Decoding The Candlestick Chart: A Complete Information For Merchants

Decoding the Candlestick Chart: A Complete Information for Merchants

Associated Articles: Decoding the Candlestick Chart: A Complete Information for Merchants

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Decoding the Candlestick Chart: A Complete Information for Merchants. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding the Candlestick Chart: A Complete Information for Merchants

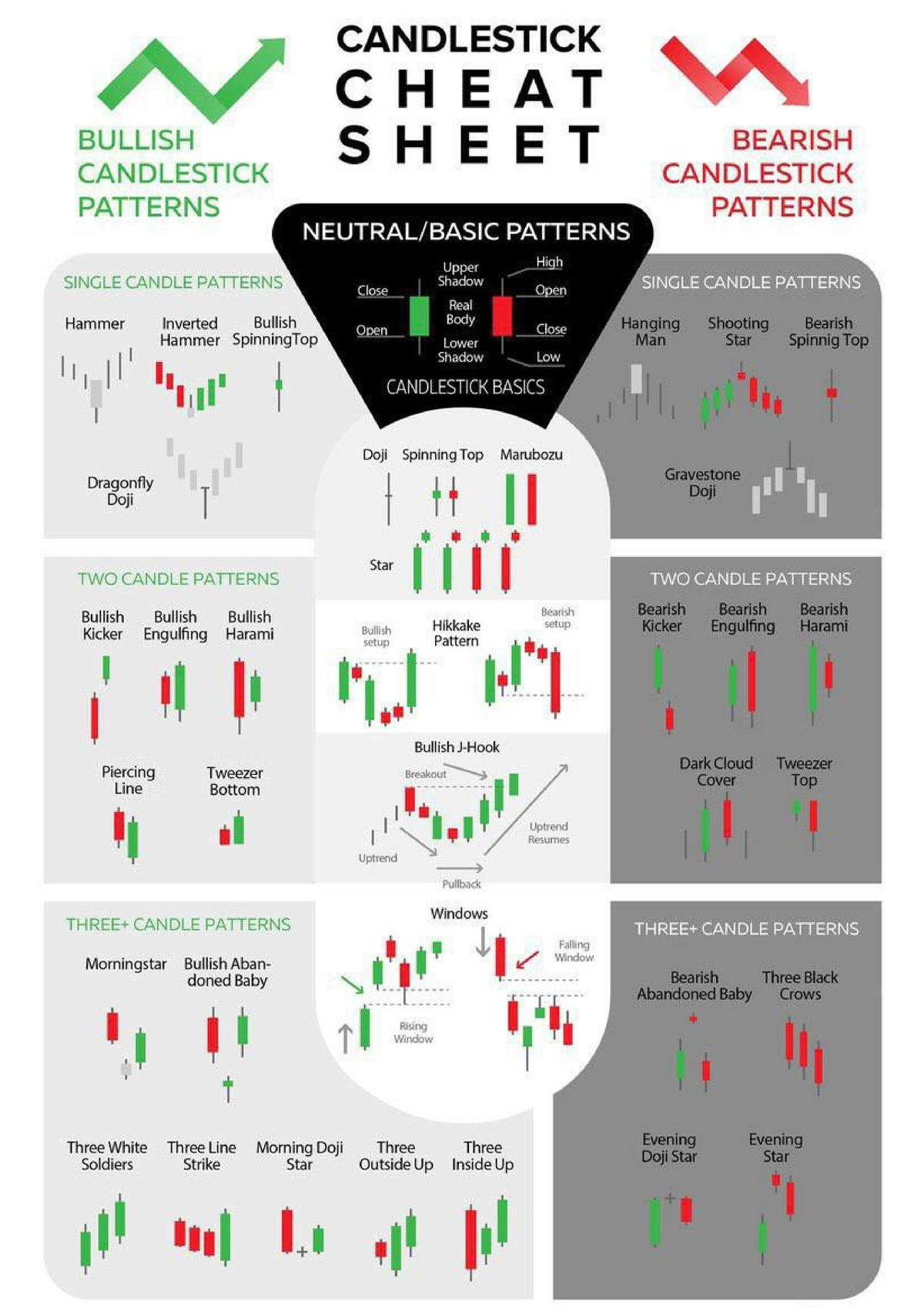

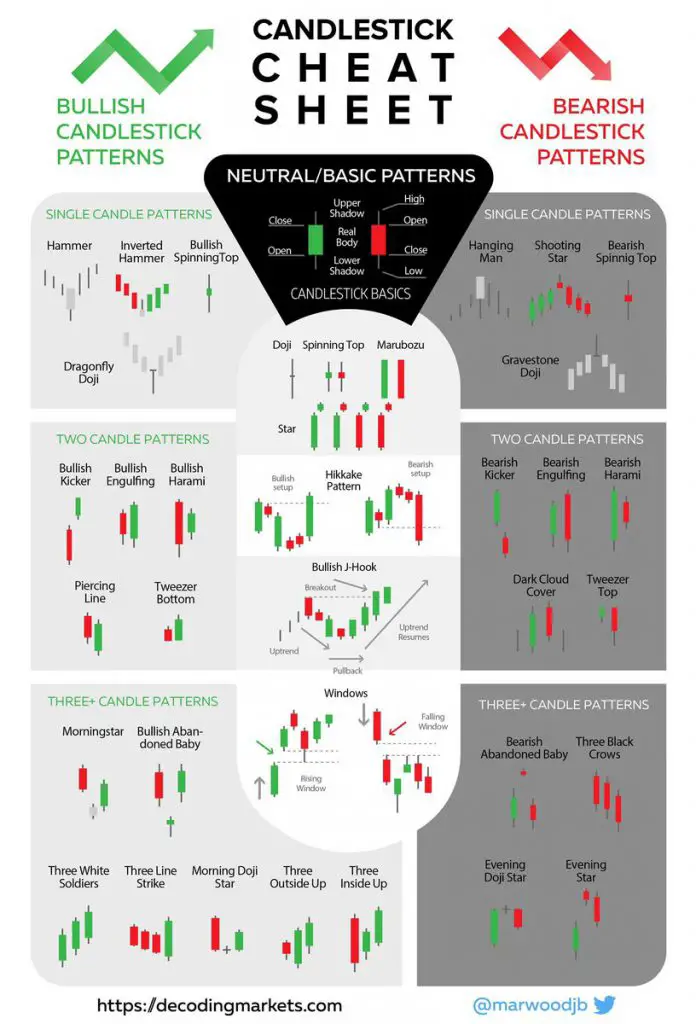

Candlestick charts are a ubiquitous software in monetary markets, providing a visually intuitive strategy to perceive value actions over time. In contrast to bar charts, which merely present the excessive, low, open, and shut costs, candlestick charts symbolize this knowledge in a graphical format that immediately conveys the market sentiment and potential value route. This text delves deep into the intricacies of candlestick charts, explaining their development, interpretation, and software in varied buying and selling methods.

Understanding the Anatomy of a Candlestick:

Every candlestick represents the worth motion of an asset over a particular time interval, which may vary from one minute to 1 month and even longer. The core elements of a candlestick are:

-

The Physique (Actual Physique): That is the oblong portion of the candlestick, representing the vary between the open and shutting costs. A bullish (or inexperienced) candlestick signifies that the closing value was greater than the opening value, signifying shopping for strain. A bearish (or pink) candlestick exhibits that the closing value was decrease than the opening value, indicating promoting strain. The size of the physique displays the magnitude of the worth change in the course of the interval.

-

The Wicks (Shadows or Tails): These are the skinny vertical strains extending above and beneath the physique. The higher wick exhibits the very best value reached in the course of the interval, whereas the decrease wick exhibits the bottom value. The size of the wicks offers extra details about the power of the worth motion and potential resistance or assist ranges. A protracted higher wick with a small physique suggests robust promoting strain close to the excessive, whereas a protracted decrease wick with a small physique suggests robust shopping for strain close to the low.

Decoding Candlestick Patterns:

The true energy of candlestick charts lies of their skill to disclose patterns that may predict future value actions. These patterns are fashioned by the mix of particular person candlesticks and their relationships to 1 one other. Whereas no single sample ensures a particular consequence, understanding these patterns can considerably enhance your buying and selling choices. Listed below are among the commonest and vital candlestick patterns:

1. Single Candlestick Patterns:

-

Doji: A Doji is a candlestick with nearly similar open and shut costs, leading to a small or nonexistent physique. It usually signifies indecision out there, a possible turning level, or a interval of consolidation earlier than a big transfer. Several types of Doji exist (e.g., long-legged Doji, headstone Doji, dragonfly Doji), every carrying barely completely different implications.

-

Hammer and Hanging Man: These are single candlestick patterns characterised by a protracted decrease wick and a small actual physique. A Hammer is bullish and seems on the backside of a downtrend, suggesting a possible reversal. A Hanging Man is bearish and seems on the prime of an uptrend, suggesting a possible reversal. The important thing distinction lies of their context inside the total development.

-

Taking pictures Star and Inverted Hammer: These are single candlestick patterns characterised by a protracted higher wick and a small actual physique. A Taking pictures Star is bearish and seems on the prime of an uptrend, suggesting a possible reversal. An Inverted Hammer is bullish and seems on the backside of a downtrend, suggesting a possible reversal. Once more, context inside the total development is essential.

2. Two-Candlestick Patterns:

-

Engulfing Sample: This sample consists of two candlesticks. The primary candlestick is comparatively small, and the second candlestick utterly engulfs the primary one. A bullish engulfing sample happens when the second candlestick is bullish and engulfs the earlier bearish candlestick, suggesting a possible bullish reversal. A bearish engulfing sample is the alternative.

-

Piercing Sample: Much like the engulfing sample, the piercing sample includes two candlesticks. The primary is a bearish candlestick, adopted by a bullish candlestick that opens decrease however closes considerably greater, penetrating at the least midway into the physique of the primary candle. This implies a possible bullish reversal.

-

Darkish Cloud Cowl and Piercing Line: These are two-candlestick patterns that sign potential development reversals. A Darkish Cloud Cowl is a bearish reversal sample, whereas a Piercing Line is a bullish reversal sample. They’re much like the engulfing sample however with particular standards for candle physique overlaps and shutting costs.

3. Three-Candlestick Patterns:

-

Morning Star and Night Star: These are three-candlestick reversal patterns. A Morning Star is a bullish reversal sample that sometimes seems on the backside of a downtrend. An Night Star is a bearish reversal sample that sometimes seems on the prime of an uptrend. Each patterns contain a big hole between the second and third candlesticks.

-

Three White Troopers and Three Black Crows: These are three-candlestick patterns that verify a powerful development. Three White Troopers is a bullish sample consisting of three consecutive bullish candlesticks with progressively greater closes, indicating robust shopping for strain. Three Black Crows is a bearish sample, consisting of three consecutive bearish candlesticks with progressively decrease closes, indicating robust promoting strain.

Past Primary Patterns:

Whereas the above patterns are elementary, skilled merchants usually analyze extra advanced combos and sequences of candlestick patterns. They may search for confirmations from different technical indicators, equivalent to transferring averages or quantity, to extend the accuracy of their predictions.

Elements to Take into account When Utilizing Candlestick Charts:

-

Timeframe: The timeframe chosen for the candlestick chart considerably impacts the interpretation. A brief timeframe (e.g., 1-minute) exhibits short-term value fluctuations, whereas an extended timeframe (e.g., each day or weekly) reveals longer-term tendencies.

-

Context: Candlestick patterns ought to at all times be analyzed inside the context of the general market development. A bullish reversal sample in a powerful downtrend is likely to be a short lived bounce moderately than a big development reversal.

-

Affirmation: It is essential to substantiate candlestick alerts with different technical indicators or elementary evaluation earlier than making buying and selling choices. Relying solely on candlestick patterns may be dangerous.

-

Quantity: Quantity evaluation can present useful insights into the power of value actions. A robust candlestick sample accompanied by excessive quantity is mostly extra vital than one with low quantity.

Benefits of Utilizing Candlestick Charts:

-

Visible Attraction: Candlestick charts are visually interesting and simple to know, even for inexperienced persons. The colour-coding of the candlesticks immediately conveys the market sentiment.

-

Complete Info: A single candlestick offers a wealth of details about the worth motion, together with the open, excessive, low, and shut costs.

-

Sample Recognition: Candlestick charts enable merchants to determine recurring patterns that may predict future value actions.

-

Versatile: Candlestick charts can be utilized throughout varied asset courses, together with shares, foreign exchange, futures, and cryptocurrencies.

Disadvantages of Utilizing Candlestick Charts:

-

Subjectivity: Decoding candlestick patterns may be subjective, and completely different merchants may need completely different interpretations of the identical sample.

-

False Indicators: Candlestick patterns can typically generate false alerts, resulting in inaccurate predictions.

-

Requires Observe: Mastering the artwork of candlestick chart evaluation requires appreciable follow and expertise.

Conclusion:

Candlestick charts are a strong software for merchants of all ranges. By understanding the anatomy of a candlestick, recognizing widespread patterns, and contemplating the broader market context, merchants can considerably enhance their buying and selling choices. Nonetheless, it is essential to do not forget that candlestick evaluation ought to be used together with different technical and elementary evaluation strategies to mitigate danger and improve the likelihood of profitable trades. Steady studying and follow are important for mastering this useful talent and harnessing the total potential of candlestick charts in your buying and selling journey.

Closure

Thus, we hope this text has supplied useful insights into Decoding the Candlestick Chart: A Complete Information for Merchants. We respect your consideration to our article. See you in our subsequent article!