Place Sizing: By no means threat greater than a small proportion of your buying and selling capital on a single commerce.

-

Cease-Loss Orders: These orders routinely exit a commerce when the worth reaches a predetermined stage, limiting potential losses.

-

Take-Revenue Orders: These orders routinely exit a commerce when the worth reaches a predetermined revenue goal, locking in earnings.

-

Diversification: Do not put all of your eggs in a single basket. Diversify your portfolio throughout completely different belongings and buying and selling methods.

-

Backtesting: Earlier than implementing any buying and selling technique, backtest it on historic information to evaluate its efficiency and threat profile.

Deciphering Market Sentiment from the Nifty Future Chart:

The Nifty future chart can present insights into market sentiment. Excessive quantity coupled with sturdy value will increase suggests bullish sentiment, whereas excessive quantity coupled with sharp value declines signifies bearish sentiment. Open curiosity (OI) also can present clues. Rising OI throughout an uptrend suggests rising bullish confidence, whereas rising OI throughout a downtrend signifies rising bearish sentiment.

Conclusion:

The Nifty future chart is a wealthy supply of knowledge for merchants. By combining technical evaluation with an understanding of basic elements and using sound threat administration methods, merchants can enhance their probabilities of success. Nonetheless, it is essential to do not forget that no buying and selling technique ensures earnings. Steady studying, adapting to market situations, and disciplined buying and selling are important for long-term success within the dynamic world of Nifty future buying and selling. This text serves as a place to begin; additional analysis and sensible expertise are essential for mastering the complexities of Nifty future chart interpretation. Keep in mind to seek the advice of with a monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has offered invaluable insights into Deciphering the Nifty Future Chart: A Complete Information for Merchants. We thanks for taking the time to learn this text. See you in our subsequent article!