Decoding The Day by day EMA Chart: A Complete Information For Merchants

Decoding the Day by day EMA Chart: A Complete Information for Merchants

Associated Articles: Decoding the Day by day EMA Chart: A Complete Information for Merchants

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Day by day EMA Chart: A Complete Information for Merchants. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Decoding the Day by day EMA Chart: A Complete Information for Merchants

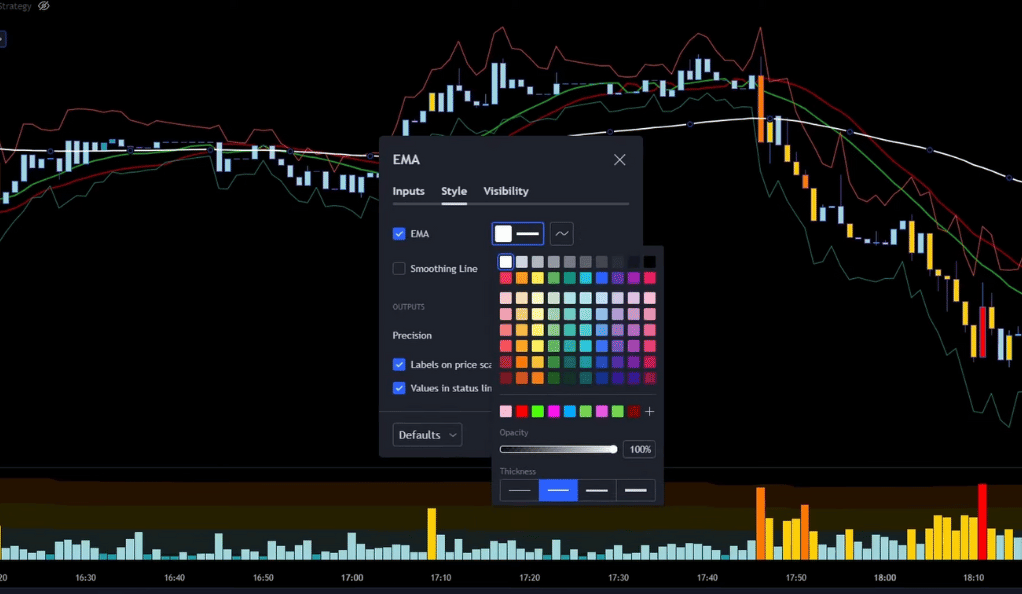

The Exponential Shifting Common (EMA) is a broadly used technical indicator in monetary markets, offering merchants with a dynamic illustration of value tendencies. Whereas EMAs are available numerous timeframes, the each day EMA chart holds important weight, providing a useful perspective on the short-term to medium-term momentum of an asset. This text delves into the intricacies of the each day EMA chart, exploring its software, interpretation, and limitations, offering a complete information for merchants of all ranges.

Understanding Exponential Shifting Averages (EMAs)

In contrast to easy shifting averages (SMAs) which give equal weight to all knowledge factors inside a interval, EMAs assign better significance to newer costs. This attribute makes EMAs extra aware of current value modifications than SMAs, making them significantly helpful for figuring out shifts in momentum. The diploma of responsiveness is set by the interval used to calculate the EMA. A shorter interval (e.g., 9-day EMA) will likely be extra delicate to cost fluctuations than an extended interval (e.g., 200-day EMA).

The formulation for calculating an EMA is extra complicated than that of an SMA, involving a smoothing issue that weighs current costs extra closely. Whereas the exact calculation is not essential for sensible software, understanding the weighting precept is significant for decoding the indicator’s conduct.

The Significance of the Day by day EMA Chart

The each day EMA chart supplies a concise overview of value motion over a single day, providing insights into short-term tendencies and potential buying and selling alternatives. Its significance stems from its potential to:

-

Determine Development Path: The slope of the EMA line signifies the prevailing development. An upward sloping EMA suggests an uptrend, whereas a downward sloping EMA suggests a downtrend. The steeper the slope, the stronger the momentum.

-

Verify Development Modifications: Crossovers between totally different EMAs or between the EMA and the worth itself can sign potential development reversals or confirmations of present tendencies. As an example, a bullish crossover happens when a shorter-period EMA crosses above a longer-period EMA, suggesting a possible purchase sign. Conversely, a bearish crossover happens when a shorter-period EMA crosses beneath a longer-period EMA, suggesting a possible promote sign.

-

Decide Assist and Resistance Ranges: EMAs can act as dynamic assist and resistance ranges. Costs are inclined to bounce off the EMA line, particularly throughout established tendencies. Breaks above or beneath the EMA can sign important value actions.

-

Measure Momentum: The speed of change within the EMA’s slope supplies insights into the energy of the momentum. A quickly rising EMA signifies accelerating bullish momentum, whereas a quickly falling EMA signifies accelerating bearish momentum.

Generally Used EMA Mixtures on Day by day Charts

Merchants typically make the most of combos of EMAs with totally different durations to generate buying and selling indicators and filter noise. Some widespread combos embody:

-

9-day EMA and 20-day EMA: This mix is often used for short-term buying and selling, offering indicators primarily based on comparatively fast value actions. Crossovers between these two EMAs can generate purchase or promote indicators.

-

50-day EMA and 200-day EMA: This mix is commonly used for figuring out longer-term tendencies. A crossover of the 50-day EMA above the 200-day EMA is taken into account a bullish sign, sometimes called a "golden cross," indicating a possible long-term uptrend. Conversely, a crossover of the 50-day EMA beneath the 200-day EMA is taken into account a bearish sign, sometimes called a "loss of life cross," indicating a possible long-term downtrend.

-

EMA Crossovers with Value: The worth crossing above or beneath the EMA may present useful buying and selling indicators. A value break above a key EMA might be interpreted as a bullish sign, whereas a value break beneath a key EMA might be interpreted as a bearish sign.

Decoding Day by day EMA Chart Indicators: Cautions and Issues

Whereas each day EMA charts provide useful insights, relying solely on them for buying and selling selections is dangerous. A number of elements ought to be thought-about:

-

False Indicators: EMA crossovers and value breakouts can generate false indicators, particularly in uneven or sideways markets. Affirmation from different technical indicators or elementary evaluation is essential to mitigate danger.

-

Lagging Indicator: EMAs are lagging indicators, that means they react to cost modifications slightly than predict them. This lag can result in missed alternatives or late entries into trades.

-

Market Context: The interpretation of EMA indicators ought to at all times be thought-about throughout the broader market context. Elements corresponding to total market sentiment, financial information, and geopolitical occasions can considerably influence value motion and invalidate EMA indicators.

-

Over-Optimization: Over-reliance on backtesting and optimizing EMA parameters can result in overfitting and poor out-of-sample efficiency. A strong buying and selling technique ought to be primarily based on a sound understanding of market dynamics and danger administration.

Combining EMAs with Different Technical Indicators

To reinforce the accuracy and reliability of buying and selling indicators derived from each day EMA charts, merchants typically mix them with different technical indicators, corresponding to:

-

Relative Energy Index (RSI): RSI measures the momentum of value modifications, offering insights into overbought and oversold situations. Combining RSI with EMA indicators can assist filter out false indicators and enhance commerce timing.

-

MACD (Shifting Common Convergence Divergence): MACD is a momentum indicator that identifies modifications in development energy. Combining MACD with EMA indicators can verify development path and establish potential turning factors.

-

Quantity: Analyzing buying and selling quantity alongside EMA indicators can present further affirmation of value actions. Excessive quantity throughout a value breakout above or beneath an EMA suggests stronger conviction behind the transfer.

-

Bollinger Bands: Bollinger Bands measure value volatility and can assist establish potential value reversals. Combining Bollinger Bands with EMAs can assist establish optimum entry and exit factors.

Conclusion:

The each day EMA chart is a strong software for technical evaluation, providing useful insights into short-term to medium-term value tendencies and momentum. By understanding the ideas behind EMAs, using acceptable combos of durations, and contemplating the broader market context, merchants can successfully leverage each day EMA charts to enhance their buying and selling selections. Nevertheless, it is essential to do not forget that EMAs are usually not a standalone resolution and ought to be used together with different indicators and sound danger administration practices to reduce losses and maximize potential earnings. Steady studying and adaptation are important for profitable buying and selling utilizing any technical indicator, together with the each day EMA chart. Always remember that previous efficiency just isn’t indicative of future outcomes, and cautious danger administration is paramount in any buying and selling technique.

Closure

Thus, we hope this text has offered useful insights into Decoding the Day by day EMA Chart: A Complete Information for Merchants. We hope you discover this text informative and useful. See you in our subsequent article!