Decoding The 40-12 months Fastened Mortgage Charge Chart: A Complete Information

Decoding the 40-12 months Fastened Mortgage Charge Chart: A Complete Information

Associated Articles: Decoding the 40-12 months Fastened Mortgage Charge Chart: A Complete Information

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to Decoding the 40-12 months Fastened Mortgage Charge Chart: A Complete Information. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Decoding the 40-12 months Fastened Mortgage Charge Chart: A Complete Information

The attract of a 40-year fixed-rate mortgage is plain. The prospect of stretching repayments over 4 a long time gives considerably decrease month-to-month funds in comparison with shorter-term loans. Nonetheless, this seemingly advantageous proposition comes with its personal set of complexities and potential pitfalls. Understanding the intricacies of a 40-year mounted mortgage charge chart, and its implications for long-term monetary planning, is essential earlier than making such a big dedication.

This text delves deep into the world of 40-year mounted mortgage charges, exploring the components that affect them, analyzing the historic developments depicted in charge charts, and offering insights into the potential advantages and downsides of choosing such a long-term mortgage. We’ll additionally study methods to interpret a 40-year mounted mortgage charge chart successfully and use this info to make knowledgeable monetary choices.

Understanding the 40-12 months Fastened Mortgage Charge Chart

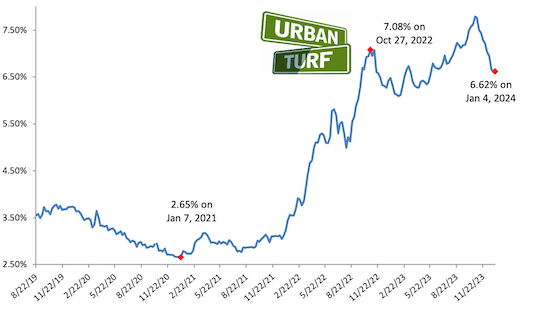

A 40-year mounted mortgage charge chart usually shows the historic and present rates of interest provided for 40-year fixed-rate mortgages. These charts normally current information graphically, usually utilizing line graphs for example the fluctuations in rates of interest over time. The x-axis represents time (e.g., months or years), and the y-axis represents the rate of interest. The road itself illustrates the pattern of the speed over the chosen interval. Some charts may also embody further information factors, akin to common charges, minimal and most charges, or the common charge for a particular interval.

Deciphering these charts requires understanding a number of key components:

- Curiosity Charge: This represents the annual proportion charge (APR) charged on the excellent mortgage stability. A decrease rate of interest interprets to decrease month-to-month funds.

- Time Interval: The chart reveals the speed’s historic trajectory, permitting debtors to see how charges have modified over time. This historic perspective gives context for present charges and helps predict potential future developments (although it is vital to do not forget that future predictions are by no means sure).

- Knowledge Supply: The reliability of the chart will depend on the supply of the information. Respected sources, akin to authorities businesses, monetary establishments, or well-established monetary information web sites, present extra correct and dependable info.

Elements Influencing 40-12 months Fastened Mortgage Charges

A number of macroeconomic components affect the rates of interest depicted on a 40-year mounted mortgage charge chart:

- Federal Reserve Coverage: The Federal Reserve (the Fed) performs a big function in setting rates of interest. When the Fed raises the federal funds charge (the goal charge banks cost one another for in a single day loans), borrowing prices usually improve, resulting in larger mortgage charges. Conversely, decreasing the federal funds charge usually leads to decrease mortgage charges.

- Inflation: Excessive inflation erodes the buying energy of cash, prompting the Fed to lift rates of interest to manage inflation. This, in flip, results in larger mortgage charges.

- Financial Progress: Sturdy financial progress can result in elevated demand for loans, probably driving up rates of interest. Conversely, weak financial progress can suppress demand, resulting in decrease charges.

- Authorities Rules: Authorities insurance policies and rules associated to the housing market can even affect mortgage charges. Modifications in lending requirements or government-backed mortgage packages can have an effect on the general provide and demand dynamics, impacting rates of interest.

- Investor Sentiment: Investor confidence within the financial system and the housing market performs a vital function. Damaging investor sentiment can result in larger rates of interest as lenders develop into extra risk-averse.

Historic Traits and Evaluation of 40-12 months Fastened Mortgage Charge Charts

Analyzing historic information from a 40-year mounted mortgage charge chart reveals cyclical patterns. Rates of interest have not all the time been constant; they fluctuate considerably over time, usually reflecting broader financial circumstances. As an illustration, charges have been traditionally excessive within the Nineteen Seventies and early Eighties, reaching double digits, earlier than declining considerably all through the next a long time. The 2008 monetary disaster prompted a pointy drop in charges, adopted by a interval of comparatively low charges till current years, the place charges have begun to climb once more.

Learning these developments permits potential debtors to achieve a greater understanding of the potential vary of charges they could encounter. Nonetheless, it is essential to do not forget that previous efficiency just isn’t indicative of future outcomes. Financial circumstances are always evolving, making exact predictions difficult.

Advantages of a 40-12 months Fastened Mortgage

- Decrease Month-to-month Funds: Probably the most vital benefit of a 40-year mortgage is the considerably decrease month-to-month fee in comparison with shorter-term loans. This will make homeownership extra accessible to people and households with restricted month-to-month budgets.

- Elevated Affordability: Decrease month-to-month funds can unencumber extra disposable earnings for different monetary priorities, akin to saving, investing, or paying down different money owed.

- Monetary Flexibility: The decrease month-to-month fee can present larger monetary flexibility, permitting debtors to adapt to sudden monetary challenges extra simply.

Drawbacks of a 40-12 months Fastened Mortgage

- Increased Whole Curiosity Paid: Whereas month-to-month funds are decrease, the overall curiosity paid over the lifetime of a 40-year mortgage is considerably larger than shorter-term loans. This implies debtors find yourself paying significantly extra for his or her dwelling in the long term.

- Longer Dedication: A 40-year mortgage represents a considerable long-term dedication. Life circumstances can change unexpectedly, and being locked right into a long-term mortgage would possibly restrict flexibility and alternatives.

- Potential for Damaging Fairness: If property values decline, debtors would possibly discover themselves in a scenario of unfavorable fairness, the place the excellent mortgage stability exceeds the house’s market worth. This danger is amplified with longer-term mortgages.

- Restricted Fairness Buildup: The slower fairness buildup can prohibit the borrower’s capacity to refinance or entry dwelling fairness for different functions.

Utilizing the Chart for Knowledgeable Resolution-Making

When utilizing a 40-year mounted mortgage charge chart to make knowledgeable choices, think about the next:

- Present Market Circumstances: Analyze the present rate of interest surroundings and its potential trajectory. Are charges rising, falling, or stabilizing?

- Private Monetary Scenario: Assess your private monetary scenario, together with your earnings, financial savings, and debt ranges. Are you able to comfortably afford the month-to-month funds, even when rates of interest rise?

- Lengthy-Time period Monetary Objectives: Think about your long-term monetary targets, akin to retirement planning and funding methods. Will a 40-year mortgage hinder your capacity to realize these targets as a result of larger whole curiosity paid?

- Danger Tolerance: Consider your danger tolerance. Are you snug with the potential dangers related to a long-term mortgage, akin to unfavorable fairness or fluctuating rates of interest?

Conclusion

A 40-year mounted mortgage charge chart gives priceless info for potential homebuyers. Nonetheless, understanding the intricacies of those charts and the components influencing rates of interest is essential for making knowledgeable choices. Whereas the decrease month-to-month funds provide vital enchantment, the upper whole curiosity paid and the longer-term dedication require cautious consideration. By completely analyzing the chart, assessing your private monetary scenario, and understanding the potential advantages and downsides, you may make a well-informed determination that aligns along with your long-term monetary targets and danger tolerance. Keep in mind to seek the advice of with a monetary advisor to debate your particular circumstances earlier than committing to such a big monetary enterprise.

Closure

Thus, we hope this text has supplied priceless insights into Decoding the 40-12 months Fastened Mortgage Charge Chart: A Complete Information. We hope you discover this text informative and helpful. See you in our subsequent article!