Decoding The Chart Of Accounts: The Spine Of Monetary Reporting

Decoding the Chart of Accounts: The Spine of Monetary Reporting

Associated Articles: Decoding the Chart of Accounts: The Spine of Monetary Reporting

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Chart of Accounts: The Spine of Monetary Reporting. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Decoding the Chart of Accounts: The Spine of Monetary Reporting

/Financial%20Statements%20Decoding%20the%20Backbone%20of%20Business.webp)

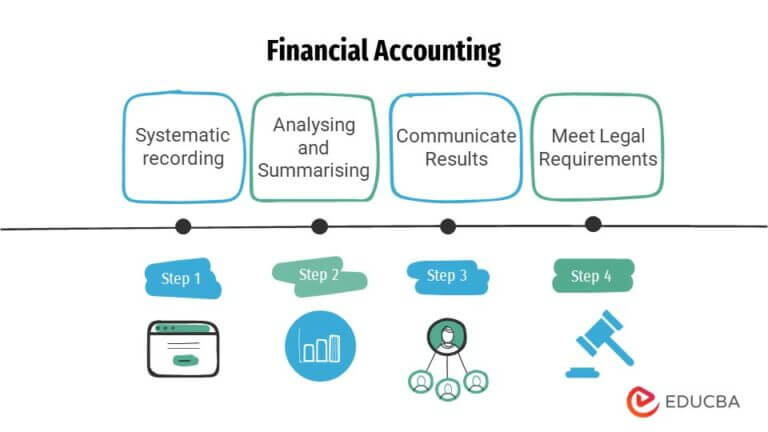

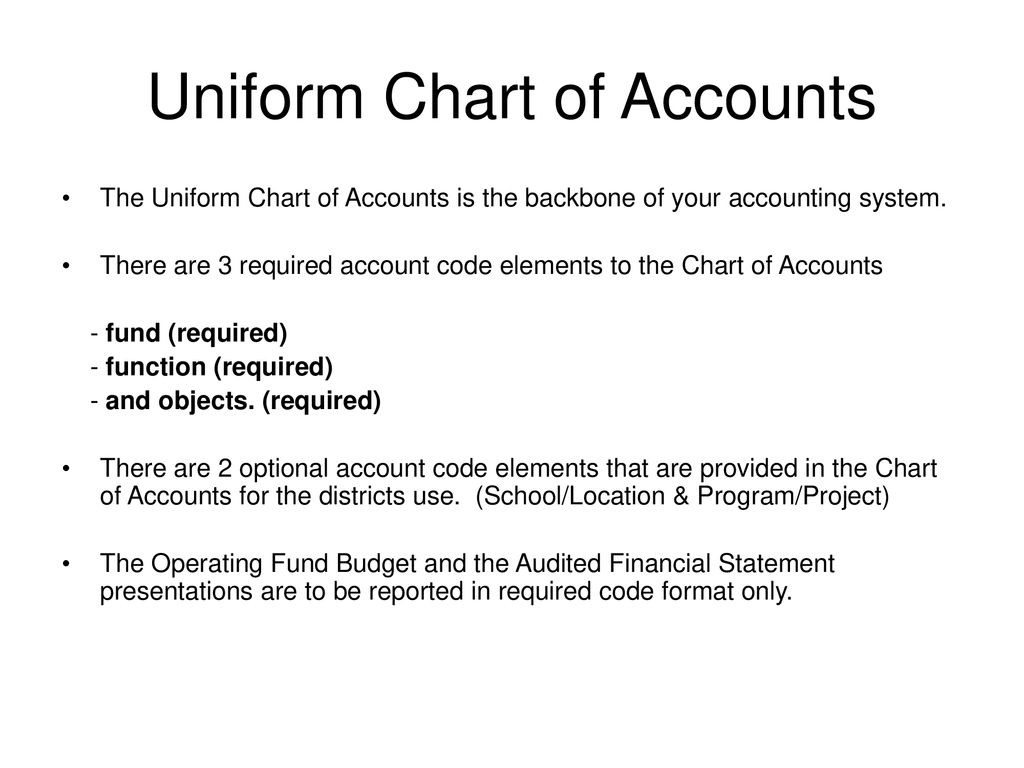

The chart of accounts (COA) is the bedrock of any group’s monetary reporting system. It is a structured checklist of all of the accounts utilized by a enterprise to report its monetary transactions. Consider it as an in depth index to the corporate’s monetary life, meticulously categorizing each influx and outflow of cash. Understanding how a chart of accounts works is essential for anybody concerned in accounting, finance, or enterprise administration. This text delves into the intricacies of COAs, exploring their construction, performance, and significance in correct monetary reporting.

The Construction of a Chart of Accounts:

A COA is not a haphazard assortment of accounts; it follows a well-defined construction, usually organized utilizing a numbering system. This technique permits for environment friendly categorization and retrieval of economic knowledge. The particular construction can fluctuate relying on the dimensions and complexity of the enterprise, business requirements, and the accounting software program used. Nonetheless, most COAs adhere to a common framework primarily based on the accounting equation: Belongings = Liabilities + Fairness.

This framework dictates the primary classes inside the COA:

-

Belongings: These signify what an organization owns. Examples embody money, accounts receivable (cash owed to the corporate), stock, tools, and property. Throughout the asset class, accounts are sometimes additional categorized by liquidity (how simply they are often transformed to money). Present belongings (simply transformed inside a 12 months) are separated from non-current or mounted belongings (long-term belongings).

-

Liabilities: These signify what an organization owes to others. Examples embody accounts payable (cash owed to suppliers), salaries payable, loans payable, and taxes payable. Much like belongings, liabilities are sometimes categorized as present (due inside a 12 months) and non-current (due past a 12 months).

-

Fairness: This represents the homeowners’ stake within the firm. For sole proprietorships and partnerships, this may merely be the proprietor’s capital account. For firms, it contains widespread inventory, retained earnings (accrued income), and different fairness accounts.

Inside every of those major classes, sub-accounts are created to offer extra element. For instance, beneath "Belongings," you might need sub-accounts for "Money in Financial institution," "Petty Money," and "Accounts Receivable – Buyer A." This hierarchical construction permits for a granular view of the corporate’s monetary place.

Numbering Methods:

The numbering system utilized in a COA is essential for its group and performance. Widespread techniques embody:

-

Sequential Numbering: Accounts are assigned consecutive numbers (e.g., 1000, 1001, 1002…). That is easy however can turn into unwieldy for giant organizations.

-

Hierarchical Numbering: Accounts are assigned numbers with segments representing completely different ranges of element. For instance, 1000 may signify "Belongings," 1100 "Present Belongings," and 1110 "Money." This technique permits for straightforward identification of account relationships and facilitates reporting.

-

Mnemonic Numbering: Numbers are assigned primarily based on a mnemonic code that displays the account’s nature. This technique can enhance memorability however may require extra complicated software program to handle.

How the Chart of Accounts Works in Observe:

The COA is the muse upon which all monetary transactions are recorded. Each transaction impacts at the least two accounts, adhering to the double-entry bookkeeping system. This technique ensures that the accounting equation at all times stays balanced.

For instance, if an organization purchases workplace provides with money:

- The "Workplace Provides" account (an asset) will increase.

- The "Money" account (an asset) decreases.

Each entries are recorded within the common ledger, which is a complete report of all transactions categorized by account. The COA supplies the framework for organizing these entries. The particular accounts used are drawn immediately from the COA.

Producing Monetary Statements:

The COA is instrumental in producing monetary statements, together with:

-

Earnings Assertion: This assertion summarizes revenues and bills over a selected interval, displaying the corporate’s profitability. The COA supplies the accounts (income accounts, price of products offered, working bills, and so forth.) essential to compile this assertion.

-

Stability Sheet: This assertion exhibits the corporate’s monetary place at a selected cut-off date, detailing its belongings, liabilities, and fairness. The COA provides the accounts used to current this snapshot of the corporate’s monetary well being.

-

Assertion of Money Flows: This assertion tracks the motion of money out and in of the corporate over a interval. The COA identifies the accounts that mirror money inflows and outflows (e.g., money gross sales, money funds to suppliers).

Significance of a Properly-Designed Chart of Accounts:

A well-designed COA is essential for a number of causes:

-

Correct Monetary Reporting: A correctly structured COA ensures that transactions are recorded persistently and precisely, resulting in dependable monetary statements.

-

Improved Monetary Evaluation: An in depth COA permits for in-depth evaluation of the corporate’s monetary efficiency, figuring out developments and areas for enchancment.

-

Enhanced Resolution-Making: Correct and detailed monetary data empowers administration to make knowledgeable enterprise selections.

-

Streamlined Auditing: A well-organized COA simplifies the auditing course of, making it simpler to confirm the accuracy of economic data.

-

Compliance: A COA that aligns with typically accepted accounting ideas (GAAP) or Worldwide Monetary Reporting Requirements (IFRS) ensures compliance with regulatory necessities.

Adapting the Chart of Accounts:

The COA just isn’t a static doc; it must adapt to the altering wants of the enterprise. As an organization grows and evolves, its operations could turn into extra complicated, requiring the addition of latest accounts or modifications to present ones. Common evaluation and updates are important to keep up the COA’s accuracy and relevance.

Conclusion:

The chart of accounts is greater than only a checklist of accounts; it is a important part of an organization’s monetary infrastructure. Its construction, numbering system, and performance immediately affect the accuracy and reliability of economic reporting. A well-designed and maintained COA is important for knowledgeable decision-making, efficient monetary administration, and compliance with regulatory necessities. Understanding its workings is essential for anybody concerned within the monetary well being and success of a enterprise.

Closure

Thus, we hope this text has offered helpful insights into Decoding the Chart of Accounts: The Spine of Monetary Reporting. We hope you discover this text informative and useful. See you in our subsequent article!