Decoding The Bitcoin Worth Chart On TradingView: A Complete Information

Decoding the Bitcoin Worth Chart on TradingView: A Complete Information

Associated Articles: Decoding the Bitcoin Worth Chart on TradingView: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Bitcoin Worth Chart on TradingView: A Complete Information. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Decoding the Bitcoin Worth Chart on TradingView: A Complete Information

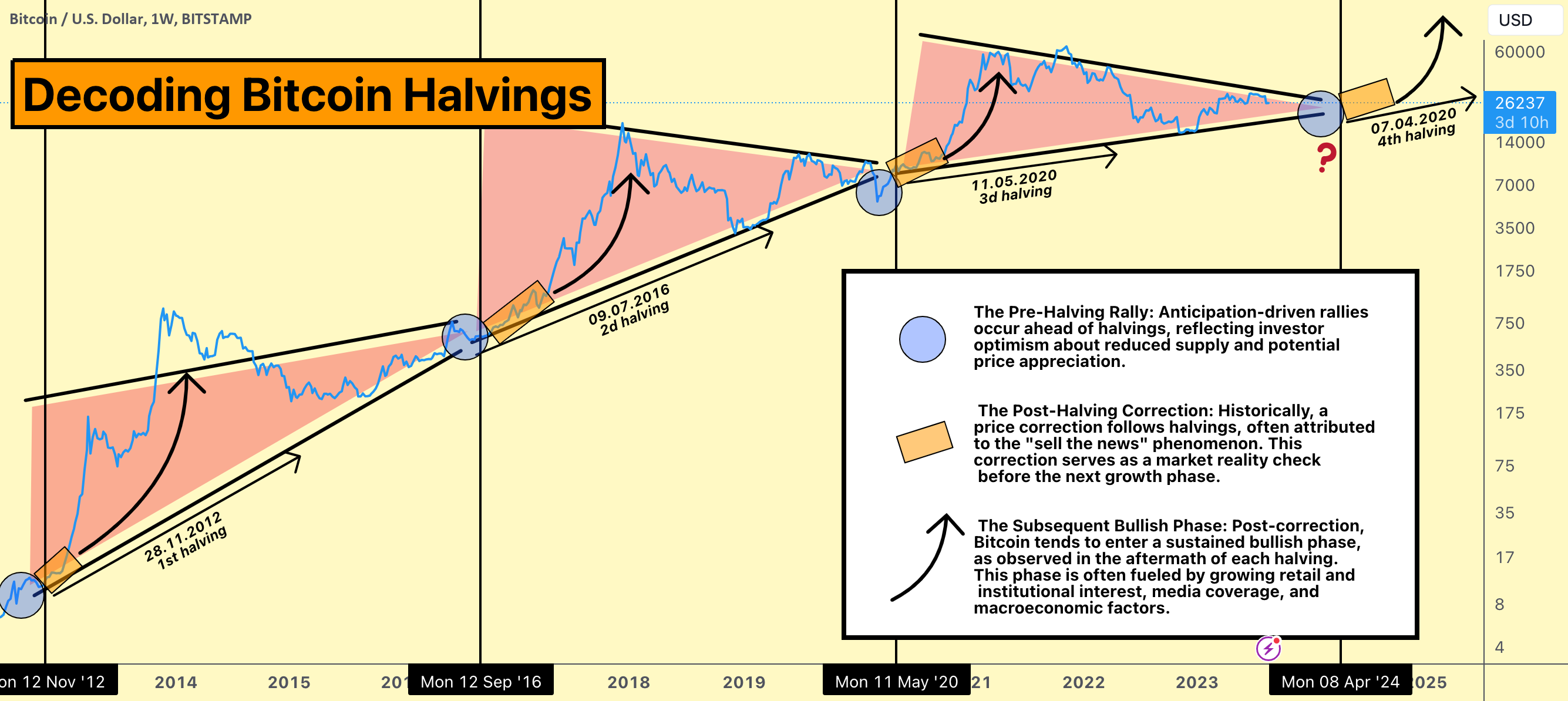

Bitcoin, the pioneering cryptocurrency, has captivated traders and technologists alike with its risky value actions and disruptive potential. Understanding its value motion is essential for anybody venturing into the cryptocurrency market, and TradingView, a preferred charting platform, offers a superb instrument for this objective. This text delves deep into deciphering the Bitcoin value chart on TradingView, exploring varied indicators, chart patterns, and techniques to reinforce your buying and selling choices.

I. Navigating the TradingView Bitcoin Chart:

TradingView gives a user-friendly interface, permitting you to customise your Bitcoin chart extensively. The default view usually shows the value in USD, however you possibly can simply change this to different fiat currencies and even different cryptocurrencies. Key parts of the chart embrace:

-

Worth Candlesticks/Bars: These signify the value motion over a particular timeframe (e.g., 1-minute, 1-hour, 1-day). Every candlestick/bar exhibits the open, excessive, low, and shutting value. Understanding candlestick patterns (e.g., hammer, engulfing, doji) is key to technical evaluation.

-

Shifting Averages (MAs): These clean out value fluctuations, revealing underlying traits. Frequent MAs embrace the easy transferring common (SMA) and exponential transferring common (EMA). Crossovers between totally different MAs (e.g., a 50-day MA crossing above a 200-day MA) can sign potential development adjustments.

-

Quantity: Buying and selling quantity signifies the variety of Bitcoin traded throughout a particular interval. Excessive quantity accompanying a value transfer confirms the power of the development, whereas low quantity suggests weak spot. TradingView means that you can show quantity as a separate histogram beneath the value chart.

-

Indicators: TradingView boasts an enormous library of technical indicators, starting from oscillators (RSI, MACD) to trend-following indicators (ADX, Parabolic SAR). These instruments present further insights into momentum, overbought/oversold situations, and potential development reversals. Experimenting with totally different indicators and discovering those who fit your buying and selling model is essential.

-

Drawing Instruments: TradingView gives a set of drawing instruments, together with development traces, Fibonacci retracements, assist/resistance ranges, and channels. These instruments assist determine potential value targets, assist and resistance areas, and potential development continuations or reversals.

II. Key Technical Indicators and Their Utility to Bitcoin:

A number of technical indicators are significantly helpful when analyzing the Bitcoin value chart on TradingView:

-

Relative Power Index (RSI): This oscillator measures the magnitude of current value adjustments to judge overbought or oversold situations. Readings above 70 usually recommend overbought situations, whereas readings beneath 30 point out oversold situations. Divergences between the RSI and value will also be vital buying and selling indicators.

-

Shifting Common Convergence Divergence (MACD): This indicator identifies momentum adjustments by evaluating two transferring averages. Crossovers of the MACD line above the sign line recommend bullish momentum, whereas crossovers beneath recommend bearish momentum. MACD histograms can additional amplify these indicators.

-

Common Directional Index (ADX): This indicator measures the power of a development. Readings above 25 usually point out a robust development, whereas readings beneath 20 recommend a weak or ranging market.

-

Bollinger Bands: These bands plot customary deviations round a transferring common, highlighting value volatility. Worth bounces off the higher or decrease bands can point out potential reversals.

-

Fibonacci Retracements: Primarily based on the Fibonacci sequence, these retracements determine potential assist and resistance ranges throughout value corrections. They’re significantly helpful in figuring out potential entry and exit factors inside a development.

III. Recognizing Chart Patterns on TradingView:

Chart patterns present helpful insights into potential value actions. TradingView means that you can simply determine and draw these patterns:

-

Head and Shoulders: This reversal sample suggests a possible development change. A transparent "head" and two "shoulders" formation signifies a possible bearish reversal. The neckline acts as an important assist/resistance stage.

-

Double Tops/Bottoms: These patterns signify potential development reversals. A double prime suggests a possible bearish reversal, whereas a double backside suggests a bullish reversal. The neckline acts as an important assist/resistance stage.

-

Triangles: These patterns recommend consolidation intervals. Breakouts from triangles can point out a continuation or reversal of the prevailing development. Symmetrical triangles are impartial, whereas ascending triangles are bullish and descending triangles are bearish.

-

Flags and Pennants: These patterns signify short-term pauses inside a robust development. Breakouts from these patterns usually sign a continuation of the prevailing development.

IV. Combining Indicators and Chart Patterns for Efficient Buying and selling:

Efficient Bitcoin buying and selling on TradingView includes combining totally different indicators and chart patterns to verify potential buying and selling indicators. For instance, a bearish head and shoulders sample confirmed by a bearish crossover on the MACD and an RSI studying above 70 might sign a robust bearish reversal. At all times keep in mind that no single indicator or sample ensures success. Combining a number of confirmations considerably reduces the chance of false indicators.

V. Danger Administration and Buying and selling Methods:

Profitable Bitcoin buying and selling on TradingView depends closely on threat administration:

-

Place Sizing: By no means threat greater than a small proportion of your buying and selling capital on any single commerce.

-

Cease-Loss Orders: At all times use stop-loss orders to restrict potential losses. Place your stop-loss order beneath a key assist stage or beneath a current swing low.

-

Take-Revenue Orders: Set take-profit orders to safe income as soon as your goal is reached. These may very well be based mostly on Fibonacci retracements, assist/resistance ranges, or different technical indicators.

-

Diversification: Do not put all of your eggs in a single basket. Diversify your portfolio throughout totally different cryptocurrencies and asset lessons to mitigate threat.

VI. Elementary Evaluation and its Function:

Whereas technical evaluation utilizing TradingView is essential, incorporating basic evaluation offers a extra holistic view. Elements comparable to Bitcoin adoption charges, regulatory adjustments, technological developments, and macroeconomic situations considerably affect its value. Staying knowledgeable about these components enhances your technical evaluation and helps you make extra knowledgeable buying and selling choices.

VII. The Significance of Backtesting and Paper Buying and selling:

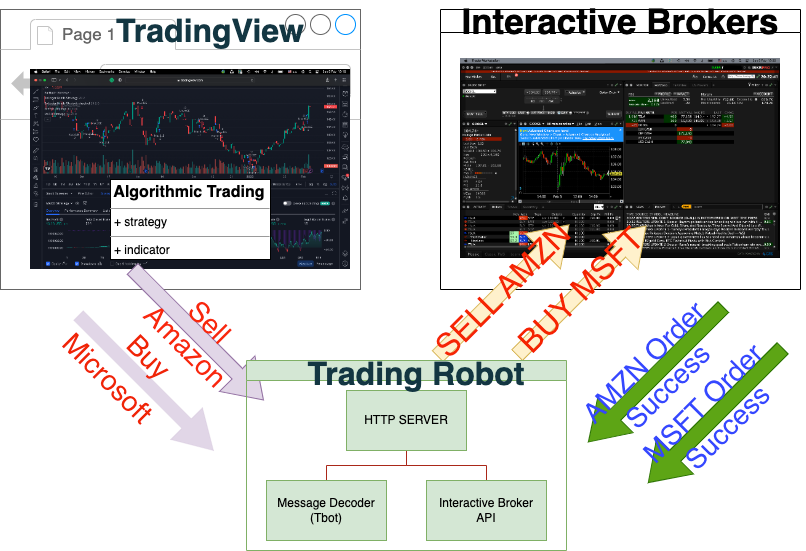

Earlier than risking actual capital, completely backtest your buying and selling methods on historic Bitcoin knowledge utilizing TradingView’s backtesting instruments. Paper buying and selling, simulating trades with out risking actual cash, means that you can refine your methods and construct confidence earlier than committing actual capital.

VIII. Staying Up to date and Adapting to Market Circumstances:

The cryptocurrency market is extremely dynamic. Staying up to date on market information, technological developments, and regulatory adjustments is essential. Be ready to adapt your buying and selling methods as market situations evolve. TradingView’s information feeds and neighborhood discussions may be helpful assets for staying knowledgeable.

Conclusion:

TradingView offers a robust platform for analyzing the Bitcoin value chart and making knowledgeable buying and selling choices. By mastering using its charting instruments, indicators, and drawing instruments, and by combining technical evaluation with basic evaluation and sound threat administration, you possibly can considerably enhance your possibilities of success within the risky however doubtlessly rewarding world of Bitcoin buying and selling. Do not forget that constant studying, adaptation, and self-discipline are key to long-term success on this dynamic market. At all times strategy buying and selling with warning and by no means make investments greater than you possibly can afford to lose.

Closure

Thus, we hope this text has supplied helpful insights into Decoding the Bitcoin Worth Chart on TradingView: A Complete Information. We hope you discover this text informative and useful. See you in our subsequent article!