Decoding The AUD/USD Stay Chart: A Complete Information For Merchants

Decoding the AUD/USD Stay Chart: A Complete Information for Merchants

Associated Articles: Decoding the AUD/USD Stay Chart: A Complete Information for Merchants

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Decoding the AUD/USD Stay Chart: A Complete Information for Merchants. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding the AUD/USD Stay Chart: A Complete Information for Merchants

The Australian greenback (AUD) in opposition to the US greenback (USD), represented as AUD/USD, is a significant forex pair extremely traded within the foreign exchange market. Its worth fluctuations are influenced by a fancy interaction of financial indicators, geopolitical occasions, and market sentiment. Understanding the AUD/USD dwell chart requires extra than simply glancing on the worth; it entails analyzing varied technical and elementary elements to successfully predict worth actions and make knowledgeable buying and selling choices. This text delves deep into deciphering the AUD/USD dwell chart, inspecting the important thing elements influencing its dynamics, and offering methods for profitable buying and selling.

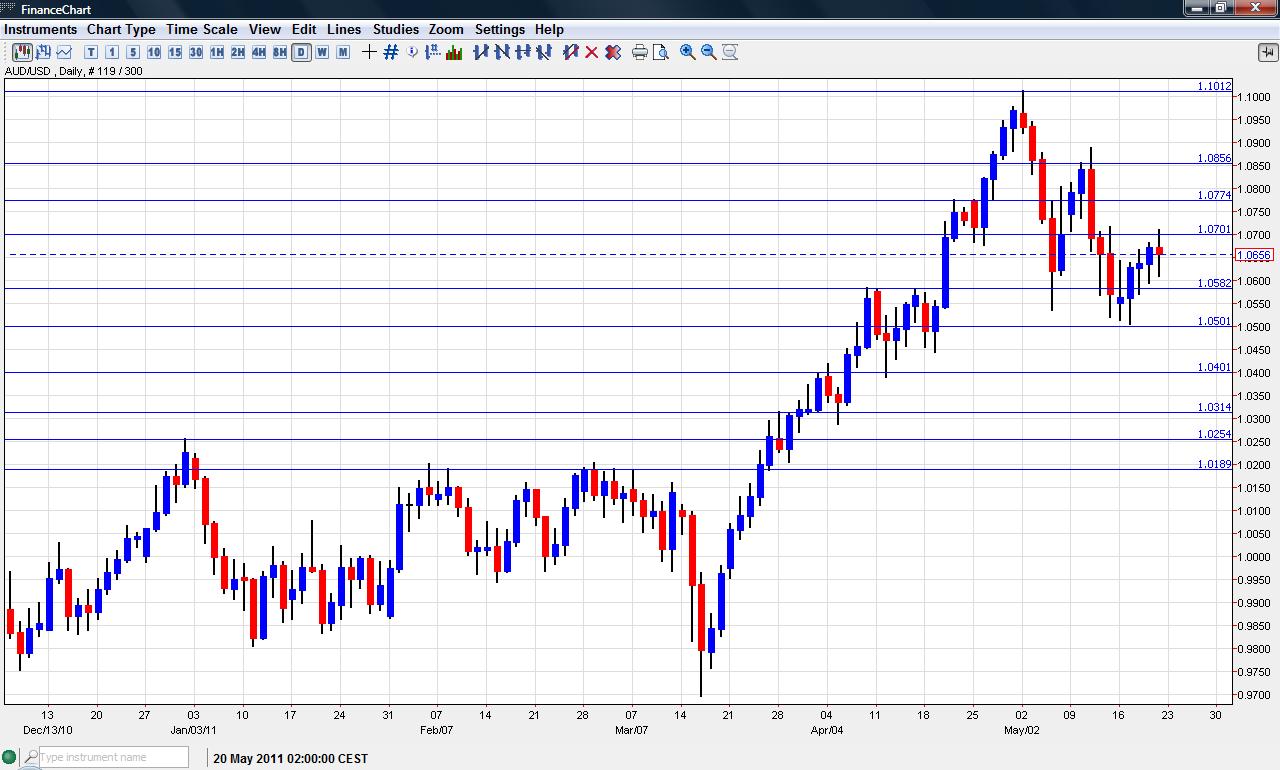

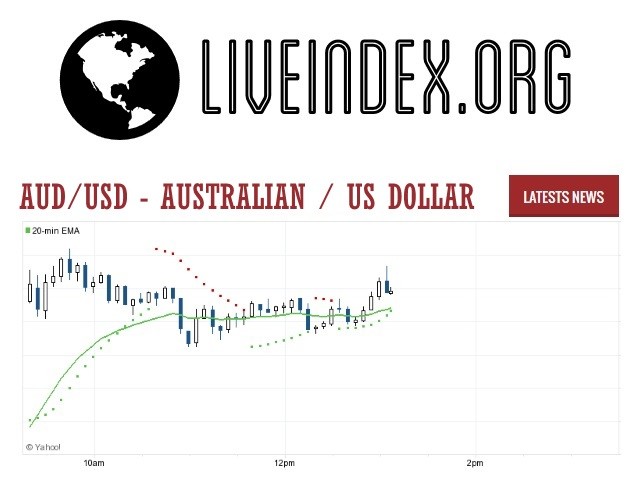

Understanding the AUD/USD Chart:

A dwell AUD/USD chart usually shows the alternate fee’s evolution over time. The vertical axis represents the worth of 1 Australian greenback when it comes to US {dollars}, whereas the horizontal axis represents time, starting from seconds to years relying on the chart’s timeframe. Widespread chart varieties embody candlestick charts, bar charts, and line charts, every providing a novel visible illustration of worth motion. Candlestick charts, specifically, are favoured for his or her potential to convey each worth vary and course inside a selected time interval.

The chart shows varied technical indicators that merchants use to establish potential buying and selling alternatives. These embody:

-

Transferring Averages (MA): These clean out worth fluctuations, highlighting traits. Generally used MAs embody the 50-day, 100-day, and 200-day shifting averages. Crossovers between completely different MAs usually sign potential development reversals or confirmations of current traits.

-

Relative Power Index (RSI): This momentum oscillator measures the pace and alter of worth actions. RSI values above 70 typically point out overbought situations, suggesting a possible worth correction, whereas values beneath 30 counsel oversold situations, probably indicating a worth rebound.

-

MACD (Transferring Common Convergence Divergence): This trend-following momentum indicator identifies adjustments within the power, course, momentum, and period of a development. MACD crossovers, divergences, and histogram evaluation can present precious insights into potential worth actions.

-

Bollinger Bands: These bands signify commonplace deviations from a shifting common, illustrating worth volatility. Worth bounces off the higher or decrease bands can sign potential development reversals or continuation.

-

Fibonacci Retracements: These ranges, primarily based on the Fibonacci sequence, establish potential assist and resistance ranges throughout worth corrections.

Elementary Elements Influencing AUD/USD:

The AUD/USD alternate fee is extremely delicate to elementary financial elements affecting each Australia and the US. Key elements embody:

-

Curiosity Charge Differentials: Variations in rates of interest between Australia and the US considerably influence the AUD/USD. Increased rates of interest in Australia typically appeal to overseas funding, rising demand for the AUD and strengthening its worth in opposition to the USD.

-

Commodity Costs: Australia is a significant exporter of commodities like iron ore, coal, and gold. Rising commodity costs increase Australia’s export income and strengthen the AUD. Conversely, falling commodity costs weaken the AUD.

-

Financial Development: Stronger financial development in Australia relative to the US tends to assist the AUD. Indicators like GDP development, employment knowledge, and client confidence play essential roles.

-

Geopolitical Occasions: World political instability, commerce wars, or main worldwide occasions can considerably influence the AUD/USD. Uncertainty usually results in elevated volatility and may push the AUD both up or down relying on the particular occasion and market sentiment.

-

US Greenback Power: The US greenback is a worldwide reserve forex. Its power or weak spot in opposition to different currencies, together with the AUD, is commonly influenced by elements like US financial knowledge, Federal Reserve coverage, and world threat urge for food. A powerful USD typically weakens the AUD.

-

Central Financial institution Insurance policies: The Reserve Financial institution of Australia (RBA) and the Federal Reserve (Fed) considerably affect the AUD/USD via their financial insurance policies. Modifications in rates of interest, quantitative easing, or ahead steerage can dramatically have an effect on the alternate fee.

Analyzing the AUD/USD Stay Chart: A Sensible Method:

Analyzing the AUD/USD dwell chart successfully requires a mixture of technical and elementary evaluation. Here is a sensible method:

-

Determine the Development: Decide the general development of the AUD/USD utilizing shifting averages, development strains, and different technical indicators. Is the pair in an uptrend, downtrend, or sideways vary?

-

Determine Help and Resistance Ranges: Pinpoint key assist and resistance ranges on the chart. These ranges signify worth areas the place the worth is more likely to discover patrons (assist) or sellers (resistance). Breaks of those ranges can sign vital worth actions.

-

Use Technical Indicators: Make use of technical indicators like RSI, MACD, and Bollinger Bands to verify the development, establish potential overbought or oversold situations, and gauge momentum.

-

Monitor Financial Knowledge: Keep up to date on key financial knowledge releases from Australia and the US. Unexpectedly robust or weak knowledge can set off vital worth actions.

-

Take into account Geopolitical Elements: Pay attention to main geopolitical occasions that would influence the AUD/USD. These occasions can introduce vital volatility and create buying and selling alternatives.

-

Handle Danger: Implement correct threat administration strategies, together with stop-loss orders and place sizing, to guard your capital from potential losses. By no means threat greater than you’ll be able to afford to lose.

Buying and selling Methods for AUD/USD:

A number of buying and selling methods may be employed when buying and selling the AUD/USD pair. These embody:

-

Development Following: This technique entails figuring out the prevailing development and driving the wave. Merchants use technical indicators to verify the development and place trades within the course of the development.

-

Imply Reversion: This technique entails figuring out overbought or oversold situations and anticipating a worth reversal again in direction of the imply. RSI and Bollinger Bands are generally used on this technique.

-

Breakout Buying and selling: This technique entails figuring out potential breakouts from established assist or resistance ranges. A profitable breakout can sign a big worth transfer within the course of the breakout.

-

Scalping: This short-term technique entails taking small income from minor worth fluctuations inside a brief timeframe. It requires fast decision-making and shut monitoring of the chart.

Conclusion:

The AUD/USD dwell chart is a dynamic and complicated panorama influenced by a mess of things. Profitable buying and selling requires a radical understanding of each technical and elementary evaluation, coupled with efficient threat administration. By diligently learning the chart, monitoring financial knowledge, and staying knowledgeable about geopolitical occasions, merchants can enhance their possibilities of making knowledgeable buying and selling choices and navigating the intricacies of the AUD/USD forex pair. Bear in mind, constant studying, apply, and self-discipline are essential for long-term success in foreign currency trading. At all times contemplate looking for recommendation from a professional monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has offered precious insights into Decoding the AUD/USD Stay Chart: A Complete Information for Merchants. We respect your consideration to our article. See you in our subsequent article!