Decoding The Each day Silver Worth Chart: A Complete Information For Traders

Decoding the Each day Silver Worth Chart: A Complete Information for Traders

Associated Articles: Decoding the Each day Silver Worth Chart: A Complete Information for Traders

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to Decoding the Each day Silver Worth Chart: A Complete Information for Traders. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Decoding the Each day Silver Worth Chart: A Complete Information for Traders

Silver, a lustrous valuable steel with a historical past spanning millennia, continues to captivate traders with its distinctive mix of business utility and funding enchantment. Understanding the day by day silver value chart is essential for anybody seeking to navigate this dynamic market. This text delves deep into the intricacies of decoding these charts, exploring the elements influencing value fluctuations, frequent charting methods, and techniques for leveraging this data in your funding choices.

Understanding the Fundamentals: What Drives Silver Costs?

Not like many commodities whose costs are primarily pushed by provide and demand in a selected sector, silver’s value is influenced by a posh interaction of things:

-

Industrial Demand: Silver’s distinctive conductivity makes it indispensable in varied industries, together with electronics (photo voltaic panels, smartphones, circuitry), cars (sensors, catalysts), and medical units. A surge in international technological development or industrial manufacturing usually boosts silver demand, pushing costs greater. Conversely, financial downturns or technological shifts can dampen demand and exert downward stress on costs.

-

Funding Demand: Silver, alongside gold, is taken into account a safe-haven asset. Throughout occasions of financial uncertainty, geopolitical instability, or inflation, traders flock to valuable metals as a hedge towards danger. This elevated funding demand can considerably influence silver costs, driving them upwards. Change-traded funds (ETFs) monitoring silver costs play a big function on this dynamic.

-

Hypothesis: The silver market is vulnerable to speculative buying and selling, the place traders wager on future value actions primarily based on anticipated developments relatively than elementary evaluation. This will result in vital value volatility, significantly within the brief time period. Information occasions, analyst predictions, and even social media sentiment can gasoline speculative exercise, creating value swings impartial of underlying provide and demand fundamentals.

-

Provide and Mining: The worldwide provide of silver is basically depending on its manufacturing as a byproduct of different mining operations, primarily copper and gold. Modifications in mining output, geopolitical occasions affecting mining areas, and manufacturing prices straight affect the accessible provide and, consequently, the worth. Disruptions to mining operations as a result of labor disputes, environmental rules, or pure disasters can result in provide shortages and value will increase.

-

Forex Fluctuations: Silver is priced in US {dollars} globally. Fluctuations within the worth of the greenback towards different main currencies can influence silver costs. A weaker greenback usually makes dollar-denominated commodities like silver extra engaging to worldwide patrons, resulting in elevated demand and better costs.

-

Authorities Insurance policies: Authorities rules, together with import/export tariffs, environmental insurance policies, and financial coverage choices, can not directly affect silver costs. For instance, adjustments in rates of interest can have an effect on funding flows into valuable metals, impacting demand and value.

Decoding the Each day Silver Worth Chart: Key Components and Indicators

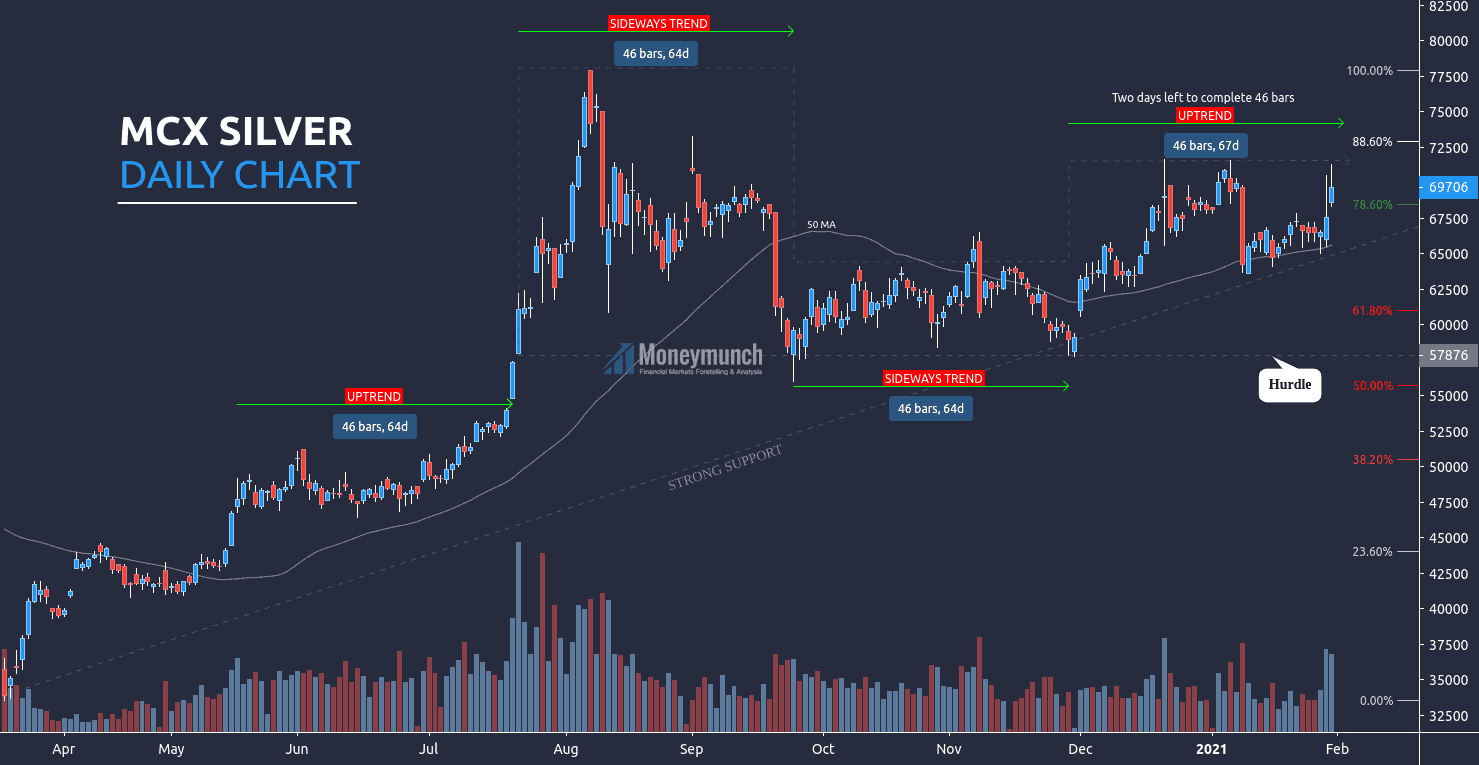

The day by day silver value chart offers a visible illustration of the steel’s value fluctuations over a 24-hour interval. Understanding the important thing components is essential for efficient interpretation:

-

Worth Axis (Y-axis): Represents the worth of silver, usually expressed in US {dollars} per troy ounce.

-

Time Axis (X-axis): Represents the time interval, usually displayed in days.

-

Candlesticks/Bars: These visible components signify the worth motion over a selected time interval (e.g., a day). Candlesticks present the opening, closing, excessive, and low costs, whereas bars usually solely show the excessive and low costs.

-

Shifting Averages: These are traces plotted on the chart that clean out value fluctuations, serving to establish developments. Widespread shifting averages embrace the 50-day, 100-day, and 200-day shifting averages. Crossovers between shifting averages can be utilized as potential buying and selling alerts.

-

Technical Indicators: A variety of technical indicators could be overlaid on the chart to supply extra insights into value developments and momentum. These embrace Relative Power Index (RSI), Shifting Common Convergence Divergence (MACD), Bollinger Bands, and Stochastic Oscillator. These indicators assist establish potential overbought or oversold circumstances, development reversals, and momentum shifts.

-

Assist and Resistance Ranges: These are value ranges the place the worth has traditionally struggled to interrupt by way of. Assist ranges signify value flooring, whereas resistance ranges signify value ceilings. Breaks above resistance ranges typically sign bullish momentum, whereas breaks under assist ranges typically point out bearish momentum.

Chart Patterns and Their Significance

Recognizing frequent chart patterns can improve your skill to foretell future value actions:

-

Head and Shoulders: This sample suggests a possible development reversal, indicating a shift from bullish to bearish sentiment.

-

Double Tops/Bottoms: These patterns additionally recommend potential development reversals, with double tops indicating a bearish reversal and double bottoms indicating a bullish reversal.

-

Triangles: These patterns point out a interval of consolidation, with the worth oscillating inside an outlined vary. Breakouts from triangles can sign a continuation or reversal of the prevailing development.

-

Flags and Pennants: These patterns recommend a short lived pause in a robust development, with the worth consolidating earlier than resuming its earlier course.

Methods for Using Each day Silver Worth Charts:

-

Development Following: Determine the general development (uptrend, downtrend, or sideways) and align your buying and selling technique accordingly. In an uptrend, search for shopping for alternatives at dips, whereas in a downtrend, contemplate brief promoting or hedging methods.

-

Imply Reversion: This technique entails figuring out overbought or oversold circumstances utilizing technical indicators, anticipating a reversion to the imply value.

-

Breakout Buying and selling: Determine assist and resistance ranges and search for alternatives to enter trades when the worth breaks by way of these ranges.

-

Threat Administration: Implement acceptable danger administration methods, together with setting stop-loss orders to restrict potential losses and diversifying your portfolio to mitigate danger.

Conclusion:

The day by day silver value chart gives a wealth of data for traders in search of to capitalize on the alternatives and challenges introduced by this dynamic market. By understanding the basic elements influencing silver costs, mastering chart studying methods, and using acceptable buying and selling methods, traders can enhance their decision-making course of and doubtlessly improve their funding returns. Nonetheless, it is essential to do not forget that no buying and selling technique ensures success, and thorough analysis, danger administration, and a long-term perspective are important for navigating the complexities of the silver market. Think about consulting with a monetary advisor earlier than making any funding choices. The knowledge supplied on this article is for academic functions solely and shouldn’t be thought-about monetary recommendation.

Closure

Thus, we hope this text has supplied worthwhile insights into Decoding the Each day Silver Worth Chart: A Complete Information for Traders. We hope you discover this text informative and helpful. See you in our subsequent article!