Deciphering The X Sample In Charts: A Complete Information

Deciphering the X Sample in Charts: A Complete Information

Associated Articles: Deciphering the X Sample in Charts: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Deciphering the X Sample in Charts: A Complete Information. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Deciphering the X Sample in Charts: A Complete Information

The X sample, a visually putting formation in technical evaluation, usually indicators a possible reversal in worth traits. Whereas not as broadly mentioned as head-and-shoulders or double tops/bottoms, understanding the X sample’s nuances can considerably improve a dealer’s capability to establish high-probability buying and selling alternatives. This text delves deep into the X sample, exploring its formation, identification, affirmation methods, and sensible purposes, offering a complete information for each novice and skilled merchants.

Understanding the X Sample’s Formation:

The X sample, often known as the double inside bar sample or generally a "double inside day" (if referring particularly to candlestick patterns), is not a rigidly outlined formation like another chart patterns. Its defining attribute is the presence of two distinct, converging worth actions that resemble the letter "X." This convergence usually happens after a big worth development, indicating a possible shift in momentum. The sample usually consists of the next parts:

-

Preliminary Development: A transparent uptrend or downtrend precedes the formation of the X sample. This development offers context and establishes the potential for a reversal. The stronger the previous development, the extra important the potential reversal implied by the X sample.

-

First Leg (Worth Consolidation): The preliminary development is adopted by a interval of consolidation or a slight retracement. That is usually characterised by a smaller worth vary in comparison with the previous development’s volatility. This leg varieties one facet of the "X."

-

Second Leg (Counter-Development Motion): A counter-trend motion then develops, pushing the worth in the other way of the preliminary development. This leg can also be characterised by a smaller worth vary than the preliminary development. This leg varieties the opposite facet of the "X."

-

Convergence Level: The 2 legs converge at some extent, creating the visible "X" form. This convergence level is essential, because it usually represents a big degree of help or resistance, relying on the path of the preliminary development.

-

Breakout: A decisive breakout from the convergence level usually confirms the sample and indicators the potential for a continuation of the counter-trend motion. The breakout will be both bullish (upward) or bearish (downward), relying on the path of the preliminary development.

Figuring out the X Sample:

Figuring out the X sample requires cautious remark and an understanding of context. Merely seeing two converging worth actions does not mechanically qualify as an X sample. A number of elements improve the reliability of identification:

-

Quantity Evaluation: Reducing quantity throughout the consolidation phases of the sample suggests weakening momentum within the preliminary development. Conversely, rising quantity throughout the breakout confirms the power of the reversal.

-

Time Body Issues: The time-frame used to research the chart considerably impacts the sample’s interpretation. A sample forming on a each day chart suggests a extra important potential reversal than one forming on a 5-minute chart.

-

Help and Resistance Ranges: The convergence level of the X sample usually coincides with pre-existing help or resistance ranges. This alignment strengthens the sample’s significance.

-

Different Technical Indicators: Combining the X sample with different technical indicators, comparable to transferring averages, RSI, MACD, or Bollinger Bands, can present further affirmation and enhance buying and selling accuracy. For example, a bearish divergence between worth and RSI throughout the formation of the X sample would strengthen a bearish interpretation.

Affirmation Methods:

Whereas the visible formation of the X sample is suggestive, affirmation is essential earlier than coming into a commerce. A number of methods can improve confidence within the sample’s reliability:

-

Breakout Affirmation: A decisive breakout past the convergence level, accompanied by elevated quantity, is essentially the most essential affirmation sign. The breakout ought to ideally clear the excessive or low of the converging legs.

-

Worth Motion Affirmation: Following the breakout, the worth ought to exhibit sustained motion within the path of the breakout. A failure to keep up momentum after the breakout suggests a false sign.

-

Indicator Affirmation: As talked about earlier, utilizing technical indicators to substantiate the sample’s sign provides a layer of validation. For instance, a bullish crossover of transferring averages after a bullish breakout reinforces the bullish sign.

-

Fibonacci Retracements: Making use of Fibonacci retracements to the preliminary development might help establish potential help and resistance ranges inside the X sample, including additional context to the breakout.

Sensible Purposes of the X Sample:

The X sample will be successfully utilized in numerous buying and selling methods:

-

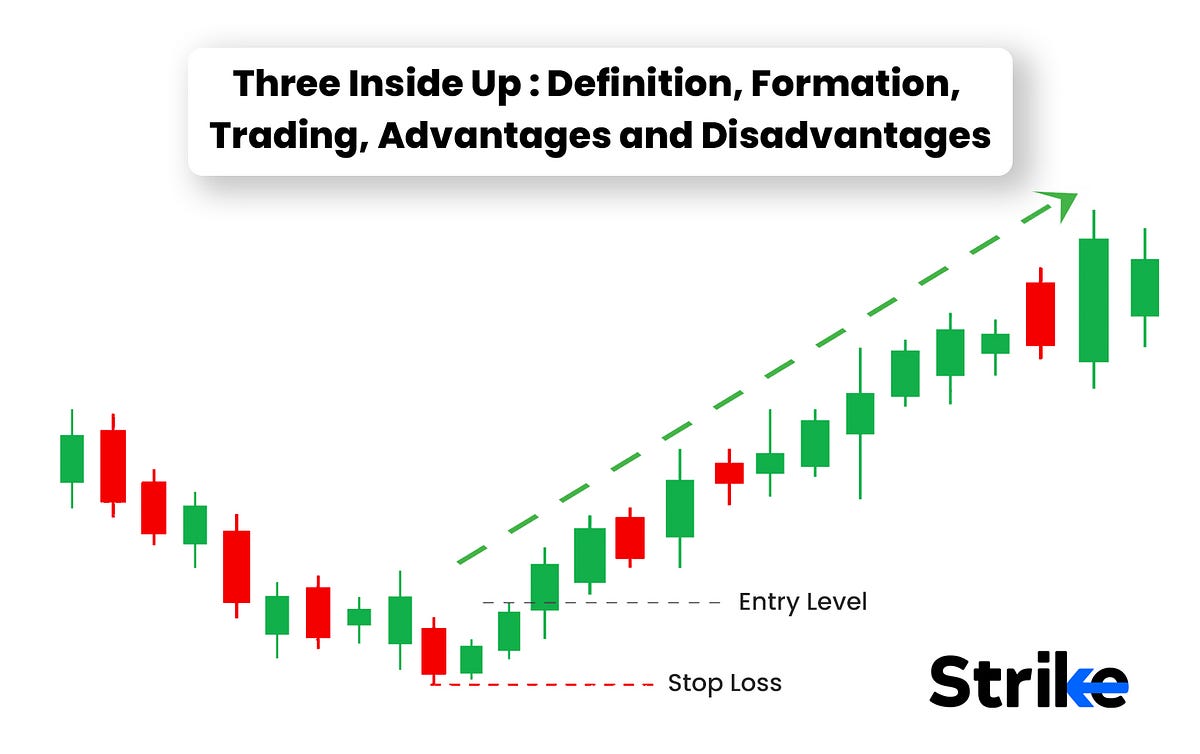

Reversal Buying and selling: The first utility of the X sample is figuring out potential reversals in worth traits. Merchants can make the most of the breakout from the convergence level to enter trades within the path of the reversal.

-

Swing Buying and selling: The X sample is appropriate for swing buying and selling methods, aiming to capitalize on medium-term worth swings. The sample’s formation and breakout usually present ample time for entry and exit methods.

-

Day Buying and selling: Whereas much less widespread, the X sample can be utilized in day buying and selling, significantly when mixed with different short-term indicators. Nevertheless, the shorter timeframe requires extra exact entry and exit methods.

-

Danger Administration: As with every buying and selling technique, threat administration is paramount. Cease-loss orders ought to be positioned under the low of the convergence level in a bullish X sample and above the excessive in a bearish X sample. Take-profit ranges will be decided primarily based on the magnitude of the preliminary development or utilizing Fibonacci extensions.

Limitations of the X Sample:

It is essential to acknowledge the restrictions of the X sample:

-

Subjectivity: The identification of the X sample will be subjective, because the exact definition is just not rigidly outlined. Completely different merchants may interpret the sample otherwise.

-

False Alerts: Like several chart sample, the X sample can produce false indicators. Affirmation methods are important to attenuate the danger of coming into shedding trades.

-

Context is Key: The X sample’s reliability is considerably influenced by the broader market context. A sample forming throughout a powerful general market development may be much less dependable than one forming throughout a interval of consolidation.

Conclusion:

The X sample, whereas not as well known as different chart patterns, provides invaluable insights into potential worth reversals. By understanding its formation, identification methods, affirmation methods, and limitations, merchants can considerably enhance their capability to establish high-probability buying and selling alternatives. Nevertheless, it is essential to keep in mind that no single indicator or sample ensures success. A complete buying and selling technique that mixes a number of technical indicators and sound threat administration practices is important for constant profitability. Diligent follow, cautious remark, and steady studying are key to mastering the artwork of decoding and using the X sample successfully in your buying and selling endeavors. All the time bear in mind to backtest your methods and modify your strategy primarily based in your outcomes and market situations.

Closure

Thus, we hope this text has offered invaluable insights into Deciphering the X Sample in Charts: A Complete Information. We respect your consideration to our article. See you in our subsequent article!