Decoding The Cocoa Bean: A Deep Dive Into Commodity Worth Charts And Market Dynamics

Decoding the Cocoa Bean: A Deep Dive into Commodity Worth Charts and Market Dynamics

Associated Articles: Decoding the Cocoa Bean: A Deep Dive into Commodity Worth Charts and Market Dynamics

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Decoding the Cocoa Bean: A Deep Dive into Commodity Worth Charts and Market Dynamics. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Decoding the Cocoa Bean: A Deep Dive into Commodity Worth Charts and Market Dynamics

Cocoa, the magical ingredient remodeling humble beans into decadent chocolate, is a globally traded commodity with a value historical past as wealthy and complicated as its closing product. Understanding the cocoa commodity value chart requires navigating a labyrinth of things, from climate patterns in West Africa to client demand in Europe and past. This text delves into the intricacies of cocoa pricing, exploring historic developments, influencing components, and the implications for producers, customers, and the worldwide economic system.

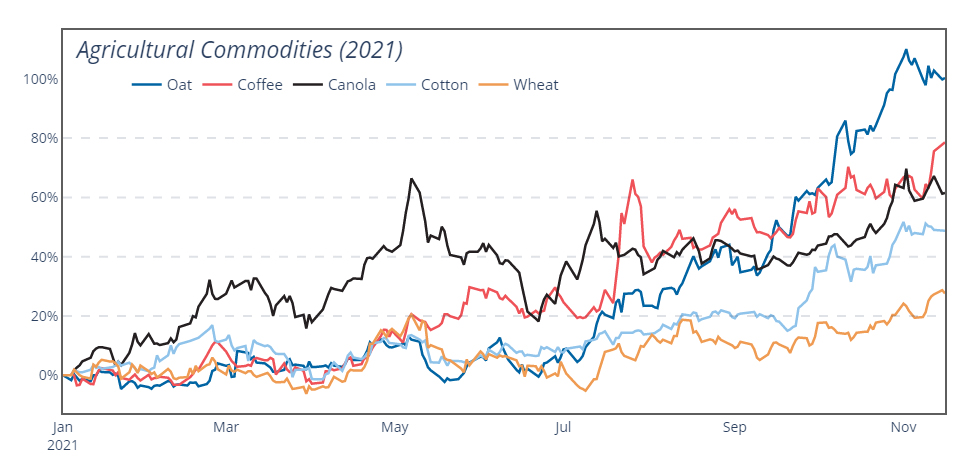

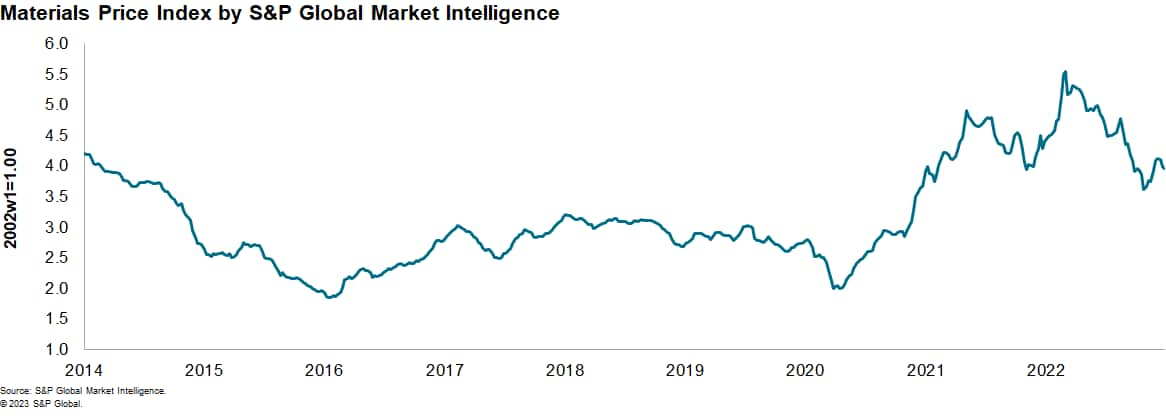

Historic Traits: A Rollercoaster Trip

A look at a cocoa value chart over the previous few a long time reveals a unstable journey, removed from a gradual upward trajectory. Costs have skilled intervals of dramatic spikes, adopted by equally sharp declines, usually mirroring the cyclical nature of agricultural commodities. The early 2000s witnessed comparatively secure costs, however the interval following noticed vital fluctuations, pushed by components we are going to discover later. The worth reached a peak in 2011, pushed by a confluence of occasions, earlier than experiencing a substantial downturn. Newer years have proven a level of stabilization, however the inherent volatility stays a defining attribute of the cocoa market.

Inspecting a longer-term chart, say from the Eighties onward, gives additional context. One can observe intervals of sustained excessive costs adopted by extended intervals of decrease costs. These cycles are sometimes linked to international provide and demand dynamics, coupled with macroeconomic components like forex fluctuations and international financial progress. Lengthy-term charts additionally spotlight the affect of main occasions, akin to droughts or political instability in key cocoa-producing areas, which may considerably disrupt provide and ship costs hovering.

Key Elements Influencing Cocoa Costs:

The cocoa value chart is just not a random stroll. Its actions are largely decided by a fancy interaction of things, together with:

-

Climate Patterns: Cocoa beans are extremely prone to climate variations. Droughts, extreme rainfall, and excessive temperatures can severely harm crops, resulting in diminished yields and consequently larger costs. West Africa, the world’s main cocoa producer, is especially susceptible to unpredictable climate patterns, making local weather change a big long-term concern for the trade. A chart displaying rainfall knowledge alongside cocoa costs usually reveals a powerful correlation.

-

Provide and Demand: This elementary precept of economics holds true for cocoa. A world scarcity of cocoa beans, pushed by components like poor harvests or elevated demand, will sometimes push costs upward. Conversely, a surplus of beans can result in value declines. Monitoring manufacturing forecasts from main cocoa-producing international locations is essential for predicting value actions. Moreover, the expansion of chocolate consumption in rising markets performs a big position in driving demand and influencing costs.

-

Political and Financial Instability: Political unrest and financial instability in cocoa-producing international locations can disrupt manufacturing and transportation, affecting provide and consequently impacting costs. Civil conflicts, forex devaluations, and commerce disputes can all contribute to cost volatility. Information occasions associated to those components usually precede notable shifts in cocoa costs.

-

Foreign money Fluctuations: The worth of the US greenback, the first forex for cocoa buying and selling, performs a big position. A stronger greenback could make cocoa dearer for consumers utilizing different currencies, probably lowering demand and impacting costs. Conversely, a weaker greenback could make cocoa extra inexpensive, probably boosting demand. Analyzing forex alternate charges alongside cocoa costs gives invaluable insights.

-

Hypothesis and Funding: The cocoa market is prone to hypothesis, with buyers and merchants influencing costs by way of futures contracts. This may amplify value swings, notably within the brief time period. Understanding investor sentiment and buying and selling exercise can supply clues to potential value actions, though predicting market psychology stays a problem.

-

Pests and Ailments: Cocoa crops are susceptible to varied pests and ailments, akin to black pod illness and cocoa swollen shoot virus. Outbreaks can considerably scale back yields and drive costs larger. Monitoring the prevalence of those ailments is vital for assessing potential provide disruptions.

-

Cocoa Processing and Manufacturing: Modifications within the international chocolate trade, akin to technological developments in processing or shifts in client preferences, can even affect cocoa costs. Elevated demand for particular forms of cocoa beans, like these used for high-quality darkish chocolate, can affect costs differentially.

Analyzing the Cocoa Worth Chart: Strategies and Instruments

Successfully decoding a cocoa value chart requires using numerous analytical methods. These embody:

-

Technical Evaluation: This method includes finding out value charts to determine patterns and developments, utilizing indicators like shifting averages, relative energy index (RSI), and assist/resistance ranges. Technical analysts search for alerts to foretell future value actions primarily based on previous value motion.

-

Basic Evaluation: This method focuses on evaluating the underlying financial components influencing cocoa costs, akin to provide and demand, climate circumstances, and geopolitical occasions. Basic analysts try to find out the intrinsic worth of cocoa and determine potential mispricing out there.

-

Chart Patterns: Recognizing frequent chart patterns, akin to head and shoulders, double tops/bottoms, and triangles, can present insights into potential value reversals or continuations.

-

Indicators: Numerous technical indicators can assist determine potential purchase or promote alerts, akin to shifting averages to easy out value fluctuations and determine developments, and RSI to measure momentum and determine overbought or oversold circumstances.

Implications for Stakeholders:

Understanding the dynamics of cocoa costs has vital implications for numerous stakeholders:

-

Cocoa Farmers: Worth volatility creates vital challenges for cocoa farmers, who usually function with restricted monetary assets and are extremely susceptible to cost fluctuations. Truthful pricing and danger administration methods are essential for his or her livelihoods.

-

Chocolate Producers: Fluctuating cocoa costs straight affect the price of manufacturing for chocolate producers. Hedging methods and long-term contracts can assist mitigate value danger.

-

Customers: Whereas value fluctuations might not all the time be straight noticeable to customers, they will not directly affect the value of chocolate merchandise. Understanding the components driving cocoa costs can assist customers make knowledgeable selections.

-

Buyers: The cocoa market provides alternatives for buyers, but in addition carries vital dangers. A deep understanding of the market dynamics and using applicable danger administration methods are important for profitable funding.

Conclusion:

The cocoa commodity value chart is a dynamic reflection of a fancy international market. Understanding the interaction of climate patterns, provide and demand, geopolitical occasions, and market hypothesis is essential for decoding value actions. By combining technical and elementary evaluation, stakeholders can achieve invaluable insights into the components driving cocoa costs and make knowledgeable choices to navigate this unstable but fascinating commodity market. The way forward for cocoa costs will proceed to be formed by the evolving international panorama, highlighting the significance of sustainable practices, local weather resilience, and honest commerce initiatives to make sure a secure and equitable future for the cocoa trade. Steady monitoring of the chart, coupled with a complete understanding of the underlying components, is crucial for anybody concerned in or impacted by the cocoa market.

Closure

Thus, we hope this text has supplied invaluable insights into Decoding the Cocoa Bean: A Deep Dive into Commodity Worth Charts and Market Dynamics. We hope you discover this text informative and helpful. See you in our subsequent article!