Decoding The Crude Oil Buying and selling View Chart: An Indian Perspective

Decoding the Crude Oil Buying and selling View Chart: An Indian Perspective

Associated Articles: Decoding the Crude Oil Buying and selling View Chart: An Indian Perspective

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the Crude Oil Buying and selling View Chart: An Indian Perspective. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Decoding the Crude Oil Buying and selling View Chart: An Indian Perspective

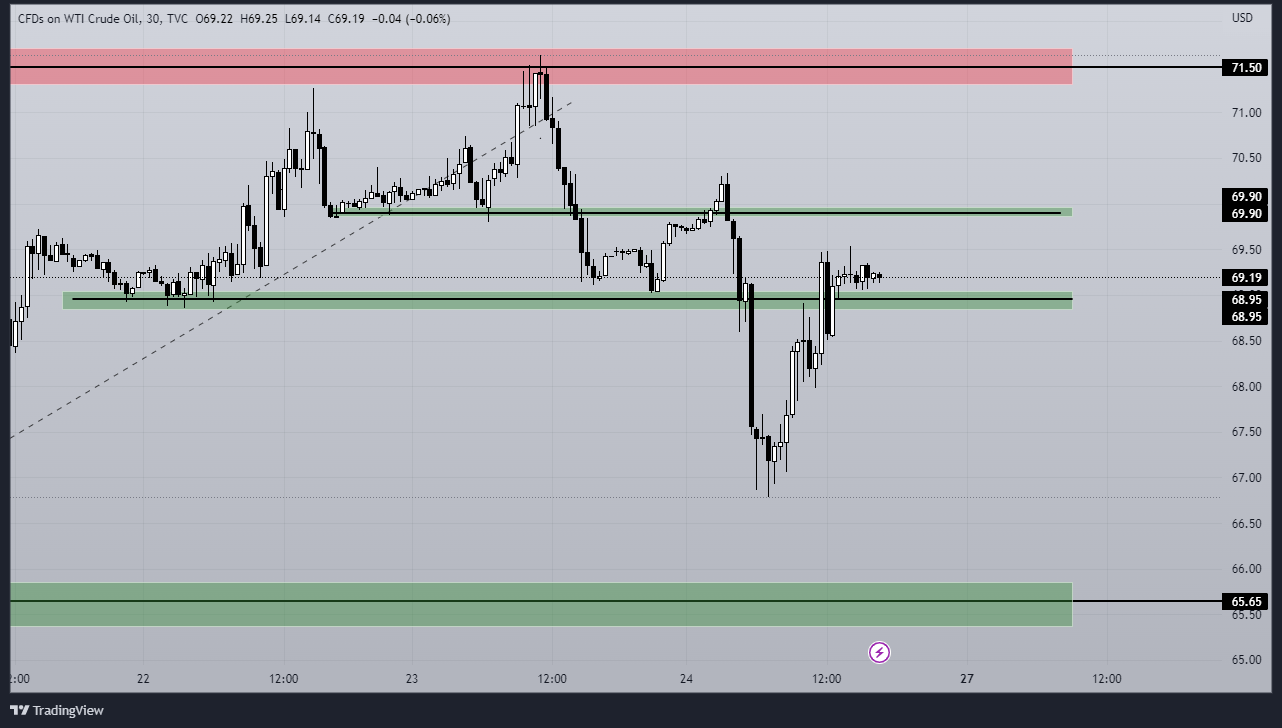

Crude oil, the lifeblood of the worldwide financial system, exerts a big affect on India’s financial panorama. As a significant importer of crude, value fluctuations instantly influence inflation, gasoline prices, and the general well being of varied sectors. Understanding the dynamics of crude oil buying and selling, notably by the lens of a buying and selling view chart, turns into essential for Indian traders, companies, and policymakers. This text delves into the intricacies of decoding crude oil buying and selling view charts, specializing in the precise context of the Indian market.

Understanding the Buying and selling View Platform

TradingView is a well-liked on-line platform that gives real-time charting, technical evaluation instruments, and social buying and selling options. It permits customers to visualise value actions of varied property, together with crude oil, throughout completely different timeframes. For Indian merchants, the platform presents entry to world crude oil benchmarks like Brent and WTI (West Texas Intermediate), together with related Indian indices and derivatives. The platform’s power lies in its customizable charts, providing a variety of indicators, drawing instruments, and the power to overlay a number of knowledge units for complete evaluation.

Key Crude Oil Benchmarks and Their Relevance to India

Whereas WTI displays the value of US crude, Brent crude is the worldwide benchmark, influencing worldwide oil costs extra broadly. India, being a big importer, is extra prone to modifications in Brent crude costs. The Indian Rupee’s change charge towards the US greenback additionally performs an important function. A depreciating rupee will increase the price of importing crude oil, placing upward stress on home gasoline costs. Subsequently, monitoring each Brent crude costs and the USD/INR change charge is important for understanding the true value of crude oil for India.

Deciphering the Buying and selling View Chart for Crude Oil

A typical TradingView chart for crude oil will show value knowledge over a particular timeframe (e.g., 1-minute, every day, weekly, month-to-month). A number of key components are essential for interpretation:

-

Value Motion: Essentially the most elementary side is the value itself. Analyzing value actions, figuring out tendencies (uptrends, downtrends, sideways actions), and recognizing potential reversals are essential. Assist and resistance ranges, areas the place the value has traditionally struggled to interrupt by, are vital indicators of potential value route.

-

Technical Indicators: TradingView presents an enormous library of technical indicators. Standard ones embrace:

- Shifting Averages (MA): These clean out value fluctuations, serving to determine tendencies. Generally used MAs are easy transferring averages (SMA) and exponential transferring averages (EMA). Crossovers between completely different MAs can sign potential purchase or promote alerts.

- Relative Energy Index (RSI): This momentum oscillator measures the pace and alter of value actions. RSI values above 70 are sometimes thought of overbought, whereas values beneath 30 are thought of oversold, suggesting potential value reversals.

- MACD (Shifting Common Convergence Divergence): This indicator identifies modifications in momentum by evaluating two transferring averages. MACD crossovers can sign potential pattern modifications.

- Bollinger Bands: These bands present value volatility. Costs bouncing off the higher or decrease bands can recommend potential reversals.

-

Quantity: Analyzing buying and selling quantity alongside value motion offers helpful insights. Excessive quantity throughout value actions confirms the power of a pattern, whereas low quantity can point out weak point.

-

Candlestick Patterns: Candlestick patterns are graphical representations of value actions over a particular interval. Figuring out patterns like hammers, engulfing patterns, or dojis can present clues about potential value route.

-

Fibonacci Retracements: These instruments determine potential assist and resistance ranges based mostly on Fibonacci ratios. They’re usually used to foretell value reversals inside a pattern.

Geopolitical and Financial Elements Affecting Indian Crude Oil Costs

The TradingView chart offers a visible illustration of value actions, however understanding the underlying components driving these actions is equally essential. A number of components considerably influence crude oil costs within the Indian context:

-

OPEC+ Choices: The Group of the Petroleum Exporting International locations (OPEC) and its allies (OPEC+) play a big function in setting world oil manufacturing ranges. Their selections instantly affect world provide and, consequently, costs.

-

International Financial Progress: Robust world financial progress sometimes results in increased demand for crude oil, pushing costs upward. Conversely, financial slowdowns can cut back demand and decrease costs.

-

US Greenback Energy: As talked about earlier, a powerful US greenback makes crude oil dearer for India, impacting home costs.

-

Geopolitical Occasions: Political instability in oil-producing areas, sanctions, or conflicts can disrupt provide chains and considerably influence costs.

-

Indian Authorities Insurance policies: Authorities insurance policies associated to gasoline pricing, taxation, and subsidies instantly have an effect on the home value of crude oil and refined petroleum merchandise.

-

Demand-Provide Dynamics inside India: India’s home demand for crude oil is continually evolving, influenced by components reminiscent of financial progress, industrial exercise, and transportation wants. Any vital modifications in home demand can influence costs.

Danger Administration and Buying and selling Methods

Buying and selling crude oil includes vital threat. Earlier than partaking in any buying and selling exercise, it’s important to grasp and handle threat successfully:

-

Diversification: Diversifying your portfolio throughout completely different asset lessons reduces general threat. Do not put all of your eggs in a single basket.

-

Place Sizing: Solely commerce with capital you may afford to lose. By no means over-leverage your positions.

-

Cease-Loss Orders: At all times use stop-loss orders to restrict potential losses. These orders routinely promote your place if the value falls beneath a predetermined degree.

-

Technical Evaluation: Whereas technical evaluation may be useful, it isn’t foolproof. Mix it with elementary evaluation and an understanding of geopolitical components for a extra complete strategy.

-

Elementary Evaluation: Keep up to date on world financial occasions, OPEC+ selections, and geopolitical developments that may considerably influence crude oil costs.

Conclusion:

The TradingView chart presents a strong software for visualizing and analyzing crude oil value actions. Nevertheless, it is essential to keep in mind that the chart is merely a illustration of value motion. Efficient buying and selling requires a deep understanding of the underlying components influencing crude oil costs, notably inside the Indian context. By combining chart evaluation with elementary evaluation, threat administration methods, and a eager consciousness of geopolitical and financial occasions, Indian merchants could make knowledgeable selections and navigate the complexities of the crude oil market. Keep in mind to at all times search skilled monetary recommendation earlier than making any funding selections.

Closure

Thus, we hope this text has supplied helpful insights into Decoding the Crude Oil Buying and selling View Chart: An Indian Perspective. We respect your consideration to our article. See you in our subsequent article!