Decoding The Chart Of Accounts: A Complete Information With Examples

Decoding the Chart of Accounts: A Complete Information with Examples

Associated Articles: Decoding the Chart of Accounts: A Complete Information with Examples

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Chart of Accounts: A Complete Information with Examples. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Decoding the Chart of Accounts: A Complete Information with Examples

A chart of accounts (COA) is the spine of any group’s monetary reporting system. It is a structured checklist of all of the accounts utilized by a enterprise to document its monetary transactions. Consider it as an in depth roadmap of an organization’s funds, offering a scientific solution to categorize and monitor each penny earned and spent. And not using a well-structured COA, monetary information turns into chaotic, making correct reporting, evaluation, and decision-making just about not possible.

This text delves into the intricacies of a chart of accounts, offering detailed examples as an instance its sensible software. We’ll discover completely different COA buildings, account varieties, and greatest practices for creating and sustaining an efficient system.

Understanding the Construction of a Chart of Accounts

A typical COA follows a hierarchical construction, typically utilizing a numbering system to categorize accounts. This construction permits for simple identification and retrieval of knowledge. The particular numbering system and stage of element can fluctuate relying on the scale and complexity of the enterprise. Generally used buildings embrace:

-

Easy Numerical System: This method makes use of a sequential numbering scheme, equivalent to 1000-1999 for property, 2000-2999 for liabilities, and many others. That is appropriate for smaller companies with easier monetary operations.

-

Alphanumeric System: This method combines numbers and letters to supply extra detailed categorization. As an illustration, 1010-Money, 1020-Accounts Receivable, 1100-Stock, and many others. This affords larger flexibility and permits for extra particular account identification.

-

Segmented System: This method divides the COA into segments, every representing a particular facet of the enterprise, equivalent to division, venture, or location. That is notably helpful for bigger organizations requiring detailed value allocation and efficiency monitoring.

Main Account Sorts inside a Chart of Accounts

A complete COA sometimes consists of accounts from the next classes, adhering to usually accepted accounting rules (GAAP) or Worldwide Monetary Reporting Requirements (IFRS):

1. Belongings: These symbolize what an organization owns.

-

Present Belongings: Belongings anticipated to be transformed into money or used inside one 12 months.

- Money: Money readily available and in financial institution accounts (e.g., 1010-Checking Account, 1020-Financial savings Account).

- Accounts Receivable: Cash owed to the corporate by prospects (e.g., 1100-Commerce Receivables, 1110-Buyer A, 1120-Buyer B).

- Stock: Items held on the market (e.g., 1200-Uncooked Supplies, 1210-Work in Progress, 1220-Completed Items).

- Pay as you go Bills: Bills paid upfront (e.g., 1300-Pay as you go Insurance coverage, 1310-Pay as you go Lease).

-

Non-Present Belongings: Belongings anticipated for use for multiple 12 months.

- Property, Plant, and Tools (PP&E): Land, buildings, equipment, and tools (e.g., 1400-Land, 1410-Buildings, 1420-Tools).

- Intangible Belongings: Non-physical property equivalent to patents, copyrights, and emblems (e.g., 1500-Patents, 1510-Copyrights).

- Investments: Lengthy-term investments in different firms (e.g., 1600-Lengthy-term Investments).

2. Liabilities: These symbolize what an organization owes to others.

-

Present Liabilities: Obligations due inside one 12 months.

- Accounts Payable: Cash owed to suppliers (e.g., 2000-Commerce Payables, 2010-Provider X, 2020-Provider Y).

- Salaries Payable: Unpaid salaries to staff (e.g., 2100-Salaries Payable).

- Quick-term Loans Payable: Loans due inside one 12 months (e.g., 2200-Quick-term Financial institution Mortgage).

-

Non-Present Liabilities: Obligations due in multiple 12 months.

- Lengthy-term Loans Payable: Loans due in multiple 12 months (e.g., 2300-Lengthy-term Financial institution Mortgage).

- Bonds Payable: Cash raised via the issuance of bonds (e.g., 2400-Bonds Payable).

3. Fairness: This represents the house owners’ stake within the firm.

- Frequent Inventory: The worth of shares issued to shareholders (e.g., 3000-Frequent Inventory).

- Retained Earnings: Accrued income that haven’t been distributed as dividends (e.g., 3100-Retained Earnings).

4. Income: Revenue generated from the corporate’s main operations.

- Gross sales Income: Income from the sale of products or providers (e.g., 4000-Gross sales Income).

- Service Income: Income from offering providers (e.g., 4100-Service Income).

5. Bills: Prices incurred in producing income.

- Value of Items Offered (COGS): Direct prices related to producing items bought (e.g., 5000-Value of Items Offered).

- Promoting, Normal, and Administrative Bills (SG&A): Bills associated to promoting, advertising and marketing, and administrative capabilities (e.g., 5100-Salaries Expense, 5110-Lease Expense, 5120-Advertising Expense).

- Curiosity Expense: Bills associated to borrowing cash (e.g., 5200-Curiosity Expense).

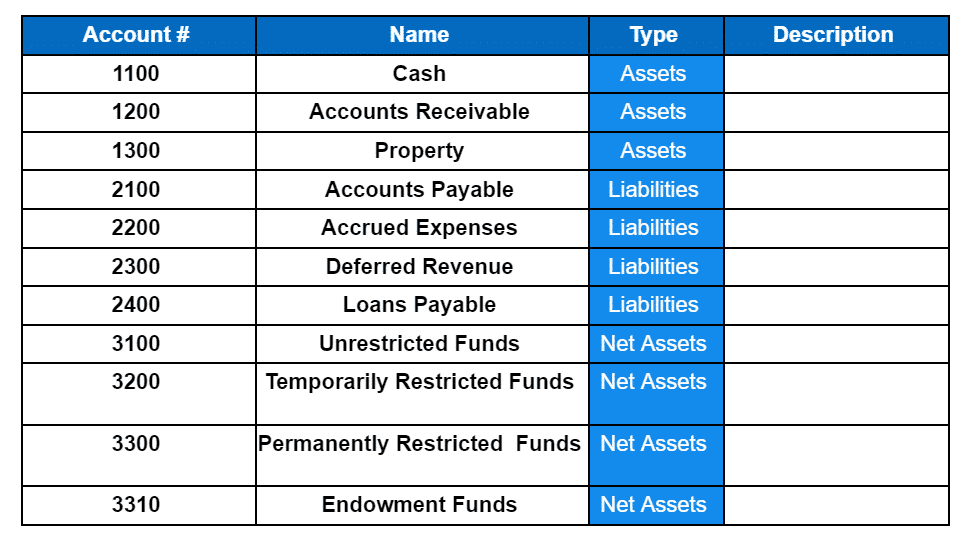

Instance Chart of Accounts for a Small Retail Enterprise:

This instance makes use of a simplified alphanumeric system.

| Account Quantity | Account Identify | Account Kind |

|---|---|---|

| 1000 | Money | Asset |

| 1100 | Accounts Receivable | Asset |

| 1200 | Stock | Asset |

| 1300 | Pay as you go Lease | Asset |

| 2000 | Accounts Payable | Legal responsibility |

| 2100 | Salaries Payable | Legal responsibility |

| 3000 | Proprietor’s Fairness | Fairness |

| 4000 | Gross sales Income | Income |

| 5000 | Value of Items Offered | Expense |

| 5100 | Salaries Expense | Expense |

| 5200 | Lease Expense | Expense |

| 5300 | Utilities Expense | Expense |

| 5400 | Advertising Expense | Expense |

Finest Practices for Creating and Sustaining a Chart of Accounts:

- Preserve it Easy: Begin with a fundamental construction and add complexity as wanted.

- Use a Constant Chart of Accounts: Keep away from making frequent adjustments to the COA to take care of information integrity.

- Frequently Evaluation and Replace: The COA needs to be reviewed and up to date periodically to mirror adjustments within the enterprise.

- Doc Your Chart of Accounts: Preserve detailed documentation of the COA, together with account descriptions and definitions.

- Think about using Accounting Software program: Accounting software program automates many points of COA administration and monetary reporting.

Conclusion:

A well-designed and maintained chart of accounts is essential for correct monetary reporting and efficient enterprise decision-making. By understanding the completely different account varieties, buildings, and greatest practices outlined on this article, companies of all sizes can create a COA that meets their particular wants and lays a stable basis for his or her monetary administration. Keep in mind, the COA is just not a static doc; it ought to evolve alongside the enterprise, adapting to adjustments in operations and reporting necessities. Common assessment and upkeep guarantee its continued effectiveness in offering invaluable insights into the monetary well being of the group.

Closure

Thus, we hope this text has offered invaluable insights into Decoding the Chart of Accounts: A Complete Information with Examples. We hope you discover this text informative and useful. See you in our subsequent article!