Decoding The Canadian Value Chart: A Complete Information To Understanding And Using Value Information

Decoding the Canadian Value Chart: A Complete Information to Understanding and Using Value Information

Associated Articles: Decoding the Canadian Value Chart: A Complete Information to Understanding and Using Value Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Canadian Value Chart: A Complete Information to Understanding and Using Value Information. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Decoding the Canadian Value Chart: A Complete Information to Understanding and Using Value Information

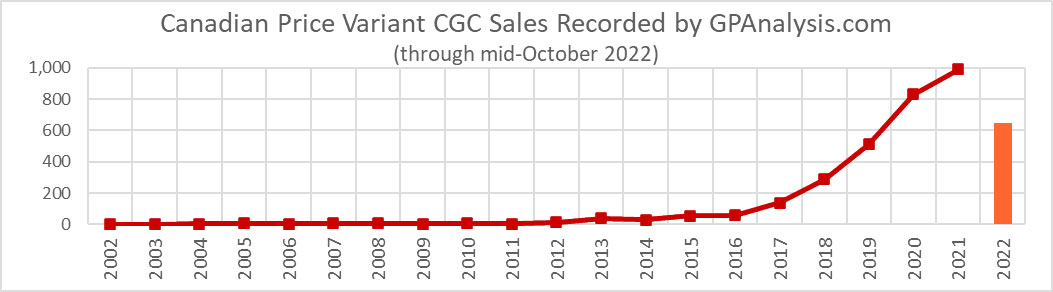

Canada’s financial system, like some other, is a posh tapestry woven with threads of provide, demand, inflation, and world influences. Understanding the nuances of worth adjustments is essential for companies, shoppers, and policymakers alike. This text delves into the intricacies of Canadian worth charts, exploring their building, interpretation, and sensible purposes. We are going to study varied worth indices, focus on the components influencing worth actions, and spotlight the significance of precisely decoding these charts for knowledgeable decision-making.

Understanding Value Indices: The Basis of Canadian Value Charts

Value charts in Canada rely closely on varied worth indices, that are statistical measures monitoring the typical change in costs of a basket of products and providers over time. These indices present a snapshot of inflation and deflation, essential for understanding the general financial well being of the nation. Some key indices embrace:

-

Client Value Index (CPI): That is arguably probably the most broadly adopted worth index in Canada. Calculated by Statistics Canada, the CPI tracks the typical change in costs paid by city shoppers for a consultant basket of shopper items and providers. It is used as a benchmark for inflation measurement, impacting every little thing from rates of interest to authorities insurance policies. The CPI is damaged down into varied parts, permitting for an in depth evaluation of worth adjustments throughout totally different sectors, resembling meals, housing, transportation, and recreation.

-

Producer Value Index (PPI): Not like the CPI, the PPI focuses on the typical change in costs acquired by home producers for his or her output. It offers insights into the price pressures confronted by companies and is usually a main indicator of future CPI adjustments. A rising PPI usually suggests potential future will increase in shopper costs.

-

New Housing Value Index (NHPI): This index particularly tracks the worth adjustments of recent houses bought in Canada. It’s a vital indicator for the housing market and offers priceless info for actual property traders, builders, and policymakers involved about housing affordability.

-

Import and Export Value Indices: These indices monitor the worth adjustments of imported and exported items, respectively. They supply insights into the influence of worldwide commerce on home costs and are important for understanding Canada’s worldwide commerce dynamics.

Establishing and Decoding Value Charts

Value charts are visible representations of worth index knowledge over time. They usually make the most of line graphs, displaying the index worth on the vertical axis and time (often months or years) on the horizontal axis. A number of key parts are important for decoding these charts successfully:

-

Development Traces: These traces spotlight the general course of worth actions (upward, downward, or sideways). Figuring out development traces helps in forecasting future worth actions, though it is essential to keep in mind that these are solely predictions and never ensures.

-

Help and Resistance Ranges: These characterize worth ranges the place the worth has traditionally struggled to interrupt by means of. Help ranges point out worth flooring, whereas resistance ranges characterize worth ceilings. Figuring out these ranges can help in buying and selling selections and predicting potential worth reversals.

-

Volatility: This refers back to the extent of worth fluctuations. Excessive volatility suggests vital worth swings, whereas low volatility signifies comparatively steady costs. Understanding volatility is essential for danger administration, particularly in funding selections.

-

Seasonality: Sure items and providers exhibit seasonal worth fluctuations. As an illustration, vitality costs may be increased in winter as a result of elevated demand. Accounting for seasonality is essential for correct interpretation of worth developments.

-

Information Smoothing Strategies: Typically, uncooked worth knowledge might be noisy and troublesome to interpret. Strategies like shifting averages can easy out the fluctuations, revealing underlying developments extra clearly.

Elements Influencing Canadian Value Charts

Quite a few components affect the actions depicted in Canadian worth charts. These might be broadly categorized as:

-

Financial Elements: Adjustments in rates of interest, financial progress, unemployment ranges, and shopper confidence considerably influence costs. Sturdy financial progress usually results in elevated demand and better costs, whereas financial downturns may end up in decrease costs.

-

Provide and Demand: The basic precept of economics dictates that costs rise when demand exceeds provide and fall when provide exceeds demand. Disruptions to produce chains, pure disasters, or geopolitical occasions can drastically influence costs.

-

Authorities Insurance policies: Authorities rules, taxes, subsidies, and financial insurance policies all play a job in shaping worth actions. For instance, carbon taxes can improve vitality costs, whereas subsidies can decrease the costs of sure items.

-

World Elements: Canada’s financial system is intertwined with the worldwide financial system. Adjustments in world commodity costs, trade charges, and worldwide commerce agreements considerably affect Canadian worth charts. For instance, fluctuations within the worth of oil, a key Canadian export, instantly influence the general worth stage.

-

Technological Developments: Technological improvements can have an effect on costs in varied methods. Technological developments can improve productiveness, doubtlessly decreasing costs, whereas the introduction of recent applied sciences would possibly initially result in increased costs.

Sensible Functions of Canadian Value Charts

Understanding and using Canadian worth charts has vital implications for varied stakeholders:

-

Customers: Monitoring CPI knowledge permits shoppers to watch inflation and make knowledgeable selections about spending and saving. Understanding worth developments might help shoppers establish alternatives to economize by buying items and providers at optimum occasions.

-

Companies: Companies use worth indices to trace enter prices, alter pricing methods, and forecast future revenues. Understanding worth developments is essential for stock administration, manufacturing planning, and funding selections.

-

Buyers: Value charts are important instruments for traders to investigate market developments and make knowledgeable funding selections. Understanding worth actions might help traders establish alternatives for revenue and handle danger successfully.

-

Policymakers: Authorities policymakers use worth indices to evaluate the effectiveness of financial insurance policies, monitor inflation, and design acceptable interventions to stabilize the financial system. Understanding worth developments is essential for formulating fiscal and financial insurance policies.

Conclusion: Navigating the Complexity of Canadian Value Charts

Canadian worth charts provide a priceless window into the nation’s financial well being and supply essential info for a variety of stakeholders. Whereas decoding these charts requires understanding the underlying knowledge, methodologies, and influencing components, the insights gained are invaluable for knowledgeable decision-making. By combining information of financial ideas with a radical evaluation of worth knowledge, people, companies, and policymakers can higher navigate the complexities of the Canadian financial system and make strategic decisions for the longer term. You will need to keep in mind that worth charts are instruments, and their efficient use requires crucial considering, a holistic perspective, and a consideration of the broader financial context. Steady studying and staying abreast of financial developments are important for maximizing the advantages of using Canadian worth charts.

Closure

Thus, we hope this text has offered priceless insights into Decoding the Canadian Value Chart: A Complete Information to Understanding and Using Value Information. We hope you discover this text informative and helpful. See you in our subsequent article!