Decoding The Naked Vibrant Copper Value Chart: A Complete Evaluation

Decoding the Naked Vibrant Copper Value Chart: A Complete Evaluation

Associated Articles: Decoding the Naked Vibrant Copper Value Chart: A Complete Evaluation

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Decoding the Naked Vibrant Copper Value Chart: A Complete Evaluation. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding the Naked Vibrant Copper Value Chart: A Complete Evaluation

Naked brilliant copper, a extremely pure type of copper with a shiny, uncoated floor, is a vital commodity in quite a few industries. Its value, subsequently, acts as a major financial indicator, reflecting world financial well being, industrial exercise, and geopolitical occasions. Understanding the fluctuations depicted in a naked brilliant copper value chart requires a multifaceted method, contemplating each short-term market dynamics and long-term tendencies. This text delves into the intricacies of deciphering these charts, exploring the important thing elements influencing value actions and providing insights into forecasting future tendencies.

Understanding the Value Chart:

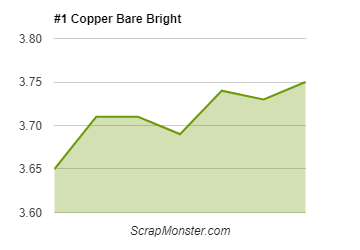

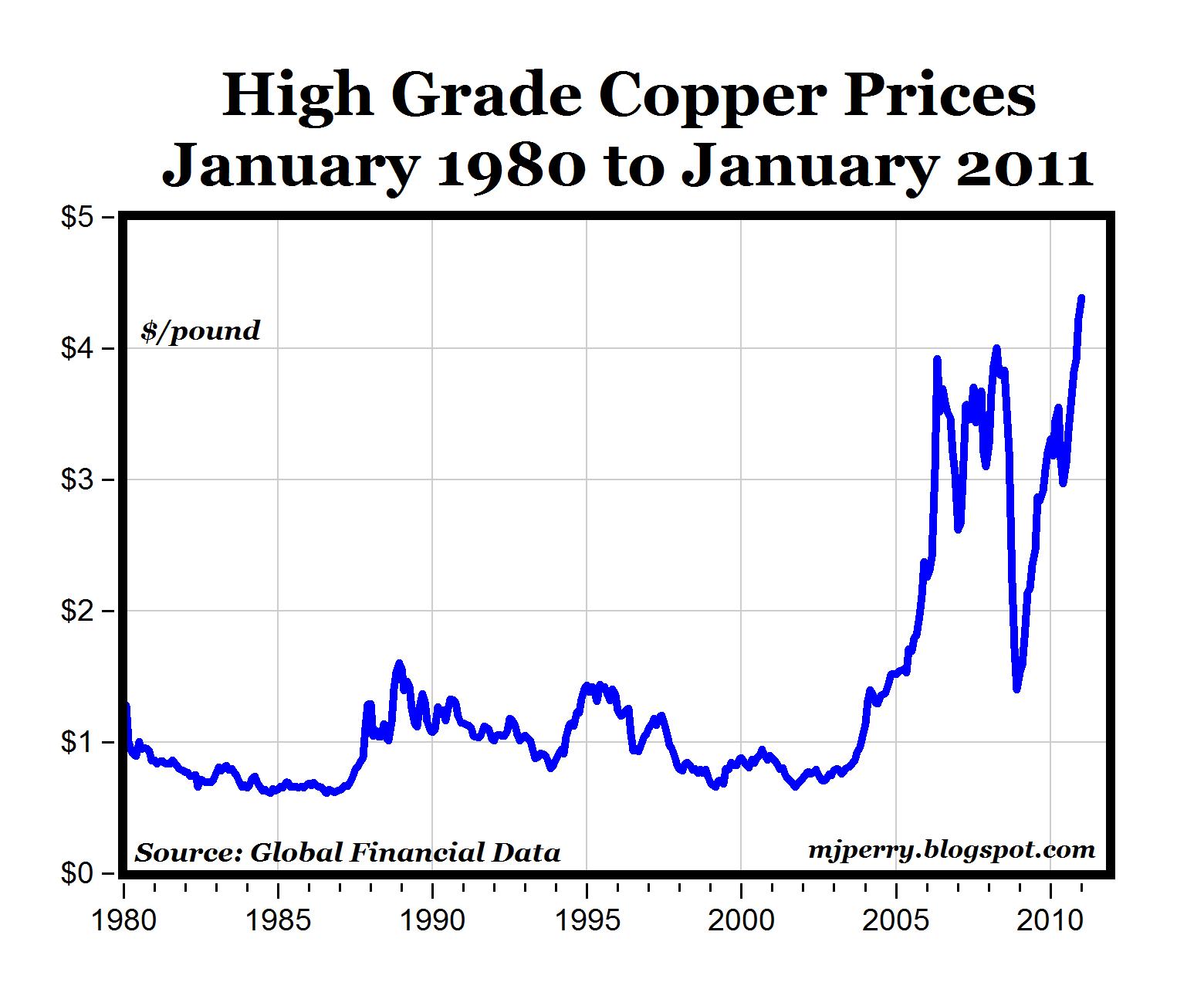

A naked brilliant copper value chart usually shows the value of copper (usually expressed in US {dollars} per pound or tonne) over a selected interval. This era can vary from a couple of days to a number of many years, permitting for evaluation of short-term volatility and long-term value patterns. The chart generally makes use of line graphs, candlestick charts, or bar charts to visualise value modifications. Key components to watch embody:

- Value Axis: Represents the value of naked brilliant copper at completely different time limits.

- Time Axis: Represents the time interval coated by the chart (e.g., day by day, weekly, month-to-month, yearly).

- Value Traits: Identifies upward (bullish), downward (bearish), or sideways (consolidation) actions within the value.

- Help and Resistance Ranges: These are value ranges the place the value has traditionally struggled to interrupt by means of, both on the upside (resistance) or the draw back (assist). Breaks above resistance or beneath assist usually sign important value actions.

- Shifting Averages: These are calculated averages of costs over a selected interval (e.g., 50-day, 200-day transferring common). They assist clean out short-term fluctuations and determine underlying tendencies.

- Indicators: Technical indicators like Relative Energy Index (RSI), Shifting Common Convergence Divergence (MACD), and Bollinger Bands can present further insights into value momentum, development energy, and potential reversals.

Elements Influencing Naked Vibrant Copper Costs:

The value of naked brilliant copper is influenced by a posh interaction of things, broadly categorized as:

1. Provide and Demand Dynamics:

- International Copper Manufacturing: Modifications in mine manufacturing on account of elements like climate circumstances, labor disputes, mine closures, and technological developments instantly influence provide. Elevated manufacturing typically results in decrease costs, whereas diminished manufacturing pushes costs greater.

- Copper Consumption: International financial development is a serious driver of copper demand. Sturdy development in building, manufacturing, and electronics sectors will increase demand, pushing costs upward. Conversely, financial slowdowns or recessions scale back demand, main to cost declines.

- Stock Ranges: Excessive stock ranges counsel ample provide, placing downward strain on costs. Conversely, low stock ranges point out tight provide, doubtlessly driving costs greater. Alternate inventories like these on the London Steel Alternate (LME) are carefully watched.

- Scrap Copper: The supply and value of scrap copper, which is recycled and reused, additionally affect the market. Elevated scrap provide can put downward strain on costs for major copper.

2. Geopolitical Elements:

- Political Instability: Political instability in main copper-producing nations can disrupt provide chains and result in value will increase.

- Commerce Wars and Tariffs: Commerce disputes and tariffs can influence the move of copper throughout borders, affecting each provide and demand.

- Forex Fluctuations: Modifications within the worth of the US greenback, the forex by which copper is primarily traded, have an effect on the value. A stronger greenback typically results in decrease copper costs for consumers utilizing different currencies.

3. Technological Developments:

- New Mining Applied sciences: Advances in mining know-how can enhance effectivity and manufacturing, doubtlessly resulting in decrease copper costs.

- Substitute Supplies: The event of substitute supplies for copper in sure functions can scale back demand and put downward strain on costs.

4. Hypothesis and Funding:

- Futures Market Exercise: Buying and selling on futures markets, the place buyers wager on future value actions, can considerably influence short-term value volatility. Massive speculative positions can amplify value swings.

- Alternate-Traded Funds (ETFs): ETFs that observe copper costs enable buyers to simply spend money on the commodity, influencing demand and costs.

Deciphering the Chart and Forecasting Future Costs:

Analyzing a naked brilliant copper value chart requires a mixture of technical and basic evaluation.

- Technical Evaluation: This entails finding out value charts to determine patterns, tendencies, and assist/resistance ranges. Technical indicators will help predict potential value actions. Nevertheless, technical evaluation shouldn’t be foolproof and must be used together with basic evaluation.

- Elementary Evaluation: This entails analyzing the underlying financial and geopolitical elements affecting copper provide and demand. Understanding these elements can present a greater understanding of long-term value tendencies.

Forecasting future copper costs is inherently difficult because of the multitude of interacting elements. Nevertheless, by fastidiously analyzing the value chart, understanding the important thing influencing elements, and incorporating each technical and basic evaluation, one can develop knowledgeable predictions. It is essential to keep in mind that forecasting entails inherent uncertainty, and no prediction is assured to be correct.

Conclusion:

The naked brilliant copper value chart serves as a priceless device for understanding the dynamics of this important commodity market. By fastidiously finding out the chart and contemplating the assorted elements influencing copper costs, companies, buyers, and policymakers can acquire insights into market tendencies and make knowledgeable selections. Whereas predicting future costs with certainty is not possible, a complete understanding of the market’s complexities will increase the probability of constructing sound judgments on this dynamic and ever-evolving sector. Steady monitoring of world financial indicators, geopolitical occasions, and technological developments is essential for staying forward within the copper market. Moreover, incorporating various analytical views, together with knowledgeable opinions and trade studies, can improve the accuracy of value forecasts and danger administration methods. The naked brilliant copper value chart, subsequently, shouldn’t be merely a visible illustration of value fluctuations, however a window into the intricate interaction of world forces shaping the financial panorama.

Closure

Thus, we hope this text has offered priceless insights into Decoding the Naked Vibrant Copper Value Chart: A Complete Evaluation. We hope you discover this text informative and helpful. See you in our subsequent article!