Decoding The 30-Day Silver Value Chart: A Deep Dive Into Market Dynamics

Decoding the 30-Day Silver Value Chart: A Deep Dive into Market Dynamics

Associated Articles: Decoding the 30-Day Silver Value Chart: A Deep Dive into Market Dynamics

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Decoding the 30-Day Silver Value Chart: A Deep Dive into Market Dynamics. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Decoding the 30-Day Silver Value Chart: A Deep Dive into Market Dynamics

The silver market, usually considered as a protected haven asset and industrial steel, shows an enchanting dynamism mirrored in its worth fluctuations. Analyzing a 30-day silver worth chart affords a invaluable snapshot of current market developments, permitting buyers and merchants to gauge momentum, establish potential turning factors, and perceive the forces shaping its worth. This text will delve into the intricacies of deciphering a 30-day silver worth chart, exploring the important thing elements influencing worth actions and offering insights into methods to make the most of this information for knowledgeable decision-making. Notice that any particular worth information talked about is hypothetical and for illustrative functions solely. At all times seek the advice of real-time information from respected sources earlier than making any funding selections.

Understanding the Chart’s Parts:

A typical 30-day silver worth chart will current the value of silver (normally expressed in US {dollars} per troy ounce) over a 30-day interval. Key elements embrace:

- Value Axis (Y-axis): Reveals the value of silver at numerous closing dates.

- Time Axis (X-axis): Represents the 30-day interval, usually displayed in days or buying and selling classes.

- Candlesticks or Line Graph: The chart might make the most of candlestick charts (every candlestick represents a day’s buying and selling, displaying the open, excessive, low, and shutting costs) or a line graph (connecting the closing costs of every day). Candlesticks present a richer visible illustration of worth motion.

- Shifting Averages: Usually overlaid on the chart, shifting averages (e.g., 5-day, 10-day, 20-day) clean out worth fluctuations and assist establish developments.

- Quantity: Some charts additionally incorporate quantity information, indicating the variety of silver contracts traded every day. Excessive quantity usually accompanies vital worth actions.

- Indicators: Technical indicators corresponding to Relative Power Index (RSI), Shifting Common Convergence Divergence (MACD), and Bollinger Bands may be added to the chart to offer additional insights into momentum and potential reversals.

Components Influencing the 30-Day Silver Value:

Analyzing a 30-day chart requires understanding the a number of forces driving silver’s worth. These may be broadly categorized as:

-

Provide and Demand: The elemental driver of any commodity worth. Elevated industrial demand (e.g., electronics, photo voltaic panels, jewellery) or funding demand (e.g., ETFs, bodily bullion) pushes costs greater, whereas elevated provide (e.g., mine manufacturing, recycling) can put downward strain. A 30-day chart would possibly reveal short-term provide disruptions or surges in demand that impression worth.

-

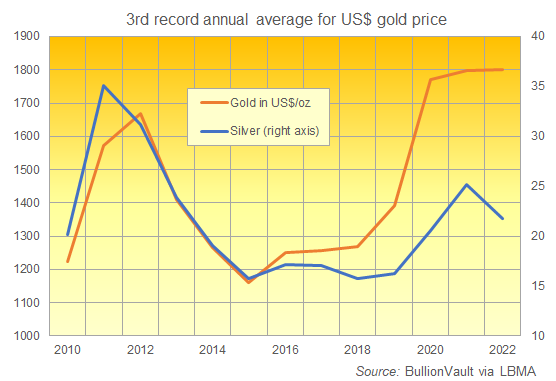

US Greenback Power: Silver is priced in US {dollars}. A strengthening greenback typically makes silver costlier for holders of different currencies, decreasing demand and probably reducing the value. Conversely, a weakening greenback can increase silver’s attraction. A 30-day chart would possibly present a correlation between greenback actions and silver worth modifications.

-

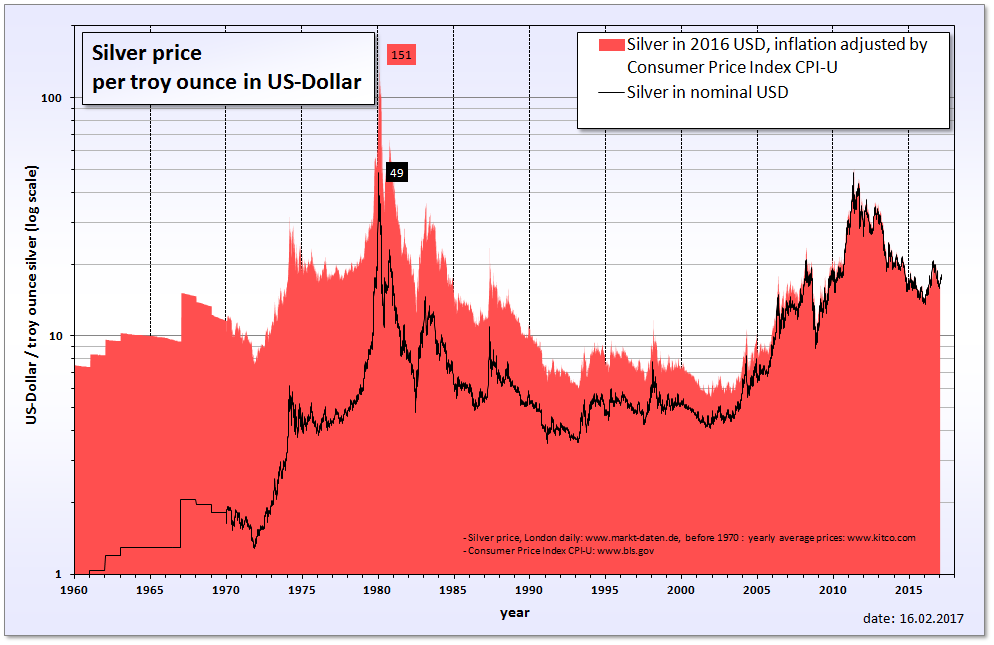

Inflationary Pressures: Silver is commonly thought-about an inflation hedge. During times of rising inflation, buyers might flock to silver as a retailer of worth, driving up its worth. A 30-day chart can spotlight the impression of inflationary considerations on silver’s efficiency.

-

Curiosity Charges: Greater rates of interest usually make holding non-interest-bearing property like silver much less engaging, probably resulting in decrease costs. Decrease rates of interest can have the other impact. The 30-day chart would possibly replicate the affect of rate of interest modifications introduced throughout that interval.

-

Geopolitical Occasions: International political instability or uncertainty can set off safe-haven demand for silver, pushing costs greater. Vital geopolitical occasions throughout the 30-day interval will seemingly be mirrored within the chart.

-

Investor Sentiment: Market psychology performs a major function. Optimism about silver’s future prospects can gas shopping for, whereas pessimism can result in promoting strain. The 30-day chart might present intervals of robust bullish or bearish sentiment.

-

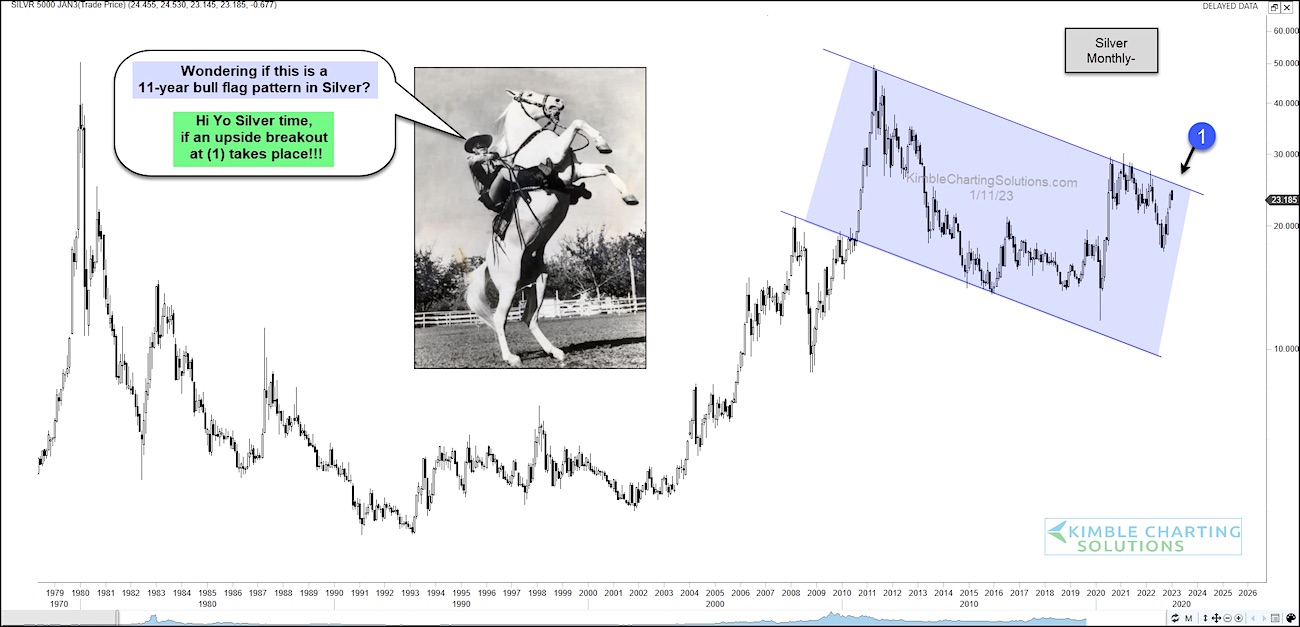

Technical Components: Chart patterns, assist and resistance ranges, and technical indicators (as talked about earlier) can present invaluable insights into potential worth actions. A 30-day chart permits for the identification of short-term developments and patterns.

Deciphering the 30-Day Chart:

Analyzing a 30-day silver worth chart includes a number of steps:

-

Determine the Pattern: Is the general pattern upward (bullish), downward (bearish), or sideways (ranging)? This gives an important context for deciphering different features of the chart.

-

Look at Value Motion: Search for candlestick patterns (e.g., hammer, engulfing patterns) that counsel potential reversals or continuations of the pattern.

-

Analyze Quantity: Excessive quantity accompanying worth will increase confirms power, whereas excessive quantity throughout worth declines suggests weak point.

-

Observe Shifting Averages: Crossovers of shifting averages can sign modifications in momentum. For instance, a short-term shifting common crossing above a long-term shifting common might be a bullish sign.

-

Make the most of Technical Indicators: RSI, MACD, and Bollinger Bands will help establish overbought or oversold circumstances, potential momentum shifts, and volatility ranges.

-

Take into account Exterior Components: Hold abreast of reports and occasions that may affect silver costs (e.g., industrial manufacturing information, inflation experiences, geopolitical developments). Correlate these occasions with worth actions on the chart.

Limitations of a 30-Day Chart:

Whereas a 30-day chart gives invaluable short-term insights, it has limitations:

- Quick Time Body: The 30-day interval may not seize longer-term developments or vital shifts in market fundamentals.

- Volatility: Silver costs may be unstable, making short-term predictions difficult.

- Restricted Context: The chart alone doesn’t present a whole image; it must be complemented by elementary evaluation and an understanding of broader market circumstances.

Conclusion:

A 30-day silver worth chart is a robust software for understanding current market dynamics. By combining chart evaluation with an consciousness of the elements influencing silver costs, buyers and merchants can achieve invaluable insights to tell their decision-making. Nevertheless, it is essential to do not forget that no chart can predict the long run with certainty. A complete strategy incorporating each technical and elementary evaluation, coupled with danger administration methods, is important for profitable buying and selling or investing in silver. At all times diversify your portfolio and search skilled monetary recommendation earlier than making any funding selections.

Closure

Thus, we hope this text has supplied invaluable insights into Decoding the 30-Day Silver Value Chart: A Deep Dive into Market Dynamics. We hope you discover this text informative and helpful. See you in our subsequent article!