Decoding The Copper Value Line Chart: A Deep Dive Into Kitco’s Knowledge And Market Insights

Decoding the Copper Value Line Chart: A Deep Dive into Kitco’s Knowledge and Market Insights

Associated Articles: Decoding the Copper Value Line Chart: A Deep Dive into Kitco’s Knowledge and Market Insights

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Copper Value Line Chart: A Deep Dive into Kitco’s Knowledge and Market Insights. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding the Copper Value Line Chart: A Deep Dive into Kitco’s Knowledge and Market Insights

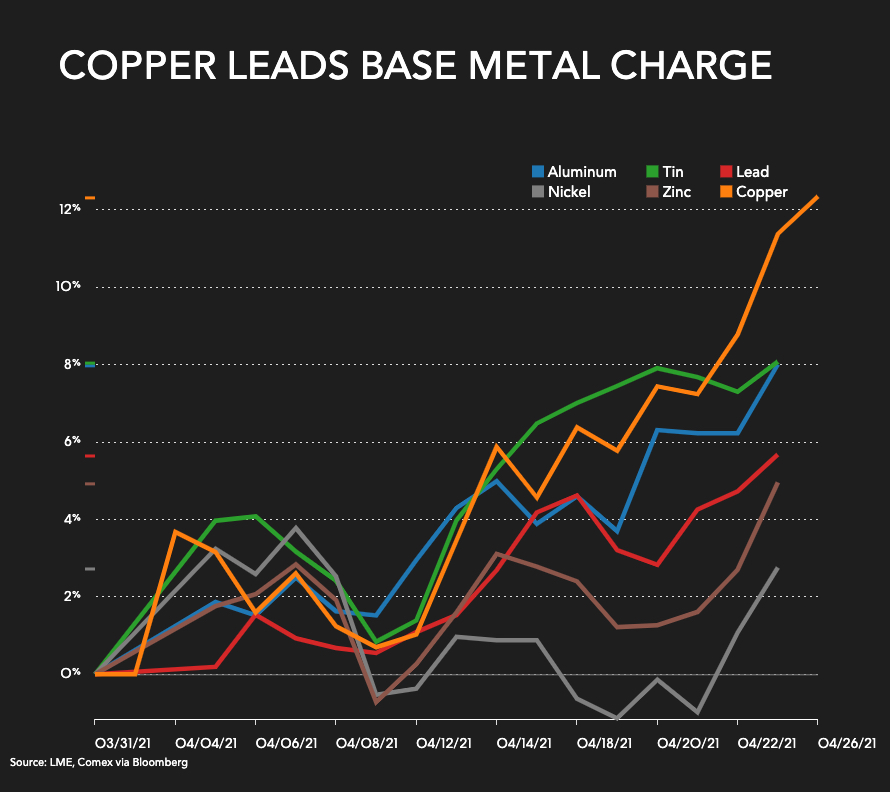

Copper, typically dubbed "Dr. Copper" for its purported skill to foretell financial well being, holds a big place within the international commodities market. Its value fluctuations, readily accessible by means of platforms like Kitco, present useful insights into the broader financial panorama and the well being of assorted industrial sectors. This text will delve into the intricacies of deciphering the copper value line chart on Kitco, exploring its historic developments, influencing elements, and the implications for traders and companies alike.

Understanding the Kitco Copper Value Chart:

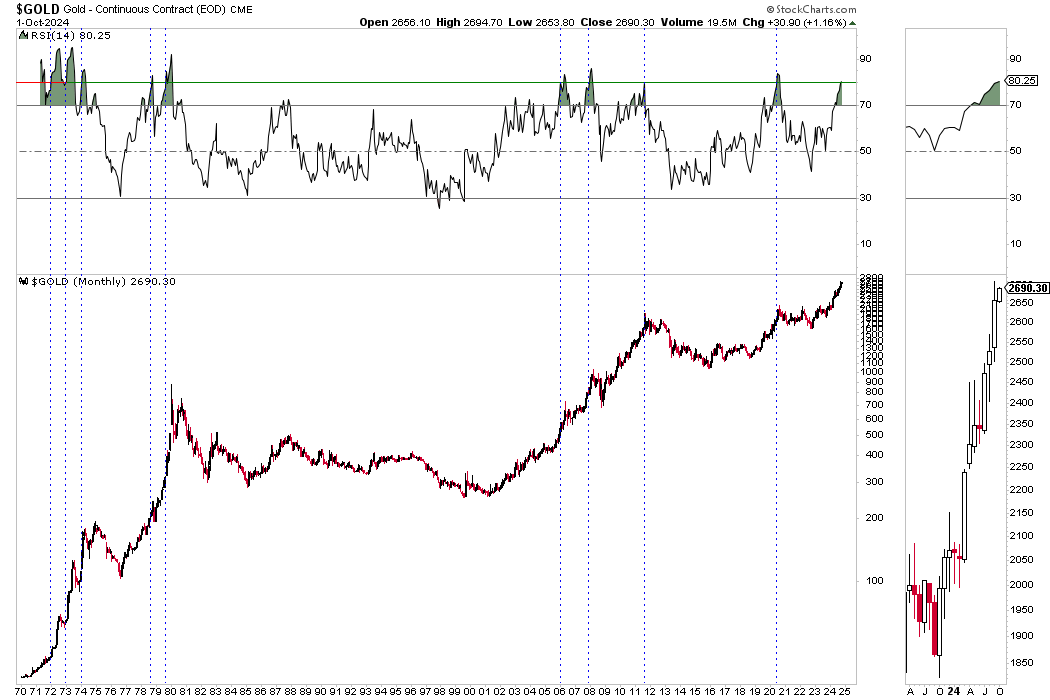

Kitco’s copper value chart presents a visible illustration of the commodity’s value motion over a selected time-frame. Usually, the chart shows the value (normally in US {dollars} per pound) on the vertical axis and time (starting from intraday to a long time) on the horizontal axis. Varied chart varieties can be found, together with line charts, candlestick charts, and bar charts, every providing a barely completely different perspective on value motion. The road chart, specifically, gives a transparent and concise overview of value developments over time.

The chart typically contains further options like:

- Transferring Averages: These strains easy out value fluctuations, revealing underlying developments. Widespread transferring averages embrace 50-day, 100-day, and 200-day averages. Crossovers between these averages can be utilized as potential buying and selling alerts.

- Quantity Indicators: Whereas not at all times straight displayed on the road chart itself, quantity information is essential. Excessive quantity throughout value will increase suggests robust shopping for strain, whereas excessive quantity throughout value decreases alerts important promoting.

- Technical Indicators: Kitco could combine technical indicators like Relative Power Index (RSI), MACD (Transferring Common Convergence Divergence), or Bollinger Bands, which assist assess momentum, potential reversals, and overbought/oversold circumstances.

- Historic Knowledge: Entry to historic information is essential for analyzing long-term developments and figuring out recurring patterns. This enables for comparability with previous financial cycles and identification of potential future eventualities.

Key Elements Influencing Copper Costs:

The copper value line chart on Kitco displays the interaction of quite a few elements, making its interpretation complicated however rewarding. These elements will be broadly categorized as:

-

World Financial Development: Copper is an important part in building, manufacturing, and infrastructure growth. Sturdy international financial development, significantly in rising markets like China and India, fuels larger demand and consequently, larger costs. Recessions or financial slowdowns, conversely, result in decreased demand and decrease costs. The Kitco chart can typically present early warning indicators of financial shifts by reflecting modifications in copper demand.

-

Industrial Manufacturing: The well being of assorted industrial sectors straight impacts copper consumption. A growth in automotive manufacturing, as an example, interprets to larger copper demand, whereas a slowdown within the building business reduces it. Analyzing the correlation between Kitco’s copper value chart and industrial manufacturing indices gives useful insights.

-

Provide and Demand Dynamics: The stability between copper provide and demand is key to cost willpower. Geopolitical occasions, mining disruptions, manufacturing capability, and stock ranges all affect provide. Surprising mine closures, labor disputes, or pure disasters can result in provide shortages and value spikes, clearly seen on the Kitco chart. Conversely, elevated manufacturing capability can result in value declines.

-

Foreign money Fluctuations: Copper is priced in US {dollars}. A weakening US greenback typically makes dollar-denominated commodities like copper extra engaging to worldwide patrons, resulting in larger demand and costs. Conversely, a strengthening greenback can suppress costs. Monitoring foreign money alternate charges alongside the Kitco chart is important for an entire understanding.

-

Speculative Buying and selling: Massive institutional traders and speculators play a big position in copper value actions. Their buying and selling actions can amplify value swings, creating volatility that is probably not solely reflective of underlying fundamentals. Figuring out durations of serious speculative exercise requires analyzing buying and selling volumes and open curiosity information alongside the Kitco chart.

-

Authorities Insurance policies and Laws: Authorities insurance policies associated to environmental laws, commerce tariffs, and infrastructure spending can considerably affect copper costs. Stricter environmental laws, as an example, can enhance manufacturing prices and probably result in larger costs. Equally, commerce disputes can disrupt provide chains and have an effect on costs.

Deciphering the Copper Value Line Chart: A Sensible Strategy:

Analyzing the Kitco copper value line chart requires a multi-faceted method:

-

Establish Traits: Search for long-term developments (e.g., upward or downward developments spanning months or years) to gauge the general market sentiment. These developments are sometimes linked to broader financial cycles.

-

Acknowledge Help and Resistance Ranges: These are value ranges the place the value has traditionally struggled to interrupt by means of. Help ranges signify potential shopping for alternatives, whereas resistance ranges point out potential promoting strain. Breaks above resistance or under assist can sign important value actions.

-

Analyze Value Patterns: Familiarize your self with widespread chart patterns like head and shoulders, double tops/bottoms, and triangles. These patterns can present clues about potential future value actions.

-

Think about Technical Indicators: Transferring averages, RSI, MACD, and Bollinger Bands can present further insights into momentum, overbought/oversold circumstances, and potential development reversals. Nonetheless, it is essential to keep in mind that technical indicators usually are not foolproof and must be used along side elementary evaluation.

-

Correlate with Macroeconomic Knowledge: Evaluate the copper value chart with related macroeconomic indicators like GDP development, industrial manufacturing, inflation, and rates of interest to determine potential causal relationships.

-

Keep Knowledgeable: Keep up to date on information and occasions that might affect copper costs, reminiscent of geopolitical developments, mining disruptions, and modifications in authorities insurance policies.

Implications for Traders and Companies:

The copper value line chart on Kitco is a useful device for each traders and companies:

-

Traders: The chart helps traders make knowledgeable selections about investing in copper futures, ETFs, or mining corporations. Understanding value developments and influencing elements permits for higher threat administration and potential revenue maximization.

-

Companies: Firms that use copper of their manufacturing processes can use the chart to forecast future enter prices and modify their pricing methods accordingly. This helps in mitigating potential dangers related to fluctuating copper costs.

Conclusion:

The copper value line chart on Kitco gives a dynamic window into the worldwide financial system. By understanding the elements that affect copper costs and using a radical analytical method, traders and companies can leverage this useful useful resource to make knowledgeable selections and navigate the complexities of the commodities market. Nonetheless, it is essential to keep in mind that no single indicator gives an ideal prediction, and mixing chart evaluation with elementary analysis and consciousness of present occasions is important for a complete understanding of copper’s value trajectory. Common monitoring of the Kitco chart, alongside different related information sources, is essential to staying forward on this ever-evolving market.

Closure

Thus, we hope this text has offered useful insights into Decoding the Copper Value Line Chart: A Deep Dive into Kitco’s Knowledge and Market Insights. We thanks for taking the time to learn this text. See you in our subsequent article!