Decoding Crypto Bubbles: A Chart-Based mostly Evaluation Of Market Mania And Meltdown

Decoding Crypto Bubbles: A Chart-Based mostly Evaluation of Market Mania and Meltdown

Associated Articles: Decoding Crypto Bubbles: A Chart-Based mostly Evaluation of Market Mania and Meltdown

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Decoding Crypto Bubbles: A Chart-Based mostly Evaluation of Market Mania and Meltdown. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Decoding Crypto Bubbles: A Chart-Based mostly Evaluation of Market Mania and Meltdown

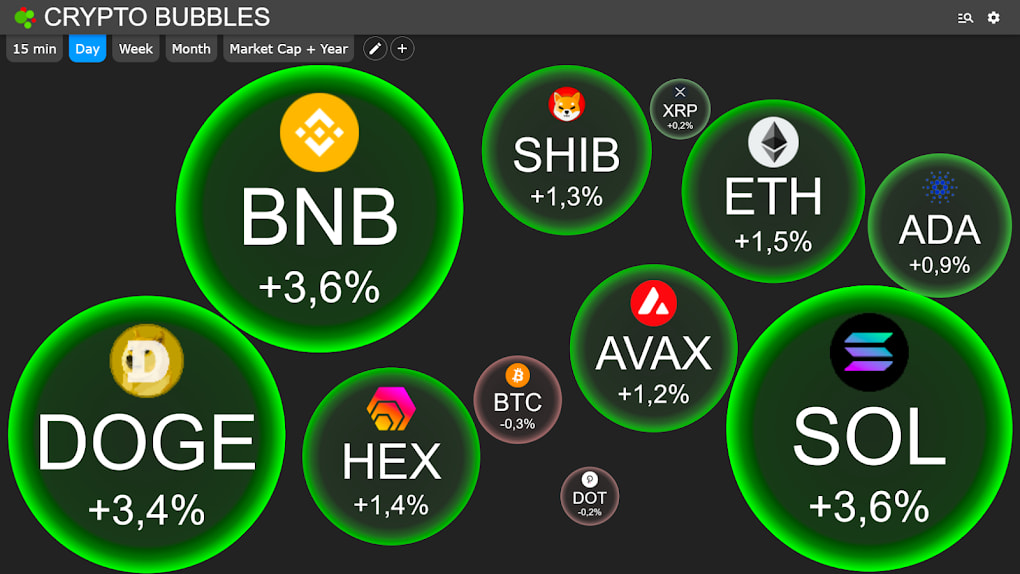

The cryptocurrency market, a unstable and sometimes unpredictable panorama, is characterised by intervals of explosive progress punctuated by dramatic crashes. These boom-and-bust cycles, also known as "bubbles," are visually putting when represented on a chart, revealing patterns of speculative fervor and subsequent disillusionment. Understanding these cyclical patterns is essential for navigating the dangers and rewards inherent within the crypto house. This text delves into the visible illustration of crypto bubbles by means of charts, analyzing their formation, traits, and implications for traders.

Visualizing the Mania: Chart Patterns of Crypto Bubbles

A typical crypto bubble, when depicted on a worth chart (normally a logarithmic scale to higher visualize exponential progress), displays a definite parabolic curve. This curve begins with a interval of comparatively sluggish, natural progress, fueled by real technological developments or growing adoption. This preliminary section is usually characterised by a gradual upward development, with intervals of consolidation and minor corrections. Nevertheless, as extra traders enter the market, fueled by hype and FOMO (worry of lacking out), the value accelerates dramatically. The parabolic curve steepens, reflecting the exponentially growing demand and worth appreciation.

Key Chart Indicators of a Bubble:

- Exponential Development: Probably the most outstanding function is the speedy, unsustainable enhance in worth. Straight traces on a logarithmic chart point out exponential progress, a trademark of a bubble.

- Excessive Buying and selling Quantity: As costs rise, buying and selling quantity usually will increase considerably, indicating heightened speculative exercise. This elevated quantity usually precedes or accompanies the parabolic section.

- Elevated Social Media Sentiment: Optimistic sentiment on social media platforms, boards, and information retailers usually correlates with the ascent of a bubble. This amplified hype contributes to the FOMO impact, driving additional worth will increase.

- Overbought Situations: Technical indicators just like the Relative Power Index (RSI) and the Transferring Common Convergence Divergence (MACD) can sign overbought situations, indicating that the value is considerably above its honest worth and vulnerable to a correction.

- Lack of Elementary Help: Throughout a bubble, the value usually detaches from the underlying fundamentals of the asset. Metrics like market capitalization, adoption charges, and technological developments might not justify the inflated worth.

- Excessive Volatility: Bubbles are characterised by excessive worth volatility, with sharp and frequent swings in each instructions. These swings may be each exhilarating and terrifying for traders.

The Inevitable Burst: Charting the Crash

The parabolic ascent of a crypto bubble is never sustainable. The basic precept of provide and demand finally reasserts itself. As the value turns into more and more indifferent from actuality, profit-taking begins. Early traders, having collected vital beneficial properties, begin promoting their holdings. This triggers a cascade impact, as extra traders comply with go well with, fearing additional worth declines. The chart then shows a pointy reversal, usually a near-vertical drop, because the bubble bursts.

Chart Patterns Throughout the Crash:

- Sharp Decline: The value plummets quickly, erasing a lot of the earlier beneficial properties. The pace and magnitude of the decline may be devastating for traders who entered the market late.

- Elevated Volatility: Volatility stays excessive throughout the crash, with wild worth swings amplifying the losses.

- Decreased Buying and selling Quantity: As panic promoting subsides, buying and selling quantity usually decreases, reflecting a much less enthusiastic market.

- Adverse Social Media Sentiment: Social media sentiment shifts dramatically from euphoric optimism to worry and despair. This unfavourable suggestions loop additional exacerbates the value decline.

- Formation of Help Ranges: After the preliminary crash, the value might discover momentary help ranges, the place consumers emerge to buy the asset at discounted costs. These help ranges may be recognized on the chart as horizontal traces the place the value consolidates.

Analyzing Historic Crypto Bubbles Via Charts:

Inspecting historic crypto bubbles by means of worth charts offers priceless insights into their typical patterns and traits. The Bitcoin bubble of 2017-2018 is a major instance. The chart reveals a transparent parabolic curve, culminating in a peak in late 2017, adopted by a dramatic crash in 2018. Comparable patterns may be noticed within the worth charts of different cryptocurrencies, although the timing and magnitude of the bubbles fluctuate.

Analyzing these charts alongside different knowledge factors, similar to buying and selling quantity, social media sentiment, and basic indicators, helps to color a extra full image of the bubble’s lifecycle. For example, evaluating the 2017 Bitcoin bubble with the newer altcoin bubbles reveals similarities within the parabolic progress section and subsequent crash, but additionally variations within the underlying components driving the value actions.

Past the Charts: Understanding the Underlying Elements

Whereas charts present a visible illustration of crypto bubbles, it is essential to grasp the underlying components that contribute to their formation and collapse. These components embrace:

- Speculative Funding: The crypto market attracts a major variety of speculative traders pushed by the potential for top returns, usually disregarding the inherent dangers.

- Technological Developments: Real technological developments can gasoline preliminary progress, however speculative fervor can shortly overshadow these fundamentals.

- Regulatory Uncertainty: Adjustments in regulatory frameworks can considerably influence the market, contributing to each bullish and bearish sentiment.

- Market Manipulation: The comparatively decentralized nature of the crypto market makes it vulnerable to manipulation by massive traders or coordinated teams.

- Media Hype and FOMO: Optimistic media protection and the worry of lacking out can drive speedy worth will increase, making a self-fulfilling prophecy.

Navigating the Dangers: Classes from Chart Evaluation

Chart evaluation is usually a priceless software for figuring out potential bubbles and managing danger within the crypto market. Nevertheless, it is important to do not forget that charts alone will not be a foolproof predictor of future worth actions. A complete funding technique ought to incorporate basic evaluation, danger administration methods, and a deep understanding of the underlying expertise and market dynamics.

By recognizing the attribute patterns of crypto bubbles on charts and understanding the underlying components driving them, traders can enhance their decision-making course of, mitigate dangers, and doubtlessly capitalize on alternatives inside this dynamic and unstable market. Nevertheless, warning and a long-term perspective are essential for navigating the unpredictable nature of the crypto house. The attract of fast earnings ought to all the time be tempered by a radical understanding of the inherent dangers. Finally, profitable funding in cryptocurrencies requires a mix of technical evaluation, basic analysis, and a wholesome dose of danger administration.

![[Official] Crypto Currency Chit Chat Group - Part 6 Page 2394](https://cryptobubbles.net/images/banner.png)

Closure

Thus, we hope this text has offered priceless insights into Decoding Crypto Bubbles: A Chart-Based mostly Evaluation of Market Mania and Meltdown. We respect your consideration to our article. See you in our subsequent article!