Decoding The Each day Dance: A Deep Dive Into VA 30-Yr Mortgage Charge Charts

Decoding the Each day Dance: A Deep Dive into VA 30-Yr Mortgage Charge Charts

Associated Articles: Decoding the Each day Dance: A Deep Dive into VA 30-Yr Mortgage Charge Charts

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Each day Dance: A Deep Dive into VA 30-Yr Mortgage Charge Charts. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding the Each day Dance: A Deep Dive into VA 30-Yr Mortgage Charge Charts

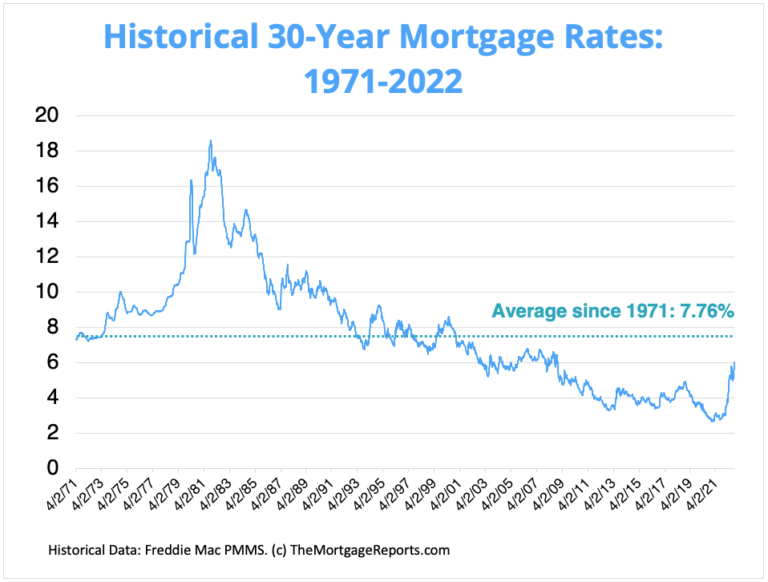

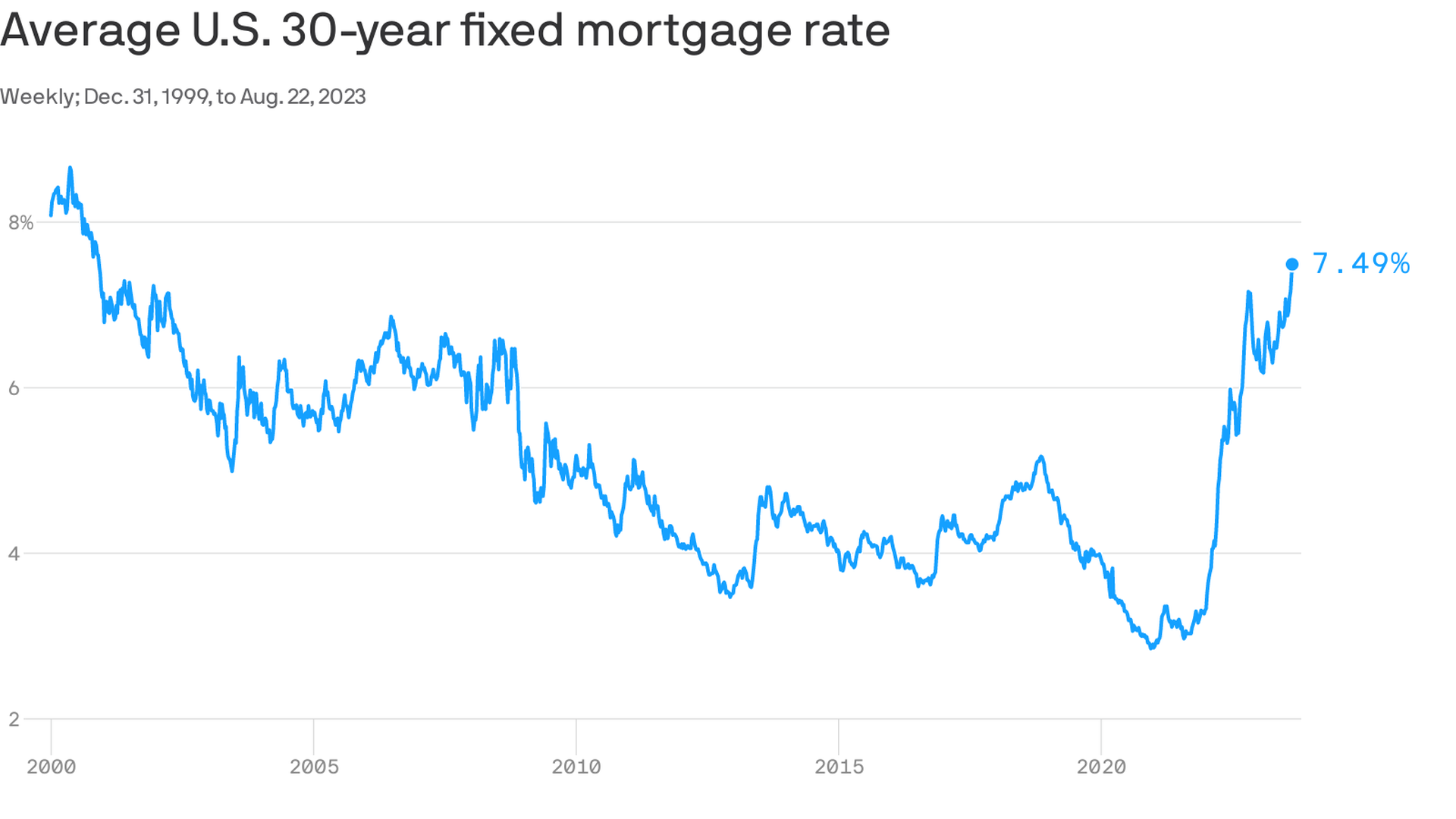

The pursuit of homeownership is a big milestone, and for eligible veterans and repair members, the VA mortgage program presents a pathway usually paved with decrease rates of interest and extra favorable phrases. Understanding the day by day fluctuations of VA 30-year mortgage charges is essential for securing the very best deal. This text will dissect the complexities of those day by day charge charts, exploring the components that affect them, find out how to interpret the info, and find out how to leverage this information to your benefit within the aggressive mortgage market.

The Ever-Shifting Panorama of VA Charges:

In contrast to mounted charges, VA 30-year mortgage charges are dynamic, responding to a mess of financial and market forces. Each day charge charts, available on-line from numerous mortgage lenders and monetary establishments, present a snapshot of those fluctuations. Nevertheless, it is important to keep in mind that these charts symbolize supplied charges, not assured charges. Your remaining charge will depend upon a number of components particular to your particular person circumstances.

Key Components Influencing Each day VA Charges:

A number of interconnected components contribute to the day by day dance of VA 30-year mortgage charges. Understanding these influences is essential to navigating the market successfully:

-

The Federal Reserve (The Fed): The Fed’s financial coverage performs a dominant position. Rate of interest hikes by the Fed typically result in increased mortgage charges throughout the board, together with VA loans. Conversely, charge cuts are likely to decrease mortgage charges. The Fed’s actions are sometimes a response to inflation, employment ranges, and total financial development. Carefully following the Fed’s bulletins and projections is essential for understanding the broader pattern.

-

The ten-Yr Treasury Be aware Yield: This benchmark yield considerably influences mortgage charges. Mortgage-backed securities (MBS), that are swimming pools of mortgages, are sometimes priced relative to the 10-year Treasury. When the 10-year yield rises, it usually pushes mortgage charges increased, and vice versa. Monitoring this yield is a priceless device for predicting potential charge actions.

-

Investor Demand for Mortgage-Backed Securities (MBS): The market’s urge for food for MBS instantly impacts mortgage charges. Excessive demand drives costs up, leading to decrease charges. Conversely, lowered demand lowers costs and pushes charges increased. This demand is influenced by numerous components, together with investor sentiment, financial forecasts, and the general well being of the monetary markets.

-

Competitors Amongst Lenders: The aggressive panorama amongst mortgage lenders additionally performs a job. Lenders usually modify their charges to draw debtors, resulting in variations in supplied charges. Purchasing round and evaluating presents from a number of lenders is essential to securing the very best charge.

-

Your Credit score Rating and Monetary Profile: Whereas the day by day charge chart gives a normal image, your particular person credit score rating, debt-to-income ratio (DTI), and total monetary well being considerably affect the speed you will finally obtain. A better credit score rating and a decrease DTI usually qualify you for higher charges.

-

Mortgage-to-Worth Ratio (LTV): The LTV, which is the mortgage quantity as a share of the house’s worth, also can affect the speed. Decrease LTV ratios typically result in higher charges as they symbolize decrease threat for lenders.

-

The Sort of VA Mortgage: Whereas the main target right here is on 30-year mortgages, it is necessary to notice that completely different VA mortgage packages might need barely various charge buildings. Understanding the nuances of every program is essential for selecting the best option.

Deciphering the Each day VA Charge Chart:

A typical day by day VA 30-year mortgage charge chart will show the speed alongside different related info, resembling:

-

The Date: Signifies the day the speed was recorded. Bear in mind, charges are always altering, so the chart displays a particular cut-off date.

-

The Charge: That is the marketed rate of interest for a 30-year VA mortgage. It is normally expressed as an annual share charge (APR). Be aware that that is usually the speed for a borrower with a robust credit score profile and favorable monetary circumstances.

-

Factors: Factors, or low cost factors, are pay as you go curiosity that may decrease your rate of interest. The chart may point out the speed with and with out factors.

-

Different Charges: Some charts could embody an estimate of closing prices and different charges related to the mortgage.

-

Mortgage Sort: The chart ought to clearly specify that the charges are for VA loans.

The right way to Use the Chart to Your Benefit:

-

Observe the Pattern: Monitor the chart over time to determine potential charge traits. This lets you anticipate potential shifts and make knowledgeable choices about when to lock in a charge.

-

Examine Lenders: Do not depend on a single supply for charge info. Examine charges from a number of lenders to seek out one of the best supply.

-

Perceive Your Monetary Profile: Be life like about your credit score rating and monetary state of affairs. This may make it easier to handle your expectations and keep away from disappointment.

-

Contemplate Charge Locks: When you discover a appropriate charge, contemplate locking it in to guard your self in opposition to potential charge will increase. Nevertheless, bear in mind that there could also be charges related to charge locks.

-

Seek the advice of a Mortgage Skilled: A professional mortgage dealer or lender can present personalised steering and make it easier to navigate the complexities of the VA mortgage course of.

Past the Numbers: The Larger Image of VA Homeownership

Whereas the day by day charge chart gives priceless knowledge, it is essential to contemplate the broader context of VA homeownership. The advantages prolong past simply doubtlessly decrease rates of interest. VA loans usually require no down cost, making homeownership extra accessible. Additionally they usually have extra lenient qualification standards in comparison with standard loans.

Conclusion:

The day by day VA 30-year mortgage charge chart is a dynamic device that gives priceless insights into the mortgage market. By understanding the components that affect charges, decoding the chart successfully, and leveraging the data to your benefit, you possibly can enhance your probabilities of securing a positive mortgage and attaining your homeownership desires. Bear in mind to at all times seek the advice of with a professional skilled for personalised recommendation and steering all through the method. The journey to homeownership is a big one, and knowledgeable decision-making is essential to navigating it efficiently. Do not solely depend on the day by day charge chart; combine it right into a complete technique that considers your particular person monetary state of affairs and long-term targets. The final word aim is not only discovering the bottom charge on a given day, however securing a mortgage that aligns along with your monetary capabilities and future aspirations.

.png)

Closure

Thus, we hope this text has offered priceless insights into Decoding the Each day Dance: A Deep Dive into VA 30-Yr Mortgage Charge Charts. We thanks for taking the time to learn this text. See you in our subsequent article!