Decoding The Canadian 10-Yr Bond Chart: A Deep Dive Into Curiosity Charges, Financial Indicators, And Market Sentiment

Decoding the Canadian 10-Yr Bond Chart: A Deep Dive into Curiosity Charges, Financial Indicators, and Market Sentiment

Associated Articles: Decoding the Canadian 10-Yr Bond Chart: A Deep Dive into Curiosity Charges, Financial Indicators, and Market Sentiment

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Canadian 10-Yr Bond Chart: A Deep Dive into Curiosity Charges, Financial Indicators, and Market Sentiment. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Decoding the Canadian 10-Yr Bond Chart: A Deep Dive into Curiosity Charges, Financial Indicators, and Market Sentiment

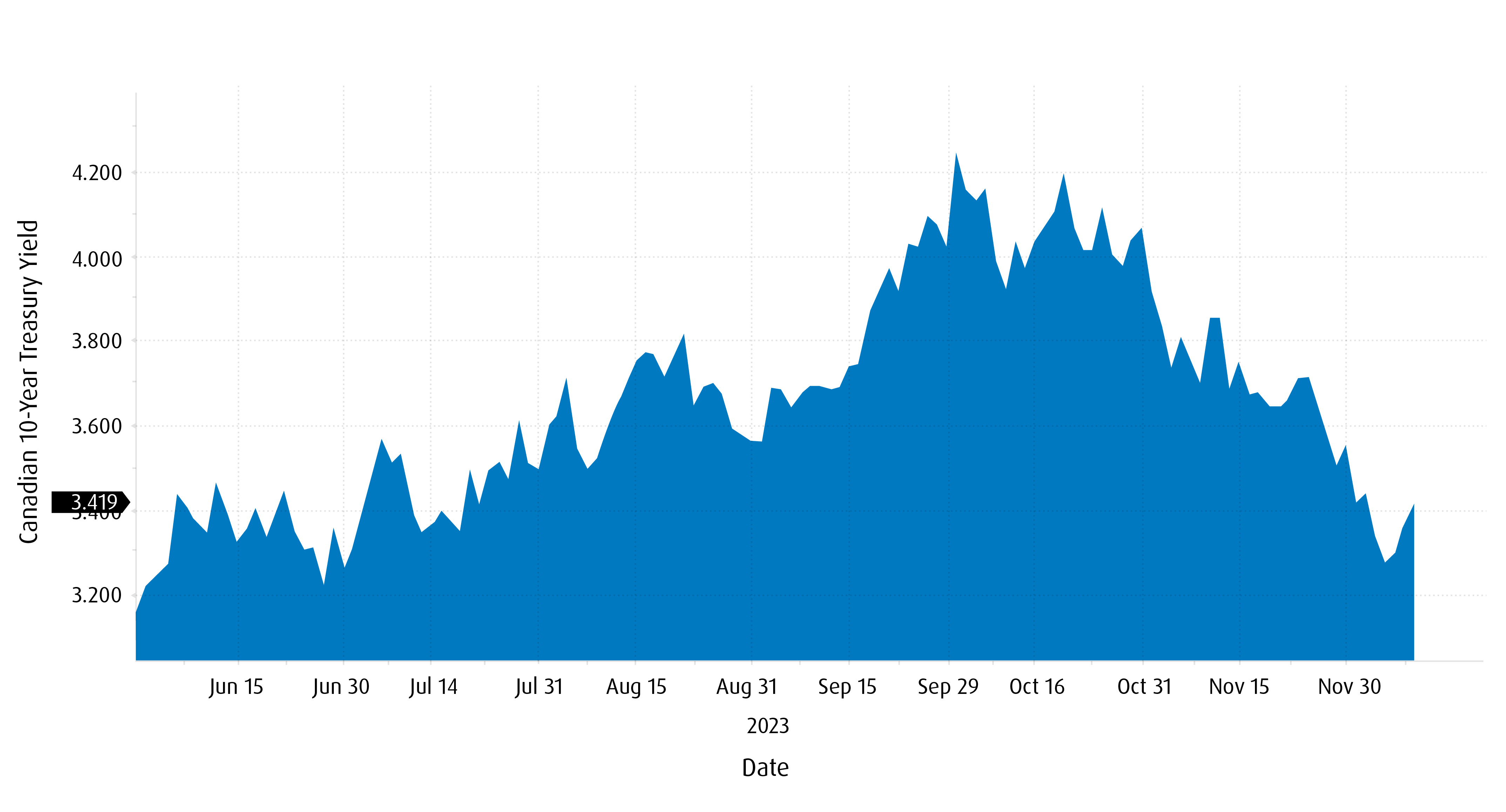

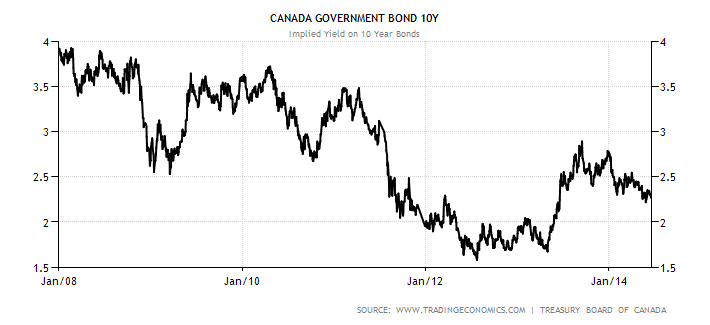

The Canadian 10-year bond, usually represented by the yield on the benchmark 10-year Authorities of Canada bond (CGB), serves as a vital barometer of the Canadian financial system. Its worth actions and yield fluctuations mirror investor sentiment, inflation expectations, and the general well being of the monetary system. Analyzing the historic chart of the Canadian 10-year bond yield supplies helpful insights into previous financial tendencies and may supply clues for predicting future actions, albeit with inherent uncertainties. This text will delve into the intricacies of deciphering the Canadian 10-year bond chart, inspecting its historic efficiency, key influencing components, and the implications for buyers and the broader financial system.

Understanding the Fundamentals: Yield and Value Inverse Relationship

Earlier than diving into the chart evaluation, it is essential to grasp the inverse relationship between bond costs and yields. The yield represents the return an investor receives on a bond, expressed as a share of its face worth. When bond costs rise, yields fall, and vice versa. This inverse relationship stems from the mounted nature of coupon funds (curiosity funds) on a bond. If the worth of a bond will increase, the yield, calculated because the coupon cost divided by the worth, decreases. Conversely, if the worth falls, the yield rises. Subsequently, when deciphering the Canadian 10-year bond chart, a rising yield signifies falling bond costs, suggesting unfavourable market sentiment or expectations of upper rates of interest. Conversely, a falling yield signifies rising bond costs, suggesting optimistic market sentiment or expectations of decrease rates of interest.

Historic Efficiency and Key Turning Factors:

A complete evaluation of the Canadian 10-year bond chart requires inspecting its efficiency over a number of a long time. The chart reveals distinct durations of excessive and low yields, reflecting important financial shifts:

-

Early 2000s: Following the dot-com bubble burst and the 9/11 assaults, yields on Canadian 10-year bonds have been comparatively low, reflecting a interval of financial uncertainty and a flight to security.

-

Mid-2000s to Late 2000s: A interval of financial enlargement led to step by step rising yields, reflecting elevated investor confidence and expectations of upper inflation.

-

World Monetary Disaster (2008-2009): The GFC triggered a pointy decline in yields as buyers sought the security of presidency bonds, mirroring a world development. This era highlights the function of danger aversion in driving bond costs.

-

Submit-GFC Restoration: Following the disaster, yields step by step elevated because the Canadian financial system recovered, reflecting improved financial prospects and elevated inflationary pressures.

-

Quantitative Easing (QE) Period: The implementation of QE applications by the Financial institution of Canada, much like different central banks globally, resulted in a major decline in yields because the central financial institution bought authorities bonds to stimulate the financial system. This artificially suppressed yields, creating a singular setting for bond buyers.

-

Latest Traits (Submit-2010s): Extra just lately, the chart has proven a extra unstable sample, influenced by components reminiscent of world financial uncertainty, fluctuating oil costs (a key part of the Canadian financial system), and altering financial coverage selections by the Financial institution of Canada. The COVID-19 pandemic, as an illustration, led to a different sharp decline in yields as buyers sought security, adopted by a gradual enhance because the financial system started to recuperate.

Key Elements Influencing the Canadian 10-Yr Bond Yield:

A number of key components work together to affect the yield on the Canadian 10-year bond:

-

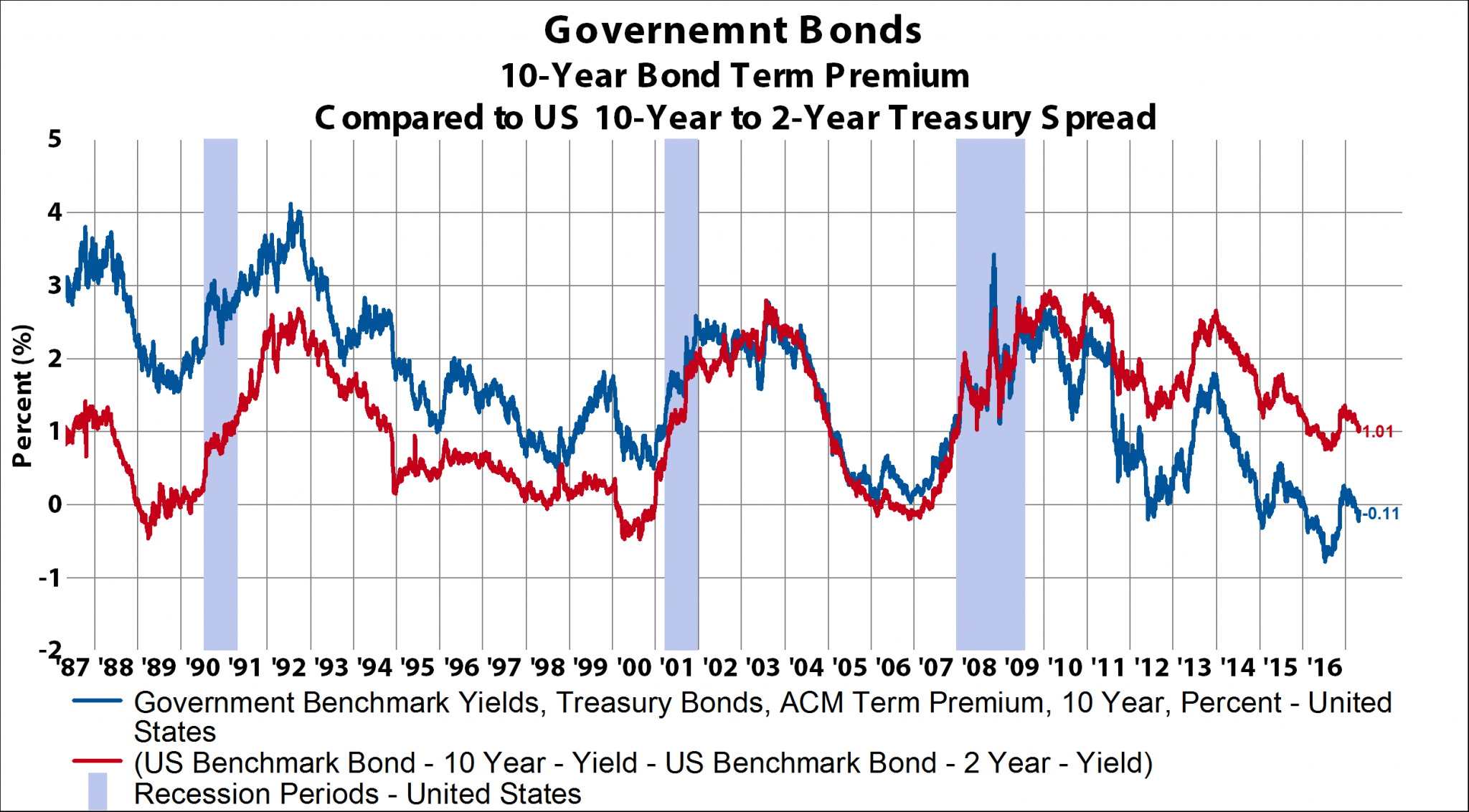

Financial Coverage: The Financial institution of Canada’s rate of interest selections straight affect bond yields. Larger rates of interest usually result in larger bond yields, as buyers demand the next return for lending their cash at elevated danger. Conversely, decrease rates of interest push yields down. The central financial institution’s ahead steering and communication concerning its future coverage intentions additionally play a major function in shaping market expectations and influencing bond yields.

-

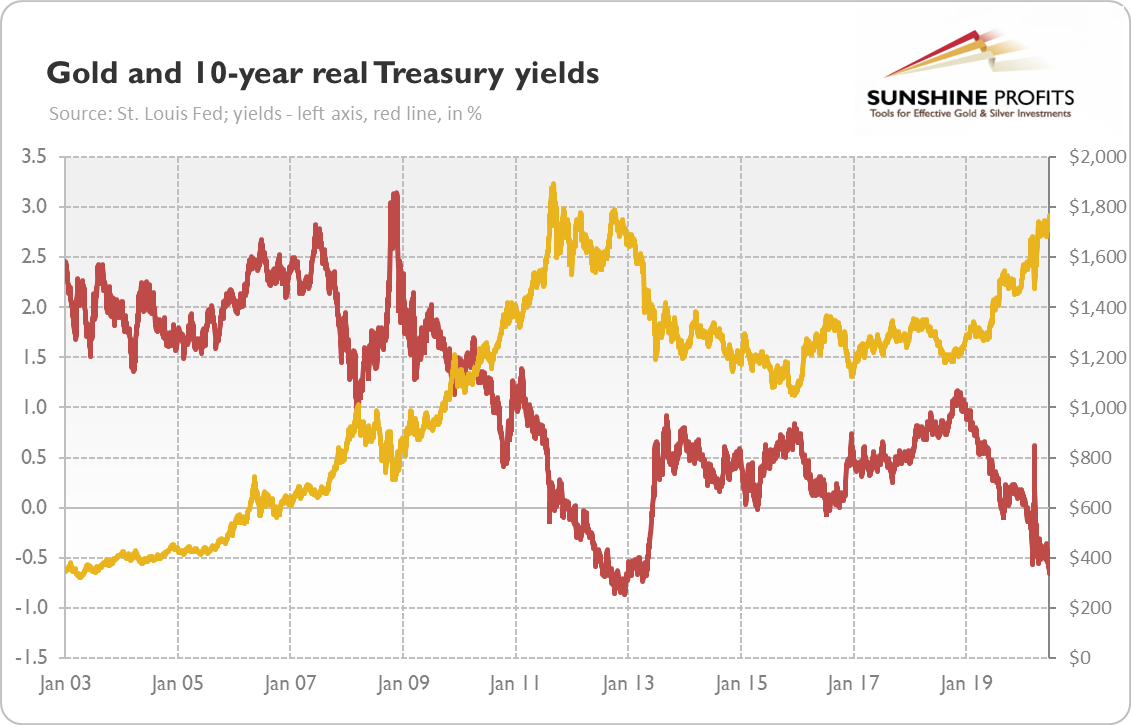

Inflation Expectations: Inflation erodes the buying energy of future bond funds. Subsequently, buyers demand larger yields to compensate for anticipated inflation. The chart usually displays market expectations of future inflation, with rising inflation expectations usually resulting in larger yields and vice versa. Inflation indices, such because the Client Value Index (CPI), are intently watched by buyers and analysts.

-

Financial Progress: Sturdy financial progress usually results in larger rates of interest, as companies and customers borrow more cash. This, in flip, pushes bond yields upward. Conversely, weak financial progress can result in decrease rates of interest and decrease bond yields. Key financial indicators like GDP progress, employment information, and client confidence indices are essential components to contemplate.

-

World Financial Circumstances: The Canadian financial system is intertwined with the worldwide financial system. World financial shocks, reminiscent of monetary crises or geopolitical occasions, can considerably affect investor sentiment and affect bond yields. World danger aversion usually results in a flight to security, pushing down yields on Canadian authorities bonds.

-

Provide and Demand: The availability of Canadian authorities bonds and the demand for them additionally affect yields. Elevated authorities borrowing can enhance the provision of bonds, probably pushing yields larger. Conversely, sturdy demand for bonds, pushed by components like investor danger aversion or low rates of interest elsewhere, can push yields decrease.

-

Oil Costs: Given Canada’s important oil and fuel sector, oil worth fluctuations can have a considerable affect on the financial system and subsequently on bond yields. Larger oil costs usually increase financial progress and may result in larger inflation, leading to larger bond yields. Conversely, decrease oil costs can dampen financial progress and result in decrease yields.

Decoding the Chart: Technical and Elementary Evaluation

Analyzing the Canadian 10-year bond chart entails a mixture of technical and elementary evaluation:

-

Technical Evaluation: This entails finding out the chart’s patterns, tendencies, and indicators to foretell future worth actions. Strategies like transferring averages, help and resistance ranges, and momentum indicators can present insights into potential yield modifications. Nonetheless, technical evaluation alone is inadequate for an entire understanding.

-

Elementary Evaluation: This entails inspecting the underlying financial components that affect bond yields. This consists of analyzing macroeconomic information, financial coverage selections, inflation expectations, and world financial situations. A radical elementary evaluation supplies a context for deciphering the technical indicators noticed on the chart.

Implications for Traders and the Broader Economic system:

The Canadian 10-year bond yield has important implications for varied stakeholders:

-

Traders: Bond yields straight affect the returns on bond investments. Understanding the components influencing yields is essential for making knowledgeable funding selections. Traders want to contemplate their danger tolerance and funding horizon when assessing the attractiveness of Canadian authorities bonds.

-

Companies: Bond yields affect borrowing prices for companies. Larger yields make borrowing dearer, probably impacting funding selections and financial progress.

-

Authorities: Authorities borrowing prices are straight linked to bond yields. Larger yields enhance the price of financing authorities debt, probably impacting fiscal coverage selections.

-

Central Financial institution: The Financial institution of Canada displays bond yields intently to gauge market expectations and the effectiveness of its financial coverage. Bond yields present helpful insights into inflation expectations and the general state of the financial system.

Conclusion:

The Canadian 10-year bond chart is a dynamic instrument that gives helpful insights into the Canadian financial system and the worldwide monetary panorama. By understanding the inverse relationship between bond costs and yields, the historic efficiency of the bond, and the important thing components that affect its yield, buyers, companies, and policymakers can achieve a deeper understanding of market sentiment, financial tendencies, and the general well being of the Canadian financial system. Nonetheless, it is essential to do not forget that predicting future actions with certainty is not possible. A mix of technical and elementary evaluation, coupled with a radical understanding of the financial context, is important for deciphering the chart successfully and making knowledgeable selections. Steady monitoring of the chart and the underlying financial components is essential for navigating the complexities of the bond market.

Closure

Thus, we hope this text has supplied helpful insights into Decoding the Canadian 10-Yr Bond Chart: A Deep Dive into Curiosity Charges, Financial Indicators, and Market Sentiment. We thanks for taking the time to learn this text. See you in our subsequent article!