Decoding The American GDP Chart: A Two-Decade Journey Of Financial Progress And Volatility

Decoding the American GDP Chart: A Two-Decade Journey of Financial Progress and Volatility

Associated Articles: Decoding the American GDP Chart: A Two-Decade Journey of Financial Progress and Volatility

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to Decoding the American GDP Chart: A Two-Decade Journey of Financial Progress and Volatility. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Decoding the American GDP Chart: A Two-Decade Journey of Financial Progress and Volatility

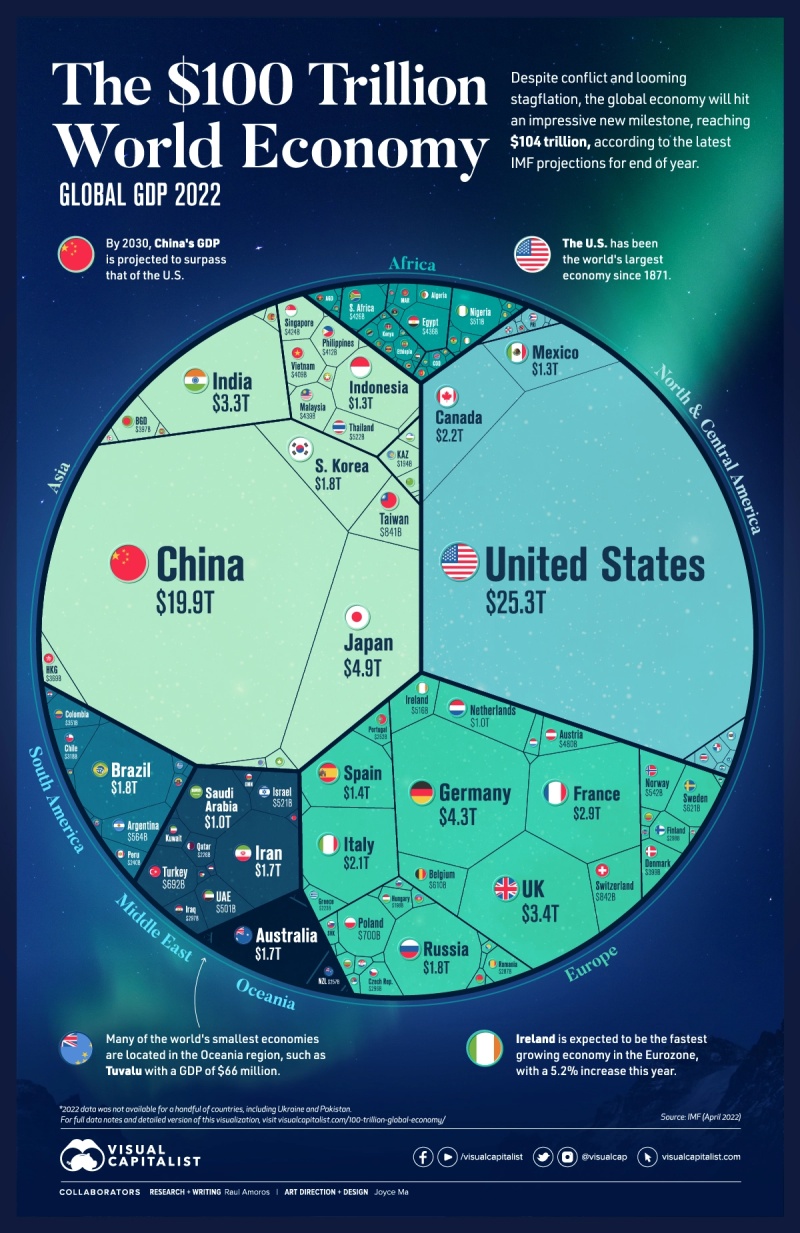

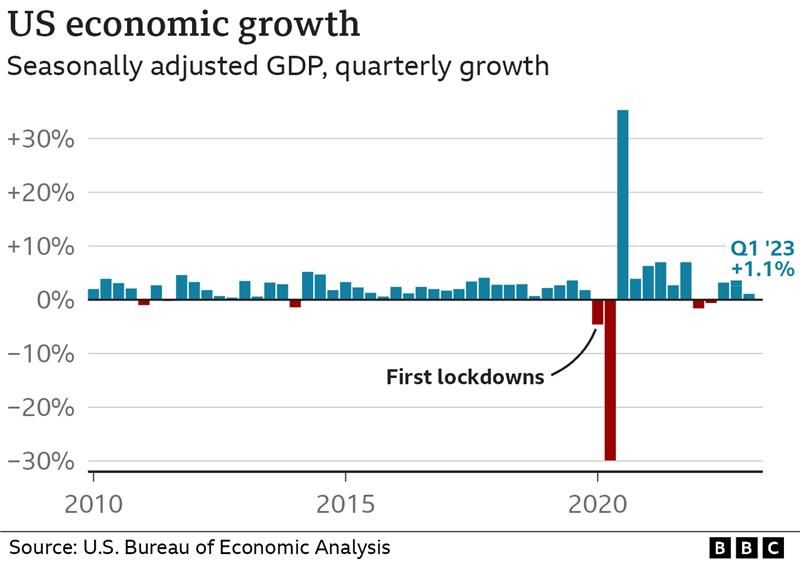

The Gross Home Product (GDP) of america, a vital indicator of the nation’s financial well being, paints a vivid image of its progress trajectory over the previous twenty years. Analyzing the GDP chart from 2000 to the current reveals a posh narrative punctuated by durations of strong growth, sharp contractions, and important structural shifts. This text delves into the important thing tendencies, underlying elements, and implications of the American GDP chart, providing a complete understanding of the financial panorama.

The Increase Years (2000-2007): A Interval of Relative Stability and Progress Fueled by Know-how and Housing

The early 2000s witnessed a interval of comparatively robust GDP progress, propelled by the burgeoning expertise sector and a sturdy housing market. The dot-com bubble burst in 2000 induced a quick recession, however the financial system shortly recovered, fueled by low rates of interest and elevated shopper spending. The housing market, experiencing a increase pushed by available mortgages and rising residence costs, considerably contributed to financial growth. This era noticed important job creation, significantly within the service sector, and a sustained rise in shopper confidence. Nonetheless, the seeds of the approaching disaster had been sown throughout this time, as unsustainable lending practices and inflated asset valuations laid the groundwork for the Nice Recession. The GDP chart from this period shows a gentle upward pattern, albeit with minor fluctuations reflecting the cyclical nature of financial progress.

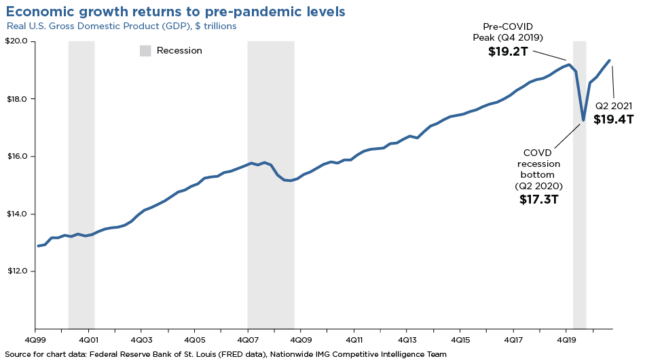

The Nice Recession (2007-2009): A Dramatic Plunge and the Aftermath

The bursting of the housing bubble in 2007 marked a turning level. The subprime mortgage disaster, triggered by widespread defaults on mortgages, triggered a cascading impact all through the monetary system. The collapse of Lehman Brothers in September 2008 served as a stark reminder of the interconnectedness of the worldwide monetary system, resulting in a dramatic contraction within the US GDP. The GDP chart sharply declines throughout this era, reflecting the severity of the recession. The disaster led to widespread job losses, a decline in shopper spending, and a big contraction in funding. Authorities intervention, together with the Troubled Asset Aid Program (TARP), performed a vital position in stopping an entire collapse of the monetary system, although the financial fallout was profound and long-lasting.

Restoration and Growth (2009-2019): A Gradual however Regular Climb

The restoration from the Nice Recession was gradual and uneven. The GDP chart reveals a gradual upward pattern, however the tempo of progress remained sluggish in comparison with earlier expansionary durations. Components contributing to the gradual restoration included excessive unemployment, deleveraging by households and companies, and lingering uncertainty within the monetary markets. The implementation of quantitative easing by the Federal Reserve, designed to inject liquidity into the monetary system, performed a big position in supporting financial progress. Moreover, technological innovation continued to drive productiveness positive aspects, and the emergence of the shale fuel revolution boosted home power manufacturing. Nonetheless, earnings inequality widened throughout this era, and considerations concerning the sustainability of the restoration continued.

The Trump Period (2017-2020): Tax Cuts and Commerce Wars

The Trump administration carried out important tax cuts in 2017, aiming to stimulate financial progress by means of elevated enterprise funding and shopper spending. The GDP chart reveals a interval of comparatively robust progress within the years following the tax cuts. Nonetheless, the administration’s commerce insurance policies, together with tariffs on imported items, created uncertainty and negatively impacted some sectors of the financial system. The influence of those insurance policies on long-term GDP progress stays a topic of ongoing debate. The comparatively sturdy progress skilled throughout this era was sadly lower quick by the onset of the COVID-19 pandemic.

The COVID-19 Pandemic (2020-Current): An Unprecedented Shock and the Street to Restoration

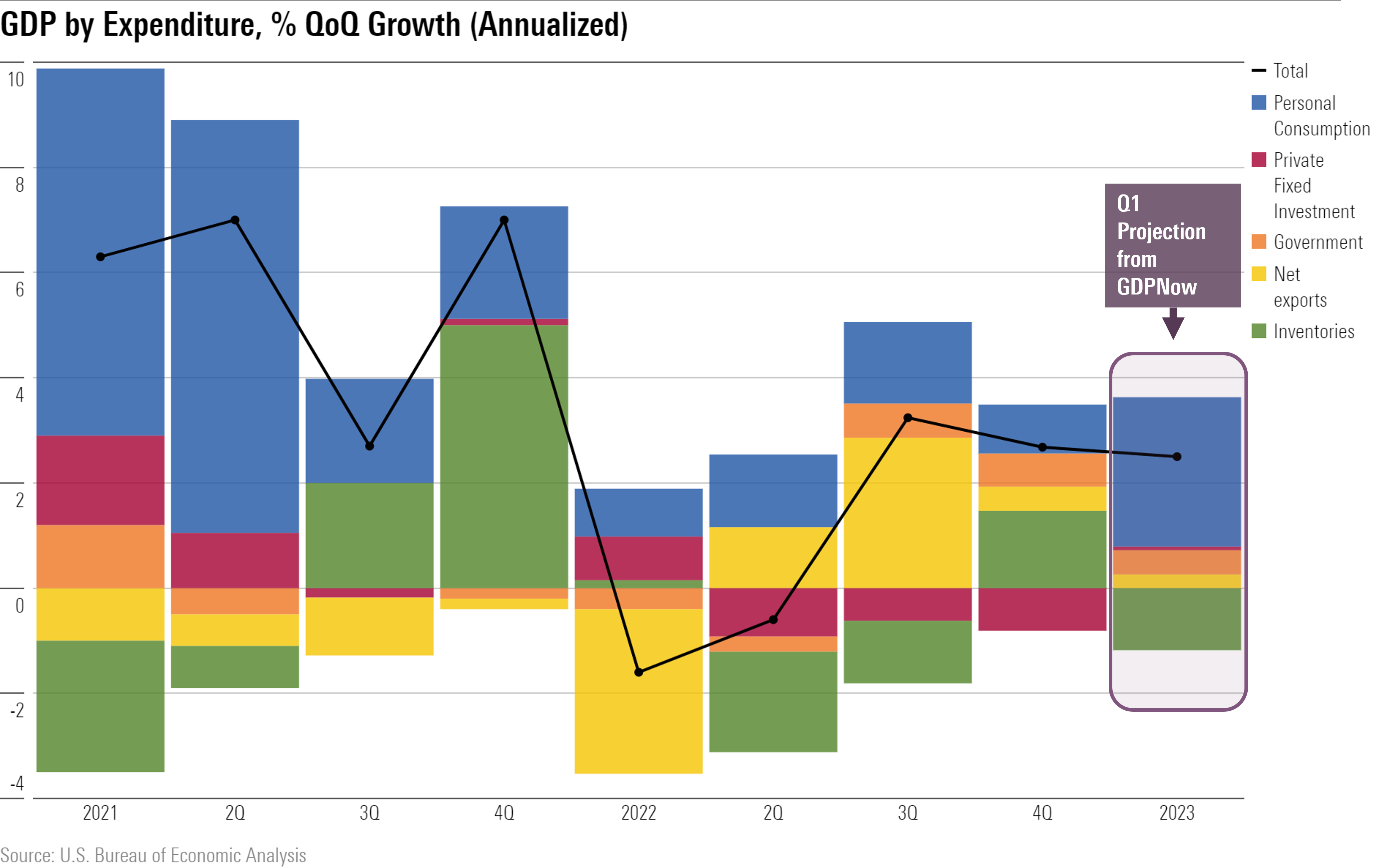

The COVID-19 pandemic dealt an unprecedented shock to the US financial system. The GDP chart reveals a dramatic decline within the second quarter of 2020, reflecting the widespread lockdowns, enterprise closures, and disruptions to provide chains. The federal government responded with huge fiscal stimulus packages, together with direct funds to people and companies, aimed toward mitigating the financial influence of the pandemic. The restoration from the pandemic-induced recession was remarkably swift, pushed by pent-up demand, authorities spending, and a fast rollout of vaccines. Nonetheless, the restoration has been uneven, with sure sectors experiencing quicker progress than others. Inflation surged within the aftermath of the pandemic, posing a brand new problem for policymakers.

Underlying Components Shaping the GDP Chart:

A number of underlying elements have formed the trajectory of the US GDP chart over the previous twenty years:

- Technological Innovation: Technological developments have persistently pushed productiveness positive aspects and financial progress. The rise of the web, cell expertise, and synthetic intelligence have remodeled industries and created new alternatives.

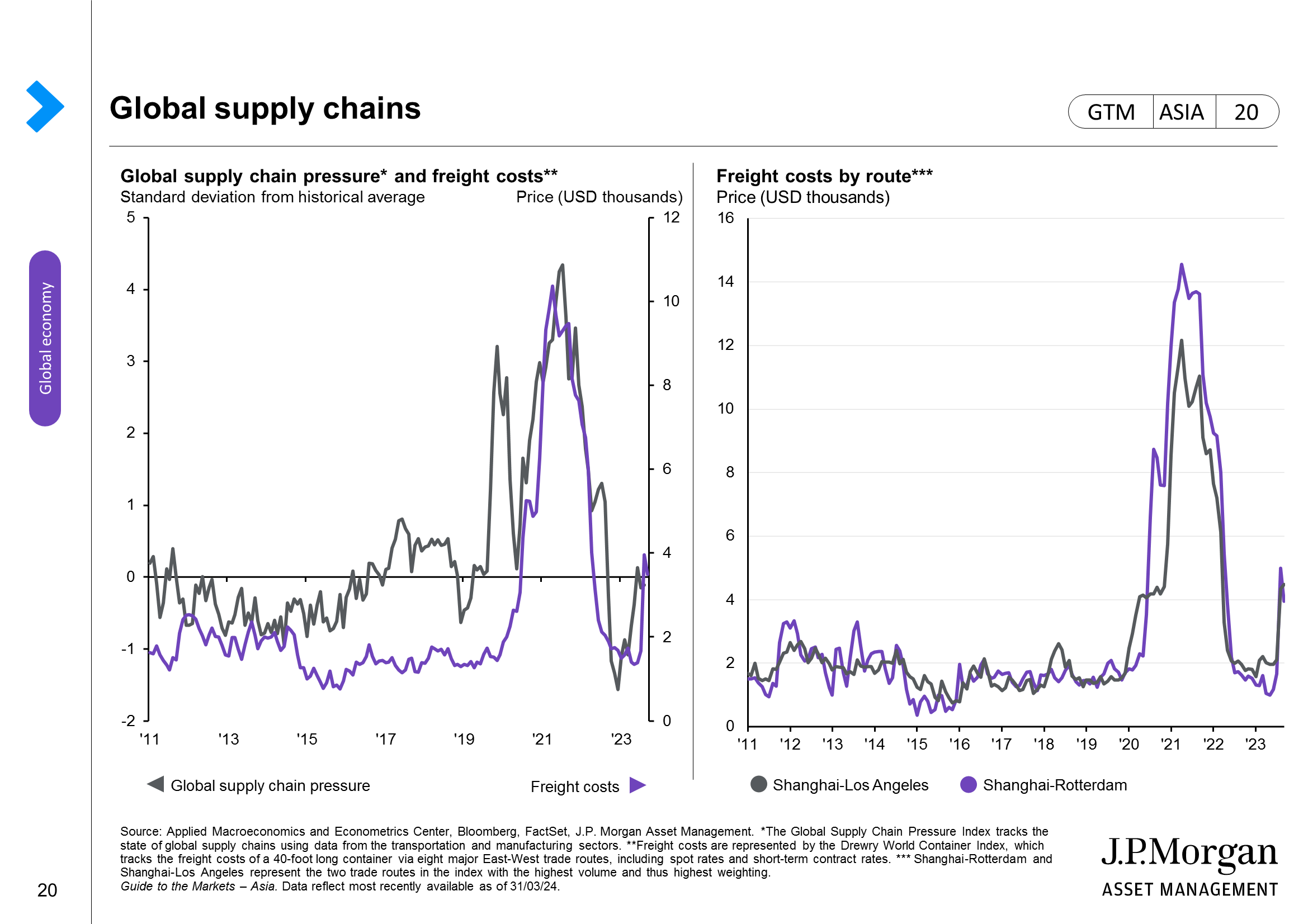

- Globalization: Elevated worldwide commerce and funding have contributed to each financial progress and elevated competitors. Nonetheless, globalization has additionally led to considerations about job displacement and earnings inequality.

- Financial Coverage: The Federal Reserve’s financial coverage choices, together with rate of interest changes and quantitative easing, have performed a big position in influencing financial progress and inflation.

- Fiscal Coverage: Authorities spending and taxation insurance policies have influenced mixture demand and financial exercise. Fiscal stimulus packages have been used to deal with financial downturns, however they will additionally contribute to authorities debt.

- Demographic Shifts: Adjustments within the inhabitants measurement, age construction, and labor pressure participation charges have influenced financial progress and productiveness.

- Geopolitical Occasions: International occasions, such because the Nice Recession, the COVID-19 pandemic, and geopolitical tensions, can considerably influence the US financial system.

Conclusion:

The US GDP chart over the previous twenty years reveals a dynamic and sophisticated financial panorama. Durations of strong progress have been punctuated by important financial shocks, highlighting the inherent volatility of the financial system. Understanding the underlying elements which have formed the GDP chart is essential for policymakers, companies, and people alike. Trying forward, the US financial system faces quite a few challenges, together with inflation, provide chain disruptions, and geopolitical uncertainty. The power to navigate these challenges shall be essential in guaranteeing continued financial progress and prosperity. Additional evaluation of the GDP chart, alongside different financial indicators, shall be important in monitoring the well being of the US financial system and informing coverage choices. The continued evolution of the GDP chart serves as a continuing reminder of the dynamic and ever-changing nature of the American financial system, demanding steady adaptation and strategic planning to make sure long-term stability and progress.

Closure

Thus, we hope this text has supplied useful insights into Decoding the American GDP Chart: A Two-Decade Journey of Financial Progress and Volatility. We recognize your consideration to our article. See you in our subsequent article!