Decoding Double Tops And Double Bottoms: Highly effective Chart Patterns For Merchants

Decoding Double Tops and Double Bottoms: Highly effective Chart Patterns for Merchants

Associated Articles: Decoding Double Tops and Double Bottoms: Highly effective Chart Patterns for Merchants

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding Double Tops and Double Bottoms: Highly effective Chart Patterns for Merchants. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Decoding Double Tops and Double Bottoms: Highly effective Chart Patterns for Merchants

Double high and double backside patterns are among the many most widely known and dependable chart patterns utilized in technical evaluation. These formations, characterised by a definite "M" form (double high) or "W" form (double backside), sign potential reversals within the value pattern. Understanding their construction, formation, and affirmation is essential for merchants seeking to capitalize on these important market shifts. This text delves deep into the intricacies of double tops and double bottoms, offering a complete information for each novice and skilled merchants.

Understanding the Mechanics: Double High Sample

A double high sample signifies a possible bearish reversal. It emerges after an uptrend, indicating a weakening of the shopping for stress and a rising probability of a value decline. The sample consists of two distinct peaks ("tops") of roughly equal top, adopted by a neckline that connects the troughs between the peaks.

Key Traits of a Double High:

- Two Peaks: The sample is outlined by two value peaks which are comparatively shut in value and time. Ideally, the peaks needs to be inside 10% of one another. A bigger discrepancy can weaken the sample’s reliability.

- Neckline: A trendline connecting the lows between the 2 peaks types the neckline. This line serves as an important help degree. A break beneath this neckline confirms the sample and indicators a possible value decline.

- Quantity: Usually, quantity is increased through the formation of the 2 peaks, indicating robust buying and selling exercise. Quantity ought to lower as the value approaches the second peak, suggesting waning shopping for curiosity. A big enhance in quantity accompanying the break of the neckline confirms the bearish sign.

- Affirmation: The sample is confirmed solely after the value decisively breaks beneath the neckline. This break ought to ideally be accompanied by elevated quantity. A easy break could also be a false sign, so merchants ought to await a detailed beneath the neckline for stronger affirmation.

- Value Goal: The value goal for a double high sample is calculated by measuring the space between the neckline and the very best peak (the very best of the 2 peaks). This distance is then projected downwards from the neckline to estimate the potential value decline.

Potential Pitfalls and Concerns for Double Tops:

- False Breakouts: The value may briefly dip beneath the neckline earlier than recovering, making a false breakout. Merchants needs to be cautious of this and await a decisive and sustained break beneath the neckline earlier than getting into a brief place.

- Asymmetrical Peaks: Whereas ideally the peaks are of equal top, slight discrepancies are acceptable. Nevertheless, important variations in peak top can weaken the sample’s predictive energy.

- Time Body: Double high patterns can kind throughout varied time frames, from short-term (intraday) to long-term (weekly or month-to-month). The time-frame influences the potential value goal and holding interval.

- Market Context: The reliability of the sample needs to be thought-about within the context of broader market tendencies and financial indicators. A double high in a robust bull market could also be much less dependable than one in a weakening market.

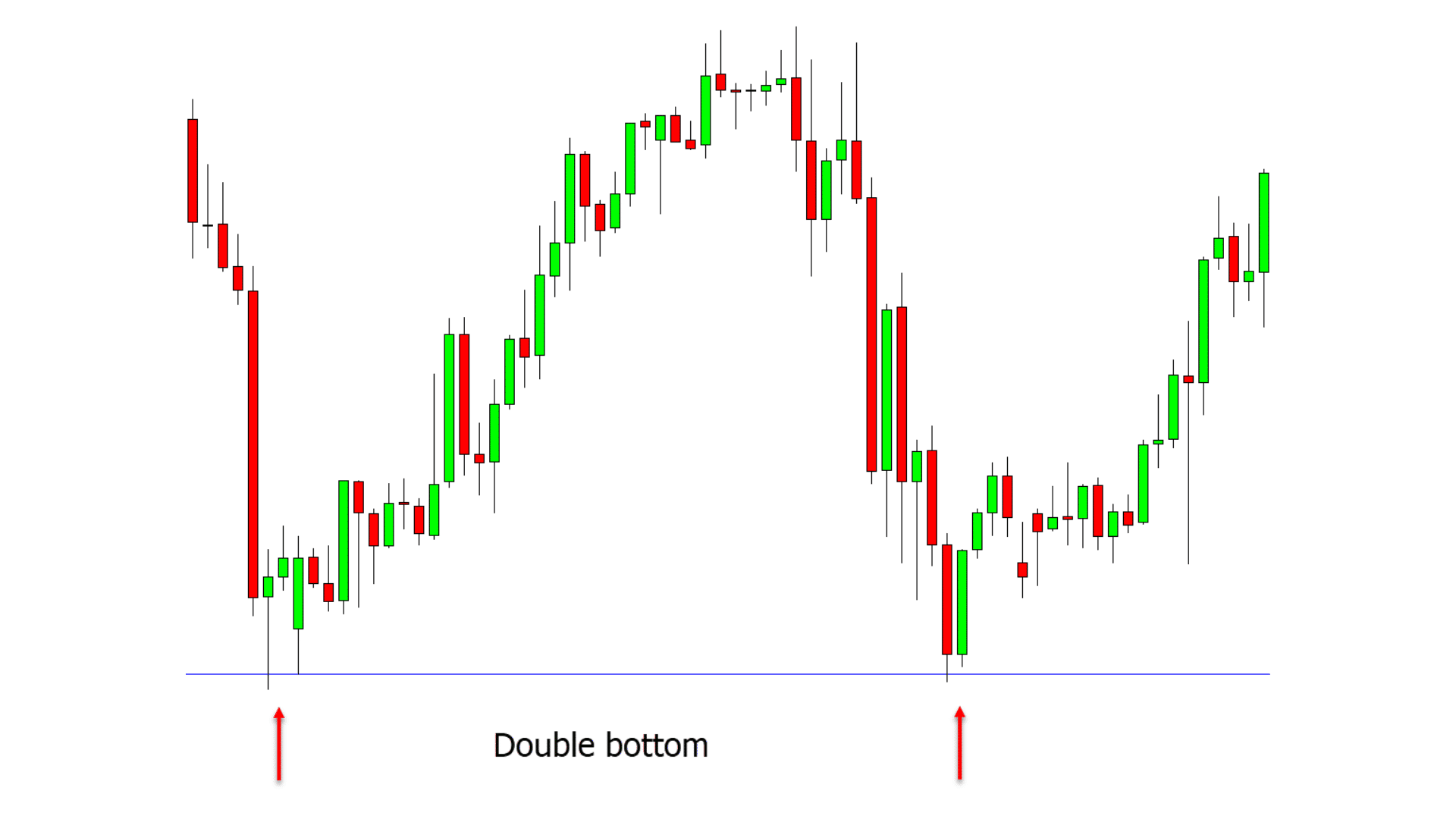

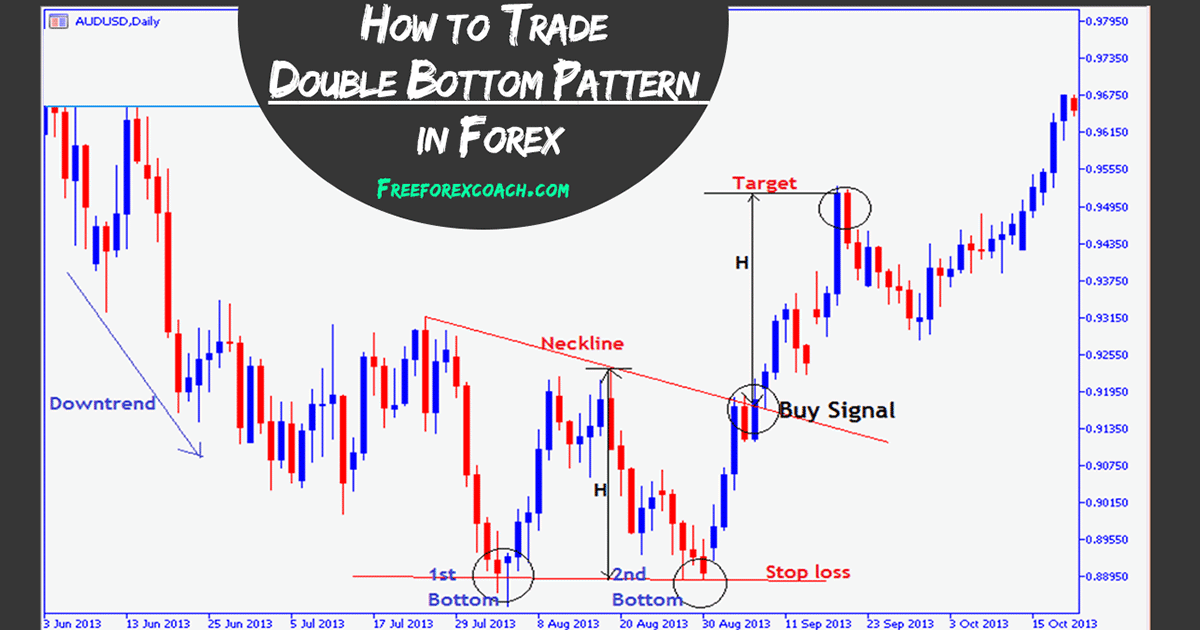

Understanding the Mechanics: Double Backside Sample

The double backside sample is the mirror picture of the double high, signifying a possible bullish reversal. It emerges after a downtrend, indicating a strengthening of the shopping for stress and a rising probability of a value enhance. The sample consists of two distinct troughs ("bottoms") of roughly equal depth, adopted by a neckline that connects the peaks between the troughs.

Key Traits of a Double Backside:

- Two Bottoms: The sample is outlined by two value bottoms which are comparatively shut in value and time. Much like the double high, the bottoms ought to ideally be inside 10% of one another.

- Neckline: A trendline connecting the highs between the 2 bottoms types the neckline. This line serves as an important resistance degree. A break above this neckline confirms the sample and indicators a possible value enhance.

- Quantity: Much like the double high, quantity is usually increased through the formation of the 2 bottoms. Quantity ought to lower as the value approaches the second backside, suggesting waning promoting curiosity. A big enhance in quantity accompanying the break of the neckline confirms the bullish sign.

- Affirmation: The sample is confirmed solely after the value decisively breaks above the neckline. This break ought to ideally be accompanied by elevated quantity. A easy break could also be a false sign, so merchants ought to await a detailed above the neckline for stronger affirmation.

- Value Goal: The value goal for a double backside sample is calculated by measuring the space between the neckline and the bottom backside (the bottom of the 2 bottoms). This distance is then projected upwards from the neckline to estimate the potential value enhance.

Potential Pitfalls and Concerns for Double Bottoms:

- False Breakouts: Much like the double high, the value may briefly rise above the neckline earlier than retracing, making a false breakout. Merchants needs to be cautious and await a decisive and sustained break above the neckline earlier than getting into an extended place.

- Asymmetrical Bottoms: Whereas ideally the bottoms are of equal depth, slight discrepancies are acceptable. Vital variations in backside depth can weaken the sample’s predictive energy.

- Time Body: Double backside patterns may kind throughout varied time frames, influencing the potential value goal and holding interval.

- Market Context: The reliability of the sample needs to be evaluated throughout the context of broader market tendencies and financial indicators. A double backside in a robust bear market is likely to be much less dependable than one in a weakening market.

Combining Double Tops and Bottoms with Different Indicators:

Whereas double tops and bottoms present precious insights, combining them with different technical indicators can improve their accuracy and cut back the chance of false indicators. Some generally used indicators embrace:

- Shifting Averages: Confirming a breakout above or beneath the neckline with the help or resistance of transferring averages can strengthen the sign.

- Relative Power Index (RSI): The RSI will help establish overbought or oversold circumstances, which may coincide with the formation of double tops and bottoms.

- MACD: The Shifting Common Convergence Divergence (MACD) can affirm the momentum shift advised by the sample.

- Quantity: As talked about beforehand, quantity affirmation is essential for validating the break of the neckline.

Conclusion:

Double high and double backside patterns are highly effective instruments for figuring out potential reversals in value tendencies. Nevertheless, they aren’t foolproof, and merchants ought to all the time use them along side different technical indicators and danger administration methods. Understanding the important thing traits, potential pitfalls, and affirmation strategies is essential for efficiently using these patterns in buying and selling choices. Keep in mind that thorough evaluation, endurance, and disciplined danger administration are important for maximizing the potential advantages and minimizing the dangers related to buying and selling these chart patterns. At all times observe accountable buying and selling and think about looking for skilled monetary recommendation earlier than making any funding choices.

Closure

Thus, we hope this text has supplied precious insights into Decoding Double Tops and Double Bottoms: Highly effective Chart Patterns for Merchants. We hope you discover this text informative and useful. See you in our subsequent article!