Decoding The Copper Worth Yearly Chart: A Two-Decade Journey Of A Crimson Metallic

Decoding the Copper Worth Yearly Chart: A Two-Decade Journey of a Crimson Metallic

Associated Articles: Decoding the Copper Worth Yearly Chart: A Two-Decade Journey of a Crimson Metallic

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Copper Worth Yearly Chart: A Two-Decade Journey of a Crimson Metallic. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Decoding the Copper Worth Yearly Chart: A Two-Decade Journey of a Crimson Metallic

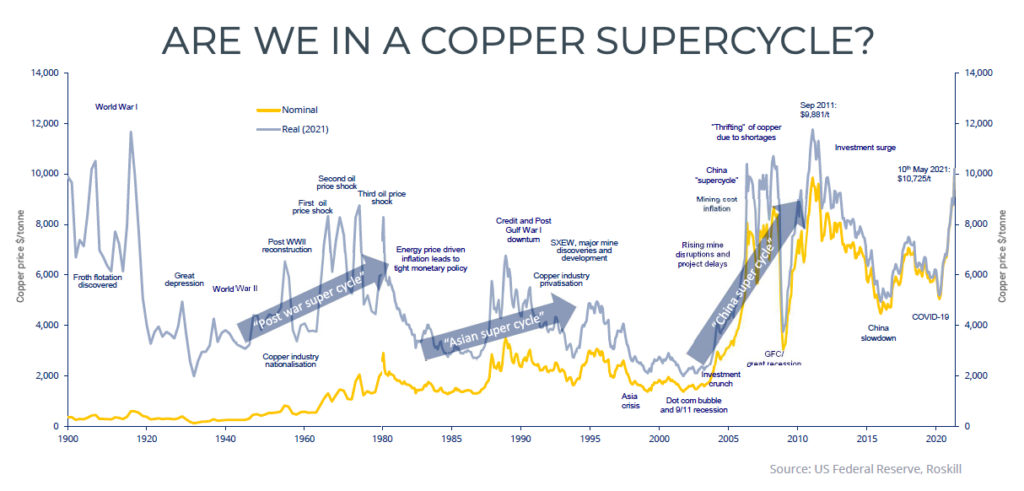

Copper, usually dubbed "Dr. Copper" for its purported potential to foretell financial well being, boasts a wealthy historical past intertwined with international financial cycles. Analyzing its yearly worth chart over the previous twenty years reveals an interesting narrative of growth and bust, influenced by a fancy interaction of provide, demand, technological developments, geopolitical occasions, and speculative buying and selling. This text delves into the important thing elements shaping copper’s worth trajectory since 2000, providing insights into previous developments and potential future implications.

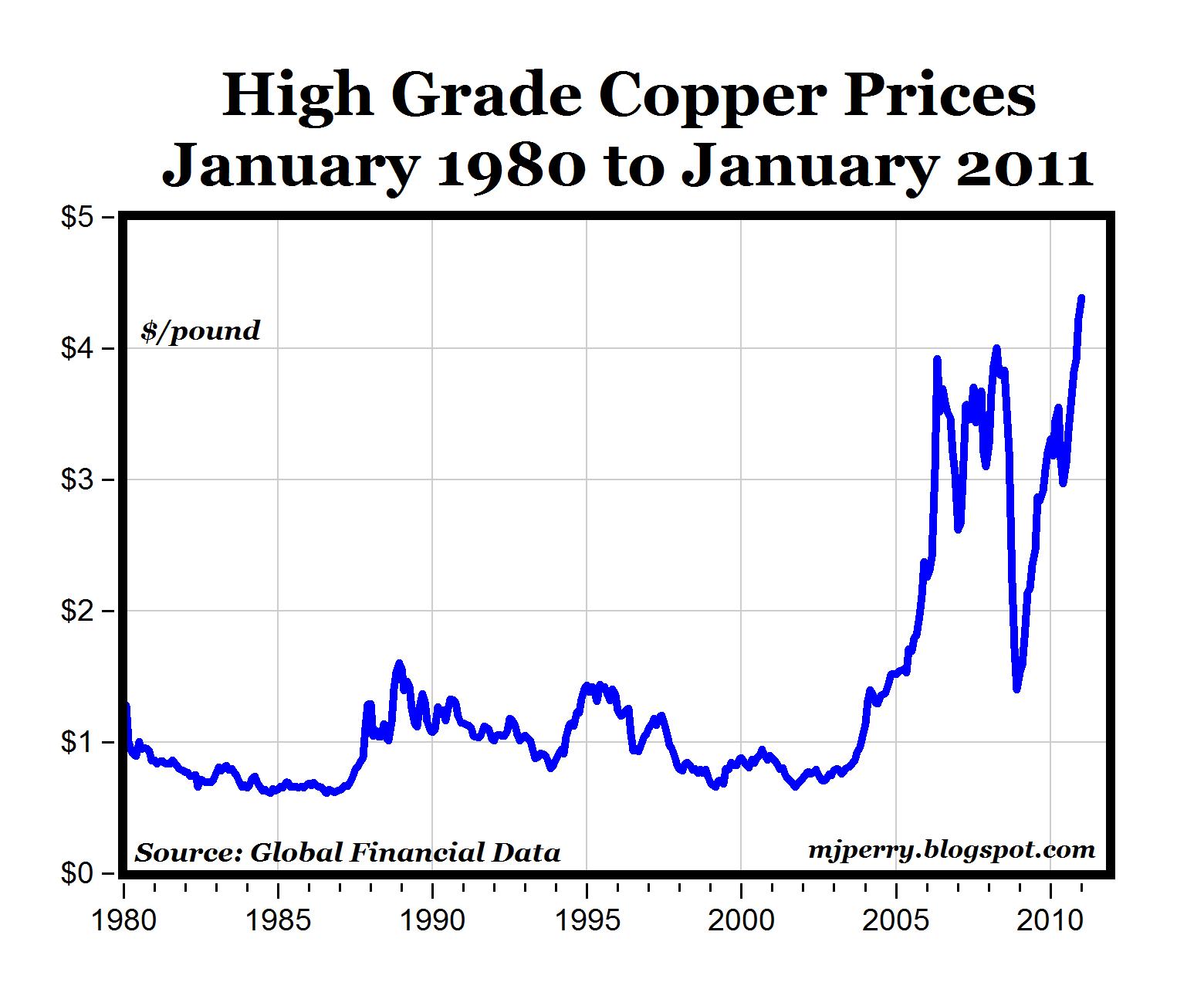

The Rise of the Crimson Metallic (2000-2011): A Decade of Development Fueled by Globalization and Infrastructure Growth

The early 2000s witnessed a interval of sustained development in copper costs, largely pushed by the burgeoning economies of China and different rising markets. China’s speedy industrialization and urbanization fueled an insatiable demand for copper, an important part in development, manufacturing, and energy era. This era noticed a big enhance in infrastructure initiatives, from skyscrapers to energy grids, all requiring huge portions of copper. The yearly chart from 2000 to 2011 displays a usually upward development, punctuated by periodic corrections however finally displaying a exceptional appreciation in worth.

A number of elements contributed to this strong development:

- Chinese language Demand: The one most important driver was China’s unprecedented financial enlargement. Its voracious urge for food for copper dwarfed that of some other nation, making a persistent upward strain on costs.

- World Infrastructure Spending: Concurrently, different creating nations launched into bold infrastructure improvement applications, additional boosting international copper demand.

- Restricted Provide Response: Whereas mines expanded manufacturing, the provision response lagged behind the surging demand, main to produce tightness and better costs. Discovering and creating new copper deposits takes appreciable time and funding.

- Speculative Funding: The rising worth attracted vital speculative funding, additional amplifying the upward development. Buyers seen copper as a protected haven asset and a hedge in opposition to inflation.

The height of this bull market occurred round 2011, with costs reaching document highs. Nonetheless, the seeds of the following downturn have been already being sown.

The Correction and Volatility (2011-2016): A Interval of Adjustment and Uncertainty

The interval from 2011 to 2016 witnessed a big correction in copper costs. A number of elements contributed to this downturn:

- Slower Chinese language Development: China’s financial development started to average, resulting in a discount in its copper consumption. This marked a big shift, as China had been the first engine of copper demand for over a decade.

- World Financial Slowdown: The worldwide financial system skilled a interval of sluggish development following the 2008 monetary disaster, additional dampening demand for copper.

- Elevated Provide: New mines got here on-line, including to the present provide and exacerbating the impression of diminished demand.

- Commodity Supercycle Issues: The notion that the commodity supercycle was over contributed to investor sentiment turning bearish.

The yearly chart throughout this era displays vital worth volatility, with durations of sharp declines interspersed with non permanent rallies. The general development, nonetheless, was downward, reflecting the basic shift available in the market dynamics.

A Interval of Stabilization and Gradual Restoration (2016-2020): Discovering a New Equilibrium

From 2016 onwards, the copper market began to stabilize, though the worth remained unstable. This era noticed a gradual restoration, pushed by a number of elements:

- Renewed Infrastructure Spending: Governments worldwide, together with China, elevated infrastructure spending, stimulating demand for copper.

- Inexperienced Power Transition: The rising adoption of renewable power applied sciences, equivalent to photo voltaic panels and wind generators, created new demand for copper, as it’s a crucial part in these applied sciences.

- Provide-Aspect Constraints: Whereas provide elevated, it didn’t maintain tempo with the recovering demand, resulting in supply-side constraints and stopping a big worth collapse.

- Improved Investor Sentiment: As financial situations improved and the inexperienced power transition gained momentum, investor sentiment in the direction of copper improved.

The yearly chart throughout this era exhibits a gradual upward development, with much less volatility than the previous years. Nonetheless, the restoration was not uniform, with durations of stagnation and even slight declines.

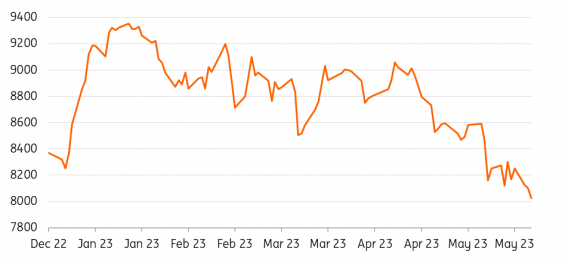

The Pandemic and Past (2020-Current): A Advanced Panorama

The COVID-19 pandemic initially prompted a pointy decline in copper costs as international financial exercise plummeted. Nonetheless, the following restoration, fueled by large authorities stimulus packages and a surge in demand for electronics and infrastructure initiatives, led to a exceptional rebound. The yearly chart for this era displays a pointy V-shaped restoration, adopted by sustained excessive costs.

A number of elements are shaping the present copper market:

- Continued Inexperienced Power Transition: The worldwide push in the direction of decarbonization is driving substantial demand for copper in electrical automobiles, renewable power infrastructure, and power storage options.

- Provide Chain Disruptions: Provide chain bottlenecks and logistical challenges have constrained copper provide, additional contributing to larger costs.

- Geopolitical Dangers: Geopolitical instability, notably regarding mining operations in key producing nations, provides uncertainty to the market.

- Inflationary Pressures: Excessive inflation charges globally have elevated the attractiveness of copper as an inflation hedge.

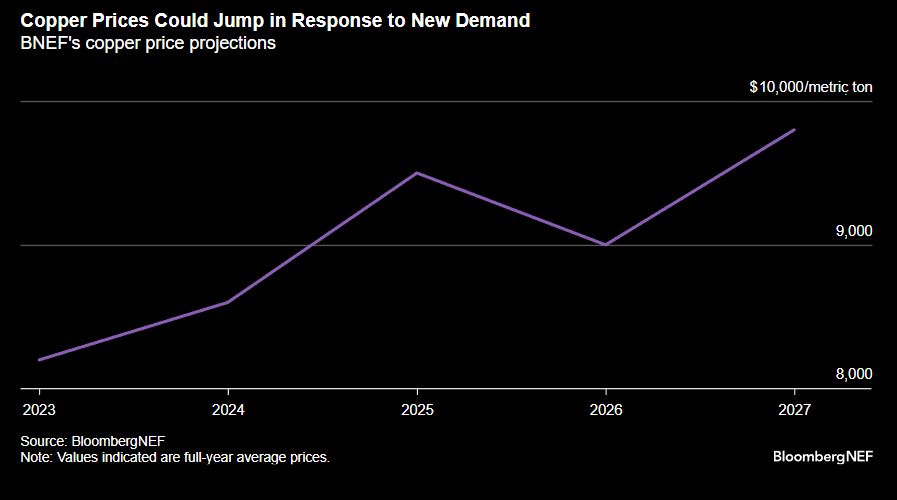

Trying Forward: Forecasting the Way forward for Copper Costs

Predicting future copper costs is a fancy endeavor, involving quite a few variables and uncertainties. Nonetheless, a number of elements recommend a doubtlessly vivid outlook for copper within the coming years:

- The continuing inexperienced power transition will seemingly stay a big driver of demand. The electrification of transportation, the enlargement of renewable power sources, and the expansion of power storage applied sciences all require substantial quantities of copper.

- Infrastructure funding, notably in creating economies, is predicted to proceed. This can create sustained demand for copper in development and energy era.

- Provide-side constraints might persist. Discovering and creating new copper deposits takes time and funding, and there are considerations in regards to the availability of high-quality ore.

- Geopolitical dangers and potential provide disruptions stay a big issue. The focus of copper manufacturing in a number of nations makes the market weak to political instability and disruptions.

Nonetheless, potential headwinds embody:

- Financial slowdowns or recessions may considerably impression demand. A world financial downturn would seemingly result in a lower in copper consumption.

- Technological developments may doubtlessly cut back copper consumption in sure purposes. The event of other supplies may reduce the reliance on copper in some sectors.

- Elevated recycling efforts may doubtlessly offset a few of the demand development. Recycling copper can considerably cut back the necessity for newly mined materials.

In conclusion, the yearly copper worth chart over the previous twenty years reveals a dynamic market formed by a fancy interaction of financial development, technological developments, geopolitical occasions, and speculative buying and selling. Whereas predicting the long run is difficult, the long-term outlook for copper seems promising, pushed primarily by the worldwide transition to a greener and extra electrified financial system. Nonetheless, buyers ought to stay vigilant about potential headwinds and the inherent volatility of the commodity market. Cautious evaluation of elementary elements, alongside an understanding of geopolitical dangers and technological developments, is essential for navigating this dynamic and important market.

Closure

Thus, we hope this text has supplied worthwhile insights into Decoding the Copper Worth Yearly Chart: A Two-Decade Journey of a Crimson Metallic. We hope you discover this text informative and helpful. See you in our subsequent article!