Deciphering The Zerodha Financial institution Nifty Chart: A Complete Information

Deciphering the Zerodha Financial institution Nifty Chart: A Complete Information

Associated Articles: Deciphering the Zerodha Financial institution Nifty Chart: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Deciphering the Zerodha Financial institution Nifty Chart: A Complete Information. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Deciphering the Zerodha Financial institution Nifty Chart: A Complete Information

The Financial institution Nifty, an index representing the efficiency of 12 outstanding banking shares listed on the Nationwide Inventory Alternate (NSE) of India, is an important benchmark for understanding the well being of the Indian monetary sector. Zerodha, a well-liked low cost brokerage in India, supplies entry to real-time charts of the Financial institution Nifty, providing merchants and buyers a strong instrument for evaluation and decision-making. This text delves into the intricacies of deciphering the Zerodha Financial institution Nifty chart, masking varied indicators, chart patterns, and methods to successfully make the most of this useful resource.

Understanding the Zerodha Platform:

Earlier than diving into chart evaluation, it is essential to know the options Zerodha provides. Its Kite charting platform is user-friendly and supplies a wealth of instruments, together with:

- A number of Chart Varieties: Zerodha helps varied chart varieties like candlestick, line, bar, and Heikin Ashi, every providing a singular perspective on worth motion.

- Technical Indicators: An unlimited library of technical indicators, together with shifting averages (SMA, EMA), Relative Power Index (RSI), MACD, Bollinger Bands, and plenty of extra, are available.

- Drawing Instruments: Instruments for drawing trendlines, Fibonacci retracements, help and resistance ranges, and different geometric patterns facilitate detailed evaluation.

- Customizability: Customers can customise the chart’s look, selecting most popular timeframes (from intraday to yearly), including or eradicating indicators, and adjusting shade schemes.

- Backtesting Capabilities: Whereas circuitously on the chart itself, Zerodha’s platform integrates with instruments that enable for backtesting buying and selling methods based mostly on Financial institution Nifty historic information.

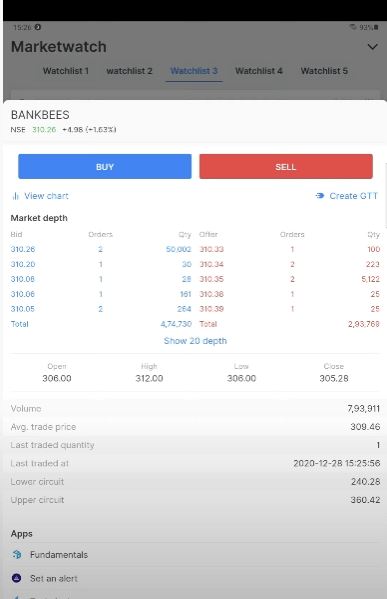

Key Parts of the Zerodha Financial institution Nifty Chart:

The Zerodha Financial institution Nifty chart shows a number of key components:

- Worth Axis (Y-axis): Represents the worth of the Financial institution Nifty index at totally different closing dates.

- Time Axis (X-axis): Represents the time interval lined by the chart (e.g., 1-minute, 5-minute, day by day, weekly, month-to-month).

- Candlesticks (or Bars): Characterize worth actions over a particular time interval. The physique of the candlestick reveals the opening and shutting costs, whereas the wicks (shadows) point out the excessive and low costs. Inexperienced (or bullish) candlesticks point out a closing worth increased than the opening worth, whereas purple (or bearish) candlesticks point out a closing worth decrease than the opening worth.

- Quantity: Typically displayed beneath the worth chart, quantity signifies the variety of contracts traded throughout every time interval. Excessive quantity typically accompanies important worth actions.

- Technical Indicators: These are mathematical calculations utilized to cost and quantity information to establish tendencies, momentum, and potential reversals. Understanding these indicators is essential for efficient chart interpretation.

Decoding Key Technical Indicators:

A number of technical indicators are often used when analyzing the Zerodha Financial institution Nifty chart:

- Shifting Averages (MA): Clean out worth fluctuations and establish tendencies. A generally used mixture is the 50-day and 200-day shifting common. A bullish crossover happens when the shorter-term MA crosses above the longer-term MA, suggesting a possible uptrend. A bearish crossover is the other.

- Relative Power Index (RSI): Measures the magnitude of current worth adjustments to judge overbought or oversold circumstances. Readings above 70 typically counsel an overbought market, whereas readings beneath 30 counsel an oversold market. These ranges usually are not absolute indicators however fairly potential warning indicators of a development reversal.

- Shifting Common Convergence Divergence (MACD): Identifies adjustments in momentum by evaluating two shifting averages. A bullish sign happens when the MACD line crosses above its sign line, whereas a bearish sign happens when it crosses beneath.

- Bollinger Bands: Present worth volatility by plotting commonplace deviations round a shifting common. When costs contact the higher band, it could counsel an overbought situation, whereas touching the decrease band might counsel an oversold situation. Breakouts above or beneath the bands can sign sturdy directional strikes.

Chart Patterns and Their Significance:

Recognizing chart patterns can present precious insights into potential future worth actions:

- Head and Shoulders: A bearish reversal sample characterised by three peaks, with the center peak (the pinnacle) being the best.

- Inverse Head and Shoulders: A bullish reversal sample, the mirror picture of the pinnacle and shoulders sample.

- Double Tops and Double Bottoms: These patterns counsel potential development reversals. A double prime signifies a possible bearish reversal, whereas a double backside signifies a possible bullish reversal.

- Triangles: Consolidation patterns that may precede a breakout in both path. Symmetrical triangles are impartial, whereas ascending triangles are bullish and descending triangles are bearish.

- Flags and Pennants: Quick-term consolidation patterns that often happen throughout a powerful development. Breakouts from these patterns typically proceed the prevailing development.

Methods for Using the Zerodha Financial institution Nifty Chart:

The Zerodha Financial institution Nifty chart can be utilized for varied buying and selling methods:

- Development Following: Establish the dominant development (uptrend or downtrend) utilizing shifting averages and different indicators and commerce within the path of the development.

- Imply Reversion: Establish overbought or oversold circumstances utilizing RSI or Bollinger Bands and anticipate a worth reversal in the direction of the typical.

- Breakout Buying and selling: Establish potential breakouts from chart patterns or help/resistance ranges and commerce within the path of the breakout.

- Swing Buying and selling: Capitalize on medium-term worth swings, holding positions for a number of days or even weeks.

- Scalping: Quick-term buying and selling technique specializing in small worth actions inside minutes or hours.

Danger Administration:

Whatever the chosen technique, efficient danger administration is essential:

- Cease-Loss Orders: At all times use stop-loss orders to restrict potential losses.

- Place Sizing: Decide the suitable place measurement based mostly in your danger tolerance and account steadiness.

- Diversification: Do not put all of your eggs in a single basket. Diversify your investments throughout totally different asset courses.

Conclusion:

The Zerodha Financial institution Nifty chart is a strong instrument for analyzing the efficiency of the Indian banking sector. By understanding the varied chart varieties, technical indicators, chart patterns, and danger administration methods, merchants and buyers can successfully make the most of this useful resource to make knowledgeable buying and selling choices. Nevertheless, it is essential to keep in mind that technical evaluation shouldn’t be foolproof, and no technique ensures success. Steady studying, follow, and disciplined danger administration are important for attaining constant profitability within the monetary markets. At all times take into account consulting with a monetary advisor earlier than making any funding choices.

![5 Best Demat And Trading Accounts For Small Investors - [ 2020 ] - RankMe1](https://www.rankme1.com/wp-content/uploads/2020/06/nifty-chart-in-kite-app-of-zerodha-1536x795.png)

Closure

Thus, we hope this text has offered precious insights into Deciphering the Zerodha Financial institution Nifty Chart: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!