Decoding The 30-12 months Mortgage Mortgage Fee Chart: A Complete Information

Decoding the 30-12 months Mortgage Mortgage Fee Chart: A Complete Information

Associated Articles: Decoding the 30-12 months Mortgage Mortgage Fee Chart: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the 30-12 months Mortgage Mortgage Fee Chart: A Complete Information. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Decoding the 30-12 months Mortgage Mortgage Fee Chart: A Complete Information

The 30-year mortgage is a cornerstone of the American Dream, providing owners a long-term, predictable cost schedule to amass their property. Nevertheless, the rate of interest connected to this mortgage considerably impacts the general price. Understanding 30-year mortgage mortgage fee charts, their fluctuations, and the components influencing them is essential for potential homebuyers. This text delves into the complexities of those charts, offering a complete understanding of their interpretation and implications.

Understanding the Fundamentals of a 30-12 months Mortgage Fee Chart

A 30-year mortgage fee chart usually shows the prevailing rates of interest for 30-year fixed-rate mortgages over a selected interval, usually starting from a number of months to a number of years. The chart’s horizontal axis represents time (normally in months or years), whereas the vertical axis shows the rate of interest (usually as a proportion). Every level on the chart represents the typical or median fee for that individual time interval. These charts are sometimes introduced graphically as a line graph, displaying the pattern of rate of interest adjustments over time.

A number of key parts are essential to decoding these charts successfully:

-

Fee Kind: The chart ought to clearly specify the kind of mortgage fee it depicts. Is it a fixed-rate mortgage (the place the speed stays fixed all through the mortgage time period), or an adjustable-rate mortgage (ARM) the place the speed can fluctuate based mostly on an index? This distinction is essential, as ARM charts will present a unique sample of fee adjustments. This text focuses totally on fixed-rate mortgages.

-

Information Supply: The reliability of the chart relies upon closely on the supply of the info. Respected sources embrace authorities companies (like Freddie Mac or Fannie Mae), monetary information retailers, and well-established mortgage lenders. Be cautious of charts from much less credible sources.

-

Averaging Technique: Charts usually show common or median charges. The common could be skewed by outliers (extraordinarily excessive or low charges), whereas the median represents the center worth and is mostly much less prone to such distortion. Understanding the averaging technique used is significant for correct interpretation.

-

Geographic Location: Rates of interest can differ barely based mostly on geographic location. A nationwide common may not precisely replicate charges in a selected area. Search for charts that specify the geographic space they cowl.

-

Credit score Rating and Mortgage Phrases: The chart might signify common charges for a selected credit score rating vary and loan-to-value ratio (LTV). Greater credit score scores and decrease LTVs usually qualify for decrease rates of interest. A chart displaying charges for all credit score profiles can be a variety, not a single line.

Components Influencing 30-12 months Mortgage Charges

Quite a few financial and market forces affect 30-year mortgage charges. Understanding these components permits for a greater understanding of the chart’s fluctuations:

-

Federal Reserve Coverage: The Federal Reserve (the Fed) performs a major position in setting rates of interest. By way of its financial coverage instruments, notably the federal funds fee (the goal fee for in a single day lending between banks), the Fed influences the general price of borrowing, together with mortgage charges. Fee hikes usually result in increased mortgage charges, and vice versa.

-

Inflation: Excessive inflation erodes the buying energy of cash, prompting the Fed to boost rates of interest to chill down the economic system. This, in flip, results in increased mortgage charges. Conversely, low inflation can result in decrease charges.

-

Financial Progress: Robust financial progress can result in increased rates of interest as demand for credit score will increase. Conversely, slower financial progress or recessionary durations can result in decrease charges.

-

Authorities Rules: Authorities laws in regards to the mortgage market can affect charges. Adjustments in lending requirements or necessities can have an effect on the supply and price of mortgages.

-

Investor Demand: The demand for mortgage-backed securities (MBS) within the secondary market influences mortgage charges. Elevated demand can push charges down, whereas decreased demand can push them up.

-

International Financial Circumstances: International financial occasions, akin to geopolitical instability or worldwide monetary crises, may also have an effect on mortgage charges within the US.

Decoding the Chart and its Implications for Homebuyers

Analyzing a 30-year mortgage fee chart requires cautious consideration of the components talked about above. A downward pattern signifies a doubtlessly favorable time to safe a mortgage, whereas an upward pattern suggests the other. Nevertheless, it is essential to do not forget that these charts signify historic information and don’t predict future charges.

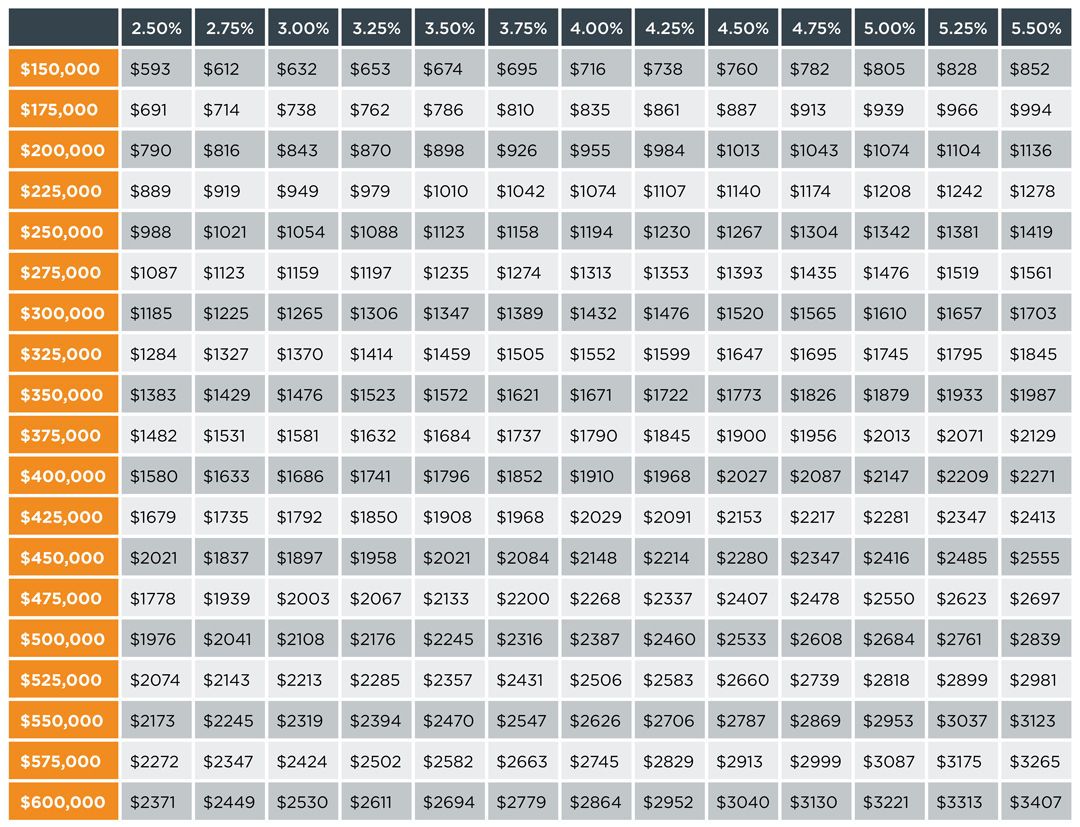

The implications for homebuyers are important. A decrease rate of interest interprets to decrease month-to-month funds and a decrease whole price of borrowing over the 30-year interval. Even a small distinction within the rate of interest can lead to substantial financial savings or elevated prices over the lifetime of the mortgage. For instance, a 0.5% distinction in rate of interest on a $300,000 mortgage can quantity to 1000’s of {dollars} in financial savings over 30 years.

Past the Chart: Different Essential Concerns

Whereas the 30-year mortgage fee chart gives useful context, it isn’t the one issue to contemplate when making a home-buying determination. Different important elements embrace:

-

Your Credit score Rating: The next credit score rating usually qualifies you for higher rates of interest. Enhancing your credit score rating earlier than making use of for a mortgage can prevent cash.

-

Down Cost: A bigger down cost normally leads to decrease rates of interest and doubtlessly avoids the necessity for Non-public Mortgage Insurance coverage (PMI).

-

Mortgage Kind: Completely different mortgage sorts, akin to FHA, VA, or typical loans, have various necessities and rates of interest.

-

Closing Prices: Bear in mind to think about closing prices, which might considerably add to the general price of shopping for a house.

-

Your Monetary State of affairs: Assess your general monetary stability and talent to handle month-to-month mortgage funds earlier than committing to a mortgage.

Conclusion:

The 30-year mortgage mortgage fee chart is a strong instrument for understanding the historic pattern of rates of interest. Nevertheless, it is essential to interpret the chart inside the broader context of financial circumstances, your private monetary state of affairs, and different components influencing mortgage charges. By understanding the components that have an effect on charges and punctiliously analyzing the chart’s information, potential homebuyers could make knowledgeable selections and safe probably the most favorable mortgage phrases potential. Bear in mind to seek the advice of with a monetary advisor and mortgage lender to obtain customized steerage tailor-made to your particular circumstances. Do not solely depend on the chart; use it as one piece of a bigger puzzle in your home-buying journey. The chart gives useful historic context, but it surely’s your particular person circumstances and future projections that may finally decide the very best time to purchase.

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] – Blog – WestMark](https://www.westmarkrealtors.com/blog/wp-content/uploads/sites/152/2020/08/Mortgage-Rates-Payments-by-Decade-INFOGRAPHIC.jpg)

Closure

Thus, we hope this text has supplied useful insights into Decoding the 30-12 months Mortgage Mortgage Fee Chart: A Complete Information. We admire your consideration to our article. See you in our subsequent article!