Decoding The Copper Worth Chart: A Dwell Look At The Purple Steel’s Market Dynamics

Decoding the Copper Worth Chart: A Dwell Take a look at the Purple Steel’s Market Dynamics

Associated Articles: Decoding the Copper Worth Chart: A Dwell Take a look at the Purple Steel’s Market Dynamics

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Decoding the Copper Worth Chart: A Dwell Take a look at the Purple Steel’s Market Dynamics. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Decoding the Copper Worth Chart: A Dwell Take a look at the Purple Steel’s Market Dynamics

Copper, typically dubbed "Dr. Copper" for its purported potential to foretell financial well being, is a vital industrial metallic with a worth chart that displays a fancy interaction of worldwide financial forces, provide chain dynamics, and geopolitical occasions. Understanding the stay copper worth chart requires extra than simply observing the fluctuating numbers; it calls for a deep dive into the elements driving its volatility and the implications for numerous sectors. This text offers a complete overview of the stay copper worth chart, exploring its present developments, historic context, key influencing elements, and potential future trajectories.

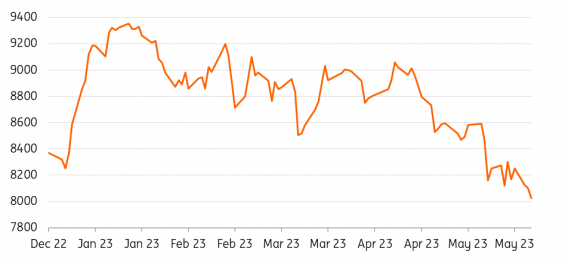

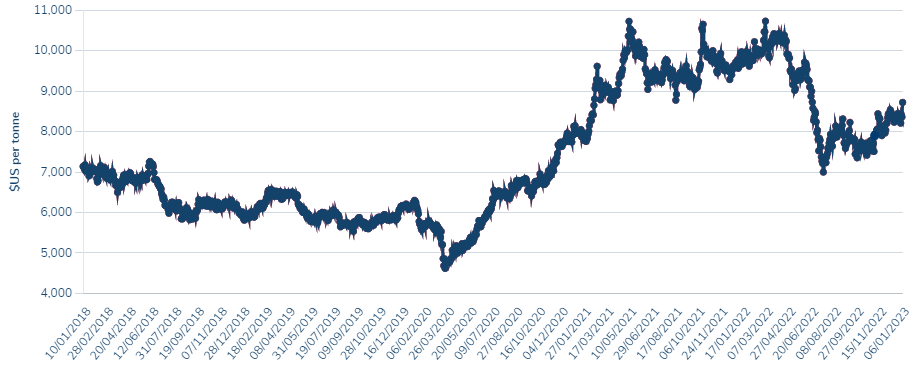

The Dwell Copper Worth Chart: A Snapshot in Time

Earlier than delving into the specifics, it is essential to acknowledge the dynamic nature of the copper market. The value is consistently fluctuating, influenced by a mess of things which can be typically interconnected and unpredictable. A stay copper worth chart, available on quite a few monetary web sites and buying and selling platforms, presents a real-time visualization of this volatility. These charts usually show the value per pound or tonne, typically alongside historic knowledge permitting for pattern evaluation. Key indicators displayed embody:

- Spot Worth: The present market worth for instant supply.

- Futures Costs: Costs for supply at a specified future date, reflecting market expectations.

- Buying and selling Quantity: The amount of copper traded inside a given interval.

- Open Curiosity: The entire variety of excellent futures contracts.

These indicators, when analyzed collectively, provide a nuanced perspective on the present market sentiment and potential future worth actions. For instance, excessive buying and selling quantity alongside vital worth fluctuations suggests sturdy market exercise and probably vital shifts in provide and demand.

Historic Context: A Century of Copper Worth Fluctuations

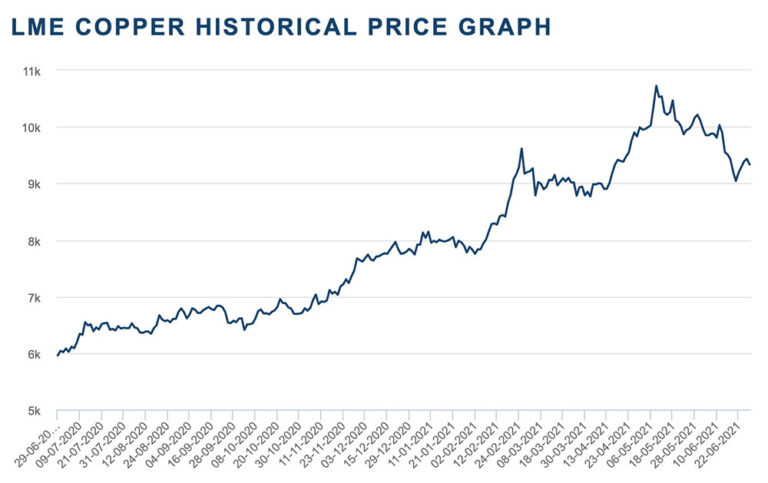

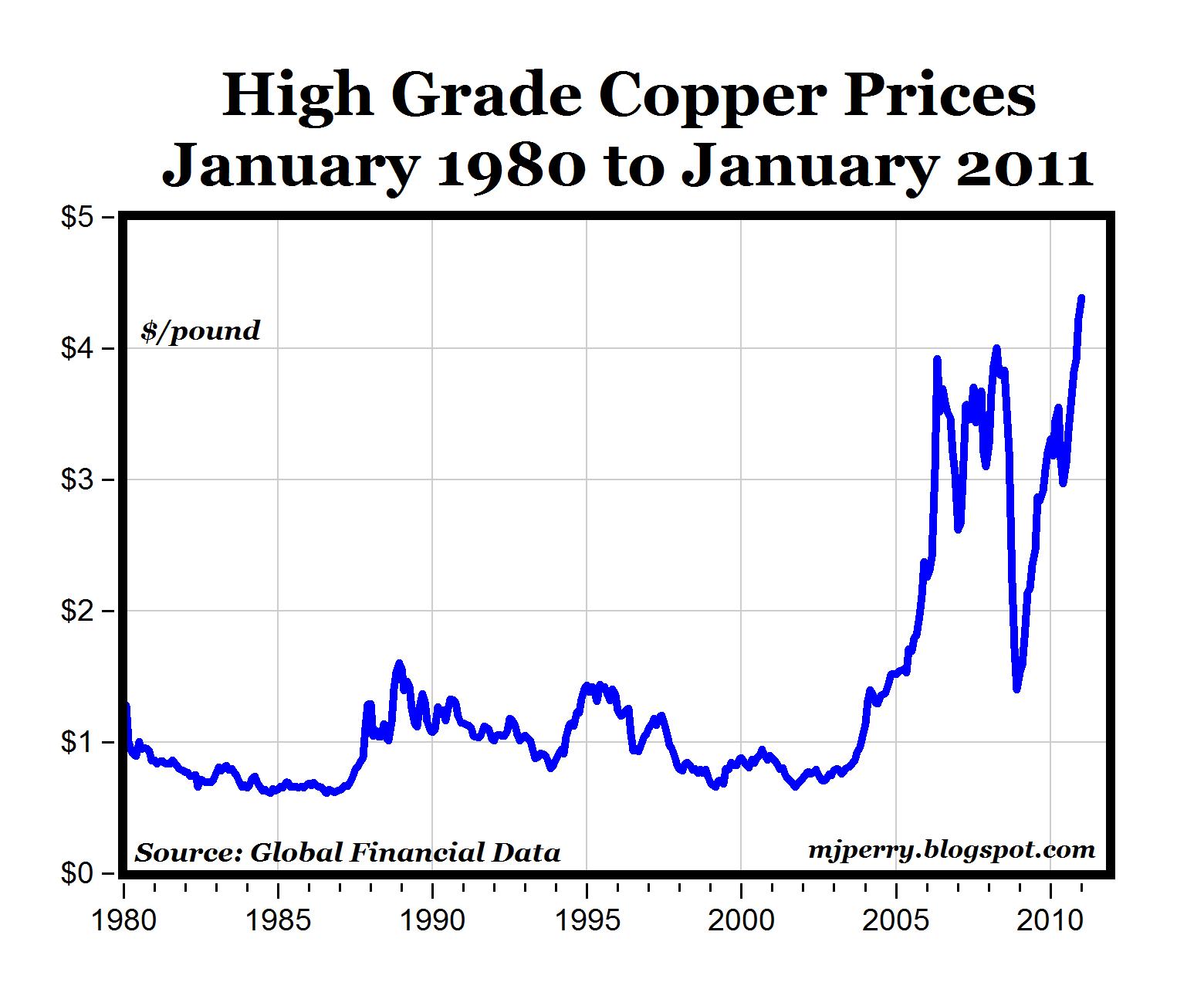

To totally recognize the present state of the copper worth chart, it is important to know its historic context. The twentieth and twenty first centuries have witnessed vital worth swings, pushed by elements starting from technological developments and industrialization to financial booms and busts, wars, and political instability. Intervals of fast financial development, significantly in rising markets like China, have traditionally correlated with vital worth will increase. Conversely, financial downturns and recessions typically result in worth declines as demand weakens.

Analyzing historic worth charts reveals recurring patterns and cycles, although predicting future actions primarily based solely on previous efficiency is inherently dangerous. Nevertheless, understanding these historic developments offers invaluable context for deciphering present market dynamics and figuring out potential turning factors. As an example, observing durations of extended worth stagnation or sharp corrections can spotlight potential resistance or help ranges, providing insights into potential future worth ranges.

Key Elements Influencing the Copper Worth Chart

The stay copper worth chart is a mirrored image of the complicated interaction of a number of key elements:

-

World Financial Progress: Copper is a vital part in building, manufacturing, and electronics. Robust world financial development usually interprets to greater demand and consequently, greater costs. Conversely, financial slowdowns or recessions dampen demand, main to cost declines. Indicators like GDP development charges, manufacturing PMI (Buying Managers’ Index), and industrial manufacturing knowledge present invaluable insights into the general financial well being and its affect on copper demand.

-

Provide and Demand Dynamics: The stability between copper provide and demand is a important determinant of worth. Provide disruptions, similar to mine closures, labor disputes, or geopolitical instability in main producing areas (Chile, Peru, Congo), can result in worth spikes. Equally, sudden will increase in demand, pushed by infrastructure tasks or technological developments, also can push costs upward. Analyzing manufacturing knowledge, stock ranges, and consumption patterns is essential for understanding the supply-demand equation.

-

Geopolitical Elements: Geopolitical occasions, together with wars, political instability, and commerce disputes, can considerably affect copper costs. These occasions can disrupt provide chains, have an effect on investor sentiment, and create uncertainty available in the market, main to cost volatility. The continued struggle in Ukraine, for instance, has had a ripple impact on world commodity markets, together with copper, on account of disruptions in provide and elevated vitality prices.

-

Technological Developments: Technological developments can affect each provide and demand. Improvements in mining know-how can result in elevated manufacturing effectivity and decrease prices, probably placing downward stress on costs. Conversely, the rising demand for copper in rising applied sciences, similar to electrical automobiles and renewable vitality infrastructure, can considerably increase demand and drive costs upward.

-

Forex Fluctuations: The value of copper is usually quoted in US {dollars}. Fluctuations within the worth of the greenback towards different currencies can affect the value. A stronger greenback could make copper costlier for patrons utilizing different currencies, probably dampening demand and placing downward stress on costs.

-

Investor Sentiment and Hypothesis: Investor sentiment and speculative buying and selling play a big function in copper worth volatility. Optimistic market sentiment can result in elevated funding and better costs, whereas damaging sentiment can set off sell-offs and worth declines. Analyzing investor sentiment via information articles, analyst experiences, and buying and selling patterns can present insights into market expectations and potential worth actions.

Analyzing the Dwell Copper Worth Chart: Methods and Instruments

Successfully analyzing the stay copper worth chart requires using numerous technical and elementary evaluation methods.

-

Technical Evaluation: This includes finding out worth charts to establish patterns, developments, and help/resistance ranges. Indicators like shifting averages, relative power index (RSI), and MACD may help establish potential purchase or promote alerts.

-

Elementary Evaluation: This includes assessing the underlying financial and market elements that affect copper costs. Analyzing macroeconomic indicators, provide and demand dynamics, and geopolitical occasions offers a broader perspective available on the market’s long-term outlook.

-

Charting Software program and Platforms: Quite a few charting software program and on-line platforms present real-time copper worth knowledge, historic charts, and technical evaluation instruments. These platforms permit for in-depth evaluation and backtesting of buying and selling methods.

The Way forward for the Copper Worth Chart: Predictions and Projections

Predicting the long run trajectory of the copper worth chart is inherently difficult because of the complicated interaction of things concerned. Nevertheless, analyzing present developments and projecting future developments can provide potential eventualities. Elements to contemplate embody:

-

Continued development in renewable vitality infrastructure: The rising adoption of renewable vitality applied sciences, similar to photo voltaic panels and wind generators, is anticipated to drive vital demand for copper within the coming years.

-

Electrical car adoption: The worldwide shift in the direction of electrical automobiles is one other vital driver of copper demand, as electrical automobiles require considerably extra copper than conventional combustion engine automobiles.

-

Infrastructure investments: Authorities investments in infrastructure tasks, significantly in growing nations, can considerably increase copper demand.

-

Provide-side constraints: Potential provide disruptions on account of geopolitical instability, mine closures, or labor disputes may result in worth will increase.

-

Technological developments in mining and recycling: Improvements in mining know-how and copper recycling may probably mitigate supply-side constraints and reasonable worth will increase.

Conclusion: Navigating the Copper Market’s Complexity

The stay copper worth chart is a dynamic and complicated illustration of worldwide financial forces, provide chain dynamics, and geopolitical occasions. Understanding the elements influencing copper costs requires a complete evaluation of each historic developments and present market circumstances. By combining technical and elementary evaluation methods and staying knowledgeable about key influencing elements, traders and companies can navigate the complexities of the copper market and make knowledgeable selections. Nevertheless, it is essential to keep in mind that the copper market stays inherently risky, and predicting future worth actions with certainty is unattainable. A cautious and well-informed method is crucial for achievement on this dynamic market.

Closure

Thus, we hope this text has offered invaluable insights into Decoding the Copper Worth Chart: A Dwell Take a look at the Purple Steel’s Market Dynamics. We recognize your consideration to our article. See you in our subsequent article!